Partnership Basis Adjustments

advertisement

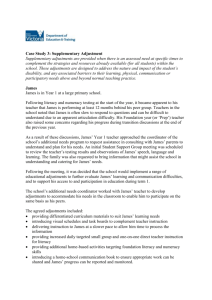

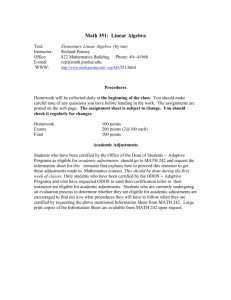

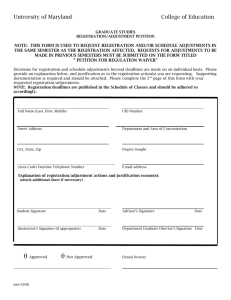

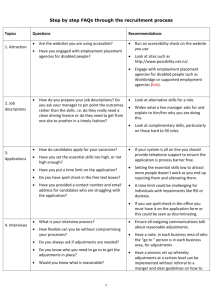

Partnership Basis Adjustments Under Internal Revenue Code Section 754 Risë Flenner, CPA/PFS, JD Tax Partner November , 2014 Background Example • D&D, LLC formed January 1, 2003 • Dumb and Dumber each put in $250,000 cash • Purchased Prime Ocean Front Property in Arizona for $500,000 • January 1, 2006 property has appreciated to $1,000,000. Background Example (continued) • Dumber sells interest to Dumbest for $500,000 • D&D’s CPA firm, Larry, Moe & Curly, LLC, make no mention of a 754 Election • Partnership then sells land for $1,000,000 on February 1, 2007 Background Example (continued) • Gain on sale is $500,000, split 50/50 each • Dumbest’ outside basis now $750,000 ($500,000 purchase price plus allocated gain of $250,000) • Partnership liquidates on July 1, 2007 Background Example (continued) • Cash split 50/50 per operating agreement and 704 principles • $500,000 to Dumbest • Dumbest recognizes a $250,000 capital loss • Dumbest fires and sues Larry, Moe and Curly, LLC Background Example (continued) Dumb Dumbest Initial Investment 250,000 500,000 Value of P’ship assets on date of investment 250,000 500,000 Tax Basis Outside Basis 500,000 750,000 Basis in Partnership Property 500,000 500,000 Today’s Agenda • Overview • 734 Adjustments • History/Background • 755 Allocations • Purpose • Top 10 Mistakes • 754 Election • Examples • 743 Adjustments Overview Applicable Code Sections: •754 – Election (to make a basis adjustment) •734 – Basis Adjustments for Distributions •743 – Basis Adjustments for Sales or Exchanges Overview (continued) Applicable Code Sections: •755 – Allocation of Basis Adjustments under 734 or 743 History Prior to 1954: • Case law only • No basis adjustments allowed • Entity approach – From Henry W. Healy v. Commissioner: • “Partnership property belongs to the partnership and not to the partners.” History (continued) What Changed? • Implementation of the Internal Revenue Code of 1954; added Code Sections 734, 743, 754 and 755. • Aggregate Approach – Think in terms of a partner’s share of partnership assets Purpose / Theory Seek to maintain equilibrium between inside and outside basis Operates from a true aggregate approach (particularly the 743 adjustment – sale or exchange) • As if the purchasing partner were purchasing his or her share of the underlying partnership assets Entity Approach Remnant – Election still made by partnership itself and is applicable to all partners 754 Election Attach Statement: • Name and address of partnership • Signed by partner (covered by 8879 if efiling) • Contain declaration electing under 754 to apply provisions of 734(b) and 743(b) Make on timely filed return including extensions Automatic 12-Month Relief under Reg. 301.9100-2(a)(2)(vi) Permanent election (can only be revoked with permission of IRS) 743 Adjustments • Covers Transfers of Interests: – Sale or Exchange – Death of Partner • Exchanges include: – Deemed distribution under 708(b)(1)(B) (technical termination) – Where transferee basis determined in reference to transferor’s basis: • Partnership interest contributed to corp. (tax-free re-org.) • Partnership interest contributed to partnership 743 Adjustments – Calculation Compare transferee’s basis in partnership interest (outside basis) to his/her share of basis in partnership property (inside basis) • If outside basis > inside basis…step-up • If inside basis > outside basis…step-down Only applies to transferee partner 743 Adjustments – Calculation (continued) Transferee’s Basis in Partnership Interest – • Purchase – The purchase price plus share of liabilities • Inherited – FMV date of death plus share of liabilities • Substituted Basis - Carryover Transferee’s Share of the Partnership’s Adjusted Basis in its Property – • Transferee’s share of previously taxed capital plus share of partnership liabilities 743 Adjustments – Calculation (continued) Previously Taxed Capital – Hypothetical Sale • Transferee’s share of cash from sale of assets (FMV) • Plus tax loss allocated to transferee • Minus tax gain allocated to transferee Layman’s Terms – IF: • Partnership formed through contribution of cash only and • No prior ownership changes, then • PTC will equal the tax capital account. 743 Adjustments – Other Considerations Subsequent Transfers – Prior Adjustments Removed from Calculations Technical Terminations: • Election can be made in final or initial return (produces different allocation results) • Basis adjustments in existence as of final return carry over to new partnership Adjustments only made to basis of transferee share of property and not to the common basis of partnership property 743 Adjustments – Other Considerations (continued) Adjustments should not impact transferee capital account (1.743-1(j)(2)) Recovery of adjustment – increase: • As if new asset depreciated with any applicable recovery period and method • Section 179 – Yes? • Bonus – Likely no Recovery of adjustment – decrease: • Over remaining life of related asset 743 Adjustments – Other Considerations (continued) Statement of Adjustment: •Name and taxpayer ID for transferee •Computation of adjustment •Properties to which adjustment allocated 743 Adjustments – Other Considerations (continued) Notification of Partnership (sale): • In writing within 30 days of sale • Signed under penalties of perjury • Include names and addresses of transferee and transferor including TIN’s and relationship of parties • Date of transfer • Liabilities assumed and money paid 743 Adjustments – Other Considerations (continued) Notification of Partnership (death): • In writing within 1 year of death • Signed under penalties of perjury • Include names and addresses of deceased partner and transferee including TIN’s and the relationship of the parties • Date of death and date transferee became owner • FMV of partnership interest and manner of determining FMV 743 Adjustments – Other Considerations (continued) Notification of Partnership – If not received: • It’s ok if partner responsible for returns has knowledge of such transfer • If partner knows of transfer, but does not receive necessary info to calculate adjustments must file return with the following: • Statement containing transferee’s name and ID • Include the following statement “RETURN FILED PURSUANT TO §1.743-1(k)(5).” on top of page 1 of the return and any other schedule of transferee relating to their income, deductions, credits, etc. 734 Adjustments Arise From Distributions Types: 1. Cash Distributions – 731(a) • Liquidating Distributions (gain or loss recognition) • Non-liquidating Distributions (potential gain recognition) • Gain Recognition: Step-Up • Loss Recognition: Step-Down 734 Adjustments (continued) Types: 2. Other Property Distributions – 732 • Excess of adjusted basis of property (inside basis) over adjusted basis of partnership interest (outside basis): step-up (liquidating or non-liquidating) • Excess of adjusted basis of partnership interest (outside basis) over adjusted basis of property (inside basis): step-down (liquidating only) 734 Adjustments – Other Considerations (continued) Attach Statement of Adjustment: • Computation of adjustment • Properties to which adjustment allocated 734 Adjustments – Other Considerations (continued) Adjustments allocable to all partners Adjustments will impact remaining partner capital accounts When distributing non-cash property, partnership needs to know partner’s outside basis 734 Adjustments – Other Considerations (continued) Recovery of adjustment – increase: • As if new asset depreciated with any applicable recovery period and method • Section 179 – Yes? • Bonus – Likely no Recovery of adjustment – decrease: • Over remaining life of related asset 755 Allocations According to code section 755, adjustment shall be allocated in 1 of 2 ways: • In such a way as to reduce difference between FMV and adjusted basis of partnership properties or • Any other way permitted by regulations 755 Allocations (continued) “It may be useful to think of the goal of the Section 755 regulations, in the case of nonsubstituted basis exchanges… as being to put the transferee partner in a position where no tax gain or tax loss would be allocated to the transferee partner if any partnership asset was sold for its fair market value immediately following the transferee’s acquisition of the partnership interest.” Brian Knudson @ SFTI 755 Allocations (continued) Three Basic Steps: 1. Determine value of partnership assets 2. Allocate Basis Adjustment between two classes of property: a. Capital gain property (capital assets and section 1231(b) property) b. Ordinary income property (all other) 3. Allocate Basis Adjustment within each class 755 Allocations – Nonsubstituted Basis Transactions Determine Value of Partnership Assets: I. For trade or business – Use Residual Method (see principles under Section 1060): A. B. C. Determine value of assets other than 197 intangibles (facts and circumstances – generally same as used in hypothetical sale under section 743) Determine Partnership Gross Value – generally purchase price or DOD value Determine value of 197 intangibles: 1. 2. If “A” > “B”, then nothing assigned to 197 intangibles If “B” > “A”, then excess represents 197 intangibles, first to other than goodwill/going concern with balance to said goodwill/going concern 755 Allocations – Non-substituted Basis Transactions (continued) Determine Value of Partnership Assets: II. For other than trade or business (i.e. investment type companies – no goodwill): – Determine value of assets – based on facts and circumstances – presumably same values as used in hypothetical sale in section 743 755 Allocations – Non-substituted Basis Transactions (continued) Allocate Basis Adjustment Between Two Classes: Hypothetical Transaction – After transaction, sell all property at FMV and allocate g/l accordingly: • Ordinary property – all adjusted to FMV • Capital Gain – Total 743(b) adjustment less portion allocated to ordinary If no purchase premium or discount, then both types of property (ordinary and capital) are adjusted to FMV 755 Allocations – Non-substituted Basis Transactions (continued) Allocate Basis Adjustment Within Ordinary Class: Gain/Loss for each property from Hypothetical Transaction 755 Allocations – Non-substituted Basis Transactions (continued) Allocate Basis Adjustment Within Capital Class: 1. Gain/Loss for each property from Hypothetical Transaction 2. Adjusted for Premium or Discount purchase price (allocated on relative FMVs) For trade or business, any premium would be allocated to goodwill or other 197 intangibles under 1.755-1(a)(5). For investment partnership, any premium would be allocated to capital assets as described above using relative FMV. 755 Allocations – Non-substituted Basis Transactions (continued) This methodology allows for step-ups to some assets and step-downs for other assets regardless of whether there is an overall step-up or step-down. This is even the case if there is an overall $0 adjustment. Original regs only allowed individual asset adjustments in the same direction as the overall adjustment unless permission obtained from IRS. • This methodology continues on with Substituted Basis Transactions and 734(b) adjustments 755 Allocations – Substituted Basis Transactions • What gives rise to Substituted Basis Transactions?: – Situation 1 (Reg. 1.755-1(b)(5)(i)) – • Prior sale or death occurs • No 754 election at that time • At a later date when there is a 754 election in place: – Partner contributes interest in LTP to UTP in section 721 contribution or – Partner contributes interest in partnership to corporation in section 351 exchange – Situation 2 – Technical Termination (Reg. 1.761-1(e)) 755 Allocations – Substituted Basis Transactions (continued) IF ADJUSTMENT IS $0, STOP!!!! NOTHING TO ALLOCATE Partnership Basis Adjustments Polling Question #3 • True or False – In a situation where a partnership interest is sold and the overall Section 743 adjustment is $0, you can stop and not worry about the 755 allocation. 755 Allocations – Substituted Basis Transactions (continued) Determine Value of Partnership Assets: I. For trade or business – Use Residual Method (see principles under Section 1060): A. Determine value of assets other than 197 intangibles (based on facts and circumstances) B. Determine Partnership Gross Value – value of partnership as a going concern C. Determine value of 197 intangibles: 1. 2. If “A” > “B”, then nothing assigned to 197 intangibles If “B” > “A”, then excess represents 197 intangibles, first to other than goodwill/going concern with balance to said goodwill/going concern 755 Allocations – Substituted Basis Transactions (continued) Determine Value of Partnership Assets: II. For other than trade or business (i.e. investment type companies – no goodwill): – Determine value of assets – based on facts and circumstances – presumably same values as used in hypothetical sale in section 743 755 Allocations – Substituted Basis Transactions (continued) Allocate Basis Adjustment Between Two Classes: • Only one class matches overall direction: – Step-up – only allocate to ordinary or capital gain property if there is net gain from a hypothetical sale of partnership property (i.e. net excess of basis in partnership interest over basis in partnership property) – Step-down – only allocate to ordinary or capital gain property if there is net loss from a hypothetical sale of partnership property (i.e. net excess of basis in partnership property over basis in partnership interest) 755 Allocations – Substituted Basis Transactions (continued) Allocate Basis Adjustment Between Two Classes: • Both classes match direction of 743(b) adjust.: – Allocate between classes based on relative gain or loss (determined by sale of all assets in each class) 755 Allocations – Substituted Basis Transactions (continued) Allocate Basis Adjustment Within a Class: 1. Increases: A. B. 2. To properties with unrealized appreciation to the extent of appreciation Excess amongst all properties in class in proportion to fair market value of assets Decreases: A. B. To properties with unrealized depreciation to the extent of depreciation Remaining decrease amongst all properties in class in proportion to their adjusted bases (incl. adjustments from “A”). **Cannot adjust basis below $0; excess creates carryover pending purchase of similar property in future 755 Allocations – Substituted Basis Transactions • 754 Planning Idea! – What if you miss the 754 election? – Have partner contribute interest in the partnership to another partnership creating a substituted basis transaction and make 754 election in current year. – You will not end up with the same allocation but will still get a step-up. 755 Allocations – 734 Adjustments Determine Value of Partnership Assets: Same as substituted basis transactions Allocate Basis Adjustment Between Two Classes: 1. Cash distribution – capital gain property 2. Non-cash distribution: – One Property – allocated to remaining property of similar character – Multiple Properties – Follow the lead of how basis allocated to distributee under 732(c) rules. These rules often result in difference being allocated to capital gain property. If so, basis adjustment would go to capital gain property for partnership as well. 3. Liquidating – Often capital 755 Allocations – 734 Adjustments (continued) Allocate Basis Adjustment Within The Classes: • Increases: • To properties with unrealized appreciation in proportion to their respective unrealized appreciation (only to extent of appreciation) • In excess of appreciation, in proportion to FMVs • Decreases: • To properties with unrealized depreciation in proportion to their respective unrealized depreciation (only to extent of depreciation) • In excess of depreciation, in proportion to adjusted bases (including effects of first step). 755 Allocations – 734 Adjustments (continued) Allocate Basis Adjustment Within The Classes: •If decrease exceeds basis, carryover excess Mandatory Adjustments 734 Adjustments – • If negative adjustment Substantial Basis exceeds $250,000 Reduction: 743 Adjustments – Substantial Built-In Loss: • Partnership Adjusted Basis in Assets exceeds FMV by more than $250,000 Top 10 Mistakes 1. Making adjustment for 721 Contributions 2. Overlooking mandatory step-down provisions 3. Misunderstanding mandatory step-down provision for “substantial built-in losses” under 743 4. Recording basis adjustment from 743 transfer on partnership’s books 5. Neglecting to maintain original 754 election in perm files Top 10 Mistakes (continued) 6. Timely filing of Election 7. Election is made in year without a qualifying event 8. Technical Termination – Consider options of filing with final or initial return 9. Not realizing that the allocations under 755 differ between 743 and 734 adjustments 10.Adjustments with negative capital balances Questions