Tamarack Project - Talon Metals Corp

advertisement

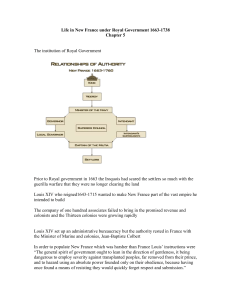

Tamarack Project Nickel-Copper-PGE TAMARACK January 2016 www.talonmetals.com TSX: TLO Conditions of Presentation • This presentation has been prepared by Talon Metals Corp. (“Talon” or the “Company”) and is being delivered for informational purposes only. The information contained herein may be subject to updating, completion, revision, verification and further amendment. Except as may be required by applicable securities laws, Talon disclaims any intent or obligation to update any information herein, whether as a result of new information, future events or results or otherwise. Neither Talon nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortuous, statutory or otherwise, in respect of the accuracy or completeness of the information or for any errors, omissions or misstatements or for any loss, howsoever arising from the use of this presentation. • This presentation should not be considered as the giving of investment advice by Talon or any of its shareholders, directors, officers, agents, employees or advisors. Each person to whom this presentation is made available must make its own independent assessment of Talon after making such investigations and taking such advice as may be deemed necessary. In particular, any estimates or projections or opinions contained herein necessarily involve significant elements of subjective judgment, analysis and assumption and each recipient should satisfy itself in relation to such matters. Neither the issue of this presentation nor any part of its contents is to be taken as any form of commitment on the part of Talon to proceed with any transaction and Talon reserves the right to terminate any discussions or negotiations with prospective investors. In no circumstances will Talon be responsible for any costs, losses or expenses incurred in connection with any appraisal or investigation of Talon. • This presentation does not constitute, or form part of, any offer or invitation to sell or issue, or any solicitation of any offer to subscribe for or purchase any securities in Talon, nor shall it, or the fact of its distribution, form the basis of, or be relied upon in connection with, or act as any inducement to enter into, any contract or commitment whatsoever with respect to such securities. TAMARACK 2 Forward Looking Information • This presentation contains certain “forward-looking statements”. All statements, other than statements of historical fact that address activities, events or developments that Talon believes, expects or anticipates will or may occur in the future are forward looking statements. These forward-looking statements reflect the current expectations or beliefs of Talon based on information currently available to Talon. Such forward-looking statements include, among other things, statements relating to future exploration potential, drilling and the timing thereof at the Tamarack Project, and more specifically, the potential extension and continuation of the MSU to the north of drill holes 14TK0211 and 15TK0219, the potential extension of the MSU to the northeast and to the southeast and northward of the 138 Zone, the potential for continuous mineralization along strike in the 221 Zone, the prospectively of the 164 Zone, 142 Zone and the “Neck”, the timing of the 2016 winter exploration program, the amount to be spent over the next two years on exploration at the Tamarack Project, the opex of high probability projected expansion projects, Kennecott Exploration Company’s (“Kennecott”) willingness to grant Talon the right to purchase the balance of the Tamarack Project and Talon’s willingness or ability to complete such purchase, the Company’s expectations with respect to its financial resources, securities and royalties, and targets, opex, capex, goals, objectives and plans and the timing associated therewith. • Forward-looking statements are subject to significant risks and uncertainties and other factors that could cause the actual results to differ materially from those discussed in the forward-looking statements, and even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on Talon. Factors that could cause actual results or events to differ materially from current expectations include, but are not limited to: changes in commodity prices, including nickel; changes in interest rates; risks inherent in exploration results, timing and success, including changes in the exploration program by Kennecott and the failure to identify mineral resources or mineral reserves; the uncertainties involved in interpreting DHEM surveys, drilling results and other geological data; inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral reserves and resources); uncertainties relating to the financing needed to further explore and develop the properties or to put a mine into production; the costs of commencing production varying significantly from estimates; unexpected geological conditions; changes in power prices; unanticipated operational difficulties (including failure of plant, equipment or processes to operate in accordance with specifications, cost escalation, unavailability of materials, equipment and third-party contractors, inability to obtain or delays in receiving government or regulatory approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); political risk, social unrest, and changes in general economic conditions or conditions in the financial markets. • Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Talon disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although Talon believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. • This presentation contains certain statistical, market and industry data obtained from government or other industry publications and Talon management’s knowledge of, and experience in, the markets in which Talon operates. Government and industry publications and reports generally indicate that information has been obtained from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. None of the authors of such publications and reports has provided any form of consultation, advice or counsel regarding any aspect of, or is in any way whatsoever associated with, the Tamarack Project. Further, certain of these organizations are participants in, or advisors to participants in, the mining industry, and they may present information in a manner that is more favourable to the industry than would be presented by an independent source. Actual outcomes may vary materially from those forecast in such reports or publications, and the prospect of material variation can be expected to increase as the length of the forecast period increases. While Talon believe this data to be reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Talon has not independently verified any of the data from third party sources referred to in this presentation or ascertained the underlying assumptions relied upon by such sources. TAMARACK 3 Technical Reference • The mineral resource figures disclosed in this presentation are estimates and no assurances can be given that the indicated levels of nickel, copper, cobalt, platinum, palladium and gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the resource estimates disclosed in this news release are well established, by their nature resource estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company. • Mineral resources are not mineral reserves and do not have demonstrated economic viability. Inferred mineral resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred mineral resources are too speculative geologically to have economic considerations applied to them to enable them to be categorized as mineral reserves. There is no certainty that mineral resources can be upgraded to mineral reserves through continued exploration. • The “Qualified Person”, as such term is defined in NI 43-101, who prepared the mineral resource estimate in this presentation is Mr. Brian Thomas (P.Geo.), who is a geologist independent of Talon and an employee of Golder Associates (“Golder”). Mr. Thomas has reviewed and approved the technical information in this presentation relating to the mineral resource estimate, including sampling, analytical and test data underlying such information. For further information, please refer to the technical report entitled “First Independent Technical Report on the Tamarack North Project, Tamarack, Minnesota” dated October 6, 2014 (“Tamarack Technical Report”) prepared by independent “Qualified Persons” Brian Thomas (P. Geo) of Golder, Paul Palmer (P. Eng) of Golder and Manochehr Oliazadeh Khorakchy (P. Eng) of Hatch Ltd. Copies are available on www.talonmetals.com or on SEDAR at www.sedar.com. • Mike Shaw, Vice President, Exploration of Talon and James McDonald, Vice President, Resource Geology of Talon are both “Qualified Persons” within the meaning of NI 43-101. Messrs. McDonald and Shaw are satisfied that the processes used by Kennecott at the Tamarack Project are standard industry operating procedures and methodologies, and they have reviewed, approved and verified the technical information disclosed in this presentation (other than the mineral resource estimate), including sampling, analytical and test data underlying such technical information. • Where “NiEq” is used in this presentation it was calculated based on the following formula using Talon’s long term metal price assumptions: NiEq% = Ni%+ Cu% x 2.91/9.20 + Co% x 14/9.20 + Pt [g/t]/31.103 x 1,400/9.2/22.04 + Pd [g/t]/31.103 x 600/9.2/22.04 + Au [g/t]/31.103 x 1,300/9.2/22.04 TAMARACK 4 Experienced Management Team with a Track Record Of Project Delivery Warren Newfield (Executive Chairman) • • • • Founded Platexco (platinum exploration) in 1997, sold to Impala in 2000 for C$191MM Founded AfriOre Ltd. (platinum exploration) in 2001, sold to Lonmin in 2007 for C$496MM Founded CIC Energy Corp. (coal exploration) in 2005, sold to Jindal Group in 2012 for C$116MM Named as one of the most influential people in South Africa's mining industry in 2008 Henri van Rooyen (CEO) • • • • • Manages exploration project evaluation, integration and development, 15 years in mining industry Founded largest silica mine in South Africa, sold to South African mining group Created one of South Africa's largest offshore diamond exploration projects, sold to a private Swiss group Developed nickel, coal, CBM, gold, potash & iron ore exploration projects from inception to exit in Botswana, Ivory Coast, South Africa & Brazil Chartered Accountant Sean Werger (President) • Manages commercial negotiations, M & A activity, legal and investor relations matters • Ten years in mining industry • Managed M &A activity of nickel, coal, CBM, gold, potash & iron ore exploration projects from inception to exit in Botswana, Ivory Coast, South Africa & Brazil • Previously a litigator with Lax, O’Sullivan Scott • LL.B/MBA Platexco Talon Metals Vince Conte (CFO) • Ten years of mining industry experience • Previously a Senior Manager with Deloitte & Touche, LLP, practicing in the financial advisory group with a focus on mining • Holds CA, CFA and CBV designations Mike Shaw (VP Exploration) • Exploration Geologist with more than 25 years mining industry experience • One of Talon’s “Qualified Person’s” in accordance with National Instrument 43-101 • Previously a Geological Consultant with Geo-Consult International and an Exploration Geologist for JCI Limited James McDonald (VP Resource Geology) • Resource Geologist with more than 20 years mining industry experience • One of Talon’s “Qualified Person’s” in accordance with National Instrument 43-101 • Previously a Senior Resource Geologist with Golder Associates, and held positions with Barrick Gold and Inco/Vale Dr. Etienne Dinel (VP Geology) • • • • Dr. Tony J. Naldrett (Director) • One of the leading experts in the world on magmatic (nickel, copper and platinum-group element) sulphide mineralization • Previously consulted for Chevron Corporation, Falconbridge Ltd., Western Mining Corporation, BHP Billiton, Rio Tinto Group and Voisey's Bay • Professor Emeritus at the University of Toronto 5 TAMARACK Geologist with more than 10 years mining experience Geoscientist specializing in Structural Geology, Petrology and Geochemistry of ore deposits Previously spent 7 years in academia as a Term Lecturer in Structural Geology at the University of Toronto PH.D in Economic Geology 5 EXECUTIVE SUMMARY TAMARACK 6 Executive Summary “We are one of the few junior exploration companies that is fully funded with the ability to progress exploration on an expedited basis” Henri van Rooyen, CEO, December 29, 2015 Press Release • Talon currently owns an 18.45% interest in the Tamarack Ni-Cu-PGE Project (includes the Tamarack North Project and the Tamarack South Project), located in Minnesota, USA • Talon has no further funding obligations to earn its interest in the Tamarack Project • The remaining 81.55% interest is owned by Talon’s partner, Kennecott Exploration Company, a subsidiary of the Rio Tinto Group • Kennecott is currently the operator of the Tamarack Project, with meaningful technical and strategic input from Talon through a joint Technical Committee • Approximately US$15 million is expected to be spent on exploration activities over the next two years (excluding project overheads) TAMARACK 7 Executive Summary - Continued • In April 2015, Talon Metals announced an updated mineral resource estimate on the Tamarack North Project, with: • 3.75 million tonnes in the indicated category at 2.35% Ni Eq; and • An additional 3.4 million tonnes in the inferred category at 2.11% Ni Eq • The inferred resource includes a high grade Massive Sulphide Unit (MSU) of 422,000 tonnes @ 7.26% NiEq • The mineralized zone (known as the Tamarack Zone) comprises less than 10% of the total strike • There remains significant growth potential at Tamarack: a) Through resource expansion within the known mineralized zone (the Tamarack Zone); and b) Talon and Kennecott have already identified new mineralized zones kilometers away from the known mineralized zone (see discoveries made in the 480 Zone, 221 Zone and 164 Zone) TAMARACK 8 COMMERCIAL TRANSACTION WITH KENNECOTT TAMARACK 9 Talon Owns an 18.45% Interest in the Tamarack Project • Talon spent a total of US$25.5 million to earn an 18.45% interest in the Tamarack Project, with all of the funds advanced being used to fund exploration expenditures, a one-time US$1 million upfront payment to Kennecott and certain land acquisitions • Talon has no further funding requirements to earn its interest in the Tamarack Project • Kennecott Exploration Company, a subsidiary of the Rio Tinto Group, is currently the operator of the Tamarack Project, with meaningful technical and strategic input from Talon through the joint Technical Committee • Once Kennecott has spent the US$15 million advanced by Talon, Talon/Kennecott will either participate in a 81.55/18.45 JV or Talon will buy-out KEX at a predetermined purchase price (see next slide for further details) • As of December 31, 2015, Kennecott had spent a total of approximately US$10.5 million of the US$25.5 million advanced by Talon TAMARACK 10 Future Optionality Once Kennecott has spent the US$25.5 million advanced by Talon, Talon/Kennecott will either participate in a 81.55/18.45 JV or Talon will buy-out KEX at a pre-determined purchase price KEX (81.55%) [180 Days] NO YES • KEX 81.55%: TALON 18.45% • KEX Operator • Fund or Dilute • JV Min Exploration $6.15M p.a. • Mutual ROFR TALON [45 Days] YES • 18 Month Option ($14m) • Talon May Explore • Talon Keeps Properties in Good Standing • Mutual ROFR NO • KEX 81.55%: TALON 18.45% • KEX Operator • Fund or Dilute • Mutual ROFR • Drag plus Tag YES • Talon pays $100M for 81.55% TAMARACK 11 THE TAMARACK PROJECT TAMARACK 12 Tamarack Project: Excellent Infrastructure with Grid Power and a Railway Line on Site The Tamarack Project is located adjacent to the town of Tamarack in north-central Minnesota approximately 85 km west of Duluth and 200 km north of Minneapolis, in Aitkin and Carlton Counties Tamarack Igneous Complex (TIC) (Magnetic 1VD Image) Power Line Tail Tamarack Zone Railway Neck 2 km Bowl Rail Lines TAMARACK 13 The Tamarack Igneous Complex is Extremely Large – 18km of Strike Length The Tamarack Igneous Complex (TIC) is comparable in footprint size to some of the world’s largest and most prolific nickel-copper-platinum intrusive complexes TAMARACK 14 TAMARACK NORTH PROJECT TAMARACK 15 Tamarack North Project - Hosts the Tamarack Zone that contains an independent mineral resource estimate (see slides 18 and 19) Platexco - Most drilling has been Talon Metals focused on the Tamarack Zone - In addition, a number of drill targets have been defined along strike 16 TAMARACK 16 The Tamarack Zone: Defined Mineral Resource in SMSU, MSU and 138 Zone Platexco 17 TAMARACK Talon Metals 17 Mineral Resource Estimate (Effective April 3, 2015)1 • Successful 2014 drilling of the step-out holes from the MSU resulted in a 167% increase in the inferred resource tonnage in the MSU • Inferred resource tonnage in the MSU increased to 422,000 tonnes @ 7.26% NiEq SMSU Indicated 3,751 1.81 1.00 0.05 0.41 0.25 0.19 2.35 Lbs NiEq* (000,000) 194.3 SMSU Inferred 949 1.12 0.62 0.03 0.25 0.16 0.14 1.47 30.8 MSU Inferred 422 6.00 2.48 0.13 0.78 0.53 0.26 7.26 67.5 138 Inferred 2,012 0.95 0.78 0.03 0.23 0.14 0.17 1.33 59.0 Total Indicated 3,751 1.81 1.00 0.05 0.41 0.25 0.19 2.35 194.3 Total Inferred 3,383 1.63 0.94 0.04 0.31 0.19 0.17 2.11 157.4 Tonnes Domain Classification (000) Ni (%) Cu (%) Co (%) Pt (g/t) Pd (g/t) Au (g/t) NiEq *(%) resources reported above a 0.9% Nickel Equivalent (“NiEq”) cut-off. Mining recovery and dilution factors have not been applied to the estimates; Tonnage estimates are rounded down to the nearest 1,000 tonnes; Estimates do not include metallurgical recovery; % = percent; g/t = grams per tonne 1All *NiEq was calculated based on the following formula using Talon’s long term metal price assumptions: NiEq% = Ni%+ Cu% x 2.91/9.20 + Co% x 14/9.20 + Pt [g/t]/31.103 x 1,400/9.2/22.04 + Pd [g/t]/31.103 x 600/9.2/22.04 + Au [g/t]/31.103 x 1,300/9.2/22.04 For further information, please refer to the Technical Reference slide of this presentation and Talon’s news release dated April 8, 2015 entitled “Talon Metals Announces 167% Increase in Tonnage for the Inferred Massive Sulphide Resource, and an Increase in Grade from 6.42% to 7.26% NiEq in the Massive Sulphide Unit at Tamarack” which is available at www.talonmetals.com or www.sedar.com. TAMARACK 18 Mineral Resources and Grades at Various cut-off Grades (Effective April 3, 2015)1 NiEq* Cut-Off (%) 0.8 0.9 1.0 1.5 2.0 2.5 Classification Indicated Inferred Indicated Inferred Indicated Inferred Indicated Inferred Indicated Inferred Indicated Inferred Tonnes (000) Ni (%) Cu (%) Co (%) Pt (g/t) Pd (g/t) Au (g/t) NiEq* (%) 3,922 4,235 3,751 3,383 3,556 2,646 2,699 1,289 1,990 752 1,459 556 1.75 1.42 1.81 1.63 1.87 1.89 2.19 2.98 2.51 4.21 2.81 5.12 0.97 0.84 1.00 0.94 1.03 1.07 1.16 1.49 1.28 1.89 1.38 2.16 0.05 0.04 0.05 0.04 0.05 0.05 0.06 0.07 0.06 0.09 0.07 0.11 0.40 0.28 0.41 0.31 0.41 0.34 0.42 0.48 0.42 0.60 0.41 0.69 0.25 0.17 0.25 0.19 0.26 0.22 0.27 0.31 0.27 0.40 0.27 0.47 0.19 0.15 0.19 0.17 0.20 0.18 0.20 0.22 0.20 0.24 0.19 0.25 2.28 1.86 2.35 2.11 2.42 2.43 2.80 3.73 3.17 5.17 3.51 6.22 1Cut-off grades are listed in the left hand column; Mining recovery and dilution factors have not been applied to the estimates; Tonnage estimates are rounded down to the nearest 1,000 tonnes; Estimates do not include metallurgical recovery; % = percent; g/t – grams per tonne *NiEq was calculated based on the following formula using Talon’s long term metal price assumptions: NiEq% = Ni%+ Cu% x 2.91/9.20 + Co% x 14/9.20 + Pt [g/t]/31.103 x 1,400/9.2/22.04 + Pd [g/t]/31.103 x 600/9.2/22.04 + Au [g/t]/31.103 x 1,300/9.2/22.04 For further information, please refer to the Technical Reference slide of this presentation and Talon’s news release dated April 8, 2015 entitled “Talon Metals Announces 167% Increase in Tonnage for the Inferred Massive Sulphide Resource, and an Increase in Grade from 6.42% to 7.26% NiEq in the Massive Sulphide Unit at Tamarack” which is available at www.talonmetals.com or www.sedar.com. TAMARACK 19 Tamarack Zone: Updated Mineral Resource included Expansion of the MSU 2014 Exploration Results of the MSU in the Tamarack Zone, demonstrate continuity of the MSU1: • 14TK0211 intersected two intercepts of massive sulphide mineralization: • the upper unit from 425.03 to 429 meters of 3.97 meters at 5.74% Ni, 2.07% Cu, 1.08 g/t PGEs and 0.10 g/t Au (6.80% NiEq); and • • the lower unit from 441 to 456.94 meters of 15.94 meters at 7.14% Ni, 2.43% Cu, 1.49 g/t PGEs and 0.39 g/t Au (8.49% NiEq). 14TK0213 similarly intersected two intercepts of massive sulphide mineralization: • an upper unit from 435.66 to 443.35 meters of 7.69 meters at 5.09% Ni, 2.22% Cu 1.37 g/t PGEs and 0.31 g/t Au (6.26% NiEq); and • a lower unit from 455.06 to 464.71 meters of 9.65 meters at 7.04% Ni, 2.43% Cu, 1.99 g/t PGEs and 1.03 g/t Au (8.60% NiEq). a list of all holes and associated drill and assay data see Talon’s Press Release dated January 15, 2015 1 For TAMARACK 20 Tamarack Zone – Further Potential for Expansion of MSU • MSU targets have been identified based on well defined downhole electromagnetic (DHEM) conductors, geology and geochemistry and represent additional near term potential resources in the Tamarack Zone area. • Drill holes14TK0211 and 14TK0213 demonstrated the potential continuity of the MSU along a trend to the northeast of the SMSU and drill hole 15TK0219 was included in the winter programme to follow-up conductors along this trend. Results from 15TK0219 included 3 intersections of massive Ni-Cu-PGE mineralization, including 0.61 meters @ 10.05% Ni, 5.78% Cu, 27.46 g/t PGEs, 1.93 g/t Au (17.91% NiEq) • A number of DHEM conductors have confirmed the extension of this trend to the north-east (see MPS-219-1, MPS 163-1, MPS-213-2) • DHEM anomalies also point to potential extensions of MSU striking southeast towards the MSU at the base of the 138 Zone (see MPS 194-1) • A DHEM plate at the base of the 138 Zone suggests massive Ni-Cu-PGE mineralization continues northward (see MPP 171-1) TAMARACK Plan Map – MSU and its Relationship to the DHEM Plate Anomalies Long Section (looking west) – MSU and its Relationship to the DHEM Plate Anomalies 21 2015 Exploration1 In 2015, a total of 17 holes were drilled, comprising 9900 meters • Tamarack North Project (14 holes) • Tamarack South Project (3 holes) The main focus of 2015 was to test new targets along strike in large step-outs a list of all holes and associated drill and assay data see Talon’s Press Releases dated July 29, 2015 and September 1, 2015 1 For TAMARACK 22 480 Zone • Potentially shallow target 3 to 4.5 km north of the Tamarack Zone. Previous drilling has intersected wide zones of disseminated mineralisation at depths 40-75m. • Drill holes 15TK0215 and 15TK02251 were drilled approximately 3 km north of the Tamarack Zone Talonprominent Metals magnetic anomalies. targeting Platexco • • Drill hole 15TK0225 intersected nickel-copperPGE sulphide mineralization at the base of the FGO/mixed zone (MZ) type intrusion, including 0.49 meters at 335m depth assaying 1.15% Ni, 0.55% Cu, 0.15 g/t PGEs and 0.04 g/t Au, (1.42% NiEq). The promising results to date indicate potential exists over a large area that requires more work to focus drilling. a list of all holes and associated drill and assay data see Talon’s Press Releases dated July 29, 2015 and September 1, 2015 1For TAMARACK 23 221 Zone Platexco 24 TAMARACK Three holes were drilled,15TK0221, 15TK0228 and 15TK0229, and Talon Metals represent a newly discovered massive sulphide zone that is a priority target 24 221 Zone Results – New Mineral Zone Discovery1 • Drill hole 15TK0221 intercepted massive nickel-copper-PGE sulphide mineralization approximately 1.6 km north of the Tamarack Zone, with an associated DHEM off-hole anomaly located approximately 80 to 100 meters to the northwest of the hole. • Drill hole 15TK0228 did not intersect the targeted conductor but the follow-up DHEM survey provided additional EM data for 3D modelling of the DHEM conductors that allowed more precise targeting for follow-up drill hole 15TK0229. • Drill hole 15TK0229 intercepted 9.88 m of disseminated and massive nickel-copper-PGE sulphide mineralization from 693.79m depth assaying 2.35% Ni, 1.40% Cu, 0.77g/t PGE’s and 0.17g/t Au (3.04% NiEq). This intersection included high grade zones of: • • 2.84 m from 700.83 m depth of 7.68% Ni, 4.59% Cu, 2.41 g/t PGE’s and 0.53 g/t Au (9.87% NiEq) 1.63 m from 702.04 m depth of 9.33% Ni, 5.14% Cu, 3.65 g/t PGE’s and 0.71 g/t Au (12.01% NiEq) • The 3D-DHEM in conjunction with the geology, magnetic and gravity data indicate that the mineralization is potentially continuous along strike and will be followed-up with a planned drill program. For a list of all holes and associated drill and assay data see Talon’s Press Releases dated July 29, 2015 and September 1, 2015 1 TAMARACK 25 164 Zone Platexco • Previous drilling has intersected mixed zones of disseminated and massive sulphide mineralisation at the base of the FGO and mixed zone (MZ) intrusions. • The target is the MSU where it is potentially hosted along an axis (keel) at the base of the FGO. • Targeting of this keel can be guided through geochemistry Talon Metals where a ‘Basal FGO’ layer can indicate proximity to the keel. • Three holes were drilled in the winter exploration program: 12LV0143 (deepened), 15TK0227 and 15TK0222 located between 0.4 km and 0.8 km south of the Tamarack Zone1. • • Drill holes 15TK0222 and 15TK0227 intercepted Mixed Zone (MZ) with associated sulphides. The new modelling of the FGO and the keel from the data provided by the drilling, combined with wide intercepts of sulphides, suggests the 164 Zone is highly prospective. a list of all holes and associated drill and assay data see Talon’s Press Releases dated July 29, 2015 and September 1, 2015 1 For 26 TAMARACK 26 142 Zone • Drill hole 15TK0226 was drilled as part of the Winter Exploration Program and is located 2km south of the Tamarack Zone1. • Platexco It targeted a DHEM off-hole anomaly surveyed previously from drill hole 12LV0142. Talon Metals • The FGO-sediment contact was intersected at a higher than anticipated level after only intersecting 55 meters of FGO that included a mineralised zone of 0.7 meters. • A DHEM survey from drill hole 15TK0226 identified an off-hole anomaly suggesting highly conductive material to the east of the hole. This is consistent with new modelling of the FGO keel and will require further drilling to test. a list of all holes and associated drill and assay data see Talon’s Press Releases dated July 29, 2015 and September 1, 2015 1 For 27 TAMARACK 27 TAMARACK SOUTH PROJECT TAMARACK 28 Tamarack South Project Platexco Tamarack South Project consists of two areas: • The “Neck” • The “Bowl” - large layered lopolith to the south. In 2015, three (3) holes were drilled in the “Neck” and “Bowl” 29 TAMARACK 29 Tamarack South: Results in the “Neck”1 • Drill hole 15TK0218 was drilled 3.8 km south of the Tamarack Zone within the “Neck” portion of the Tamarack South Project. • The “Neck” has been interpreted based on similar geochemistry, as a possible entry point to the larger “Bowl” or lopolithic intrusion to the south, with potential implications as a site for settling and accumulation of massive sulphide in a setting similar to many other deposits. • The results from drill hole 15TK0218 have confirmed the potential for significant mineralization within the “Neck”. • • The FGO intersected from drill hole 15TK0218 shows the same geochemical trends and magmatic layering observed in the Tamarack Zone, and importantly the presence of disseminated sulphides and development of the basal FGO that is typically associated with the keel. A DHEM survey from drill hole 15TK0218 shows a proximal off-hole anomaly coincident with the base of the FGO, highlighting the potential for the development of massive sulphides similar to the Tamarack Zone. • Further follow-up drilling is planned. a list of all holes and associated drill and assay data see Talon’s Press Releases dated July 29, 2015 and September 1, 2015 1 For TAMARACK 30 NEXT STEPS TAMARACK 31 Next Steps • Talon and Kennecott are currently planning the 2016 winter exploration program at Tamarack, which will commence in Q1, 2016 • Approximately US$15 million is expected to be spent on exploration activities over the next two years Stay Tuned for drill results…… TAMARACK 32 TALON CAPITAL STRUCTURE (as of January 21, 2016) TAMARACK 33 Talon Capital Structure TSX:TLO Issued Shares: 128,809,937 Total Diluted Shares: 152,502,339 1 Securities and Royalties: • 14.2 million shares in Tlou Energy Limited (ASX:TOU) • Receive up to 30 million Rand (SA) from its royalty on the Boikarabelo Coal Mine in South Africa owned by Resource Generation Ltd (ASX:RES) RCF Loan: • On December 29, 2015, Talon received US$14-million from Resource Capital Fund V.I. LP (“RCF”) in the form of an unsecured convertible loan • RCF has a right to convert all or part of the loan at a price of C$0.156 per Talon share • The RCF loan matures on November 25, 2018 and bears interest at 12% p.a. 1 The above does not include any further shares that may be issued to RCF in the event of an election to convert all or part of the loan and/or interest TAMARACK 34