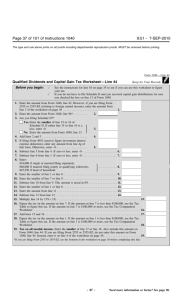

Caution: DRAFT FORM

advertisement

From the library of Caution: DRAFT FORM This is an advance proof copy of an IRS tax form. It is subject to change and OMB approval before it is officially released. You can check the scheduled release date on our web site (www.irs.gov). If you have any comments on this draft form, you can submit them to us on our web site. Include the word DRAFT in your response. You may make comments anonymously, or you may include your name and e-mail address or phone number. We will be unable to respond to all comments due to the high volume we receive. However, we will carefully consider each suggestion. So that we can properly consider your comments, please send them to us within 30 days from the date the draft was posted. 3 TLS, have you transmitted all R text files for this cycle update? Date I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS FORM 8917, PAGE 1 of 2 MARGINS: TOP 13mm (1⁄ 2 "), CENTER SIDES. PRINTS: HEAD TO HEAD PAPER: WHITE WRITING, SUB. 20. INK: BLACK FLAT SIZE: 203mm (8") x 279mm (11") PERFORATE: (NONE) DO NOT PRINT — DO NOT PRINT — DO NOT PRINT — DO NOT PRINT Action Date Signature O.K. to print Revised proofs requested return to From the library of Form 8917 Department of the Treasury Internal Revenue Service Name(s) shown on return OMB No. 1545-0074 Tuition and Fees Deduction 2007 f o s a 7 t 0 f 0 a 2 r / D /27 6 0 © © See Instructions. Attachment Sequence No. Attach to Form 1040 or Form 1040A. 63 Your social security number Caution: You cannot take both an education credit and the tuition and fees deduction (Form 1040, line 34, or Form 1040A, line 19) for the same student in the same year. ✔ Figure any write-in adjustments to be entered on the dotted line next to Form 1040, line 36 (see the Before you begin: Form 1040 instructions for line 36). ✔ If you file Form 2555, 2555-EZ, or 4563, or you exclude income from sources within Puerto Rico, use the worksheet in Pub. 970 to figure your entry on line 5 below. Do not complete lines 3 and 4. 1 (a) Student’s name (as shown on page 1 of your tax return) First name Last name (b) Student’s social security number (as shown on page 1 of your tax return) 2 2 Add the amounts on line 1, column (c), and enter the total 3 Enter the amount from Form 1040, line 22, or Form 1040A, line 15 3 4 Enter the total from either: ● Form 1040, lines 23 through 33, plus any write-in adjustments entered on the dotted line next to Form 1040, line 36, or ● Form 1040A, lines 16 through 18 4 5 6 (c) Qualified expenses (see instructions) Subtract line 4 from line 3.* If the result is more than $80,000 ($160,000 if married filing jointly), stop; you cannot take the deduction for tuition and fees Tuition and fees deduction. Is the amount on line 5 more than $65,000 ($130,000 if married filing jointly)? Yes. Enter the amount from line 2, but do not enter more than $2,000. Also enter this amount on Form 1040, line 34, or Form 1040A, line 19. No. Enter the amount from line 2, but do not enter more than $4,000. Also enter this amount on Form 1040, line 34, or Form 1040A, line 19. % 5 6 *If you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from Puerto Rico, see Pub. 970 for the amount to enter. For Paperwork Reduction Act Notice, see back of form. Cat. No. 37728P Form 8917 (2007)