college of william and mary

advertisement

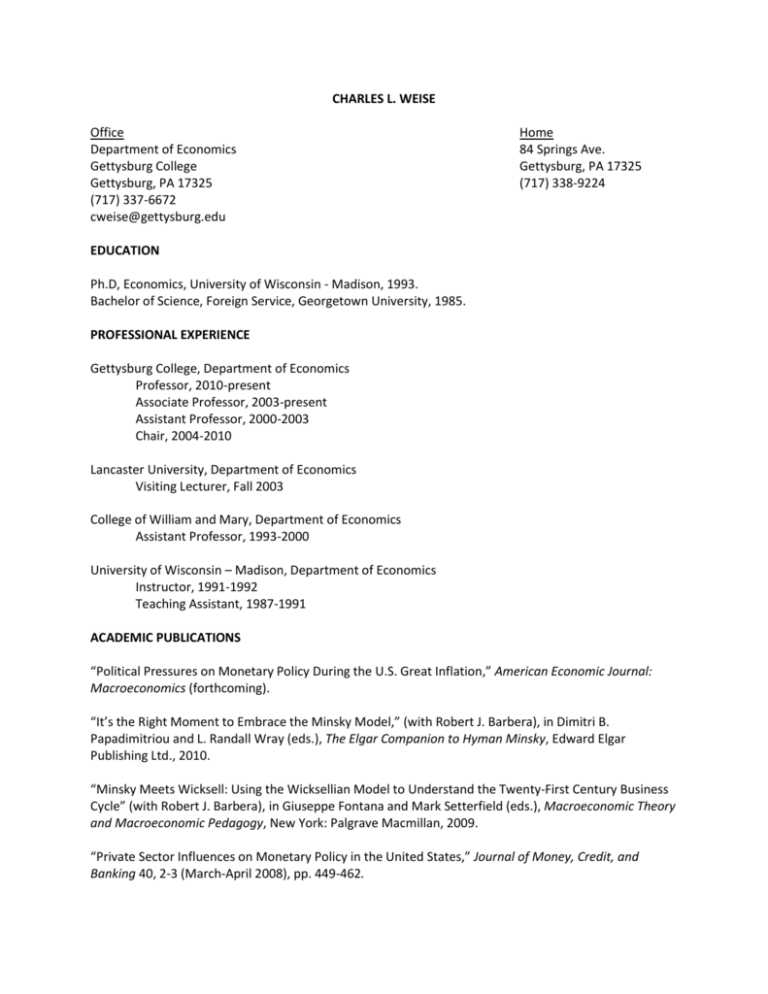

CHARLES L. WEISE Office Department of Economics Gettysburg College Gettysburg, PA 17325 (717) 337-6672 cweise@gettysburg.edu Home 84 Springs Ave. Gettysburg, PA 17325 (717) 338-9224 EDUCATION Ph.D, Economics, University of Wisconsin - Madison, 1993. Bachelor of Science, Foreign Service, Georgetown University, 1985. PROFESSIONAL EXPERIENCE Gettysburg College, Department of Economics Professor, 2010-present Associate Professor, 2003-present Assistant Professor, 2000-2003 Chair, 2004-2010 Lancaster University, Department of Economics Visiting Lecturer, Fall 2003 College of William and Mary, Department of Economics Assistant Professor, 1993-2000 University of Wisconsin – Madison, Department of Economics Instructor, 1991-1992 Teaching Assistant, 1987-1991 ACADEMIC PUBLICATIONS “Political Pressures on Monetary Policy During the U.S. Great Inflation,” American Economic Journal: Macroeconomics (forthcoming). “It’s the Right Moment to Embrace the Minsky Model,” (with Robert J. Barbera), in Dimitri B. Papadimitriou and L. Randall Wray (eds.), The Elgar Companion to Hyman Minsky, Edward Elgar Publishing Ltd., 2010. “Minsky Meets Wicksell: Using the Wicksellian Model to Understand the Twenty-First Century Business Cycle” (with Robert J. Barbera), in Giuseppe Fontana and Mark Setterfield (eds.), Macroeconomic Theory and Macroeconomic Pedagogy, New York: Palgrave Macmillan, 2009. “Private Sector Influences on Monetary Policy in the United States,” Journal of Money, Credit, and Banking 40, 2-3 (March-April 2008), pp. 449-462. “A Simple Wicksellian Macroeconomic Model,” The B.E. Journal of Macroeconomics: Vol. 7: Iss. 1 (Topics), Article 11, 2007. “Does the Time Consistency Model of Inflation Explain Cross-Country Differences in Inflation Dynamics?” (with John F. Boschen). Journal of International Money and Finance 2004, 735-759. “What Starts Inflation: The Evidence from OECD Countries” (with John F. Boschen). Journal of Money, Credit, and Banking, June 2003, 323-350. “The Ex Ante Credibility of Disinflation Policy and the Cost of Reducing Inflation” (with John F. Boschen), Journal of Macroeconomics, Summer 2001, 323-347. “Is Delayed Disinflation More Costly?” (with John F. Boschen). Southern Economic Journal, January 2001, 701-712. “The Asymmetric Effects of Monetary Policy: A Nonlinear Vector Autoregression Approach,” Journal of Money, Credit, and Banking, February 1999, 85-108. “Severity of Economic Fluctuations Under a Balanced Budget Amendment,” Contemporary Economic Policy, April 1996, 26-40. UNPUBLISHED PAPERS AND RESEARCH IN PROGRESS “The Monetary Policy Response to Changes in Credit Spreads” (with David Krisch), September 2010, under review. NON-ACADEMIC PUBLICATIONS “A Job-Rich US Recovery Is Still Possible” (with Robert J. Barbera), Financial Times, January 10, 2010. Online Case Studies for Money, Banking and Financial Markets, Laurence M. Ball. PRESENTATIONS AT CONFERENCES AND SEMINARS “The Monetary Policy Response to Changes in Credit Spreads,” Eastern Economic Association Conference, New York, February 2009. “Minsky Meets Wicksell: Using the Wicksellian Model to Understand the Twenty-First Century Business Cycle,” Johns Hopkins University Department of Economics Macroeconomics Workshop, November 2008. “Political Constraints on Monetary Policy During the U.S. Great Inflation,” Johns Hopkins University Department of Economics Macroeconomics Workshop, March 2008. “Private Sector Influences on Monetary Policy in the United States,” Eastern Economics Association 2 Annual Meeting, New York, NY, February 2007. “Alternative Explanations for the ‘Great Inflation’”, University of Richmond Economics Department seminar, January 2005. “A Wicksellian Model for the Intermediate Macroeconomics Course”, Sixth Annual Economics and the Classroom Conference, Jackson Hole, Wyoming, September 2004. “Alternative Explanations for the ‘Great Inflation’”, Lancaster University Economics Department seminar, December 2003. “Alternative Explanations for the ‘Great Inflation’”, Money Macro and Finance Research Group Annual Conference, Cambridge, UK, September 2003. “State and Local Fiscal Policy and the Business Cycle”, November 2002. Southern Economics Association annual meeting, New Orleans, LA. “Trouble Ahead for the U.S. Economy?”, August 2002. DeutschAmerikanisches Institut Summer Workshop at Gettysburg College. Three Things I Learned From the Current Recession. Association of Independent Colleges and Universities of Pennsylvania Donor Breakfast Meeting, Lancaster Pennsylvania, February 2002. How Conservative is the Federal Reserve? Annual Meeting of the Econometrics Society, Atlanta, Georgia, January 2002. Private Sector Influences on Monetary Policy in the United States. Gettysburg College Department of Economics Seminar, November 2001. The Economic Impact of September 11. Presentation to New York Leadership Group, November 2001. What Starts Inflation: The Evidence from OECD Countries. Board of Governors of the Federal Reserve, February 2000. What Starts Inflation: The Evidence from OECD Countries. Federal Reserve Bank of St. Louis, June 1999. Oil and Commodity Price Shocks, Inflation Persistence, and the Political Environment. Theories and Methods in Macroeconomics Conference, Universite du Quebec a Montreal, May 1999. Oil and Commodity Price Shocks, Inflation Persistence, and the Political Environment. Midwest Macroeconomics Conference, University of Pittsburgh, March 1999. Oil and Commodity Price Shocks, Inflation Persistence, and the Political Environment. Department of Economics seminar, Virginia Commonwealth University, November 1998. 3 The Political Environment and the Dynamics of Inflation. Department of Economics seminar, Johns Hopkins University, March 1998. Why Inflations Start: An Empirical Analysis. Department of Economics seminar, Virginia Tech, November 1997. Sources of High Unemployment in OECD Countries. Banco de Portugal, Lisbon, Portugal, July 1997. The Ex Ante Credibility of Disinflation Policy and the Cost of Reducing Inflation. NBER Summer Institute, Monetary Economics Program, July 1997. Credibility and the Costs of Disinflation. Department of Economics Seminar, College of William and Mary, March 1996. Credibility and the Costs of Disinflation. Annual meeting of the Econometric Society, January 1996. Sources of the ‘Asymmetric Effects’ of Monetary Policy. Southern Economic Association annual conference, November 1995. Productivity and Earnings in the 1980s. Southern Economics Association annual conference, November 1994. Local Interaction, Sectoral Shocks, and Aggregate Fluctuations. Department of Economics Seminar, College of William and Mary, April 1994. COURSES TAUGHT AT GETTYSBURG COLLEGE Introductory Economics Current Economic Issues Principles of Macroeconomics Intermediate Macroeconomics History of Economic Thought Money and Financial Intermediaries International Monetary Economics Econometrics Seminar: Advanced Topics in Theoretical and Applied Macroeconomics Honors Research Seminar J.M. Keynes and Britain Between the Wars PROFESSIONAL SERVICE Member, American Economic Association, Southern Economic Association. Referee: American Economic Review, Journal of Money, Credit, and Banking, Journal of Economics and Business, Canadian Journal of Economics, Journal of Macroeconomics, Scottish Journal of Political 4 Economy, Quarterly Journal of Business and Economics, Journal of Economic Dynamics and Control, Macroeconomic Dynamics, Oxford Bulletin of Economics and Statistics. Textbook reviewer: McGraw-Hill (Frank and Bernanke, Principles of Economics, 2nd edition); McGraw-Hill (DeLong, Macroeconomics, 2nd edition); Worth Publishers (Ball, Money and Banking, 1st edition). 5