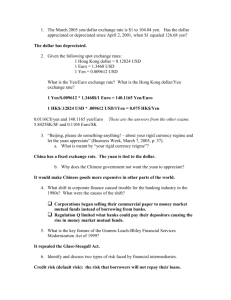

Financial Results for the Year Ended March 2015

advertisement