ARTICLE - American Constitution Society for Law and Policy

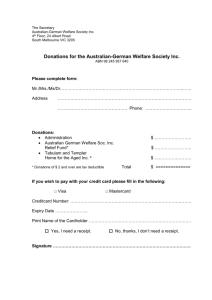

advertisement