Primary Activities: Agriculture, Fishing, and Forestry

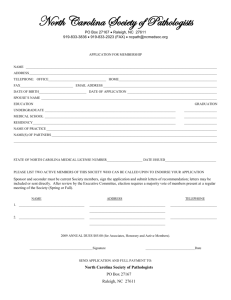

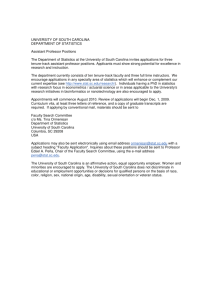

advertisement