Iron Ore Futures and OTC

advertisement

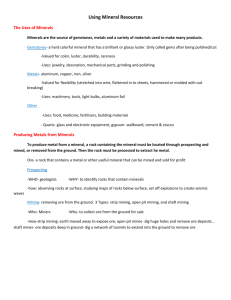

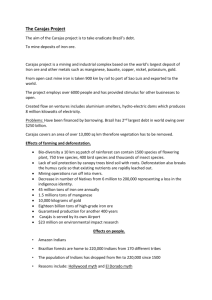

TSI Market Watch April 4, 2014 Iron Ore Futures and Derivatives Trading Booms as Spot Prices Slump The volume of iron ore swaps, options and futures cleared in March smashed their previous monthly record, as sharp swings in physical spot prices for the steelmaking raw material drove market participants to the paper market to offset risk. In total, over 53 million tonnes of iron ore futures and derivatives were cleared basis The Steel Index (TSI), up by more than 70% on February and smashing the previous all-time high of 33.7 million tonnes reached in January by almost 60%. Year-on-year, March volumes grew by nearly 170%. As usual, Singapore Exchange (SGX) handled the bulk of liquidity, clearing just shy of 50 million tonnes. The CME Group accounted for nearly 3.5 million tonnes. Within the total, March also set a new record for the monthly volume of options cleared, exceeding 6.3 million tonnes, more than 18% higher than the previous monthly record in January this year. SGX accounted for 77% of this and CME Group 23%. 60 50 40 Iron Ore Futures and OTC Derivatives Contracts - Volume Cleared and Open Interest* (million tonnes) Futures 35 Options 30 Swaps SGX Daily Open Interest (RHS)** 25 20 30 15 20 10 10 5 0 0 * Total volume cleared by SGX, CME Group, LCH.Clearnet, NOS Clearing and ICE; Open interest for SGX only ** End of month The culmination of weak demand and undisrupted supply led iron ore prices to plunge to depths not seen in more than a year, catching many who had banked on the usual seasonal price support unawares. The price of 62% Fe iron ore fines fell below US$105/dry metric tonne on 10 March, in a daily price drop of almost $10/dry metric tonne that took iron ore to its lowest level since October 2012. All in all, the March monthly average was around 8% lower than February. Weak economic data coming out of China, coupled with an ongoing credit squeeze and clampdown on polluting industries, has limited Chinese mills’ demand for spot iron ore at a time of strong iron ore imports. The usual seasonal supply disruptions from rains in Brazil and cyclones off the coast of Western Australia were relatively mild this year, as was the winter in northern China, where many domestic mining operations are based. These mines contribute around 300 million tonnes/year of 62% Fe equivalent ore to the country’s steelmakers. © Copyright The Steel Index 2014 /1 TSI 62% Fe Fines Benchmark Price (CFR Tianjin Port) 200 US$/ dry metric tonne 175 150 125 100 75 50 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Open interest for iron ore swaps, options and futures on Singapore Exchange (a measure of outstanding open contracts, seen as the best measure of market liquidity) stood at 35.5 million tonnes at the end of March, its highest-ever level at month close. For further information Please contact: Oscar Tarneberg (Singapore) +65 6530 6412 o.tarneberg@thesteelindex.com The Steel Index (TSI) is a leading specialist source of impartial steel, scrap, iron ore and coking coal price information based on spot market transactions. Iron ore price indices are published daily at 19:00 Singapore/Shanghai time (11:00 GMT) and coking coal price indices daily at 18:30 Singapore/Shanghai time (10:30 GMT). Steel prices for Northern Europe, Southern Europe and US HRC are published daily at 14:00 UK time and for ASEAN HRC imports daily at 18:30 Singapore time. Scrap prices for Turkish imports are published daily at 13:30 UK time. Weekly steel and scrap price indices are published every Monday and Friday respectively, with each price representing the average transaction price for the previous calendar week. Transaction price data is submitted confidentially to TSI on-line by companies buying and selling a range of relevant steel, iron ore, scrap, coking coal products. TSI’s index reference prices are then calculated using transparent and verifiable procedures. TSI’s indices are widely used by steel mills, miners, traders, distributors and manufacturing companies worldwide as the basis for their physical pricing arrangements. TSI’s indices are also used as the industry standard in the settlement of ferrous financial contracts. Singapore Exchange (SGX), LCH.Clearnet (London), CME Group (Chicago), NOS Clearing (Oslo), Intercontinental Exchange (ICE) and Indian Commodity Exchange (ICEX) all use TSI’s iron ore index for settling their monthly cleared iron ore financial contracts. SGX also uses TSI’s hot rolled coil index for ASEAN imports to settle its Asian HRC futures and swap contracts. In addition, TSI’s prices are used for the settlement of European hot rolled coil steel contracts and Turkish scrap imports contracts on LCH.Clearnet and CME Clearing Europe. In all cases, settlement prices are the average of TSI’s reference prices published in the expiring month. TSI is a Platts business, part of McGraw Hill Financial. Further information on TSI, including a free trial of the service, is available at http://www.thesteelindex.com. Platts, founded in 1909, is a leading global provider of energy, petrochemicals and metals information and a premier source of benchmark prices for the physical and futures markets. Platts' news, pricing, analytics, commentary and conferences help customers make better-informed trading and business decisions and help the markets operate with greater transparency and efficiency. Customers in more than 150 countries benefit from Platts’ coverage of the carbon emissions, coal, electricity, oil, natural gas, metals, nuclear power, petrochemical, and shipping markets. A division of McGraw-Hill Financial, Platts is headquartered in New York with approximately 900 employees in more than 15 offices worldwide. Additional information is available at http://www.platts.com © Copyright The Steel Index 2014 /2