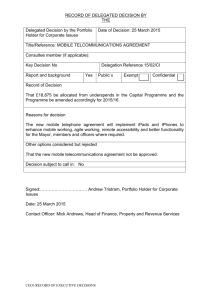

Original Print PDF - Legislation.gov.uk

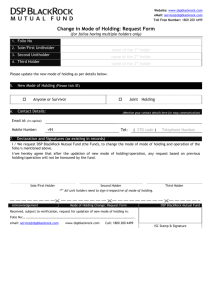

advertisement