Frequently Asked Questions Health Benefits Q1. How

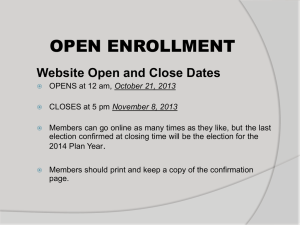

advertisement

Frequently Asked Questions Health Benefits Q1. How are contribution rates determined? A1. Payroll deduction, deductible and co-insurance maximum levels are tiered based on family size, annual salary level and plan choice, with the result being that higher compensated employees pay more for the GE Health Benefits plans. View 2015 Costs by Pay and Option Q2. How is wage band determined? A2. Refer to the Costs by Pay and Option page to view your annual pay range (wage band). Q3. How do I transfer my deductible and out-of-pocket amounts from one plan administrator to another if I switch administrator’s mid-year (e.g. Aetna to UnitedHealthcare)? A3. The member has to get a copy of their most recent EOB for the current plan year from their original plan administrator and then contact their new administrator customer service to have their deductible & out-of-pocket amounts updated. Q4: What services are not applied to my out-of-pocket maximum? A4: The following services are not applied to your out-of-pocket maximum: Services that are excluded from your GE Medical Care plan. Services that are above the plan’s allowable amount, such as charges for services received out-of-network. Infertility services in excess of the $15,000 lifetime maximum benefit. The difference in cost between brand name and generic prescription drugs. This is the difference you pay when you choose to use a brand name drug when a lower cost generic or co-branded substitute is available. Services or visits that exceed plan limits or maximums. Q5. Will you verify that the spouse with the higher wage band is covering the spouse with the lower wage band? A5. This is reviewed after Annual Enrollment each year to confirm the spouse with the higher wage band is covering the spouse with the lower wage band. Q6. How does coverage work if my spouse is also a Company employee? A6. If both you and your spouse are eligible Company employees, you should enroll only one of you as a Company employee — the spouse or same-sex domestic partner in the lower wage band must be covered as a dependent of the higher wage band employee; if you are both in the same wage band, either of you may enroll as the "employee." 1 Q7. Can a retired spouse cover an active spouse? A7. Yes, the spouse with the higher wage band can cover the spouse with the lower wage band. Q8. If you have children who live in a different state with a different administrator, how will that work? A8. One plan administrator – determined by the employee’s home address – covers the entire family. Most plan administrators have a national network. Q9. How is my HRA funded? A9. Once you make your annual election during open enrollment, GE will fully fund your account at the beginning of the plan year based on the option selected and your level of coverage. Q10. What if I have money left in my HRA at the end of the year? A10. Any funds remaining in your HRA at the end of the year will remain in your account and be available to pay eligible expenses during the next calendar year. Q11. What happens to the unused HRA Benefit Credits when the employee is no longer the policy holder but now the dependent? A11. The HRA administrator will determine your HRA balance as of June 30 of the following plan year and will combine any remaining balance with the HRA credit/balance associated with the new account. This account reconciliation will be performed annually due to IRS regulations. Please contact the Benefit Center for details. Timely filing claims guidelines apply. Q12. Two Company employees, higher wage band is covering the lower wage band as a dependent. They get a divorce. What happens to their HRA Benefit Credits? A12. The higher paid employee who is the owner of the HRA Benefit Credits keeps the HRA Benefit Credits. If the lower paid employee enrolls in Company coverage he or she will receive the applicable HRA Benefit Credits for Tier 1 coverage. Q13. Is preventive care covered out-of-network? A13. No, and the cost does not go toward your deductible or co-insurance. Q14. Is there a list of preventive screenings that are covered? A14. Yes, you can download a printer friendly version here. Q15. Are multiple colonoscopies and mammograms covered at 100% if I need to have either of these performed multiple times in a year due to family history or medical condition? A15. Yes, routine and medically necessary diagnostic colonoscopies and mammograms are covered at 100%, regardless of the number of times you may need to have either of these procedures in a given year. To receive 100% coverage, services must be performed by an innetwork provider. 2 Q16. Will I still be able to see a doctor who is not in the network? A16. Yes, but covered services will be paid at the out-of-network levels. Out-of-network expenses do apply to your deductible; however, charges above the plan's payment allowance will not go toward your deductible. Keep in mind, certain services are not covered out-of-network. Q17. Once you meet the deductible and the co-insurance max, are brand name prescriptions paid at 100% or 20/30%? A17. If you‘re on a brand name drug without a generic alternative, after you meet your outof-pocket max you are covered at 100%. If you choose to take a brand name drug with a generic alternative then you are still responsible for the brand-generic difference regardless of whether you have met your out-of-pocket maximum. Q18. If a generic prescription drug is not available; will employees be responsible for the cost of the brand? A18. Yes, employees will be responsible for the cost of the brand name drug. Q19. Can prescription drugs be purchased out-of-network? A19. There is no out-of-network benefit for prescription drugs. Q20. What happens if I drop coverage and stay with Medicare only? A20. Medicare pays first unless you have coverage through an employed spouse, and your spouse’s employer has at least 20 employees. Q21. Who is Health Coach from GE? A21. Health Coaches are specially trained nurses supported by a team of doctors and other specialized resources. Your Health Coach will discuss your healthcare questions and concerns and can also conduct research for you using a range of resources, including specialty resources that only health professionals may access. Q22. Does GE have access to what I discuss with Health Coach? A22. NO. Health Coaches are independent resources hired by GE. The service is not connected directly to our health benefits administrators or any of our health plans. Your privacy is completely protected. 3 Q23. How does Health Coach know the right answers? A23. The medical experts at Health Coach tap into a list of trusted resources including: Nationally recognized medical experts Specialty societies and national organizations such as the American College of Cardiology and American Cancer Society Government agencies such as the U.S. Department of Health & Human Services Health Coaches will pull all of this information together and review it with you, so you can make the right healthcare choices for you and your family. 4