Reformulating Procedure Statement of Common

advertisement

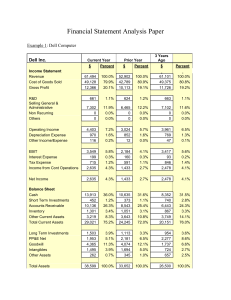

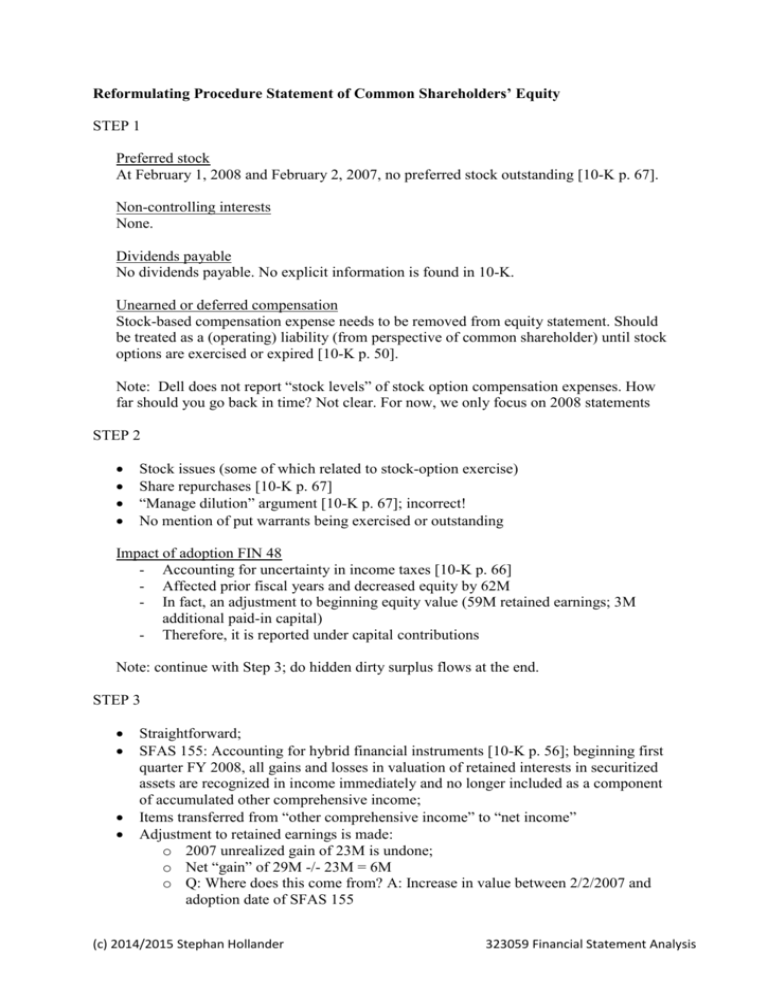

Reformulating Procedure Statement of Common Shareholders’ Equity STEP 1 Preferred stock At February 1, 2008 and February 2, 2007, no preferred stock outstanding [10-K p. 67]. Non-controlling interests None. Dividends payable No dividends payable. No explicit information is found in 10-K. Unearned or deferred compensation Stock-based compensation expense needs to be removed from equity statement. Should be treated as a (operating) liability (from perspective of common shareholder) until stock options are exercised or expired [10-K p. 50]. Note: Dell does not report “stock levels” of stock option compensation expenses. How far should you go back in time? Not clear. For now, we only focus on 2008 statements STEP 2 Stock issues (some of which related to stock-option exercise) Share repurchases [10-K p. 67] “Manage dilution” argument [10-K p. 67]; incorrect! No mention of put warrants being exercised or outstanding Impact of adoption FIN 48 - Accounting for uncertainty in income taxes [10-K p. 66] - Affected prior fiscal years and decreased equity by 62M - In fact, an adjustment to beginning equity value (59M retained earnings; 3M additional paid-in capital) - Therefore, it is reported under capital contributions Note: continue with Step 3; do hidden dirty surplus flows at the end. STEP 3 Straightforward; SFAS 155: Accounting for hybrid financial instruments [10-K p. 56]; beginning first quarter FY 2008, all gains and losses in valuation of retained interests in securitized assets are recognized in income immediately and no longer included as a component of accumulated other comprehensive income; Items transferred from “other comprehensive income” to “net income” Adjustment to retained earnings is made: o 2007 unrealized gain of 23M is undone; o Net “gain” of 29M -/- 23M = 6M o Q: Where does this come from? A: Increase in value between 2/2/2007 and adoption date of SFAS 155 (c) 2014/2015 Stephan Hollander 323059 Financial Statement Analysis o Clear that it is reported as part of comprehensive income. This was also the case in fiscal year 2007 [it is an unrealized gain/loss]. (STEP 4) HIDDEN DIRTY SURPLUS FLOWS HDSFs arise only from the exercise of employee stock options Methods 1, 2, or 3 Due to change in accounting rules (now: SFAS 123R; see 10-K p. 57, 71), the reported excess tax benefit no longer reflects (market price -/- exercise price) x #options exercised so, loss of 34 is an underestimate Part has already been reported as stock-based compensation expense in previous year (which resulted in a tax deduction/benefit) Method 3 o Data on 10-K p. 69 o Use estimate of market price yearly average Method 1 o Data on 10-K p. 70 o Reported intrinsic value Note: not clear which method is most reliable o Method 2: Do all stock options qualify for tax benefit? (10-K p 35, 64) o Method 1: Should you correct for past stock option expenses? o The difference between the two methods is 30 (i.e., 1% of comprehensive income) Note: HDSF changes CI and d, but not CI + d!! Reformulating Balance Sheet Textbook: p. 547 10-K: p. 47 Procedure: check all line items; are they referring to operating or financing activities? Cash and cash equivalents: 100% F (arbitrary) Short-term investments: p. 59 10-K F Accounts receivable O Financing receivables: p. 75 10-K O Inventories O Other assets: o p. 65 10-K: Deferred tax assets O o p. 84 10-K: Restricted cash related to Dell’s financial services to customers O PPE, Goodwill, Intangibles O Short-term borrowing F Accounts payable O Accrued and other: p. 91 10-K; relates to warranties and compensation O Deferred service revenue: p. 84 10-K O Other non-current liabilities: p. 91 10-K; relates to warranties and tax liabilities O (c) 2014/2015 Stephan Hollander 323059 Financial Statement Analysis Redeemable common stock: registration issue with SEC; gives these stockholders the right to undo their stock purchases: p. 67 10-K Financing liability We need to add stock based compensation as operating liability; it is transferred from the equity statement Final remarks: 1. Dell has net operating liability. This means that suppliers are “financing” Dell’s operating activities; 2. Dell has net financing assets. This means that Dell would not need debt to finance the company; 3. Note that these numbers are partially influenced by allocating all cash as financing assets. Allocating 0.5-1.0% as operating would not change this. If one would allocate all cash as operating, the picture significantly changes (but this is not appropriate allocation). Reformulating Income Statement Textbook: p. 546 10-K: p. 48 Operating income from sales follows straightforwardly from income statement Other operating income: not reported in income statement Add (hidden) dirty surplus flows from equity statement o Unrealized gain on derivatives OI or NFI? Used to hedge against foreign currency (OI) and interest risks (NFI) 10-K p. 61/62: OI = (25) Allocate (13) to NFI? No. o Unrealized gain on financial assets NFI o Investment and other income 10-K p. 92 Some items belong to NFI, others to OI Classify all items as NFI because you cannot decompose “investments” in the balance sheet accordingly and OI items are relatively small anyway. Tax allocation o 10-K p. 66: Marginal tax rate = 35% o Note: (hidden) dirty surplus flows are not taxed in financial report. Reformulating Cash Flow Statement 10-K p. 49 Cash from operating activities o Interest revenue and interest expense are included in cash from operating activities transfer to F o 10-K p. 92: Interest paid is disclosed (54); interest received not. Take “investment income” as proxy (496) Cash used in investment activities (c) 2014/2015 Stephan Hollander 323059 Financial Statement Analysis o Purchases and sales of interest-bearing securities belong to F o The other three items (i.e., Capital expenditures; Acquisition of business; Proceeds from sale of building) belong to I Cash paid to debtholders o Include interest paid and proxy for interest received o Change in cash and cash equivalents 100% allocated to F (arbitrary); consistent with reformulated B/S o Note: Change in cash includes exchange rate effects Cash paid to shareholders (3,856) o As reported on cash flow statement (but signs differ) o “d” does not match with reformulated equity statement (3,861; small difference); due to error in calculating employee stock option exercises at market value? o Excess tax benefit Operating or financing? FASB: Financing Operating? It is related to compensation of employees. However, the expense on which the tax benefit is received is not a cash outflow. Also not reported in cash flow statement. Hence, the tax benefit will increase cash from operating activities. This is strange! Better to include it in financing activities. Done! (c) 2014/2015 Stephan Hollander 323059 Financial Statement Analysis