Consumer Trends - Sauces, Dressings and Condiments in the

advertisement

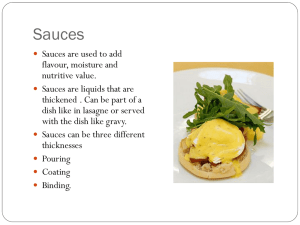

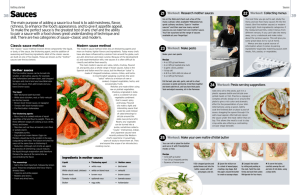

International Markets Bureau MARKET INDICATOR REPORT | MARCH 2013 Consumer Trends Sauces, Dressings and Condiments in the United States Source: Planet Retail, 2012 Source: Planet Retail, 2011 Consumer Trends Sauces, Dressings and Condiments in the United States CONSUMER TRENDS The sauces, dressings and condiments category saw steady growth from 2007 to 2012, benefitting from cost-conscious consumers increasingly eating at home following the economic downturn, particularly in 2009. However, as the United States (U.S.) economy continues to strengthen and consumers gradually return to foodservice, this category is expected to face challenges. Despite this, consumer demand for the category is forecast to see continued growth in the near-term. An increasingly ethnically diverse population, and consumer tastes for ethnic and spicy flavours present an opportunity for new culturally authentic products as consumers look for flavourful food experiences. Premium product growth is also expected as consumer preference for high-quality ingredients and artisanal products increases. The growing Hispanic consumer population in the U.S. presents a promising market for authentic, culturally inspired flavours, such as sofrito (which is a blend of garlic, onion, bell pepper and tomato), or cumin and oregano. INSIDE THIS ISSUE Consumer Trends 2 Retail Sales 3 Health and Wellness 4 Market Shares by Brand and Company 4 Distribution Channels 5 New Product Analysis 6 New Product Examples - Dressings and Vinegars 9 - Sauces 10 - Dips 11 - Packaging Innovation 12 Trade Data 13 Consumer awareness of health and wellness and the trend toward natural health products are key drivers in new product development for sauces and seasonings. Products with natural, organic, and vegetable/bean ingredients are increasingly popular, as well as those with no additives or preservatives. Kosher claims are also growing, along with allergen-reduced products. However, the trend in sodium reduction, which has affected other sectors, is a challenge for sauces and seasonings due to the prominent use of salt. While consumers are interested in healthier products, they don’t want to have to compromise on taste. The trend toward convenience is also having a significant impact on the sauces and seasonings category and has led to the launch of seasoning products that save time in the kitchen and are easy to use, such as prepared mixed herbs. Convenient packaging, which caters to evolving households, such as the growing number of single-person households, is also forecast to be an area for future development in sauces and seasonings. Private label sauces, dressings and condiments experienced strong value share growth in 2009 as cost-conscious consumers prepared more food at home. However, in 2010 these products saw only a small share increase to represent 13% of the market, a share that remained steady in 2011 and 2012*. Many private labels also now offer gourmet features and a variety of ethnic flavours to cater to diverse consumer tastes. Source for both: Planet Retail, 2012 *Please note that for the purposes of this report, 2012 figures are provisional estimates based on partial-year data. PAGE 2 RETAIL SALES In 2012, retail value sales of sauces, dressings and condiments in the U.S. reached US$18.6 billion, representing a compound annual growth rate (CAGR) of 2.7% from 2007 to 2012. Within the sauces, dressings and condiments market, tomato pastes and purées experienced the most growth from 2007 to 2012, increasing by a CAGR of 4.0%. Other sauces, dressings and condiments followed with the second-fastest CAGR of 3.6%, while table sauces was third, registering growth of 3.0%. From 2011 to 2012, the sauces, dressings and condiments market grew by 1.4%. Table sauces led this growth, with an increase of 2.4%, followed by other sauces, dressings and condiments (2.0% growth), and dips (1.9% growth). In contrast, pickled products saw a decrease of 0.4%, and tomato pastes and purées went down 0.2%. Sauces, Dressing and Condiments Market in the United States Retail Value in US$ Millions — Current Prices Categories Sauces, dressings and condiments Cooking sauces Dips Pickled products Table sauces Tomato pastes and purées Other sauces, dressings and condiments 2007 2008 2009 2010 2011 2012* 2007-2012 % CAGR 16,287.5 16,987.4 18,043.4 18,064.3 18,369.1 18,635.1 2.7 4,298.8 2,182.5 2,118.0 6,651.4 4,467.5 2,275.9 2,214.8 6,944.2 4,758.3 2,388.6 2,319.2 7,396.3 4,753.1 2,377.8 2,343.3 7,372.8 4,820.6 2,443.2 2,337.5 7,532.1 4,854.9 2,490.6 2,329.3 7,711.2 2.5 2.7 1.9 3.0 433.0 474.6 518.6 528.3 527.8 527.0 4.0 603.8 610.5 662.4 688.9 707.9 722.1 3.6 Retail value sales of sauces, dressings and condiments in the U.S. are forecast to continue growing, and at a slightly faster rate, with a CAGR of 3.0% from 2012 to 2017. Dips are expected to lead growth in this category, increasing by a CAGR of 3.3% from 2012 to 2017, followed by cooking sauces and table sauces, which are each forecast to record a CAGR of 3.0%. Sauces, Dressing and Condiments Market in the United States Historic/Forecast Retail Value in US$ Millions — Current Prices Categories Sauces, dressings and condiments Cooking sauces Dips Pickled products Table sauces Tomato pastes and purées Other sauces, dressings and condiments 2012* 2013 2014 2015 2016 2017 2012-2017 % CAGR 18,635.1 19,228.8 19,807.4 20,395.0 20,970.9 21,551.0 3.0 4,854.9 2,490.6 2,329.3 7,711.2 5,019.1 2,576.6 2,385.9 7,957.9 5,173.7 2,660.2 2,442.1 8,202.9 5,325.5 2,742.2 2,508.9 8,454.9 5,478.3 2,833.6 2,565.8 8,692.9 5,630.9 2,923.3 2,622.3 8,935.7 3.0 3.3 2.4 3.0 527.0 545.7 559.6 575.5 590.3 606.0 2.8 722.1 743.6 768.9 788.0 809.8 832.7 2.9 Source for both: Euromonitor, 2012 *Note: All 2012 data is provisional and based on part-year estimates. PAGE 3 HEALTH AND WELLNESS The health and wellness sauces, dressings and condiments market has a retail value of nearly US$1.9 billion and currently represents 10.1% of the total sauces, dressings and condiments market in the U.S. From 2007 to 2012, the health and wellness sauces, dressings and condiments market increased at a CAGR of 4.2%. In the future, this category is expected to further increase, with a CAGR of 5.4% from 2012 to 2017. This growth is notably faster than that of the overall sauces, dressings and condiments market, which is expected to increase by a CAGR of 3.0% from 2012 to 2017. Health and Wellness (HW) Sauces, Dressings and Condiments Market in the United States Historic/Forecast Retail Value in US$ Millions — Current Prices 2014 2015 2016 2017 Categories 2007 2008 2009 2010 2011 2012* 2013 HW sauces, dressings 1,526.9 1,633.6 1,725.1 1,757.3 1,811.3 1,879.7 1,973.3 2,080.2 2,199.5 and condiments 2,315.4 2,440.8 Source: Euromonitor, 2012. *Note: All 2012 data is provisional and based on part-year estimates. The health and wellness trend has influenced the sauces, dressings and condiments market as manufacturers respond to consumer demand for natural and organic ingredients, and products without additives or preservatives. There may also be market opportunities for products perceived as healthier, such as hummus and vegetable/bean-based dips and sauces. Consumers are increasingly conscious of product ingredients and are aware that low fat dressings and dips may have significantly higher sugar levels. As a result, some consumers are switching back to higher fat/lower sugar products. Sodium reduction, which has been a common trend in a number of other food categories, does present a challenge, as salt is a popular ingredient used to enhance flavour. However, the demand for both healthy and flavourful food products presents opportunities for new product launches that can balance taste and lower salt content. MARKET SHARES BY BRAND AND COMPANY In 2012, the top ten brands account for an estimated 32.7% of the retail market for sauces, dressings and condiments in the U.S., while the top five brands account for 22.0% of the overall market. All of the top ten brands in the market are well-known and well-established within the U.S. However, private label products also have a notable presence, accounting for an estimated 13.4% of the retail market in 2012. McCormick brand, Mayonnaise with Lime Juice Kraft brand, Basil Parmesan Vinaigrette Dressing Heinz brand, Gourmet Malt Vinegar Source for all: Mintel 2012. PAGE 4 MARKET SHARES BY BRAND AND COMPANY (continued) Top Brand Shares by Company (Global Brand Owner) of Sauces, Dressings and Condiments in the United States — Retail Value % Breakdown Brand McCormick Kraft Heinz Ragú Hellmann's Tostitos Kikkoman Hidden Valley Sabra Hunt's Private label Company (Global Brand Owner) 2007 2008 2009 2010 2011 2012* McCormick & Co Inc. Kraft Foods Group, Inc.** Heinz Co, HJ Unilever Group Unilever Group PepsiCo Inc. Kikkoman Corp Clorox Co, The Strauss Group Ltd ConAgra Foods Inc. Private label 6.4 5.8 3.7 3.3 2.8 2.6 2.5 1.8 0.5 1.9 11.6 6.5 5.6 3.7 3.4 3.1 2.6 2.4 1.8 0.7 1.8 12.4 6.6 5.4 3.6 3.5 3.1 2.8 2.4 1.8 0.9 1.9 13.2 6.7 5.1 3.6 3.4 3.1 2.6 2.5 1.9 1.3 1.8 13.4 6.7 5.1 3.6 3.4 3.2 2.6 2.5 1.9 1.6 1.8 13.4 6.8 5.1 3.6 3.3 3.2 2.6 2.5 2.0 1.8 1.8 13.4 Source: Euromonitor, 2012. *Note: All 2012 data is provisional and based on part-year estimates. **Note: In 2011, Kraft Foods announced the division of its operations into two businesses, separating the North American Grocery division of the company from the Global Snacks division. As a result, the Kraft brand was under Kraft Foods Inc. up to 2011, and in 2012 came under Kraft Foods Group, Inc. DISTRIBUTION CHANNELS In 2011, 70.2% of all sales of sauces, dressings and condiments in the U.S. were through supermarkets or hypermarkets, an increase from 69.7% in 2006. Small grocery retailers (including convenience stores, independent small grocers and forecourt retailers) accounted for 13.0% of sales. Of small grocery retailers, independent small grocers represented the largest distribution channel, with an overall market share of 11.6%. Other non-grocery retailers also comprised a notable market share of 9.0%. While discounters only accounted for 4.9% of sales in 2011, their market share has been increasing, from 4.3% in 2006. Distribution Shares of Sauces, Dressings and Condiments in the United States – Retail Value, 2011* 1.3% 0.6% 0.5% Supermarkets/Hypermarkets 1.1% Discounters 9.0% Convenience Stores Independent Small Grocers 11.6% 0.9% Forecourt Retailers 4.9% Other Grocery Retailers 70.2% Health and Beauty Retailers Other Non‐Grocery Retailers Internet Retailing Source: Euromonitor, 2011 *The most recent data available is from 2011. PAGE 5 NEW PRODUCT ANALYSIS A total of 9,776 new sauce, dressing and condiment products entered the U.S. market between January 2008 and October 2012, according to Mintel’s Global New Products Database (GNPD). These products represent the following sub-categories: pasta sauces, cooking sauces, seasonings, pickled condiments, oils, other sauces and seasonings, mayonnaise, table sauces, and dips. Of the product introductions, seasonings were the most common, with over 2,000 product launches, followed by table sauces (1,693), and cooking sauces (1,124). Mayonnaise Other sauces and seasonings Stocks Pasta sauces Oils Dips Pickled condiments Dressings and vinegar Cooking sauces Table sauces Seasonings Number of Introductions Sauce, Dressing and Condiment Product Introductions in the United States January 2008 to October 2012 Source: Mintel GNPD, 2012 The annual number of new sauce, dressing and condiment product launches, from January 2008 to October 2012, accounted for similar proportions across the various sauce, dressing and condiment sub-categories. The year 2009 seemed to have notably fewer launches across all sub-categories, while 2010 generally had significantly more product launches across sub-categories, particularly among seasoning, table sauce, and pasta sauce products. PAGE 6 NEW PRODUCT ANALYSIS (continued) Over the past five years, introductions of sauce, dressing and condiment products have fluctuated, from a peak of over 2,300 in 2010, to just under 1,500 as of October 2012. New private label products have fluctuated in a similar pattern over the past five years, with 560 launches as of October 2012. The most common launch type among new sauces, dressings and condiments, was new products (5,045 products). Launches that were new products consisted mainly of seasonings (1,089 products), such as salt and pepper, garlic and spicy mixes for chili, fajitas and tacos, followed by table sauces (868 products), such as salsas, barbecue and hot/spicy sauces, and then cooking sauces (615), such as Italian, Indian and Asian cooking sauces. The second most common launch type was products that were new varieties and range extensions (3,399), followed by 1,174 products with new packaging, 110 products that were a new formulation, and 48 re-launches. Retail Channel Distribution Supermarkets were by far the most commonly used retail channel for new sauces, dressings and condiments, accounting for more than half of introductions. Mass merchandisers/hypermarkets were the second-most common channel (7.3% of introductions), followed by natural/health food stores (6.8%). Flavours Fruit and vegetable, herb and spices, and savoury flavours were the most commonly used flavour categories used for new sauce, dressing and condiment products launched from January 2008 to October 2012. Store Format Supermarket Mass merchandisers/ hypermarket Natural/health food store Specialist retailer Gourmet store Internet/mail order Department store Club store Drug store/pharmacy Convenience store Other stores Number of Introductions 5,405 715 670 515 331 310 258 254 77 34 1,240 More specifically, the most common type were vegetable flavours, used in 1,846 new launches, followed by sauce flavours such as soy, hoisin, and buffalo sauces (1,370 launches), spices (605), fruit flavours (394), and herbs (355). Other common flavours amongst the new products were cheese, alcohol, and citrus fruit. Claims The use of claims has been steady but growing throughout the last five years, continuing into this year. Sauces, dressings and condiments can sometimes fall into the specialty food category, and claims on product launches represent this as well. The most popular claims catered specifically to certain consumers (such as those looking for kosher, allergen-free foods, or healthier products). The influence of environmental and convenience trends is also apparent, with eco-friendly and easy-to-use claims also popular among the product launches. Year 2008 2009 2010 2011 2012 (Jan.-Oct.) Total Number of Claims 3,179 2,543 4,012 3,878 2,747 16,369 Number of Introductions 2,105 1,650 2,357 2,171 1,493 9,776 Source for all: Mintel, 2012 PAGE 7 NEW PRODUCT ANALYSIS (continued) Claims (continued) Manufacturers have been innovating through new products that respond to merging consumer trends such as the growing Hispanic consumer demographic and growing interest among consumers overall in new flavour experiences and diversity. Consumers are being exposed to new ethnic dishes at restaurants and then wanting to duplicate these flavours/sauces at home. However, these flavours/sauces can be complex for a consumer to duplicate from scratch, leading to increased opportunities for prepared ethnic sauces at retail. Another growing innovation trend is related to the ingredients used in new products, which reflect popular consumer trends regarding health and wellness, and premium quality products. For example, products are formulated for reduced fat, sodium, or acidity; some are fortified with omega-3 or omega-6, or contain live and active cultures or antioxidant-rich ingredients such as pomegranate. The natural benefits of ingredients are also being highlighted in products such as tomato sauce, coconut oil/milk, and pure apple cider vinegar. Innovative packaging that allows for easier product use and storage, or suggests premium quality attributes to the consumer, was also found amongst the new launches. Number of Claims Sauce, Dressing and Condiment Product Introductions in the United States January 2008 to October 2012 – By Top Ten Claims Ease-of-use Low/no/reduced fat Eco-friendly package Premium Organic Gluten-free Low/no/reduced allergen No additives/ preservatives All natural product Kosher Source: Mintel GNPD, 2012 Source: Mintel GNPD, 2012 PAGE 8 NEW PRODUCT EXAMPLES – DRESSINGS AND VINEGARS The following are several examples of innovative dressing and vinegar introductions to the U.S. between January 2008 and October 2012, from Mintel GNPD. Innovation in this category appears to focus on increasing and highlighting the diverse uses of these products, as well as high-quality and healthy ingredients. Unfiltered All Natural Apple Cider Vinegar Company: H.J. Heinz Brand: Heinz Price (US$): 2.78 Date published: October 2012 Positioning claim: All natural product, kosher. Description: Raw, unpasteurized, and made with 100% all natural apples, this certified-kosher product retains the "mother" of vinegar, a compound created naturally during vinegar's fermentation process. It retails in a 32-fl. oz. bottle. Healthy Vinaigrette Company: Bragg Live Foods Brand: Bragg Price (US$): 5.29 Date published: July 2012 Positioning claims: Kosher, low/no/ reduced sodium, low/no/reduced trans-fat, no additives/preservatives, organic. Description: Made with Bragg organic apple cider vinegar and Bragg organic extra virgin olive oil, this product is free from preservatives, chemicals, additives, added salt, trans fat, and retails in a 12-fl. oz. bottle. Pomegranate Champagne Vinegar Company: O Olive Oil Brand: O Olive Oil Price (US$): 12.00 Date Published: December 2011 Positioning claims: Antioxidant, gluten-free, low/no/reduced allergen. Glaze with Balsamic Vinegar of Modena Company: Monari Federzoni Brand: Monari Federzoni Price (US$): 4.98 Date published: October 2012 Positioning claims: Ease-of-use, environmentally friendly package. Description: This product features the sweet taste of wild berries that are slowly steeped and aged in California champagne. Antioxidant-rich and sparkling, it can be splashed on anything from watercress to late summer soups. This gluten-free vinegar is made by hand in small batches and retails in a 6.8-fl. oz. bottle. Description: Described as a delicious, ready-to-use dressing, this product is said to be perfect on grilled or baked vegetables, hamburgers, fries, cheese, and salads, as a dipping sauce, and on vanilla ice cream, fruit salad or strawberries. This product retails in a 9.1-oz. recyclable pack. Pure Apple Cider Vinegar Company: M. A, Gedney Brand: Gedney Price (US$): 1.99 Date published: June 2010 Positioning claims: Kosher, functional. Source for all: Mintel, 2012 Description: Ideal for cooking and canning, this product has been reduced with water to 5% acidity. The kosher certified product is a perfect addition to many recipes, and will add robust flavour when marinating meats and vegetables, pickling, and making salad dressings. According to the manufacturer, pure apple cider vinegar is a versatile home remedy and may have numerous health benefits. The product retails in a 32-fl. oz. bottle. PAGE 9 NEW PRODUCT EXAMPLES – SAUCES The following are several examples of innovative sauce introductions in U.S. between January 2008 and October 2012, from Mintel GNPD. Key areas of product innovation include highlighting functional qualities of ingredients or other healthy attributes of the product. Some companies have also emphasized the diverse uses of their product, or its unique taste/flavouring. Garden Vegetable Pasta Sauce Company: Lidestri Foods Brand: Francesco Rinaldi To Be Healthy Price (US$): 2.00 Date published: May 2010 Positioning claim: Brain and nervous system (functional), cardiovascular (functional), low/no/reduced sodium, low/no/ reduced sugar. Description: Available in a 16-oz. jar, this product contains 290 mg of sodium per serving, which is 29% less than the sodium in Francesco Rinaldi Chunky Garden Combo. It contains no added sugar and is fortified with 64 mg DHA (Docosahexaenoic Acid) omega-3 per serving for a healthy brain, heart, and eyes. Tomato Sauce Company: ConAgra Foods Brand: Hunt’s Price (US$): 6.98 Date published: October 2010 Positioning claims: Antioxidant, no additives/preservatives. Description: Now available in a 12 x 15-oz. pack with recipes on the back, this rich, red sauce is great for Italian cuisine, pasta dishes or steak stroganoff. The product is free from artificial ingredients and provides a natural source of the antioxidant lycopene. Cultured Coconut Milk Company: Turtle Mountain Brand: So Delicious Price (US$): 3.00 Date Published: June 2010 Positioning claims: Gluten-free, kosher, low/no/reduced allergen, low/no/reduced lactose, organic, prebiotic. Description: This is a dairy-free and soy-free product made with organic coconut. It is vanilla flavoured and contains six active and live cultures, including lactobacillus bulgaricus, streptococcus thermophilus, lactobacillus rhamnosus, lactobacillus acidophilus, bifidus bifidum, and bifidus animalis. The product retails in a 16-oz. tub. Medium Chipotle Pumpkin Salsa Company: Frontera Foods Brand: Frontera (private label) Price (US$): 6.99 Date published: January 2012 Positioning claims: All natural product, limited edition, no additives/preservatives, seasonal. Description: From the kitchen of chef Rick Bayless, this limited edition product features a seasonal recipe with roasted tomatillo, chipotle chiles and roasted garlic. It is 100% natural and free from preservatives. The medium spicy salsa can be served with tortilla chips, roast chicken or slow-cooked pork. It retails in a 16-oz. jar. Savory Sauce Company: Good Healthy Foods Brand: Black Horse Price (US$): 6.99 Date published: August 2009 Positioning claims: Cardiovascular (functional), gluten-free, low/no/reduced allergen. Description: This gluten-free product can be used as a glaze, marinade, dip, grilling sauce, or stir fry sauce. It retails in a 12-fl. oz. bottle, and claims to be heart healthy. Also available are the following varieties: Apricot Sauce; Verde Chile Sauce; and Raspberry Mustard Sauce. Source for all: Mintel, 2012 PAGE 10 NEW PRODUCT EXAMPLES – DIPS The following are several examples of innovative dip introductions in U.S. between January 2008 and October 2012, from Mintel GNPD. Health has also been a key focus for product development in this category, both through functional attributes and healthy ingredients. New flavour combinations (such as edamame hummus) and convenience (such as dip packaged with bread), have also been areas for innovation. Edamame Hummus Company: Summer Fresh Salads Brand: Summer Fresh Salads Price (US$): 3.99 Date published: January 2009 Positioning claims: Gluten-free, low/no/reduced allergen, low/no/reduced lactose, prebiotic, vegetarian. Description: This soy bean and chickpea spread retails in an 8-oz. tub. Also available in this range are: Power + Humus with a Strawberry and Vanilla flavour, which provides a good source of omega-3, fibre, and is prebiotic; and Power + Hummus with an Apple and Cinnamon flavour. Probiotic Classic Hummus Company: Pulmuone Wildwood Brand: Wildwood Organic Price (US$): 3.79 Date published: November 2009 Positioning claims: Digestive (functional), kosher, organic. Description: A creamy, smooth and fullflavour hummus that promotes healthy digestion. Certified organic by the USDA, The Iowa Department of Agriculture and Land Stewardship, this spread retails in a 10-oz. tub. Black Bean Dip Company: Wegmans Brand: Wegmans (private label) Price (US$): 1.99 Date Published: March 2012 Positioning claims: Vegan, cardiovascular (functional), gluten-free, low/no/reduced allergen, low/no/reduced calorie, low/no/reduced lactose. Description: Now available in a newly designed 16-oz. jar, this vegan product is heart healthy, contains low calorie and is free from gluten and lactose. Also available are the following varieties: Salsa con Queso (Salsa with Cheese); and Hot Salsa. Spinach & Artichoke Dip Company: Bellisio Foods Brand: Michelina’s Lean Gourmet Price (US$): 1.78 Date published: May 2012 Positioning claims: All natural, slimming, economy, microwaveable, no additives/ preservatives, ethical - environmentally friendly package. Salsa Style Fire Roasted Diced Tomatoes in Puree Company: Aldi Brand: Happy Harvest (private label) Price (US$): 0.89 Date published: November 2011 Positioning claims: All natural product, ethical - environmentally friendly package, gluten-free, low/no/reduced allergen, antioxidant. Description: This dip is all-natural and contains spinach and artichokes in a creamy mozzarella and parmesan cheese sauce, with pull-apart bread. This low-priced dip contains no artificial preservatives, is microwavable, and retails in an 8-oz. pack that has been certified by the Sustainable Forestry Initiative. Also available is a Black Bean & Corn Salsa with Flatbread variety. Description: This product is is a source of antioxidants. gluten-free product can be with chips and is retailed recyclable can. all-natural and This naturally served chilled in a 14.5-oz Source for all: Mintel, 2012 PAGE 11 NEW PRODUCT EXAMPLES – PACKAGING INNOVATION The following are several examples of sauce and seasoning introductions in the U.S. between January 2008 and October 2012, from Mintel GNPD, that feature innovative and interesting packaging. Packaging innovation has largely focused on making products more convenient, by increasing their ease of use. However, packaging has also been used to highlight certain ingredients or high-quality attributes. Pinot Noir Steak Sauce Company: Harry and David Brand: Harry & David Price (US$): 7.00 Date published: June 2012 Positioning claims: Interesting packaging. Description: A rich and thick steak sauce flavored with Pinot Noir, this product retails in a 11-oz. bottle with a reusable snap-on cap. The shape of the bottle is meant to mirror a wine carafe, to highlight the wine ingredient in the product, while the bottle cap is a re-usable snap-on tin plate. Tomato Ketchup Company: H.J. Heinz Brand: Heinz Price (US$): 0.99 Date published: May 2012 Positioning claims: Economy, gluten-free, interesting packaging, low/no/reduced allergen. Light Dressing Company: Kraft Foods Brand: Kraft Miracle Whip Price (US$): 2.26 Date published: March 2008 Positioning claims: Interesting packaging, kosher, low/no/reduced calorie, low/no/ reduced fat, low/no/reduced saturated fat, low/ no/reduced trans-fat. Sweet Pepper Roasted Garlic Seasoning Sheet Company: Housewares Brand: Debbie Meyer Flavor Genius Price (US$): 24.90 Date Published: September 2009 Positioning claims: Ease-of-use, glutenfree, low/no/reduced allergen, novel. Tomato Sauce Company: ConAgra Foods Brand: Hunt’s Price (US$): 2.39 Date Published: October 2012 Positioning claims: All natural, antioxidant, convenient packaging, ethical - charity, no additives/preservatives. Description: Re-packaged with an updated design and now retails in a 10-oz. pouch pack, this sauce is gluten-free, is made from tomatoes grown from Heinz seeds, and claims to retail at a great low price. Description: This product contains 50% less fat and 30% fewer calories than regular Miracle Whip Dressing. It features the Sensible Solution green flag, indicating that it meets specific nutrition criteria derived from 2005 U.S. Dietary Guidelines. Free from trans-fat and saturated fat (per serving), this product has been repackaged and it is now available in an 18-fl. oz. non-stick bottle. Description: This product is described as a new, unique, easy and convenient way to season meat, poultry, fish and veggies. The meat, fish or poultry is to be placed onto the sheet and chilled for 30 minutes, until the seasoning transfers to the food. This item retails in a pack containing nine sheets. Description: This tomato sauce is now available in a 33.5-oz. re-sealable pack. The packaging is also easy to open, store, and pour, for less mess. This 100% natural sauce has been blended with choice seasonings and spices, and contains lycopene, an antioxidant naturally found in tomatoes. It also features the "Child Hunger Ends Here" logo. Source for all: Mintel, 2012 PAGE 12 TRADE DATA Canada’s global exports related to sauces, dressings and condiments (as outlined in the table below), totaled $225 million as of September 2012. Overall, this export category has been on a downward trend since 2009, registering a decline of 17.7% from 2009 to 2011. Tomato purées and pastes saw the greatest decline from 2009 to 2011. However, these products had relatively small export values to begin with. Exports of anise seeds and other similar spices also saw notable declines from 2009 to 2011, as did exports of cinnamon. However, several products did experience positive growth from 2009 to 2011. Cloves, for example, experienced growth of 34.9% from 2009 to 2011, while soya sauce exports grew by 14.9%, exports of nutmeg, mace and cardamoms increased by 9.0%, and prepared/preserved cucumbers and gherkins grew by 1.4%. Canada’s Exports to the World Sauce, Dressing and Condiment-Related Categories - C$ Commodity* Sauces and preparations and mixed condiments and seasonings 2009 2010 Jan. - Sept. 2012 2011 206,332,757 163,156,831 186,380,891 156,505,126 Tomato ketchup and other tomato sauces 69,013,170 69,698,290 48,246,508 32,736,481 Mustard flour, meal, and prepared mustard 32,118,696 24,697,554 22,244,742 18,754,289 13,119,551 11,663,312 7,382,789 4,582,865 6,844,738 5,852,697 5,599,525 4,165,230 6,542,885 4,175,338 4,544,341 3,066,024 2,985,786 2,819,908 3,027,104 2,691,573 Soya sauce 1,217,565 1,528,476 1,392,270 1,226,578 Nutmeg, mace and cardamoms 1,184,753 1,563,313 1,291,455 654,191 Cinnamon and cinnamon-tree flowers 983,405 979,509 632,738 478,093 Cloves (whole fruit, cloves and stems) 114,679 216,336 154,751 62,142 Tomato paste, in air-tight containers less than 1.4 kg 347,737 1,232 39,194 33,601 Tomato paste, prepared/preserved other than by vinegar/acetic acid, not in airtight container 480,424 73,777 60,527 0 1,311 0 0 0 127,844 5,981 3,958 0 Seeds of anise, badian, fennel, coriander, cumin, caraway or juniper Ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry and other spices Pepper of the genus Piper; dried, crushed or ground fruit of genus Capsicum or Pimenta Cucumbers and gherkins, prepared or preserved by vinegar or acetic acid Tomato purée, in air-tight containers less than 1.4 kg Tomato purée, prepared/preserved other than by vinegar/acetic acid, not in airtight container Total 341,415,301 286,432,554 281,000,793 224,956,193 Source: CATSNET, 2012 *HS Codes in order of appearance: 210390, 210320, 210330, 0909, 0910, 0904, 200110, 210310, 0908, 0906, 0907, 20029011, 20029019, 20029021, and 20029029. PAGE 13 TRADE DATA (continued) Similar to Canada’s sauce, dressing and condiment-related exports to the world, exports to the U.S. also declined (17.5%) from 2009 to 2011. As of September 2012, exports destined for the U.S. were worth nearly $200 million. The U.S. is a key market for Canada’s agri-food and seafood exports, and the same is true for sauce, dressing and condiment products. The U.S. accounts for nearly all Canadian exports of sauces, dressings and condiments in some categories, and at least a significant portion of exports in others. For example, the U.S. was the destination for nearly all of Canada’s nutmeg, mace and cardamom exports this year, representing 99.0% of exports as of September 2012. While overall exports of sauce, dressing and condiment products to the U.S. declined from 2009 to 2011, some categories experienced growth, including cloves, which grew by 208.4%, nutmeg, mace and cardamom (18.3%), soya sauce (14.0%), and prepared/preserved cucumbers and gherkins (2.1%). Canada’s Exports to the United States in Sauce, Dressing and Condiment-Related Categories - C$ Commodity* 2009 2010 2011 Jan. - Sept. % of Canada’s 2012 World Exports** Sauces and preparations and mixed 186,987,566 147,497,706 168,463,940 143,279,469 condiments and seasonings Tomato ketchup and other tomato 67,754,642 68,393,610 47,077,289 31,836,046 sauces Mustard flour and meal and prepared 19,496,655 15,032,153 14,029,197 11,496,190 mustard Seeds of anise, badian, fennel, 9,693,131 8,137,107 5,019,409 3,440,880 coriander, cumin, caraway or juniper Ginger, saffron, turmeric (curcuma), thyme, bay leaves, curry and other 3,388,200 3,016,864 2,843,020 1,902,350 spices Pepper of the genus Piper; dried, crushed or ground fruit of genus 6,287,631 3,788,137 3,814,344 2,886,990 Capsicum or Pimenta Cucumbers and gherkins, prepared or 2,830,467 2,699,685 2,891,085 2,634,681 preserved by vinegar or acetic acid Soya sauce 1,129,296 1,376,159 1,287,627 1,156,732 Nutmeg, mace and cardamoms 1,064,045 1,388,770 1,258,974 647,456 Cinnamon and cinnamon-tree flowers 772,502 882,493 504,389 370,705 Cloves (whole fruit, cloves and stems) 43,422 16,731 133,915 47,775 Tomato paste, in air-tight containers 66,156 0 39,061 29,000 less than 1.4 kg Tomato paste, prepared/ preserved other than by vinegar/ 479,548 60,512 12,894 0 acetic acid, not in airtight container Tomato purée, in air-tight containers 0 0 0 0 less than 1.4 kg Tomato purée, prepared/preserved other than by vinegar/ 11,089 5,981 3,803 0 acetic acid, not in airtight container 300,004,350 252,295,908 247,378,947 199,728,274 Total 91.5% 97.2% 61.3% 75.1% 45.7% 94.2% 97.9% 94.3% 99.0% 77.5% 76.9% 86.3% 0 0 0 88.8% Source: CATSNET, 2012 *HS codes in order of appearance: 210390, 210320, 210330, 0909, 0910, 0904, 200110, 210310, 0908, 0906, 0907, 20029011, 20029019, 20029021, and 20029029. **Based on 2012, as of September. PAGE 14 The Government of Canada has prepared this report based on primary and secondary sources of information. Although every effort has been made to ensure that the information is accurate, Agriculture and Agri-Food Canada assumes no liability for any actions taken based on the information contained herein. Consumer Trends: Sauces, Dressings and Condiments in the United States © Her Majesty the Queen in Right of Canada, represented by the Minister of Agriculture and Agri-Food Canada (2013). ISSN 1920-6615 AAFC No. 11978E Photo Credits All photographs reproduced in this publication are used by permission of the rights holders. All images, unless otherwise noted, are copyright Her Majesty the Queen in Right of Canada. For additional copies of this publication or to request an alternate format, please contact: Agriculture and Agri-Food Canada 1341 Baseline Road, Tower 5, 4th floor Ottawa, ON Canada K1A 0C5 E-mail: infoservice@agr.gc.ca Aussi disponible en français sous le titre : Tendances de consommation : Sauces, vinaigrettes et condiments aux États-Unis