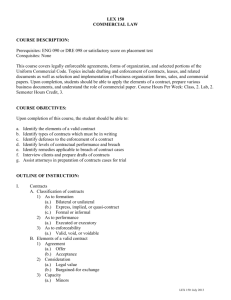

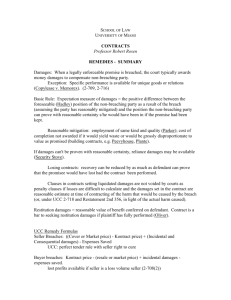

Calculation of Damages under CISG Article 74[**]

advertisement

![Calculation of Damages under CISG Article 74[**]](http://s3.studylib.net/store/data/008364457_1-e34e1decba9f214865c68c23267e532b-768x994.png)