Estimating the commercial trading value of spectrum

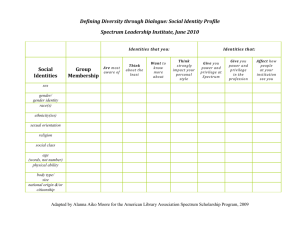

advertisement