qualitative and quantitative analysis of nokia

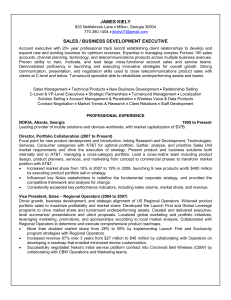

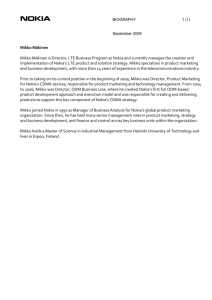

advertisement