AUDIT | DECEMBER 2012

THE POWER

OF BEING

UNDERSTOOD

U.S. GAAP VS. IFRS: INCOME TAXES AT-A-GLANCE

Increasing globalization coupled with related regulations

continues to put pressure on moving towards a common global

accounting framework – International Financial Reporting

Standards (IFRS). Currently, more than 100 countries use

IFRS, so if your business goals include global expansion, it is

critical to educate yourself about the impact of IFRS on your

financial reporting processes and business now. To gain a better

understanding of what IFRS means for your organization, we

have prepared a series of comparisons dedicated to highlighting

significant differences between IFRS and U.S. generally accepted

accounting principles (GAAP). This particular comparison

focuses on the significant differences between U.S. GAAP and

IFRS when accounting for income taxes. For other comparisons

available in this series, refer to our U.S. GAAP vs. IFRS

comparisons at-a-glance series.

A discussion about U.S. GAAP and IFRS would not be complete

without mentioning the status of the Securities and Exchange

Commission’s (SEC) activities focused on determining

whether the application of IFRS by U.S. registrants should be

required or allowed. While the SEC has not made any final

decisions with respect to use of IFRS by U.S. registrants, its

activities are ongoing. For more information, refer to our

IFRS Resource Center.

The guidance related to accounting for income taxes in U.S.

GAAP is included in the Financial Accounting Standards Board

(FASB) Accounting Standards Codification (ASC) Topic 740,

Income Taxes. In IFRS, the guidance related to accounting for

income taxes is contained in International Accounting Standard

(IAS) 12, Income Taxes.

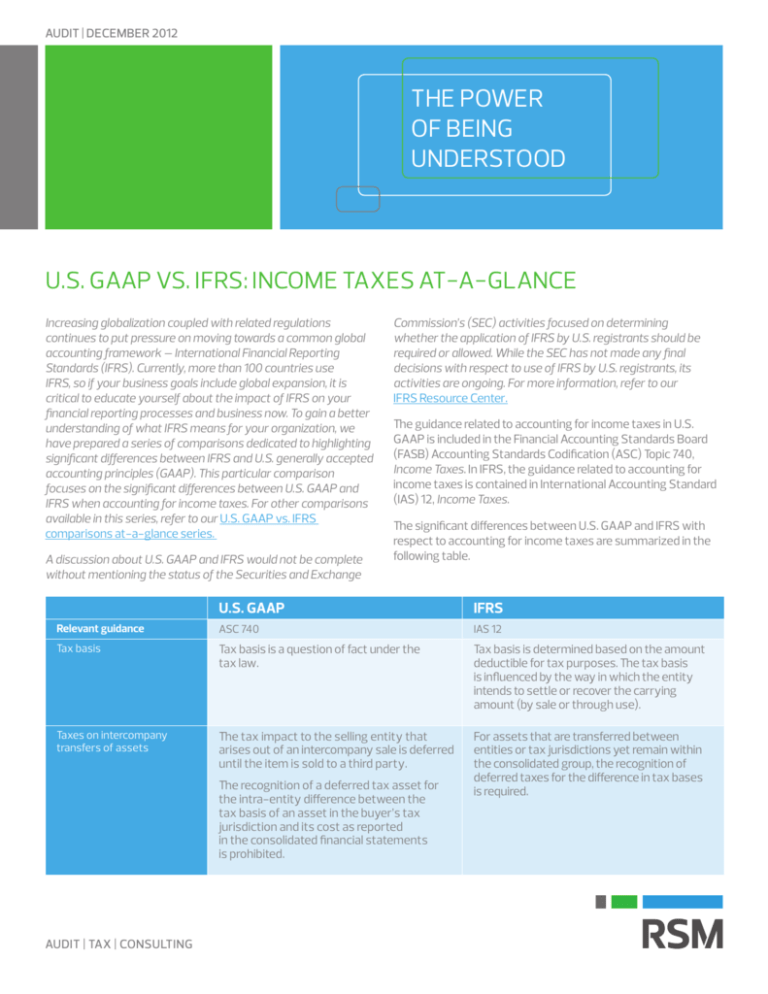

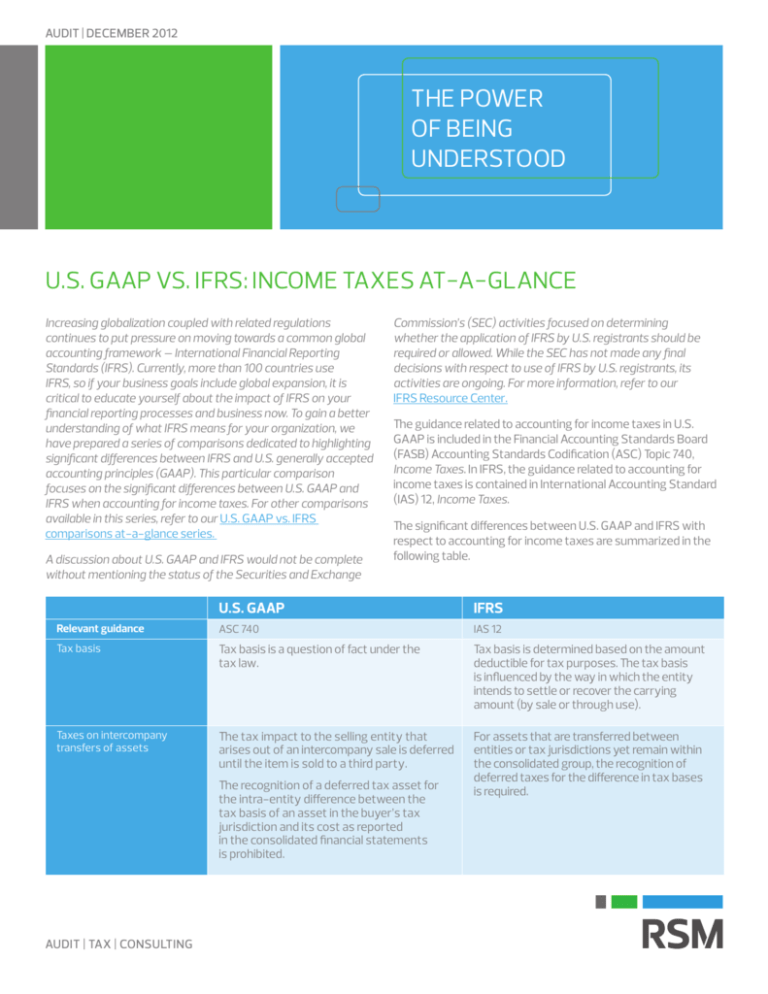

The significant differences between U.S. GAAP and IFRS with

respect to accounting for income taxes are summarized in the

following table.

U.S. GAAP

IFRS

Relevant guidance

ASC 740

IAS 12

Tax basis

Tax basis is a question of fact under the

tax law.

Tax basis is determined based on the amount

deductible for tax purposes. The tax basis

is influenced by the way in which the entity

intends to settle or recover the carrying

amount (by sale or through use).

Taxes on intercompany

transfers of assets

The tax impact to the selling entity that

arises out of an intercompany sale is deferred

until the item is sold to a third party.

For assets that are transferred between

entities or tax jurisdictions yet remain within

the consolidated group, the recognition of

deferred taxes for the difference in tax bases

is required.

The recognition of a deferred tax asset for

the intra-entity difference between the

tax basis of an asset in the buyer’s tax

jurisdiction and its cost as reported

in the consolidated financial statements

is prohibited.

AUDIT | TAX | CONSULTING

U.S. GAAP

IFRS

Use of valuation allowance

An entity records a full deferred tax asset

and then reduces that recorded asset by a

valuation allowance if realization of the asset

is not “more likely than not.”

An entity records a deferred tax asset if it is

probable (i.e., greater than 50 percent likely)

that the asset will be realized.

Changes in tax rates and laws

Changes in tax rates and tax laws used in

the calculation of income tax amounts are

reflected when enacted.

Changes in tax rates and tax laws used in the

calculation of income tax amounts are reflected

when enacted or substantively enacted. A rate

is considered “substantively enacted” when

only perfunctory actions are required for a

measure to become law.

Uncertain tax positions

A two-step process is applied. A benefit

is recognized when it is “more likely than

not” that the position will be upheld based

on its technical merits. The benefit would

be measured at the largest amount that

is greater than 50 percent likely of being

realized upon ultimate settlement.

Specific guidance pertaining to uncertain

tax positions is not provided. Tax assets and

liabilities should be measured at the amount

expected to be paid. If it is deemed more likely

than not that a liability has been incurred, the

entity would record the liability using either a

single-best-estimate measure or a weightedaverage probability of the outcomes.

Balance-sheet classification

The classification of deferred tax assets

and liabilities is related to the classification

of the asset or liability that generated the

temporary difference.

All deferred tax assets and liabilities are

classified as noncurrent regardless of what

asset or liability generated the difference.

Outside basis differences

An entity does not recognize a deferred tax

liability related to an investment in a foreign

subsidiary or corporate joint venture that

is essentially permanent in duration. This

guidance applies to all subsidiaries (foreign

or domestic), branches, associates and

interests in joint ventures.

An entity is required to recognize a deferred tax

liability unless: (a) the entity has control over

the reversal of the temporary difference and

(b) it is more likely than not (i.e., greater than

50 percent likely) that the temporary difference

will not reverse in the foreseeable future. The

exception applies solely to foreign subsidiaries

and foreign joint ventures that are essentially

permanent in duration.

These are the significant differences between U.S. GAAP and

IFRS with respect to accounting for income taxes. Refer to ASC

740 and IAS 12 for all of the specific requirements applicable

to accounting for income taxes. Refer to our U.S. GAAP vs.

IFRS comparisons at-a-glance series for more comparisons

highlighting other significant differences between U.S. GAAP

and IFRS.

Contact:

Richard Stuart, Partner

National Accounting Standards Group, RSM US LLP

+1 203 905 5027

richard.stuart@rsmus.com

+1 800 274 3978

www.rsmus.com

This document contains general information, may be based on authorities that are subject to change, and is not a substitute for professional advice or services. This document does not constitute audit, tax, consulting,

business, financial, investment, legal or other professional advice, and you should consult a qualified professional advisor before taking any action based on the information herein. RSM US LLP, its affiliates and related

entities are not responsible for any loss resulting from or relating to reliance on this document by any person. Internal Revenue Service rules require us to inform you that this communication may be deemed a solicitation

to provide tax services. This communication is being sent to individuals who have subscribed to receive it or who we believe would have an interest in the topics discussed. RSM US LLP is a limited liability partnership and

the U.S. member firm of RSM International, a global network of independent audit, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and

distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/aboutus for more information regarding

RSM US LLP and RSM International. RSM® and the RSM logo are registered trademarks of RSM International Association. The power of being understood® is a registered trademark of RSM US LLP.

© 2015 RSM US LLP. All Rights Reserved.

is_as_0915_ifrs_income_taxes_at_a_glance