Section 754 and Basis Adjustments for Partnership and LLC Interests

advertisement

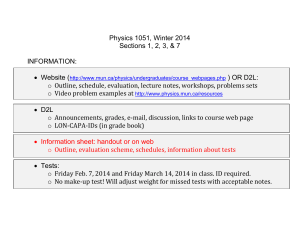

Presenting a live 110‐minute teleconference with interactive Q&A Section 754 and Basis Adjustments for Partnership and LLC Interests Navigating Complexities in Federal Tax Treatment of Distributions and Sales of Interests TUESDAY, SEPTEMBER 13, 2011 1pm Eastern | 12pm Central | 11am Mountain | 10am Pacific Today’s faculty features: Janice Eiseman, Eiseman Principal Principal, Cummings & Lockwood, Lockwood Stamford, Stamford Conn Conn. Craig Taylor, Director, Carruthers & Roth, Greensboro, N.C. Craig Gerson, Principal, National Tax Services, PricewaterhouseCoopers, Washington, D.C. For this program, attendees must listen to the audio over the telephone. Please refer to the instructions emailed to the registrant for the dial-in information. Attendees can still view the presentation slides online. If you have any questions, please contact Customer Service at1-800-926-7926 ext. 10. Conference Materials If you have not printed the conference materials for this program, please complete the following steps: • Click on the + sign next to “Conference Materials” in the middle of the lefthand column on your screen. screen • Click on the tab labeled “Handouts” that appears, and there you will see a PDF of the slides for today's program. • Double click on the PDF and a separate page will open. • Print the slides by clicking on the printer icon. Continuing Education Credits FOR LIVE EVENT ONLY Attendees must listen to the audio over the telephone. Attendees can still view the presentation slides online but there is no online audio for this program. Please refer to the instructions emailed to the registrant for additional information. If you have any questions, please contact Customer Service at 1 1-800-926-7926 800 926 7926 ext. 10. Tips for Optimal Quality S Sound d Quality Q lit For this program, you must listen via the telephone by dialing 1-866-873-1442 and entering your PIN when prompted. There will be no sound over the web co ect o . connection. If you dialed in and have any difficulties during the call, press *0 for assistance. You may also send us a chat or e-mail sound@straffordpub.com immediately so we can address the problem. Viewing Quality To maximize your screen, press the F11 key on your keyboard. To exit full screen, press the F11 key again. again Section 754 and Basis Adjustments for S ti d B i Adj t t f Partnership and LLC Interests Seminar Sept. 13, 2011 Janice Eiseman, Cummings & Lockwood jeisem@cl-law.com Craig Gerson, PricewaterhouseCoopers craig.a.gerson@us.pwc.com Craig Taylor, Carruthers & Roth cat@crlaw.com Today’s Program Introduction To Key Concepts [Janice Eiseman] Slide 7 – Slide 11 Sect. 754 Elections [Craig Taylor] Slide 12 – Slide 19 Sect. 743(b) Adjustments On Transfer Of Partnership Interests [Janice Eiseman] Slide 20 – Slide 37 Sect. 734(b) Adjustments On Distributions From Partnerships [Craig Taylor] Slide 38 – Slide 50 Collected Issues And Nuances Of Partnership Basis Adjustments [Craig Gerson] Slide 51 – Slide 70 Janice Eiseman, Cummings & Lockwood INTRODUCTION TO KEY CONCEPTS PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS O Overview i A. Subchapter K: In parts of Subchapter K, the subchapter governing the taxation of partnerships hi andd partners, a partnership hi is i treatedd as a separate entity, i which hi h is i distinct di i from its partners. In other parts of Subchapter K, a partnership is treated as an aggregate of individuals, each of whom owns an undivided interest in partnership assets. B. Outside basis: “Outside basis” refers to a partner’s tax basis in the partnership interest itself. The partnership is treated as an entity separate from its partners and the partnership interest as an intangible asset that is separate and distinct from partnership assets. This is similar to a shareholder’s tax basis in a share of stock. C. Inside basis: “Inside basis” refers to the partner’s share of the basis in the assets held by the partnership. Because the partnership is not a separate taxable entity, its income is allocated and taxed to its partners, partners treating them like owners of undivided interests in the assets and business of the partnership, i.e., as an aggregate of individuals. This does not have a direct analog in the Subchapter C or Subchapter S world, because corporations are treated as separate entities. 8 8 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Overview (Cont.) (Cont ) D. Sect. 754 election: Purpose of making a Sect. 754 election is to equalize the “outside basis” and the “inside basis,” to the extent allowed. A Sect. 754 election activates both Sect. 743(b), which applies to certain transfers of partnership interests, and Sect. 734(b), which applies to certain distributions of property by the partnership to a partner. 1. If a Sect. 754 election is not made, there is no change to the inside basis of partnership assets; that is, there is no adjustment to a transferee’s “inside basis” no adjustment to the tax basis of partnership assets because of a distribution of property by the partnership to a partner. • For example, Sect.743(a), which treats the partnership as an entity, provides that the basis of partnership property is not adjusted as a result of a sale, or exchange, or the death of a partner unless an election has been made under Sect. 754 or unless the partnership has a “substantial built-in loss.” • If a Sect. S t 754 election l ti is i made, d then th Sect. S t 743(b) is i operative. ti A Sect. S t 743(b) adjustment dj t t implements an aggregate approach by adjusting the tax consequences allocable to a transferee partner so as to provide the transferee with an approximation of a cost basis in an undivided interest in the partnership property. The legislative history of the 1954 Code states that the p purpose p of Sect. 743(b) ( ) is to ensure that a transferee’s distributive share of income,, gain, loss, deduction or credit is the same “as though the partnership had dissolved and been reformed, with the transferee of the interest a member of the partnership.” H.R. Rep. No. 1337, 83rd Cong., 2d Sess. 70 (1954). In other words, the function of a Sect. 743(b) adjustment is to offset gain or loss that accrued prior to the transferee becoming a partner. 2 2. A Assuming i that h there h is i a basis b i adjustment, dj the h amount off the h adjustment dj is i determined d i d under d Sect. S 743(b) in the case of a transfer and Sect. 734(b) in the case of a distribution. 9 9 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS O Overview i (Cont.) (C t ) E. Sect. 755: How the adjustment determined under Sect. 743(b) or Sect. 734(b) is allocated to partnership assets is determined under Sect. 755. F. Mandatory adjustment under Sect. 743: If there is a transfer of a partnership interest, and immediately after such transfer the adjusted tax basis of all of the partnership assets exceeds the fair market value of the partnership assets by more than $250,000 (“substantial built-in loss”), then the partnership must make a Sect. 743(b) adjustment as if an election under Sect. 754 were in effect. I.R.C. § 743(d). E Exceptions i for f electing l i investment i partnerships hi (e.g., ( buyout b funds, f d venture capital funds and fund of funds) and securitization partnerships. I.R.C. §§ 743(e) & (f) 10 10 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS O Overview i (Cont.) (C t ) G. Mandatory adjustment under Sect. 734: If there is a distribution of partnership t hi property t in i liquidation li id ti off a partner’s t ’ interest, i t t andd the th difference diff between the sum of (i) the basis of the distributed property to the partner, which equals the value of his partnership interest in the partnership under Sect. 732(b), and the tax basis of the distributed property to the partnership; and (ii) the loss recognized by the liquidating partner exceeds $250,000, then the tax basis of partnership property must be decreased as if a Sect. 754 election were in effect. I.R.C. § 734(d). There is an exception for securitization partnerships. I R C § 734(e). I.R.C. 734(e) H. Summary: Under sections 734(a) and 743(a), the partnership is treated as an entity, ii.e., e , no adjustments to basis of partnership property unless mandatory adjustments are required. If a Sect. 754 election is made, then adjustments can be made to the basis of partnership property (the “inside basis”) under sections 734(b) and 743(b). How the amount of the adjustment is allocated among partnership hi assets is i determined d i d under d Sect. S 755. 755 11 11 © Cummings & Lockwood LLC 2011 Craig Taylor, Carruthers & Roth SECT 754 ELECTIONS SECT. 754 ELECTIONS M ki Th S Making The Sect. 754 Election El i • Partnership may make the Sect. 754 election at any time – does not require the occurrence of a triggering event. Election must be signed by a partner. • Election El ti is i filed fil d with ith a timely ti l fil filed d partnership t hi return t (including (i l di extensions). • Once made, the Sect. 754 election is: • In effect for the tax year of the partnership return containing the election; and • In effect for all future tax years of the partnership, partnership unless revoked. • Revocation requires a special application to the IRS and will be granted d only l iff there h are substantial b l changes h to the h b business or assets of the partners. Sect. 1.754-1(c). 13 When To Consider The Sect. 754 Election • Distributions of property other than cash, cash especially where tax basis of property is different from fair market value (whether appreciated or depreciated) • Any distributions of cash or property that are disproportionate to partnership interests p to recognize g • Distributions of cash that will cause the recipient gain • Liquidating distributions of cash or property • Sales S l or exchanges h off interests i t t iin th the partnership t hi • Death of a partner y , “good” g for all • Sect. 754 elections are often,, but not always, partners and all partnerships. Each situation should be evaluated carefully. 14 Eff Effects Of The Sect. 754 Election Of Th S El i EXAMPLE 1: Purchase of a partnership interest A and B form a 50/50 partnership. Each contributes $150,000 in cash. The AB Partnership buys Asset for $300,000. $300 000 Asset appreciates to $400,000. $400 000 C buys a 50% interest in the AB Partnership for $200,000, and the ABC Partnership sells Asset for $400,000 – a gain of $100,000. If no Sect. 754 election is in place: Partner C’s outside basis: C’s 50% share of gain: C’ss share of cash distributed: C $200,000 $ 50,000 ( $200,000) Partner C’s remaining basis: $50,000 15 Effects Of The Sect. 754 Election (Cont.) EXAMPLE 1: Purchase of a partnership interest (Cont.) • Partner C cannot use the $50,000 in remaining basis until it sells the interest (unlikely) ( l k l ) or the h partnership h is lliquidated. d d • If Partner C recognizes a loss, it will be a capital loss. • If Asset is a non-capital asset, the $50,000 income allocated to Partner C will ill be b ordinary di iincome, but b tP Partner t C’s C’ lloss will ill be b a “mismatched” “ i t h d” capital loss. • If Asset is sold in 2011, but ABC Partnership doesn’t liquidate until 2012, Partner C C’ss loss will be delayed and “mismatched” mismatched to the 2011 income income. • If a Sect. 754 election is made for the year of the sale, or is already in place, both of these bad outcomes are avoided. 16 Effects Of The Sect. 754 Election (Cont.) EXAMPLE 2: Non-liquidating distributions to partners property Partner D has an outside basis of $40,000 in the DEF Partnership. Partner D receives a distribution of land that has a fair market value (FMV) of $75,000 and an inside basis of $50,000. • If no Sect. 754 election is in place, Partner D will hold the land with a basis of $40 $40,000. 000 The remaining $10 $10,000 000 of basis is “lost” lost . • If a Sect. 754 election is in place, the DEF Partnership would increase its basis in its remaining assets by $10,000 $10 000 under Sect. Sect 734(b). 17 Effects Of The Sect. 754 Election (Cont.) EXAMPLE 3: Non-liquidating distributions to partners – cash and property Partner D has an outside basis of $40,000 in the DEF Partnership. Partner D receives a distribution d b off cash h off $$50,000 and d a distribution d b off lland d that h has a fair market value (FMV) of $75,000 and an inside basis of $50,000. • Partner D recognizes a gain of $10,000 from the distribution of cash (Sect. 731) and d its it outside t id basis b i is i reduced d d to t $0. $0 If no Sect. S t 754 election l ti is i in i place, Partner D will hold the land with a basis of $0. $50,000 of basis is “lost.” • If a Sect Sect. 754 election is in place place, the DEF Partnership would increase its basis in its remaining assets by $60,000 under Sect. 734(b) – the sum of $10,000 in gain recognized by Partner D and $50,000 of “lost basis.” 18 Effects Of The Sect. 754 Election (Cont.) EXAMPLE 4: Liquidating distributions to partners Partner D has an outside basis of $40,000 in the DEF Partnership. Partner D receives a liquidating l d distribution d b off land l d that h has h a fair f market k value l (FMV) of $75,000 and an inside basis of $25,000. • If no Sect. S t 754 election l ti is i in i place, l P Partner t A will ill hold h ld th the land l d with ith a basis of $40,000, and there will be no impact on Partnership DEF’s other assets. • If a Sect. 754 election is in place, Partner A will hold the land with a basis of $40,000, but the DEF Partnership would be required to decrease its basis in its remaining assets by $15,000 under Sect. 734(b). 19 Janice Eiseman, Cummings & Lockwood SECT. 743(B) ADJUSTMENTS ON SECT 743(B) ADJUSTMENTS ON TRANSFER OF PARTNERSHIP INTERESTS PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Abilit To Ability T Make M k A Sect. S t 754 El Election ti Due To A Transfer A. Sect. 743(b): Election may be made when there is a sale or exchange of a partnership interest or upon the death of a partner. If a triggering event has not occurred, no Sect. 754 election can be made, and, therefore there will be no change to the tax basis of partnership assets with regard to the transferee unless the mandatory rule for basis adjustment applies. 1. Sales or exchanges: This includes a carryover basis exchange, such as under Sect. 351. Transfers by gift do not trigger a Sect. 754 election, because transfers by gift are not sales or exchanges under Sect. 743(b). 21 21 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Ability To Abilit T Make M k A Sect. S t 754 El Election ti Due To A Transfer (Cont.) 2. Distribution of partnership interest: Note that Sect. 761(e)(2) provides that for purposes of Sect. 743, any distribution of an interest in a partnership (not otherwise treated as an exchange) shall be treated as an exchange. Thus, if there is a “constructive termination” under Sect. 708(b)(1)(B), i.e. sale or exchange of 50% or more of the total interest in partnership capital and profits within a period of 12 consecutive months, then the deemed distribution of an interest in the new partnership by a terminating partnership is treated as an exchange of the interest in the new partnership for interest in the terminating partnership, t hi for f purposes off Sect.743. S t 743 This Thi allows ll the th new partnership t hi to make a Sect. 754 election because the exchange requirement of Sect. 743(b) is satisfied. 22 22 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS What Happens Under Sect. Sect 743(b) When A Sect. 754 Election Is Made? A A. The actual amount of the Sect. Sect 743(b) adjustment: Sect. Sect 743(b) states that the adjustment to the basis of partnership property to the transferee equals the difference between the (i) transferee’s tax basis in his partnership interest (i.e., the purchase price of the interest or its fair market value at date of death plus his share of partnership liabilities) and (ii) the transferee liabilities), transferee’ss “proportionate proportionate share of the adjusted basis of partnership property.” Treasury Reg. §1.743-1 flushes out how to determine the transferee’s “proportionate share of the adjusted basis of partnership property.” To understand the regulations, it is important to always remember what the Sect. 743(b) adjustment is designed to do; namely, namely to prevent the transferee from recognizing gain or loss already accounted for in the purchase price of the partnership interest. 1. Treasury Reg. §1.743-1(d) provides that the transferee’s “share of the adjusted b i to the basis h partnership hi off partnership hi property”” is i equall to the h sum off the h transferee’s interest as a partner in the partnership’s “previously taxed capital” plus his share of partnership liabilities. The transferee’s share of “previously taxed capital” is defined to be the amount of cash the transferee would receive if the partnership t hi were liquidated li id t d by b selling lli its it assets t att fair f i market k t value. l 23 23 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS What Happens Under Sect. Sect 743(b) When A Sect. 754 Election Is Made? (Cont.) andd (i) increasing i i the th amountt off cashh by b the th tax t loss l (including (i l di any remedial di l allocations under Treasury Reg. §1.704-3(d)) that would be allocated to the transferee to the extent attributable to the transferred interest, or (ii) decreasing the amount by the amount of tax gain (including any remedial allocations under T Treasury Reg. R §1.704-3(d)) §1 704 3(d)) th thatt would ld bbe allocated ll t d tto th the ttransferee f tto th the extent t t attributable to the transferred interest. (Note that non-contingent liabilities do not affect the amount of the adjustment because they are included in the transferee’s tax basis and the computation of the transferee’s share of the adjusted basis of partnership t hi property.) t ) 2. In essence, the tax capital account that the transferee inherits from his transferor determines the transferee’s share of the partnership basis in its assets. By using transferor’s tax capital account as a measure of inside basis, the Treasury regulations generally ensure that a transferee receives a basis adjustment that takes into account both pre-contribution gain or loss and post-contribution changes in value. 24 24 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS What Happens Under Sect. 743(b) When A Sect. 754 Election Is Made? 3. Example 2 of Treasury Reg. §1.743-1(d)(3) illustrates the computation of the Sect. 743(b) adjustment. See Exhibit A. 4. As this example shows, if the partnership sells the land for $1,300, the gain from the sale equals $900. Transferee will have $700 of the gain allocated to him, and the other two partners will each have $100 allocated to them. Because the transferee has a tax basis of $700 in the land, he will recognize no gain. 25 25 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS What Happens Under Sect. Sect 743(b) When A Sect. 754 Election Is Made? B. Note the following with regard to a Sect. 743(b) adjustment: 1. The adjustment applies only to the transferee partner. There is no adjustment to common basis of partnership property. The adjustment essentially operates outside the partnership. Treas. Reg. § 1.743-1(j)(1) 2 2. The adjustment Th dj t t hhas no effect ff t on the th computation t ti off the th partnership’s t hi ’ income i or loss. Treas. Reg. § 1.743-1(j)(1) 3. The adjustment has no effect on the transferee’s capital account. The transferee steps into the capital account of the transferor. transferor Treas. Treas Reg. Reg § 1.7431 743 1(j)(2) 4. The adjustments to the transferee’s distributive share of income or loss must be shown on the Form K-1 K 1 issued to the transferee. transferee Treas Treas. Reg Reg. § 1.743-1(j)(2) 5. Where there has been more than one transfer of a partnership interest, a transferee’ss basis adjustment is determined without regard to any prior transferee transferee’s basis adjustment. Treas. Reg. § 1.743-1(f) 26 26 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS S t 755 B Sect. Basis i Adj Adjustments t t A. Three sets of rules 1 1. Transfer of partnership interest when assets of partnership do not constitute a trade or business. business Treas. Reg. § 1.755-1(b)(1)-(b)(4) 2. Transfer of partnership interest involving “substituted basis exchanges” (e.g., Sect. 351 and 721 exchanges). Treas. Reg. §1.755-1(b)(5). Also, Treasury Reg. §1.755-1(b)(5) applies to basis adjustments that result from exchanges in which the transferee’s transferee s basis in the partnership interest is determined by reference to other property held at any time by the transferee e.g. a constructive termination under Sect. 708(b)(1)(B) in which the terminated partnership is deemed to contribute its assets to a new partnership in exchange for an interest in the new partnership and the terminated partnership is deemed to distribute interests in the new partnership in liquidation of the partner’s interest in the terminated partnership. Sect. 761(e) provides the “exchange,” meaning the distribution of partnership interests in the new partnership is an “exchange” for purposes of Sect. 743(b). Because the distribute-partner of the terminated partnership receives its interest in the new partnership in a liquidating distribution, the distributee takes a substituted basis in the new partnership under Sect Sect.732(b). 732(b) A Sect Sect. 754 election by the new partnership will bring into play Treasury Reg. §1.755-1(b)(5). 3. Transfer of a partnership interest when the assets of the partnership constitute a trade or business, as described in Reg. §1.1060-1(b)(2) Treas Reg. Treas. Reg §1.755-1(a)(2)-(a)(6) §1 755 1(a)(2) (a)(6) 27 27 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS S t 755 B Sect. Basis i Adj Adjustments t t (C (Cont.) t) B. Transfer of partnership interest when assets of partnership do not constitute a “trade trade or business” business 1. First, determine the adjusted basis and the fair market value of the partnership assets immediately after the transfer and determine how much income, gain or loss (including remedial allocations under Treasury Reg. §1.704-3(d)) would be allocated to the transferee-partner, if the partnership were to sell all of its assets for cash in a hypothetical sale for an amount equal to their fair market values. If, in fact, the purchase price for the partnership interest equals the fair market value of the assets, then the adjustment to the basis of partnership property with respect to the transferee-partner is done. Treas. Reg. §1.755-1(b)(1)(ii); Example 1, Treas. Reg. 1.755-1(b)(2)(ii) 2. The portion of the transferee-partner’s basis adjustment allocated to ordinary income property is equal to the total income gain or loss (including remedial allocations) that would be allocated to the transferee with respect to the hypothetical yp sale of ordinaryy income property. p p y Treas. Reg. g §§1.755-1(b)(2) ( )( ) 28 28 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS S t 755 B Sect. Basis i Adj Adjustments t t (C (Cont.) t) 3. The portion of the transferee-partner’s basis adjustment allocated to capital gain property is equal to the Sect. 743(b) adjustment reduced by the amount allocated to ordinary income property. If the purchase price of the partnership interest is less than the purchase price based upon fair market value, and there has to be a decrease in capital gain property, the decrease cannot be greater than the “partnership’s basis” in the property or the transferee’s share of any remedial loss under Treasury Reg. §1.704-3(d). Any excess is applied to reduce the basis of ordinary income property. Treas. Reg. §1.755-1(b)(2) • 4 4. Note that this approach allocates any overpayment or underpayment for the partnership interest to the basis of capital gain property. Adjustments Adj t t can be b made d to t individual i di id l assets t even though th h the th total t t l amountt off basis adjustment is zero. Treas. Reg. §1.755-1(b)(1)(i) • Note that in a substituted basis transaction, no adjustment can be made if the total amount of the Sect. 743(b) adjustment is zero. 29 29 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS S t 755 B Sect. Basis i Adj Adjustments t t (C (Cont.) t) 5. Allocations have to be made within the class of ordinaryy income property p p y and within the class of capital gain property. a. Within the class of ordinary income property, the basis of each property is generally adjusted by an amount equal to the income, gain or loss (including remedial allocations) that would be allocated to the transferee upon a sale of the property in the hypothetical transaction. b. Within the class of capital gain property, the basis of such property is generally adjusted by (1) the amount of income, gain or loss that would be allocated to the transferee in the hypothetical transaction, transaction minus (2) a portion (based on the market value of a particular property) compared to the aggregate market value of all capital gain property. Treas. Reg. §1.7551(b)(3) c. N t that Note th t there th mustt be b an adjustment dj t t whenever h the th actual t l Sect. S t 743(b) adjustment is either more or less than what it would be if the transferee had paid fair market value for each partnership asset. 6. See subsequent exhibits B and C for examples of Sect. 755 allocations 30 30 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Sect 755 Basis Adjustments (Cont.) Sect. (Cont ) C. Substituted basis exchanges 1. The rules for “substituted basis exchanges” are set forth in Treasury Reg. §1.755-1(b)(5). If the basis adjustment is positive, positive an adjustment can be made only if the hypothetical sale of the partnership’s assets results in a net gain to the transferee. a. The increase is allocated between classes of assets (ordinary and capital) in proportion to the net income or gain of each class allocable to the transferee. b b. Within each class, class increases are first allocated to properties with unrealized appreciation in proportion to the transferee’s share of such unrealized appreciation until the transferee’s share of the appreciation is eliminated. Any remaining amount is allocated among assets in the class according to the transferee’s share of the amount realized from the hypothetical sale of each asset in the class. 2. Likewise, if the basis adjustment is negative, an adjustment can only be made if the hypothetical sale results in the allocation of a net loss to the transferee. a. The decrease is allocated between asset classes in proportion to the net loss allocable to the transferee from the hypothetical sale of all assets in each class. b b. Within i hi eachh class, l the h decrease d is i allocated ll d to properties i with i h unrealized li d depreciation d i i in i proportion to the transferee’s shares of such unrealized depreciation until they are eliminated. Remaining decreases are allocated in proportion to the transferee’s shares of the adjusted bases of all assets in the class until these shares of adjusted bases are reduced to zero, with any y remaining g downward adjustment j suspended p until the partnership p p acquires q additional property in that class. 31 31 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Sect 755 Basis Adjustments (Cont Sect. (Cont.)) D. Sale of business 1. 2. If the assets of the partnership constitute a trade or business (as described in Treasury Reg. §1.1060-1(b)(2)), § ( )( )), the partnership p p must use the residual method to assign g values to the partnership’s Sect. 197 intangibles. Treas. Reg. §1.755-1(a)(2) Residual method involves the following steps: a. b. c. d. e. First, the partnership must determine the value of its assets other than Sect. 197. Second, the partnership must determine “partnership gross value” under Treasury Reg. §1.755-1(a)(4). Third, the partnership gross value is then compared to the aggregate value of all partnership property other than Sect. 197 intangibles. If there is no residual value, then the value of all Sect. 197 intangibles is deemed to be zero. If there is a residual value, then the amount must be Sect. 197 intangibles g in order to assign g a value to them under the rules of Treasury y allocated to S Reg. §1.755-1(a)(5). “Partnership gross value” generally is equal to the amount that, if assigned to all partnership property, would result in a liquidating distribution to the partner equal to the transferee’s basis in the transferred partnership interest immediately following the relevant transfer (reduced by the amount amount, if any any, of such basis that is attributable to partnership liabilities) liabilities). Treas Treas. Reg Reg. §1.755-1(a)(4)(i)(A). Treasury Reg. §1.755-1(a)(5)(i) requires that the residual value be allocated first among Sect. 197 intangibles other than goodwill and going concern value, but the value assigned to a Sect. 197 intangible (other than goodwill and going concern value) is limited to its actual fair market value l on the h date d off the h relevant l transfer. f Any A remaining i i residual id l value l is i then h allocated ll d to goodwill and going concern value. 32 32 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Exhibit A Example 2 of Treasury Reg. Sect. 1.743-1(d)(3) Tax Land Cash Total A B C Fair market value on contribution date Sale of partnership interest for fair market value by A $$400 $2,000 $2,400 $$1,000 $2,000 $3,000 $$1,300 $2,000 $3,300 $400 $ $1,000 $1,000 $1,000 $ $1,000 $1,000 $1,100 $ $1,100 $1,100 Transferee's share of previously taxed capital: Cash received on sale of assets for fair market value Less: Gain allocated to transferee Share of previously taxed capital $1,100 $700 (Pre-contribution gain & post-contribution gain) $400 Section 743(b) adjustment: Outside basis of price paid for partnership interest Less: Share of previous taxed capital Amount of Section 743(b) adjustment to the basis of the land $1,100 $400 $700 33 33 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Exhibit B Example 2 of Treasury Reg. §1.755-1(b)(3)(iv): T buys A’s partnership interest for $110,000. Capital gain property Assett 1 A Asset 2 Ordinary Income property Asset 3 Asset 4 Adjusted Basis Fair Market Value at time of contribution $25 000 $25,000 $100,000 $50 000 $50,000 $100,000 $75 000 $75,000 $117,500 $192,500 $33,604 $33 604 $2,646 $36,250 $40,000 $10,000 $175 000 $175,000 $40,000 $10,000 $200 000 $200,000 $45,000 $2,500 $47 500 $47,500 $2,500 ($3,750) ($1 250) ($1,250) $240,000 $35,000 Total Book Capital Accounts A B $100,000 $100 000 $100,000 Fair Market Value at time of sale Basis Adjustment $120,000 $120 000 $120,000 Section 743(b) adjustment: T's partnership basis $110,000 Less: T's share of adjusted basis ($75,000) partnership pp property p y in p Adjustment $35,000 Ordinary income adjustment ($1,250) Capital gain adjustment $36,250 Total capital gain Asset 1 Asset 2 Total capital gain/Adjustment $37,500 $ $8,750 $46,250 Adjustment $33,604 ($37,500 -($10,000*$75,000/$192,500)) $ $2,646 ($8,750-($10,000*$117,500/$192,500)) $ $ $ $ $36,250 34 34 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Exhibit C Page C-1 Example of complicated adjustment for an interest held by a Grantor Trust upon death of Grantor; value of membership interest determined for estate tax purposes purposes. I. Calculation of Section 743(b) ( ) Adjustment j to Trust Step-up in basis of Company assets based on fair market value at date of death Proportionate Share of Tax Basis in Company's Assets Gain recognized upon liquidation Real Estate Accrued Dividend Sysco Johnson & Johnson Schering Plough United Health Care Cisco Dover Emerson Bershire Hathaway A Berkshire Hathaway B $173,500 $173 500 $17,826,500 $17 826 500 0 $578 0 $37,129 0 $15,242 0 $10,379 0 $6,226 0 $18,306 0 $13,729 0 $11,295 0 $46,525 0 $30,462 $173,500 $18,016,371 (Stock contributed by children of grantor of Trust) II. Trust Trust'ss previously taxed capital: Liquidation proceeds based on fair market value: $19,100,813 * Less: Gain recognized on liquidation $18,016,371 Previously Taxed Capital $1,084,442 III. IV. Code Section 743(b) Adjustment based on Fair Market Value: Fair Market Value less IRD Less: Previously Taxed Capital Section 743(b) Adjustment $19,100,235 $1 084 442 $1,084,442 $18,015,793 Code Section 743(b) Adjustment based on Estate Tax Audit: Value of Membership Interest Less: Income in respect of a Decedent Tax basis of Membership Interest Less: Trust's previously taxed capital Section 743(b) Adjustment $17,815,000 $578 $17,814,422 $1,084,442 $16,729,980 Code § 743(b) Basis Adjustment & Code § 755 Allocation $17,826,500 $17 826 500 0 $37,129 $15,242 $10,379 $6,226 $18,306 $13,729 $11,295 $46,525 $30,462 $18,015,793 ($19,100,813 -$578) (Treas. Reg. Section 1.755-1(b)(4).) * $19,100,813 (liquidating proceeds) = $20,609,423 (Fair Market Value of Company at date of death)*92.68% (Trust Percentage Interest) 35 35 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Exhibit C Page C-2 Calculation of Section 743(b) basis adjustments to capital gain assets based on Fair Market Value must must be reduced pro rata by $1,285,813 under Treasury Regulation Section 1.755-1(b)(3)(ii). § 743(b) adjustment based on FMV Less: § 743(b) adjustment based on Estate Tax Valuation Amount to be allocated among assets $18,015,793 $16 729 980 $16,729,980 $1,285,813 Code Section 743(b) Adjustment based on FMV Fair Market Value Real Estate Sysco Johnson & Johnson Schering Plough United Health Care Cisco Dover Emerson Berkshire Hathaway A Berkshire Hathaway B $18,000,000 $188,564 $276,334 $65,400 $60,000 $326 250 $326,250 $98,063 $54,750 $227,800 $153,384 $19,450,545 $17,826,500 $37,129 $15,242 $10,379 $6,226 $18 306 $18,306 $13,729 $11,295 $46,525 $30,462 $18,015,793 Decrease* Tentative Section 755 Allocation $1,189,922 $12,465 $18,268 $4,323 $3,966 $21 567 $21,567 $6,483 $3,619 $15,059 $10,140 $1,285,813 $16,636,577.87 $24,663.64 -$3,025.55 $6,055.62 $2,259.59 -$3 $3,261.34 261 34 $7,246.37 $7,675.65 $31,465.87 $20,322.28 $16,729,980.00 *Decrease to each asset is calculated as follows: $1,285,813 x (Fair Market Value of each asset/$19,450,545 (Total Fair Market Value)) Note: Assets with respect to which transferee has no interest in income, gain, losses or deductions are not taken into account in applying adjustment to basis under Code Section 755. Treas. Reg. Section 1.755-1(b)(3)(iii). 1.755 1(b)(3)(iii). 36 36 © Cummings & Lockwood LLC 2011 PARTNERSHIP BASIS: INSIDE AND OUTSIDE BASIS Exhibit C Page C-3 Calculation of Section 755 Basis Adjustments Based On Code Section 743(b) Adjustment of $16,729,980 (A) Proportionate Share of Tax Basis in Sasco's Assets Real Estate Sysco Johnson & Johnson Schering Plough United Health Care Cisco Dover Emerson Berkshire Hathaway A Berkshire Hathaway B (B) Tentative § 755 Allocation $173,500.00 0 0 0 0 0 0 0 0 0 $16,636,577.87 $24 663 64 $24,663.64 ($3,025.55) $6,055.62 $2,259.59 ($3,261.34) $$7,246.37 , $7,675.65 $31,465.87 $20,322.28 $16,729,980.00 (C) Adjustment for Negative Decrease* ($6,249.83) ($9 17) ($9.17) $3,025.55 ($2.25) ($0.84) $3,261.34 ($2.69)) ($ ($2.85) ($11.70) ($7.56) $0.00 (D) § 755 Allocation ((B)-(C)) $16,630,328.04 $24 654 47 $24,654.47 $0.00 $6,053.37 $2,258.75 $0.00 $$7,243.68 , $7,672.80 $31,454.17 $20,314.72 $16,729,980.00 Column C: Treas. Reg. §1.755-1(b)(3)(iii)(B) (Column B Positive Adjustment) x $6,289.89 (Total Value of Negative Adjustments) (Total Column B Positive Adjustments off $16,909,766.89) $16 909 766 89) 37 37 © Cummings & Lockwood LLC 2011 Craig Taylor, Carruthers & Roth SECT. 734(B) ADJUSTMENTS SECT 734(B) ADJUSTMENTS ON DISTRIBUTIONS FROM PARTNERSHIPS Transactions Causing 734(b) Adjustments • If a Sect. 754 election is in place, all of the following may give rise to adjustments under Sect. 734(b): 39 • Any distribution of cash when recipient recognizes gain • Any distribution of property where there is “lost basis” • Liquidating distributions when recipient recognizes loss • Liquidating distributions where there is “acquired basis” M d Mandatory 734(b) Adjustments (b) Adj • Even if a Sect. 754 election is NOT in place, under Sect. 732(d), the following may require mandatory 734(b) adjustments: 40 • A partner acquires a partnership interest by transfer when no Sect. 754 election is in place, AND • That partner receives a distribution of property within two years; OR • That partner receives a distribution of property at any time, if at the time of the original transfer the FMV of noncash partnership property exceeded 110% of its inside basis in the hands of the partnership. Sect. 755 Allocation Of 734(b) Adjustments To allocate basis adjustments required by Sect. 734(b), refer to Sect. 755 and Regulations Sections 1.755-1(a) and (c): 41 • p p must determine the value of each of its assets,, using g the First,, the partnership rules in Regulations Sect. 1.755-1(a). Note the specific rules for treatment of Sect. 197 intangibles in Regulations Sect. 1.755-1(a)(5) • Second,, in g general,, basis adjustments j arising g ((i)) from distributions of capital p gain property are allocated to capital assets and Sect. 1231(b) property; and (ii) from distributions of ordinary income property to any other property of the partnership (ordinary income property). Properties and potential gain treated as unrealized receivables under Sect. 751(c) are treated as separate assets that are ordinary income property. • Third, allocate basis adjustments within each class using the rules in Regulations Sect. 1.755-1(c) Sect. 755 Allocation Of 734(b) Adjustments (Cont.) • Sect. 755 and Regulations Sect. 1.755-1(a) and (c) contain certain special rules, including the following: 42 • A basis adjustment resulting from the recognition of gain on a cash distribution or from a loss from the distribution of cash cash, unrealized unreali ed recei receivables ables or inventory, in entor must be allocated to the partnership capital gain property. Regulations Sect. 1.755-1(c)(1)(ii) • Within a class, class basis increases due to “lost basis“ basis are allocated first to properties with unrealized appreciation up to and in proportion with their respective unrealized appreciation. Any excess is allocated among all properties in the class in proportion to FMV. Regulations Sect. 1.755-1(c)(2) • Within a class, basis decreases due to “acquired basis” are allocated first to properties with unrealized depreciation up to and in proportion with their respective amounts of unrealized depreciation. Any excess is allocated among all the properties within the class in proportion to their adjusted basis (after taking into account the first allocation). Regulations Sect. 1.755-1(c)(2) Sect. 755 Allocation Of 734(b) Adjustments (Cont.) • 734(b) basis adjustment special rules (Cont.) 43 • If a decrease in basis is required and the basis adjustment exceeds the remaining basis in the assets in a class, class the assets are reduced to zero, but not below zero. The unused basis is carried forward until such time as the partnership acquires new property in the class. This is contrary to the Sect. 755 rules for death, sales or exchanges h that h require i excess capital i l gain i decreases d to be b applied li d against ordinary income assets. Sect. 755(b) • When an increase or decrease in the basis of undistributed property cannot be made because the partnership owns no property of the character required to be adjusted, the adjustment is made when the partnership acquires property of a like character to which hi h an adjustment dj t t can be b made. d Regulations R l ti S Sect. t 11.755-1(c)(4) 755 1( )(4) Calculation Of 734(b) Basis Adjustment EXAMPLE 1: Distribution of cash Partner D has an outside basis of $25,000 in the DEF Partnership. Partner D receives a distribution of $40 $40,000. 000 This is the balance sheet of DEF Partnership: Cash Inventory Investments 44 Adjusted Basis $ 60,000 $ 27,000 $ 13,000 $100,000 FMV $ 60,000 $ 30,000 $ 70,000 $160,000 Calculation Of 734(b) Basis Adjustment (Cont.) EXAMPLE 1: Distribution of cash result Partner D realizes a gain of $15,000 = $40,000 cash distribution less $25,000 basis Under Sect. 734(b), DEF Partnership is entitled to increase its inside basis in its assets by $15,000. Under Sect. 755, the basis adjustment is allocated to the same property class as that in which the distributed property is included. Under the special rule of Regulations Sect. 1.755-1(c)(1)(ii), inside basis adjustments due to distributions of cash in excess of basis must be allocated to capital gain property. Therefore, DEF Partnership must allocate the $15,000 increase in inside basis to the investments. 45 Calculation Of 734(b) Basis Adjustment (Cont.) EXAMPLE 2: Liquidating distribution of real estate Partner A owns a 40% interest in ABC Partnership with an outside basis of $28,000. ABC Partnership liquidates Partner A A’ss interest by distributing land (Tract 2) with an adjusted basis of $30,000 and FMV of $40,000. ABC Partnership’s balance sheet is as follows: Cash A/R Land – Tract 1 Land – Tract 2 Land – Tract 3 46 Adjusted Basis $ 10,000 $ 5,000 $ 5,000 $ 30,000 $ 20,000 $ 70,000 FMV $ 10,000 $ 5,000 $ 25,000 $ 40,000 $ 20,000 $100,000 Calculation Of 734(b) Basis Adjustment (Cont.) EXAMPLE 2 : Liquidating distribution of real estate result g $2,000 in “lost Partner A would have a basis in Tract 2 of $28,000, causing basis.” If a Sect. 754 election is place, ABC Partnership must increase its basis in its assets by $2,000. The property distributed was capital gain property (real estate). Accordingly, the $2,000 upward basis adjustment is allocated to capital p g gain p property p y – Tracts 1 and 3. Sect. 755(b) ( ) Tract 1 is the only asset with unrealized appreciation, so all $2,000 must be allocated to Tract 1. Sect. 755(a)(1) 47 Calculation Of 734(b) Basis Adjustment (Cont.) EXAMPLE 3: Liquidating distribution of real estate Partner D purchases Partner A’s 40% interest in ABC Partnership for $40,000. Then, ABC Partnership liquidates Partner D D’ss interest by distributing land (Tract 2) with an adjusted basis of $30,000 and FMV of $40,000. ABC Partnership’s balance sheet is as follows: Adjusted Basis FMV Cash $ 10,000 $ 10,000 A/R $ 5,000 $ 5,000 Land – Tract 1 $ 5,000 $ 25,000 Land – Tract 2 $ 30,000 $ 40,000 $ 20,000 Land – Tract 3 $ 25,000 $ 75,000 $100,000 N t FMV off partnership Note: t hi assets t iis greater t than th 110% off b basis i att ti time off ttransfer. f 48 Calculation Of 734(b) Basis Adjustment (Cont.) EXAMPLE 3: Liquidating q g distribution of real estate result Partner A would have a basis in Tract 2 of $40,000, causing $10,000 in “acquired basis.” Because FMV exceeded basis by y more than 110% at time of transfer, Sect. 732(d) ( ) requires a Sect. 734(b) adjustment, even if no Sect. 754 election is in place. ABC Partnership must decrease its basis in its assets by $10,000. The property distributed was capital p g gain p property p y ((real estate). ) Accordingly, g y the $10,000 downward basis adjustment is allocated to capital gain property – Tracts 1 and 3. Sect. 755(b) Tract 3 is the only y asset with unrealized depreciation, p so the adjustment j is first allocated to Tract 3 to the extent of the unrealized depreciation ($5,000). Regulations Sect. 1.755-1(c)(2)(ii) g $5,000 decrease is allocated between Tract 1 and Tract 3 in The remaining proportion to their inside basis, taking into account the first allocation to Tract 3. Regulations Sect. 1.755-1(c)(2)(ii) (see next slide) 49 Calculation Of 734(b) Basis Adjustment (Cont.) EXAMPLE 3 result (Cont.) The remaining $5,000 decrease is allocated between Tract 1 and Tract 3 in proportion to their inside basis, taking into account the first allocation to Tract 3. Regulations Sect. 1.755-1(c)(2)(ii) Tract 1: Tract 3: Total 50 Starting Basis $ 5,000 $20,000 $ $25,000 Percentage Adjustment $5,000/$25,000 = 20% $5,000*20% = $1,000 $20,000/$5,000 = 80% $5,000*80% = $4,000 Final Basis $ 4,000 $16,000 $ $20,000 Craig Gerson, PricewaterhouseCoopers COLLECTED ISSUES AND NUANCES OF PARTNERSHIP BASIS ADJUSTMENTS Collected Issues Involving Basis Adjustments Agenda for this section • Basis adjustments and partnership technical terminations • Adjustments to the basis of stock of a corporate partner • Contingent liabilities and allocations of basis adjustments Section 754 and Basis Adjustments PwC 52 Basis Adjustments And Technical Terminations Technical terminations generally: • • • • Partnership technical termination occurs when partners sell or exchange 50% or more of interests in partnership profits and capital within a 12-month period. Limited federal income tax consequences Partnership elections reset New partner gets basis adjustment if original partnership has Sect. 754 election or if the new partnership makes an election. Section 754 and Basis Adjustments PwC 53 Basis Adjustments And Technical Terminations (Cont.) C Deemed steps: • Contribution of assets/liabilities to new partnership • Distribution of new partnership interests to continuing partners in liquidation of old partnership Sale A 50% 50% B Old Assets & Liabilities New Section 754 and Basis Adjustments PwC 54 Basis as s Adjustments djust e ts And d Technical ec ca Terminations (Cont.) Basis adjustment allocation in taxable transaction Basis adjustment allocation in non recognition transaction non-recognition • Bi-directional adjustments permitted (increasing basis of some assets and (decreasing basis of other assets) • Single directional adjustments okay • Adjustments permitted when net allocation is zero • No adjustments permitted when net allocation is zero Section 754 and Basis Adjustments PwC 55 Basis Adjustments And Technical Terminations (Cont.) Taxable exchange g C Sale A 50% 50% B Old Non-recognition g exchange g Assets & Liabilities i bili i New Section 754 and Basis Adjustments PwC 56 Basis Adjustments And Technical Terminations (Cont.) • Arguably, purchasing partners can elect which basis adjustment allocation scheme to apply by choosing whether to elect under Sect. 754 for the new partnership. • By purchasing an interest and subsequently transferring the interest in a non-recognition transaction (e.g., a Sect. 351 transaction), the partner might avoid a decrease to the basis of assets if the partnership is allocating a positive basis adjustment. Section 754 and Basis Adjustments PwC 57 Basis Adjustments And Technical Terminations (Cont.) Example • C purchases A’s partnership interest and receives a basis adjustment of $100. The partnership has two assets: Asset #1 partnership p would and Asset #2. On a sale of these assets, the p allocate ll gain off $140 to C ffrom Asset #1 and d lloss off $40 to C from Assets #2. Asset #1 Asset #2 Section 754 and Basis Adjustments PwC Allocation All i on sale Allocation All i on _distribution_ $140 ($ 40) $100 - 58 Adjustments To Basis Of Stock Of Corporate Partner • Prior to 2004, partners could duplicate losses by disposing of partnership interest in a loss transaction and stepping down the partnership p p basis of p partner stock. • Loss transaction examples: • Sale of interest for loss • Redemption of interest for cash for loss • Redemption of interest for property, increasing basis in distributed property Section 754 and Basis Adjustments PwC 59 Adjustments To Basis Of Stock Of Corporate Partner (Cont.) • After reducing the basis of stock, partnership could distribute stock to corporate partner, partner which could liquidate distributed company while retaining high basis in underlying assets. • To prevent this result, result Congress enacted Sect. Sect 755(c) in 2004 2004. Section 754 and Basis Adjustments PwC 60 Adjustments To Basis Of Stock Of Corporate Partner (Cont.) • • • • Sect. 755(c) limits the ability of partnership to reduce basis of stock in “corporate partner.” • Corporate partner is defined broadly to include any related person under sections 267(b) or 707(b)(1). Basis reductions that would be applied against stock basis must instead reduce basis of other partnership assets. Partnership recognizes a gain if it does not hold other assets with sufficient basis. Partnership with gain under Sect. 755(c) should consider whether h th b better tt results lt can b be achieved hi d under d S Sect. t 732(f). (f) Section 754 and Basis Adjustments PwC 61 Adjustments To Basis Of Stock Of Corporate Partner (Cont.) Example: • Asset 1 distributed to Sub 2 in redemption of its interest. PY S b1 Sub S b2 Sub 49% AB = 100 • Reduction to CFC stock is disallowed under Sect. 755(c). • Partnership has no other assets, so it must recognize a $100 gain. gain Section 754 and Basis Adjustments PwC LLC CFC Asset 1 AB = $100 AB = $0 FMV = $100 FMV = $100 62 Basis Adjustments And Contingent Liabilities Contingent liabilities generally: • • Partnership “contingent” liabilities are obligations that have not yet given rise to basis or a deduction for tax purposes. purposes Examples: • Employee benefits • Commercial C i l or ttortt claims l i • Environmental remediation Section 754 and Basis Adjustments PwC 63 Basis Adjustments And Contingent Liabilities (Cont.) Liabilities and Sect Sect. 743(b) basis adjustments • • Ordinary partnership tax liabilities do not affect partnership basis adjustments under Sect Sect. 743(b) Sect. 743(b) adjustment equals: • Outside basis (inclusive of allocated liabilities), less • Previously taxed capital plus allocated liabilities. • Sect. 752 liabilities cancel each other out in this equation. Section 754 and Basis Adjustments PwC 64 Basis Adjustments And Contingent Liabilities (Cont.) Liabilities and Sect. 743(b) basis adjustments (Cont.) • • • The effect Th ff off contingent i obligations bli i on partnership hi b basis i adjustments under Sect. 743(b) is less clear. Contingent obligations are not treated as “liabilities,” for purposes of calculating Sect. Sect 743(b) adjustment adjustment. However, a contingent obligation may function as a “negative asset,” which would reduce the basis adjustment amount. Section 754 and Basis Adjustments PwC 65 Basis Adjustments And Contingent Liabilities (Cont.) Is a contingent obligation a “partnership asset”? • TR 1.752-7(b)(3) (b)( ) provides id that h a contingent i li liability bili iis one that h has not given rise to tax basis or a deduction. • TR 1.752-7(c) ( ) provides id th thatt sections ti 704(b) (b) and d 704(c) ( ) apply l tto contingent liabilities. Section 754 and Basis Adjustments PwC 66 Basis Adjustments And Contingent Liabilities (Cont.) If the contingent obligation is a partnership asset asset, it affects the calculation of the step up: Example: Assume $100 purchase of partnership interest; purchaser’s g liability. y share of asset has $120 value, $60 basis, $20 contingent Treated as Asset Not Treated as Asset Outside Basis Less sum of: Cash on liquidation l less gain i iin assets t plus loss in assets Sect. 743(b) adjustment Section 754 and Basis Adjustments PwC $100 $100 $80 ($60) $20 ($40) $60 $80 ($60) -__ ($20) $80 67 Basis Adjustments And Contingent Liabilities (Cont.) • The treatment of the contingent obligation also affects the allocation of the adjustment in the partnership. • The regulations under Sect. 755 describe allocations of basis adjustments to “partnership partnership property. property.” • A contingent liability functions like a negative built-in loss asset. Section 754 and Basis Adjustments PwC 68 Basis Adjustments And Technical Terminations Example • C receives a basis adjustment of $100 on the purchase of a partnership interest. The partnership has one asset, Asset #1. On a sale of this asset, the partnership would allocate gain of $140 to C. In addition, the partnership has a contingent liability which, when paid, will generate a $40 deduction to C. C Treated as Property Not Treated as Property Asset #1 Contingent liability $140 ($ 40) $100 -_ Total adjustment $100 $100 Section 754 and Basis Adjustments PwC 69 Basis Adjustments And Contingent Liabilities (Cont.) Should the contingent liability be treated as partnership “property”? property ? Yes? • Treating contingent liability as property is most consistent with purpose of basis adjustment and allocation rules. No? • Sect. 755 applies to “property”, and Sect. 743(b) applies to assets; neither applies pp to partnership obligations. • TR 11.752-7 752-7 treats contingent liability as built-in loss property. Section 754 and Basis Adjustments PwC 70