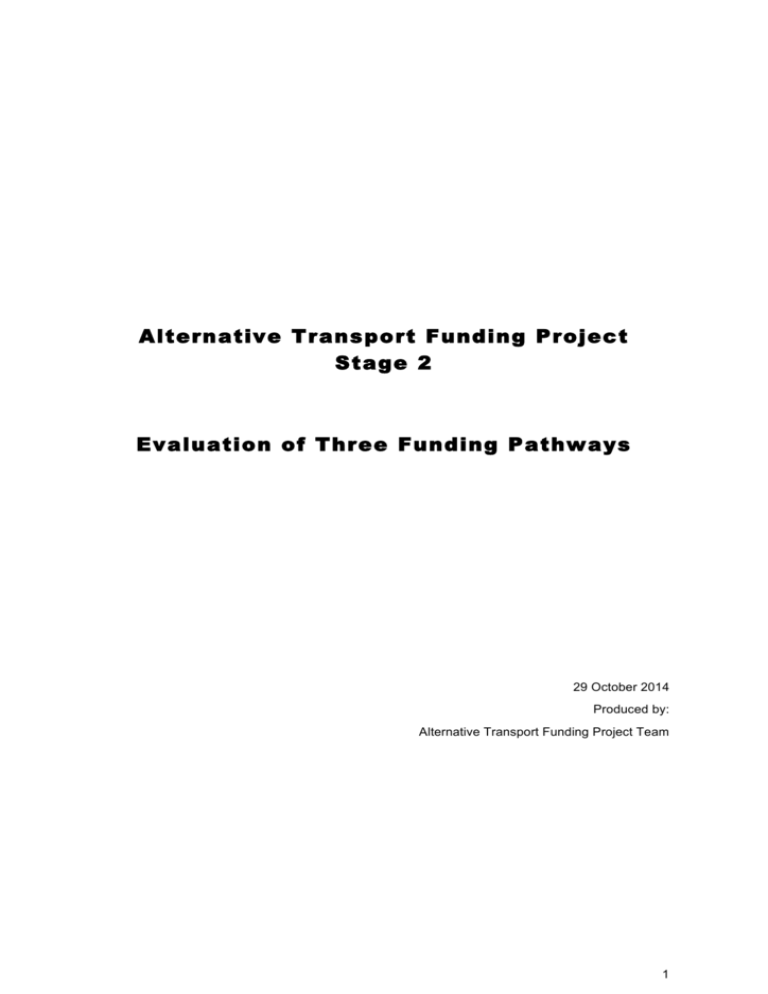

Alternative Transport Funding Project Stage 2 Evaluation of Three

advertisement

Alternative Transport Funding Project Stage 2 Evaluation of Three Funding Pathways 29 October 2014 Produced by: Alternative Transport Funding Project Team 1 This is a final report for the Alternative Transport Funding Project prepared by the Project Team. It consolidates the analysis undertaken for the Alternative Transport Funding Independent Advisory Body during the project, but is based on the most recent information consistent with that in the Independent Advisory Body’s final report. It does not necessarily reflect the views of each member of the Independent Advisory Body, or the views of Auckland Council or Auckland Transport. 2 Contents! 1! Introduction .......................................................................................................................... 4! 2! Issues: Evaluation highlights .............................................................................................. 4! 2.1! Revenue potential ....................................................................................................... 4! 2.2! Strategic Alignment ..................................................................................................... 4! 2.3! Administrative simplicity .............................................................................................. 5! 2.4! Efficiency ..................................................................................................................... 6! 2.5! Fairness ....................................................................................................................... 6! 2.6! Risk ............................................................................................................................. 7! 3! Detailed evaluation ............................................................................................................... 7! Appendix 1 ................................................................................................................................... 8! Detailed Evaluation of Three Funding Pathways ..................................................................... 8! 3 1 Introduction This paper sets out the detailed evaluation of three funding pathways: a rates and fuel tax pathway, a fixed motorway charge of $2, and a variable motorway charge of $3 during the peak and $2 during the inter-peak. 2 Issues: Evaluation highlights 2.1 Revenue potential Overall conclusion: All three scenarios raise sufficient net-revenue to cover the funding gap. Rates are a predictable source of revenue but there are some risks to revenue from motorway charging and fuel tax that will need to be managed. The motorway charging options have greater revenue raising potential than increases to rates and fuel tax. Balanced against this, the rates and fuel tax revenue is more predictable. Provided that growth in the rating base occurs at the speed we have predicted, there are few risks to rating revenue. Fuel tax revenue is not as predictable, with less being received in recent years than expected, despite the Government increasing the level of Petroleum Excise Duty. However, we anticipate that the Government could diversify its revenue sources to contend with vehicle fuel efficiency improvements, hybrids and alternative fuels. Under this option it would also be easier to ensure revenue is spent in accordance with the purpose for which it is raised. Rates or a regional fuel tax could be easily hypothecated for investment in the Auckland Plan Transport Network, but increases to national fuel tax are not necessarily hypothecated to Auckland. Motorway charging is new to New Zealand and would be on a much larger scale than charging schemes elsewhere. There are greater risks to revenue associated with our ability to predict how motorists will respond to the imposition of new charges. Revenue raised through a motorway charges could be hypothecated and applied only to transport investments in Auckland but there is a risk that the new revenue is used as a substitute for existing funding. 2.2 Strategic Alignment Overall conclusion: The greatest strategic benefits stem from implementing the Auckland Plan Transport Network. Beyond this the motorway charging pathways have greater motorway decongestion benefits than the rates and fuel tax pathway and make a greater contribution to various Auckland Plan and Government transport objectives. A variable motorway charge of $3 on-peak has greater motorway decongestion benefits than a $2 fixed charge. The rates and fuel tax option is likely to make a small, but not significant, contribution to the transport objectives in the Auckland Plan and Government Policy Statement. It makes a much lower contribution than the motorway charging option. This pathway is unlikely to significantly decongest Auckland’s roads, increase average travel times for Aucklanders, or greatly increase future public transport use. Nor would it reduce transport-related accidents and fatal injuries, or decrease transport-related greenhouse gas emissions and air pollution. This is because increases to rates do not affect people’s travel choices and small changes in the price of fuel have only a limited effect on the level of car use. Both motorway options provide greater transport and congestion benefits and slow the rate at which motorway congestion grows. However, they may also have some congestion dis-benefits on local roads. The variable motorway scenario provides greater transport benefits than fixed charges. Due to the travel demand impact of motorway charges, the projected growth in transport-related greenhouse gas emissions and air pollution is marginally slower under the 4 motorway scenarios than the rates and fuel tax scenario. The variable charging has a slightly greater impact on air pollution and greenhouse gas emissions than a fixed motorway charge because it has a greater travel demand impact during times of peak congestion. The rates and fuel excise pathway has a higher cost/benefit ratio than motorway charging and therefore provides better value for money. However, it generates new welfare benefits substantially lower than the motorway charging scenarios. The motorway charging scenarios are economically efficient, but not as efficient as increases to rates and fuel tax. This is because they are relatively costly to implement. However, they increase economic wellbeing more than increases to rates and fuel tax. Variable charges of $3 on-peak provide the largest transport benefits and increase economic wellbeing the most. There are many factors at play which determine whether a funding scenario would support the realisation of a quality compact environment. However, changes in accessibility can increase the desirability of certain locations. We measured this using ‘travel time to work’ as a proxy. Our transport modelling suggests that none of the scenarios are inconsistent with the realisation of a quality compact environment, but for different reasons. Increasing rates and fuel tax are unlikely to encourage or undermine the achievement of a ‘quality compact environment’ because they make such a small difference to average travel times to work and the desirability of different locations. The introduction of motorway charges may make some locations slightly more or less accessible because they make some difference to the average travel times to work (by car) during the morning peak, and the changes in travel time vary across different locations. The areas that benefit most tend to align with growth areas identified in the draft Unitary Plan. 2.3 Administrative simplicity Overall conclusion: Increases to rates and fuel tax are simple, quick and cost-effective – systems already exist to implement and administer this pathway. The introduction of motorway charges is achievable but more complex and costly. The implementation of rates and fuel tax increases are simple, quick and cost-effective to introduce and to administer. Systems already exist for their administration, collection and distribution; few additional implementation costs would be incurred. Given their long history in New Zealand, these funding sources are also well understood by the public and relatively simple to operate. There is no requirement to construct physical infrastructure or put in place new technology. The major time cost would be in securing agreement from Cabinet and Auckland Council’s Governing Body, and legislative/regulatory change for either a regional fuel tax or increases to Petroleum Excise Duty. The introduction of motorway charges is achievable but is more complex and costly. The requirement for new legislation, modelling, designing, consenting and constructing a motorway charging scheme, as well as working through implementation and operational risks would present complexities to work through. The estimated cost of implementation is approximately $108 million, including roadside equipment, back-office and other setup costs. The estimated operating costs are estimated to be around 10-12% of revenue. Transaction costs are likely to be approximately 24 cents per trip for both a fixed and variable charging scheme. Some compliance costs for users might arise through the establishment and maintenance of motorway charging accounts. These are reasonable, given that: account holders would qualify the user for a discount; and the use of accounts would also reduce the overall costs of operating the scheme. It may be more onerous for low income households to make the ‘lump sum’ payments required to establish and ‘top up’ a motorway charging account. 5 2.4 Efficiency Overall conclusion: All pathways are economically efficient. Increases to rates and fuel tax have a high benefit-cost ratio because they are inexpensive to implement and administer, but provide relatively low benefits. Motorway charging makes a greater difference to economic welfare. With a Benefit Cost Ratio (BCR) of 15, the rates and fuel tax scenario has the highest economic efficiency. However, this is because there are low implementation and operating costs associated with this scenario. The rates and fuel tax pathway offers only limited transport benefits and does not greatly increase economic welfare. Motorway charging is more costly to implement and therefore has a lower BCR (1.7 for both charging scenarios). However, these options offer significant congestion benefits and therefore increase economic welfare more than the rates and fuel tax scenario. Evasion of new charges is unlikely under all three scenarios, although the implementation of exemptions could increase the potential for this. 2.5 Fairness Overall conclusions: All options target the funding burden at those who benefit. Increases in rate cannot be avoided by changing travel behaviour, but motorway charges can be. Under all pathways, the majority of households would experience a low financial impact but a minority would be highly affected. Under the rates/fuel tax scenario, most of those severely affected are low income households, but the overall number of vulnerable households in this category is lower than the motorway scenarios. Motorway charging has a greater cost impact on frequent motorway users, but these drivers will also benefit from higher motorway speeds. On average, businesses receive a net-benefit under all pathways, but the impacts are not felt evenly across sectors. The business sector contributes a lower proportion of the additional revenue under the rates and fuel tax pathway than under either motorway charging pathway. Under all scenarios, those who pay are likely receive (to differing degrees) benefits in return. However there is far poorer alignment between those who pay and those who benefits with the Rates and Fuel Tax pathway than with motorway charges. Motorway charges match new costs with transport use – those who pay will benefit from transport improvements. Under the Rates and Fuel Tax pathway ratepayers indirectly benefit from higher property values as a result of transport improvements, but ratepayers who are low transport users would pay a disproportionate share of additional costs in relation their direct benefits. The rates and fuel tax scenario spreads the funding burden broadly - few households suffer a severe financial impact. There is only limited opportunity for these households to change their behaviour in order to reduce the amount of rates and fuel tax that they pay. Of the households that suffer a severe financial impact, almost all are low income households. On average, businesses will receive a slight net benefit from the implementation of the Auckland Plan Transport Network and increases to rates and fuel tax, but these benefits are not spread evenly. The motorway charging scenarios target the funding burden at motorway users, particularly frequent motorway users, who will pay significantly higher amounts than most households. However, because many households can alter their travel behaviour to avoid paying motorway charges, the vast majority of households will experience only a low budgetary impact. More low income households will suffer a high or very high cost impact under the motorway charging scenarios, but the overall number remains relatively small. Vulnerable households contribute a lower proportion of additional funding under the motorway charging scenarios than they do under the rates and fuel tax pathway. Some areas adjacent to motorways, or which are dependent of 6 motorways for access to other parts of the region, may have greater exposure to the effects of motorway charges. 2.6 Risk Overall conclusion: Motorway charging is new to New Zealand and would be on a large scale – these pathways carry greater risk than the rates and fuel tax pathway. Motorway charging is new for New Zealand and will be on a large scale, even by international standards. It therefore carries a higher degree of risk (including IT risk) than increases to rates and fuel tax. None of the funding scenarios include design features which are likely to present particular barriers from a public acceptability point of view. However, rates and fuel tax schemes are more familiar to the public. Under the motorway charging scenarios, the nature of variable charges may be more difficult for the public to understand than a fixed charge. Under all scenarios, the public acceptability of increasing household and introducing a new type of funding mechanism would need to be navigated. The most significant public acceptability issue for motorway charging is likely to be privacy concerns in relation to the information that is collected and what it may be used for. 3 Detailed evaluation A detailed assessment of the scenarios against the IAB’s evaluation criteria is set out in appendix 1 of this report. 7 Appendix 1 Detailed Evaluation of Three Funding Pathways Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) Revenue sufficiency This option has the potential to raise sufficient revenue through a series of small progressive increases to rates and fuel tax. However, it does not raise as much revenue as motorway charges could. Both motorway charging scenarios have the potential to raise sufficient revenue, and have greater potential to raise more revenue than the rates and fuel excise option. Both motorway charging scenarios have the potential to raise sufficient revenue, and have greater potential to raise more revenue than the rates and fuel excise option. This pathway would provide a steady funding stream, however only some funding sources within this pathway could easily be hypothecated to the Auckland Plan Transport Programme. A transport rate could be assigned and used only for transport in Auckland, as could a regional fuel tax. However, under the current funding arrangements, an increase in fuel taxes is tagged for transport, but not for the Auckland region. As is currently the case, Auckland Transport, along with all other regional transport agencies, would need to submit funding proposals that met governmentset criteria. Revenue raised through a Congestion Reduction Charge can be tagged and applied only to Auckland transport, giving Aucklanders some assurance that the funding is used for its intended purpose. However, even here, there is a risk that the new revenue is used as a substitute for existing funding. The revenue sustainability of this funding scenario is the same as the revenue sustainability for a fixed motorway charge. Rates and fuel tax increases are secure, provided there is sufficient political will to implement them. Revenue from motorway charging would be less certain. The risks for the fixed and variable charging schemes are the same. The risks to revenue under a variable motorway charging scenario are similar to the risks under a fixed scenario. However, calculating the estimated travel demand response to charges is slightly more complex, as demand elasticity may differ between the peak/offpeak and between price points. • • Net revenue is equal to the estimated funding gap. Revenue is available when required. Revenue sustainability • Revenue source is secure and there are few risks to revenue. Rates provide a predictable form of revenue, although estimated rates revenue is subject to our estimates of population growth and an increase in the rating base. Fuel tax revenue is also reasonably predictable, although less than expected has been received in recent years despite increases in the level of PED. In the longer term, the government may need to diversify its revenue sources to contend with vehicle fuel efficiency improvements, hybrids and alternative fuels. Realising a quality compact environment (Auckland Plan) • 8 Travel times to work are shorter in areas zoned for intensification compared to areas that are not zoned for The existing tools scenario does not make any locations significantly more or less desirable to live in from an accessibility perspective because it makes little difference to average travel times to work (by car) during the AM peak. Although average travel times to work improve slightly more in some suburbs than others, the amount of time savings that are attributable to the funding tools (as opposed to the implementation of the Auckland Plan Transport Network) are small. A motorway scheme would be new and untested on Auckland roads, and accurately setting the level of charge carries risks. A charge that is too high could suppress demand, overload the local roads network and decrease revenue, and if too low, decongestion benefits may not be achieved. Making predictions about how people’s travel behaviour will change in response to a charge is difficult. The risk relating to traffic volumes are highest during the initial stages of the scheme, when the demand response is not yet established. This scenario is consistent with ‘a quality compact city’. Although it may make some locations slightly more or less desirable from an accessibility perspective, the suburbs that benefit the most tend to be consistent with growth areas identified in the draft Unitary Plan. In 2026, the decrease in average travel time to work is greatest for commuters from Matakana, Warkworth, Kumeu, Muriwai, Wellsford, Omaha, Muriwai and Devonport/Takapuna, who experience a saving of 4.1 – 7.0 This scenario is consistent with a ‘quality compact city’. In 2026, the decrease in average travel time to work is greatest for commuters from Warkworth, Kumeu, Muriwai, Wellsford, Omaha, Hobsonville, Whenuapai and Devonport/Takapuna, all of which experience savings in the region of 5.2 – 6.9 minutes. In 2046 Warkworth, Wellsford, Pukekohe, Hobsonville, Whenuapai, Te Atatu, Rosebank and Devonport/Takapuna experience the greatest savings. Key performance indicators and measures • growth. If the accessibility of key destinations by private vehicle decreases under a funded scenario, they remain accessible by PT. Creating enduring neighbourhoods, centres and business areas (Auckland Plan) • • • More Aucklanders have access to key destinations. Improved accessibility to employment. Charging infrastructure does not undermine the urban amenity of neighbourhoods, centres and business areas. Existing tools 1 The Auckland Plan Transport Network includes significant investment in public transport under all funding scenarios. This will increase the proportion of Aucklanders living within 10 minutes walk of a high frequency public transport stops and provide transport alternatives for those who wish to reduce the amount of time that the spend in congestion. There is no difference between the funding scenarios for this measure. There is no difference between the funding scenarios for this measure. None of the funding scenarios makes a significant impact on access to key destinations, although the Auckland Plan does improve public transport access to Auckland’s metrocentres. In 2026, under this scenario: Fixed motorway charges do not significantly improve access to key destinations compared to the other scenarios. In 2026, under this scenario: Variable motorway charges do not significantly improve access to key destinations compared to the other scenarios. In 2026, under this scenario: 97% of Aucklanders will be able to reach their nearest metrocentre within 30 minutes by car (no change from 2013); 97% of Aucklanders will be able to reach their nearest metrocentre within 30 minutes by car (no change from 2013); 69% of Aucklanders will be able to reach their nearest metrocentre within 30 minutes by public transport 69% of Aucklanders will be able to reach their nearest metrocentre within 30 minutes by public transport 58% of Aucklanders will be able to reach the CBD within 45 minutes by public transport (no change from 2013). 58% of Aucklanders will be able to reach the CBD within 45 minutes by public transport (no change from 2013). This scenario makes a greater improvement to accessibility to employment than the existing tools scenario, but a lower improvement than the variable motorway charging scenario. In 2026 under this scenario: This scenario makes a slight improvement to accessibility to employment. In 2026 under this scenario: 97% of Aucklanders will be able to reach their nearest metrocentre within 30 minutes by car during the AM peak; 69% of Aucklanders will be able to reach their nearest metrocentre within 30 minutes by public transport 57% of Aucklanders will be able to reach the CBD within 45 minutes by public transport (no change from 2013) All funded scenarios make slight improvements to employment accessibility. This scenario has the lowest impact of all three scenarios. In 2026 under this scenario: 25.55% of jobs will be accessible to the average Aucklander within 45 minutes by public transport. • Motorway variable charge ($3/$2) minutes. In 2046 Warkworth, Wellsford, Devonport/Takapuna, Hobsonville, Whenuapai, Te Atatu and Rosebank receive the greatest savings. 50% of jobs will be accessible to the average Aucklander within 30 minutes by car. Double passenger transport from 70 million boardings (2012) to 140 million by 2022 (Auckland Plan) Motorway fixed charge ($2) 56% of jobs will be accessible to the average Aucklander within 30 minutes by car. 58% of jobs will be accessible to the average Aucklander within 30 minutes by car. 25.91% of jobs will be accessible to the average Aucklander within 45 minutes by public transport. 25.86% of jobs will be accessible to the average Aucklander within 45 minutes by public transport. Increases to rates and fuel excise will not result in any visual imposition of charging infrastructure on the urban amenity of neighbourhoods, centres and businesses. The introduction of motorway charges will involve the construction of gantries across the motorway or poles at motorway entries/exits, but will not result in any visual imposition of charging infrastructure on the urban amenity of neighbourhoods, centres and businesses. The impact on urban amenity for this scenario is the same as it is for the ‘fixed charging’ scenario. This scenario makes the least contribution to increases in public transport patronage, although some growth is expected due to the higher levels of public transport service provided by the Auckland Plan Transport network. In 2026, under this scenario, annual public transport boardings will be 141.381 million (compared to 66.282 million in 2013). This scenario makes a greater contribution to increases in public transport patronage than the existing tools scenario, but a lower contribution than the variable charging scenario. In 2026, under this scenario, annual public transport boardings will be 144.530 million. Of the three scenarios, this scenario makes the highest contribution to increases in public transport patronage, due to its high travel demand impact on motorway travel. In 2026, under this scenario annual public transport boardings will be 145.336 million. Increased PT use.""" 9 Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) Increase the proportion of trips made by passenger transport into the city centre during the morning peak from 47% of all vehicular trips (2011) to 70% by 2040 (Auckland Plan). This scenario would have a mildly positive impact on the proportion of people who would access the city centre by public transport in the future, but it has the least impact of the three funding scenarios. In 2026 under this scenario, 59% of trips to the CBD would be by public transport. This scenario would has a slightly more positive impact on future access to the city centre by public transport than the existing tools scenario, but a lower impact the variable motorway charge. In 2026 under this scenario, 60% of trips to the CBD would be by public transport. This scenario has the greatest impact on future access to the city centre by public transport, but it is not substantially greater than the fixed motorway charge. In 2026 under this scenario, 61% of trips to the CBD would be by public transport. This scenario has a small impact on average speeds on the strategic freight network during the AM peak, but this is not as significant as the impact of the motorway charging scenarios. In 2026, under this scenario, average speeds on the strategic freight network during the AM peak (at peak congestion but measured in both directions) would be 51 kilometres per hour. This is an improvement on the daily average speed in 200609. This scenario has a positive impact on average speeds on the strategic freight network and slows the rate at which these speeds decline in the face of population growth. It has a less dramatic impact than variable motorway charges, but a higher impact than increases to rates and fuel tax. In 2026, under this scenario, average speeds on the strategic freight network during the AM peak would be 57 kilometres per hour. Of all three funding scenarios, this option has the most positive impact on average speeds on the strategic freight network. It dramatically slows the rate at which these speeds decline. In 2026, under this scenario, average speeds on the strategic freight network during the AM peak (would be 60 kilometres per hour. Implementing the Auckland Plan Transport Network the rate at which severe congestion grows on the strategic freight network (which is essentially the motorway network). However, funding these improvements through rates and fuel tax increases does not improve upon this achievement. In 2026, if this scenario was implemented: This funding scenario would reduce congestion levels on the strategic freight network during the AM peak, but have little more effect on interpeak congestion than rates and fuel tax increases. In 2026, if this scenario was implemented: Of all three scenarios, this scenario would have the biggest impact on congestion levels on the strategic freight network during the AM peak, but have little more effect on interpeak congestion than the other two funding scenarios. In 2026, if this scenario was implemented: • Increase proportion of people accessing CBD by PT. Reduce congestion levels for vehicles on the strategic freight network to at, or below, the average of 2006-09 levels (average daily speed of 45kph and average delay of 32 seconds per kilometre) by 2021 (Auckland Plan). • • Average vehicle speeds on the Strategic Freight Network are maintained at acceptable levels in a growing Auckland. Severe congestion on the strategic freight network does not increase significantly. “An effective, efficient, safe, secure, accessible and resilient transport system that supports the growth of NZ’s economy, in order to deliver greater prosperity, security and opportunities for all New Zealanders” (Government Policy Statement). • 10 Auckland experiences less congestion The percentage of travel time spent in severe congestion on the strategic freight network during both the AM peak and the interpeak would be 18%. The percentage of travel time spent in severe congestion on the strategic freight network during the AM peak would both be 12%. The percentage of travel time spent in severe congestion on the strategic freight network during the interpeak would both be 17%. The percentage of travel time spent in severe congestion on the strategic freight network during the AM peak would both be 9%. The percentage of travel time spent in severe congestion on the strategic freight network during the interpeak would both be 17%. This option is unlikely to significantly reduce congestion in Auckland and would have a far lower impact than either of the motorway charging scenarios. In 2026, under this scenario: This option will slow the rate at which region-wide congestion grows, but not as much as the variable motorway charge. In 2026, if this scenario was implemented: A variable motorway charge slows the rate at which regionwide congestion grows more than the other funding scenarios. In 2026, if this scenario was implemented: The amount of traffic on Auckland’s roads would be 0.3% lower than if the Auckland Plan Transport Network had not been implemented. The amount of traffic on Auckland’s roads would be 1.5% lower than if the Auckland Plan Transport Network had not been implemented. The amount of traffic on Auckland’s roads would be 12.4% lower than if the Auckland Plan Transport Network had not been implemented. Peak hour travel times from the north, south and west of the region to the city centre are estimated to be 1 per cent lower than they would under a ‘basic’ network. Peak hour travel times from the north, south and west of the region to the city centre are estimated to be 10 - 12 per cent lower than they would under a ‘basic’ network. Peak hour travel times from the north, south and west of the region to the city centre are estimated to be 12 - 15 per cent lower than they would under a ‘basic’ network. The proportion of time spent in severe congestion on the motorway network would decrease by 5% by 2046, with no The proportion of time spent in severe congestion on the motorway network peak is estimated to decrease by The proportion of time spent in severe congestion on the motorway network peak is estimated to decrease by Key performance indicators and measures • Use of passenger transport increases. Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) change in the inter-peak period. approximately 24 per cent in the AM peak and 12.5% in the inter-peak by 2046. approximately 33 per cent in the AM peak and 12.5% in the inter-peak by 2046. Under this option, some traffic will divert off the motorway and onto the arterial road network in order to avoid motorway charges. It is likely that additional capacity will be needed on Triangle Road in Massey, particularly between Waimumu Road and Lincoln Road; on Great South Road in Otahuhu, particularly between Mangere Road and Bairds Road; on Bairds Road Otara between Great South Road and Hellabys Road; and on Great South Road between Takanini and Papakura. This option would have similar local road impacts to the fixed charge option, although they may be slightly more pronounced during the peak period, when motorway users would face a $3 charge as opposed to a $2 charge under the fixed charging scenario. Further investigation is needed in some other locations to determine whether traffic can be managed or improvements are needed. In addition, some planned improvement works are likely to need to be brought forward, particularly widening State Highway 20B (the Airport Eastern Access) and upgrading Mill Road (linking Papakura and Otara). The reduction in motorway flows might also mean some planned motorway improvements are no longer required Value for money (Government objective). • The benefit-cost ratio for the funded scenario is positive. Safety and environment (Government objective). • • Reduced fatal and serious injuries from transport-related accidents. Reduced greenhouse gas emissions and air pollution from transport sources. This scenario does not increase public transport use as much as the other two funding scenarios. In 2026, under this public transport boardings would increase by 0.3%. This scenario makes a bigger difference to public transport use than the rates and fuel tax scenario, but less of an impact than variable charges. In 2026, under this scenario, public transport boardings would increase by 1.6%. This scenario makes the biggest difference to public transport use during the AM peak. In 2026, under this scenario, public transport boardings would increase by 2.0%. The Benefit Cost ratio for this option is 15. It is therefore likely to provide higher value for money than the other two scenarios. However, the high benefit/cost ratio is driven by the minimal implementation and operational costs associated with increasing rates and fuel tax. This scenario delivers a much lower level of economic welfare gains than the other two scenarios. This scenario increases economic welfare by $247 million. The Benefit Cost ratio for this option is 1.7. It is economically efficient, but does not provide as much value for money as the rates and fuel tax scenario. However, this scenario does deliver higher net gains to economic welfare than the existing tools scenario. This scenario increases economic welfare by $585 million. The Benefit Cost ratio for this option is 1.7 It is economically efficient, but does not provide as much value for money as the rates and fuel tax scenario. However, this scenario delivers higher net gains to economic welfare than the other two funding scenarios because it has a bigger impact on congestion and travel times. This scenario increases economic welfare by $594 million. The number of fatal and serious injuries from transport-related accidents on Auckland’s roads reduces the same amount under all funding scenarios and is minimal. The reduction is attributable to improvements in the quality of Auckland’s transport network under the Auckland Plan, rather than the funding mechanism which pays for it. In 2013, there were 0.0109 transport-related fatalities and serious injuries per capita. In 2026, if Auckland Plan Transport Network is implemented, there would be 0.0067 transport related fatalities and serious injuries per capita. There is no difference between the funding scenarios in relation to this indicator. There is no difference between the funding scenarios in relation to this indicator. Population growth results in an overall growth in transportrelated greenhouse gas emissions between 2013 and 2026. They would grow marginally more if this funding scenario was Transport-related greenhouse emissions and air pollution grow less under the motorway charging scenarios than the existing tools scenario. This is because fewer car trips will be This scenario would do the most to decrease the rate at which transport-related greenhouse gas emissions and air pollution 11 Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) implemented, than they would under the other funding scenarios. This is because private vehicle use does not decline as much under this scenario. In 2026 under this scenario: made overall. The impact is marginally less under this scenario than under the variable charging scenario. In 2026 under this scenario: grow in Auckland. In 2026 under this scenario: the amount of transport-related greenhouse gas emissions in 2026 would be 9,025,000 kilograms; and 5,600 kilograms of VOC emissions per day would be attributable to transport; 19,100 kilograms of NOx emissions per day would be attributable to transport; 810 kilograms of PM emissions per day would be attributable to transport. Implementation costs • • Implementation costs are reasonable. Implementation of the scheme is achievable. The implementation costs of this option are reasonable. Systems already exist for the collection of rates and fuel excise, so few additional implementation costs would be incurred if increases to these taxes were implemented. New legislation would not be required unless fuel tax increases were achieved through a regional fuel tax scheme. the amount of transport-related greenhouse gas emissions in 2026 would be 9,025,000 kilograms 5,440 kilograms of VOC emissions per day would be attributable to transport; 18,910 kilograms of NOx emissions per day would be attributable to transport; the amount of emissions in 2026 would be 8,996,000 kilograms. 5,420 kilograms of VOC emissions per day would be attributable to transport; 18,880 kilograms of NOx emissions per day would be attributable to transport; 790 kilograms of PM emissions per day would be attributable to transport. 800 kilograms of PM emissions per day would be attributable to transport. The estimated cost of implementing a motorway charging scheme are likely to be approximately $108.7 million, including roadside equipment, back-office and other setup costs. This assumes that Automatic Number Plate Recognition is used to identify vehicles using the motorway). The implementation costs for this scenario are essentially the same as the costs for a fixed charge motorway scheme. New legislation is likely to be required and could lead to delays in implementation. The Land Transport Management Act 2003 provides for tolling on new roads, but only allows tolling on existing roads where they are physically or operationally integral to the new road. However, there is also a provision within the Local Government Act 1974 under which the Minister may “authorise a council to establish, by using the special consultative procedure, toll gates and collect tolls at any bridge, tunnel, or ferry within the district or under control of the council.” Compliance costs (to users/payers). • Compliance costs are reasonable. Implementation of this scheme would be relatively quick and achievable. There is no requirement to construct physical infrastructure or put in place new technology. The major time cost would be in securing agreement from Cabinet and Auckland Council’s Governing Body, and legislative/regulatory change for either a regional fuel tax or increases to Petroleum Excise Duty. Implementation of the scheme would be achievable, but would take longer than increases to rates and fuel tax. New legislation would be required which could lead to delays implementation. Modelling, designing, consenting and constructing a motorway charging scheme, as well as working through implementation and operational risks would also present complexities to work through. Implementation of this scheme is achievable. Systems already exist for the collection of rates and fuel excise. No additional compliance costs would be associated with increases to these taxes unless an exemptions or rebates system was introduced. (Under an exemptions or rebates scheme individuals who met certain criteria would need to apply for an exemption or rebate and would need to If Automatic Number Plate Recognition (ANPR) technology was used, this scheme would involve very few compliance costs compared to many international road charging schemes because vehicles would not need to be fitted with transponders or GPS. The compliance costs for this scenario are essentially the same as they are for a fixed motorway charge, although care will need to be taken to ensure that motorists are aware of changes in price for motorway use during the peak/offpeak. Reasonable compliance costs would be associated with the 12 Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) support their application with proof that they meet the criteria). establishment and maintenance of accounts (for regular users). Although account holders will need to pay a small lump sum to establish and ‘top-up’ their account, they will receive a 15% discount for doing so. In addition, the establishment of accounts significantly reduces the costs of scheme collection and therefore reduce the gross revenue requirement, meaning that motorway users can be charged at a lower rate than would otherwise be required. Motorway variable charge ($3/$2) The compliance costs of establishing and maintaining accounts for low income households may be more onerous, as they are less likely to have the ability to fund ‘lump sum’ top-ups. Operating costs (to scheme operators). • Operating costs are reasonable. Scheme complexity and transparency. • Scheme is simple and understandable. Economic efficiency. • Scheme has a BCR of 1 or higher. Systems already exist for the administration of rates and fuel excise. Additional administration costs would be low and are reasonable. An increase in rates or national fuel tax would not materially affect collection costs. The introduction of a new regional fuel tax would not create significantly additional operating costs. The estimated annual operating costs of a motorway charging scheme are estimated to be around 10-12% of revenue. Transaction costs are likely to be 24 cents per transaction. The operating and transaction costs for this scenario are the same the costs for the fixed charge scenario. This is the simplest and most understandable funding pathway to implement. Given their long history in New Zealand, rates and fuel excise are funding sources that are well understood by the public and relatively simple to operate. Increases to these funding sources can be introduced relatively easily and at a low cost. If motorway charging is introduced, a fixed charge would be simpler for motorway users to understand than a variable charging scheme. The introduction of either motorway charging scheme would, be more complex than increases to rates and fuel tax. From the perspective of the user, a variable charging scheme would be more complex than a fixed charging scheme. Motorway users would need to anticipate the price that they would pay before they entered the motorway. This could be difficult to calculate if traffic leading onto the motorway is congested. The introduction of either motorway charging scheme would, be more complex than increases to rates and fuel tax. Compared to motorway charging, this option has a high benefit cost ratio of 15 and from that perspective, it is highly economically efficient. The reason for such a high benefit/cost ratio is that the costs of this option are relatively low. This option is economically efficient, although not quite as efficient as the rates and fuel excise option. It has a benefit cost ratio of 1.7. This option is equally economically efficient as the fixed motorway scenario, but as efficient as the rates and fuel excise option. It has a benefit cost ratio of 1.7. It increases economic welfare more than the fixed motorway scenario because results in greater transport benefits for users. There is an economic welfare gain of $594million under this scenario. The drawback of this option from an economic perspective is that although it is relatively low cost, it also fails to generate significant benefits and therefore it does not greatly increase economic wellbeing. Unlike motorway charging, it does not provide significant congestion or travel time benefits and therefore only increases economic wellbeing by $247 million. Evasion/non-compliance. • Opportunities and incentives to evade payment are limited. There are few (if any) means of evading rates and fuel tax increase. If fuel excise increases were implemented by way of a Regional Fuel Tax, it is possible that two compliance issues could arise: Unlike the rates and fuel excise option, the economic costs of implementing and operating motorway charges are high. However, these costs are offset by the decongestion, travel time and environmental benefits that are generated as a result of pricing use of the motorway network. Under this option, the implementation of a new funding tool increases economic wellbeing by $585 million. The motorway charging options that we have presented leaves little room for avoidance or non-compliance. The numbers of all vehicles using the motorway will be automatically recorded and the registered owner will be automatically charged for the associated motorway trip. The performance of this scenario against this criterion is the same as the fixed charge. It is possible that a small proportion of motorway users could 13 Key performance indicators and measures Equal treatment of ‘like’ payers. (Horizontal equity). • Those receiving similar benefits or creating similar costs pay the same level of charge/tax. Fair distribution of burden between different groups. • • • 14 Benefits to households and businesses outweigh the costs incurred. Even distribution of impact across different business and household types and sizes. Even distribution of impact across different parts of the region. Existing tools 1 Motorway fixed charge ($2) Motorists might avoid paying a higher price for fuel by refuelling outside of Auckland; or Fuel companies could increase the retail price of fuel in other regions in order to minimise the increase within Auckland. refuse to comply with their payment obligations, but the experience with the Northern Gateway suggests that this is rare. In cases where a motorway user refused to pay, or was late in making their payment, enforcement action could be taken. These possibilities would not occur if fuel excise increases were implemented by way of a national fuel excise increase. They are also unlikely under a regional fuel tax scenario because the price differential between Auckland and other regions would not be high enough to induce this type of behaviour. If an exemptions scheme were implemented, or a limit was set on the number of times that a vehicle could incur a charge each day, significant evasion and compliance issues could arise. The Independent Advisory Body has therefore not included exemptions or capping proposals in the scheme presented in its report. This option treats all ‘like’ payers equally. All property owners with similarly valued properties located within a defined geographic area will be subject to the same level of rates increase and are likely to benefit from similar increases in their property value as a result of Auckland Plan Transport improvements. Motorway charging has high horizontal equity. All motorway users would be charged the same amount for using the network, notwithstanding their personal, household or business characteristics. In return for their payment, they will all benefit from quicker travel times and less congestion on the motorway. All motorists will be subject to the same level of fuel increase, notwithstanding their personal, household or business characteristics. The amount that they pay is proportional to the amount of fuel that they use (or travel that they undertake in a private vehicle) and is therefore proportional to their contribution to congestion. Motorists who travel on the motorway at peak time will receive similar levels of benefit to each other. Motorists who travel on the motorway during the inter-peak will receive similar levels of benefit to each other. This option spreads the funding burden between those who benefit most from the Auckland Plan Transport Network and those who contribute most to the requirement for investment: property owners and motorists. Land owners would indirectly benefit from improved property values and motorists benefit from improved travel options and slower increases in congestion. However, property owners who have low transport use will benefit more than ratepayers with low transport use. Both charging options concentrate the funding burden on motorway users. This group contributes significantly to congestion and the need for the Auckland Plan Transport Network, and will receive travel time savings on the motorway in return for their payment. However, it could equally be argued that motorway users will subsidise other transport users who benefit from Auckland Plan transport investments that are not motorway related. Overall, the business sector would be $256 million or 5.3% better off in 2026 under this scenario than if the Auckland Plan Transport Network had not been implemented and paid for by rates and fuel tax increases. However, the net benefit is lower than if motorway charges were introduced. The net savings arise because although the business sector will incur additional direct transport costs, these would be outweighed by the savings that result from travel time improvements resulting from the implementation of the Auckland Plan Transport Network. Overall, the business sector benefits more under this scenario, than if rates and fuel taxes were increased. In 2026, the business sector will realise net savings of $303 million or 6.2%. The savings are greater than under the rates and fuel tax pathway because of the positive effects that motorway charges have on motorway speeds (in additional to the travel time benefits provided by transport improvements). Motorway variable charge ($3/$2) This scenario has relatively high horizontal equity. All motorway users are charged the same amount for using the network, according to the time that they travel. Those who pay the same amount will receive a similar level of transport benefits in return. The groups that pay, and who benefit are similar under this scenario to those under the fixed charging scenario. Of the three options, this provides the greatest benefit to businesses because it has the largest impact on travel times. In 2026, the business sector would be $314 million better off under this scenario than under a ‘basic transport network’ scenario. Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) Distribution between household/business sector Distribution between household/business sector Distribution between household/business sector Households would contribute 66% of gross revenue and businesses would contribute 34%. Households would contribute 59% of gross revenue and businesses would contribute 41%. Households would contribute 54% of gross revenue and businesses would contribute 46%. Distribution between households Distribution between households Distribution between households This pathway spreads the funding burden evenly and broadly but there are few opportunities to reduce the amount paid – rates cannot be avoided. A small proportion of households suffer a severe financial impact - most of these are low income households. Super-annuitants with a low annual income and living in high value properties could be disproportionately affected. This pathway focuses of the funding burden on frequent motorway users, who would pay (and benefit) significantly more than the average. The majority of households would experience a low financial impact because they can minimise the amount of charges they pay be altering their travel behaviour (albeit at a social/convenience cost). A slightly greater number of vulnerable households would suffer a high financial impact than if rates and fuel tax were increased. The household and business impacts of this pathway are very similar to the impacts of the fixed charge scenario. In 2026, if this pathway was implemented: The average household would pay $345 per year, but after taking into account changes in their fuel use, parking and vehicle operating costs related to changes in travel behaviour, the net average cost that households would need to accommodate within the non-transport areas of their budget is $217 per year. In 2026, if this pathway was implemented: 96.7% of Auckland households would experience a low financial impact. 2.4% of households would face costs that equate to more than 2.5% of their after-tax income. In 2026, if this pathway was implemented: 97.9% of Auckland households would experience a low financial impact. 0.3% of households would face costs that equate to more than 2.5% of their after-tax income The average household would pay $348 per year, but after taking into account changes in their fuel use, parking and vehicle operating costs related to changes in travel behaviour, the net average cost that households would need to accommodate within their budget is $297 per year. Vulnerable households account for approximately 18% of Auckland’s population and would contribute 14.7% of the revenue raised. The average vulnerable household would pay $251 per year. 1.5% of Auckland’s vulnerable households would suffer a high or very high financial impact. Distribution between business sectors The impact of rates and fuel tax increases are not felt evenly across all business sectors. In 2026, if this scenario was implemented: 96.7% of Auckland households would experience a low financial impact. 2.5% of households would face costs that equate to more than 2.5% of their after-tax income The average household would pay $371 per year, but after taking into account changes in their fuel use, parking and vehicle operating costs as a result of changes in travel behaviour, the net average cost they would have to accommodate within their budget is $256 per year. Frequent motorway users would account for 7.5% of households, but would pay 26% of the total revenue from a Motorway User Charge. Frequent motorway users would account for 6.7% of households, but would pay 30% of the total revenue from a Motorway User Charge. Vulnerable households would contribute 11% of the revenue raised. After adjusting their travel behaviour to reduce the costs they pay, the average vulnerable household would pay $140 per year. Vulnerable households would contribute 11% of revenue. After adjusting their travel behaviour to reduce the costs they pay, the average vulnerable household would pay $160 per year. 3.4% of Auckland’s vulnerable households would suffer a high or very high financial impact. 3.9% of Auckland’s vulnerable households would suffer a high or very high financial impact. The impact on businesses, business sectors and retail are similar to the fixed motorway charging scenario. In 2026, if this scenario was implemented: Distribution between business sectors Distribution between business sectors Core transport businesses would receive a net-benefit of $8.7million. Businesses highly reliant on the transport sector to move goods essential to their business would bear increased costs of $13.6 million. Businesses that use the transport network to provide mobile goods and services (such as construction trades, painters, Most businesses benefit from a Motorway User Charge, but some sectors will benefit more than others, because they have greater ability to alter their travel patterns in order to reduce the amount of motorway charges they pay. In 2026, if this scenario was implemented: Core transport businesses would receive a net-benefit of Core transport businesses would receive a net-benefit of $10.7million. Businesses highly reliant on the transport sector to move goods essential to their business would receive net benefits of $4.7 million. Businesses that use the transport network to provide mobile goods and services (such as construction trades, painters, 15 Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) cleaners and waste collection businesses) will receive net benefits worth $96.6 million. $11.0million. cleaners and waste collection businesses) will receive net benefits worth $105.9 million. Under all funding scenarios, retail spending would be 0.60.9% lower than under a scenario that does not require additional funding because households would have less discretionary income to spend. Changes in where and how households choose to shop may also alter the distribution of retail sales across the region. Businesses highly reliant on the transport sector to move goods essential to their business would receive net benefits of $6.1 million. The impacts on retail are the same as those under the rates and fuel tax pathway. Businesses that use the transport network to provide mobile goods and services (such as construction trades, painters, cleaners and waste collection businesses) will receive net benefits worth $108.4 million. The impacts on retail are the same as those under the rates and fuel tax pathway. From a household perspective, the impacts of this scenario are spread relatively evenly across Auckland. Very low impacts are evident in most areas, apart from a handful of locations where relatively high property values coincide with relatively low household incomes. From a business perspective, trucking firms on the outskirts of Auckland, and areas where there are high concentrations of heavy commercial vehicle operators are likely to feel a greater impact than other areas under this scenario. Affordability • • Impact on household budgets and business overheads. Low-income households not disproportionately affected compared to high income households. This funding pathway is more affordable for the average household than the motorway charging scenario, but there is less scope to reduce the costs that they incur by changing their travel behaviour. 97.8% of households would feel a low impact on their budget. Under this option would be increased charges would equate to more than 2.5 of households income for (0.29%) of households. For these households that would be a severe financial impact. This option spreads the funding burden evenly, so there are few households that are severely impacted. However, low income households are disproportionately represented in this category because they account for 92.6% of those households that are severely financially impacted. 16 From a household perspective, the impacts of motorway charging are likely to be more concentrated in areas that are close to the motorway or where the motorway is the dominant option for accessing other parts of Auckland. These areas are likely to be more exposed to Motorway User Charges, but will also receive significant travel time benefits when travelling on the motorway. This scenario has the same geographic impacts as the fixed charge. Firms located in Auckland’s industrial areas may experience a larger effect. This is because they tend to have good transport and motorway accessibility (a key consideration affecting business location decisions). However, many of these firms will be better off from a Motorway User Charge, with benefits exceeding their additional direct costs. By a small margin, this funding pathway is slightly less affordable for the average household than the other funding scenarios, but remains affordable for the majority. 95.8% of households would feel a low impact on their budget. Charges under this option would equate to more than 2.5% of household income for (2.2%) of households. For these households that would be a severe financial impact. This scenario is likely to be less affordable for frequent motorway users. They would pay between $1,140 and $1,260 per year. However, they will receive travel time savings on the motorway in return. Low income households make up 30.8% of those households that suffer a severe financial impact under this scenario. A disproportionate financial impact will be felt by a small group of low income households that are also frequent motorway users. This funding pathway is slightly less affordable than rates and fuel tax increases, but remains affordable for the majority. 96% of households would feel a low impact on their budget. Charges under this option would equate to more than 2.5% of household income for (2.5%) of households. For these households that would be a severe financial impact. This scenario is likely to be the least affordable for frequent motorway users. They would pay between $1,430 and $1,580 per year. However, they will receive travel time savings on the motorway in return. Low income households make up 24.8% of those households that suffer a severe financial impact under this scenario. A disproportionate financial impact will be felt by a small group of low income households that are also frequent motorway users. Key performance indicators and measures Existing tools 1 Motorway fixed charge ($2) Motorway variable charge ($3/$2) Risks The revenue, implementation and operational risks for the rates and fuel tax pathway are relatively low. The mechanisms for setting, collecting and administering them are well established Given the unknown nature of this funding source and the scale of the proposed scheme, there are greater risks (for example, IT risks and traffic volume risks) than for the rates and fuel tax pathway. Given the unknown nature of this funding source and the scale of the proposed scheme, there are greater risks than for the rates and fuel tax pathway. The scheme design features of the proposed rates and fuel tax schemes do not appear to present specific barriers to public acceptability. However the public acceptability of increasing household and business costs would need to be navigated. The potential public responses to increases in these funding sources are well understood. The scheme design features of the fixed motorway scheme do not appear to present specific barriers to public acceptability. This scheme has been kept as simple as possible to ensure that it is understandable to the public and as affordable as possible. However the public acceptability of increasing household and introducing a new type of funding mechanism would need to be navigated. Most of the scheme design features of the fixed motorway scheme do not appear to present specific barriers to public acceptability. However, the variable nature of charges may be harder for the public to understand. The public acceptability of increasing household and introducing a new type of funding mechanism would also need to be navigated. • • Few risks, with low likelihood of occurring Scheme design features of funding pathway likely to be acceptable to the public. 17