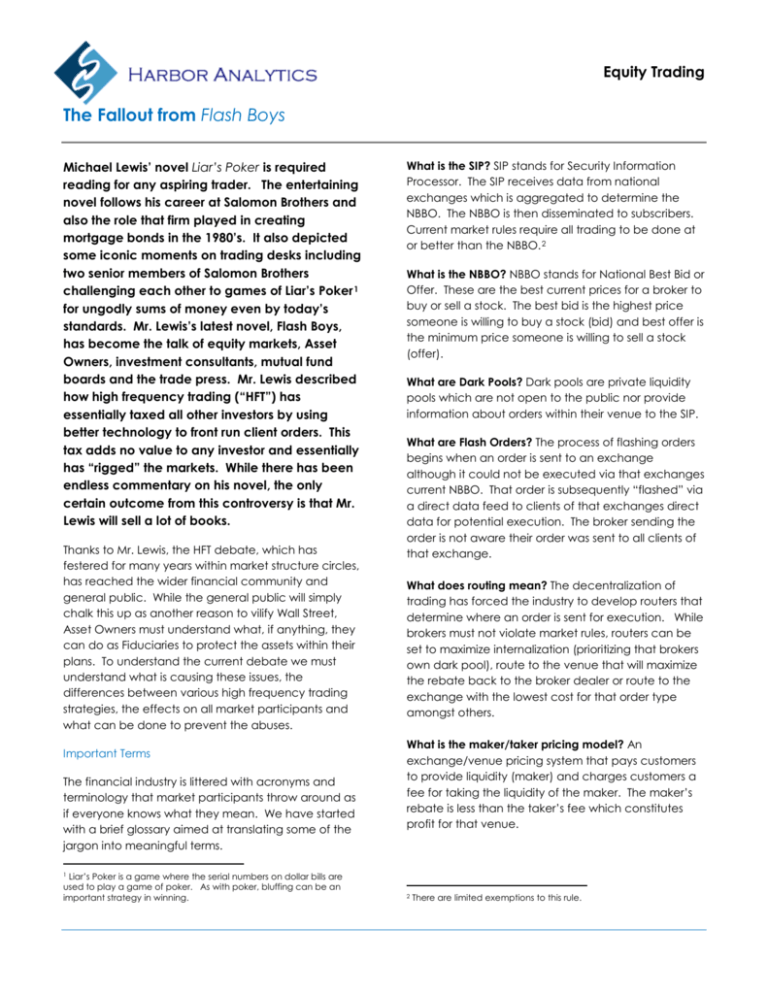

The Fallout from Flash Boys

advertisement

Equity Trading The Fallout from Flash Boys Michael Lewis’ novel Liar’s Poker is required reading for any aspiring trader. The entertaining novel follows his career at Salomon Brothers and also the role that firm played in creating mortgage bonds in the 1980’s. It also depicted some iconic moments on trading desks including two senior members of Salomon Brothers challenging each other to games of Liar’s Poker 1 for ungodly sums of money even by today’s standards. Mr. Lewis’s latest novel, Flash Boys, has become the talk of equity markets, Asset Owners, investment consultants, mutual fund boards and the trade press. Mr. Lewis described how high frequency trading (“HFT”) has essentially taxed all other investors by using better technology to front run client orders. This tax adds no value to any investor and essentially has “rigged” the markets. While there has been endless commentary on his novel, the only certain outcome from this controversy is that Mr. Lewis will sell a lot of books. Thanks to Mr. Lewis, the HFT debate, which has festered for many years within market structure circles, has reached the wider financial community and general public. While the general public will simply chalk this up as another reason to vilify Wall Street, Asset Owners must understand what, if anything, they can do as Fiduciaries to protect the assets within their plans. To understand the current debate we must understand what is causing these issues, the differences between various high frequency trading strategies, the effects on all market participants and what can be done to prevent the abuses. Important Terms The financial industry is littered with acronyms and terminology that market participants throw around as if everyone knows what they mean. We have started with a brief glossary aimed at translating some of the jargon into meaningful terms. Liar’s Poker is a game where the serial numbers on dollar bills are used to play a game of poker. As with poker, bluffing can be an important strategy in winning. What is the SIP? SIP stands for Security Information Processor. The SIP receives data from national exchanges which is aggregated to determine the NBBO. The NBBO is then disseminated to subscribers. Current market rules require all trading to be done at or better than the NBBO. 2 What is the NBBO? NBBO stands for National Best Bid or Offer. These are the best current prices for a broker to buy or sell a stock. The best bid is the highest price someone is willing to buy a stock (bid) and best offer is the minimum price someone is willing to sell a stock (offer). What are Dark Pools? Dark pools are private liquidity pools which are not open to the public nor provide information about orders within their venue to the SIP. What are Flash Orders? The process of flashing orders begins when an order is sent to an exchange although it could not be executed via that exchanges current NBBO. That order is subsequently “flashed” via a direct data feed to clients of that exchanges direct data for potential execution. The broker sending the order is not aware their order was sent to all clients of that exchange. What does routing mean? The decentralization of trading has forced the industry to develop routers that determine where an order is sent for execution. While brokers must not violate market rules, routers can be set to maximize internalization (prioritizing that brokers own dark pool), route to the venue that will maximize the rebate back to the broker dealer or route to the exchange with the lowest cost for that order type amongst others. What is the maker/taker pricing model? An exchange/venue pricing system that pays customers to provide liquidity (maker) and charges customers a fee for taking the liquidity of the maker. The maker’s rebate is less than the taker’s fee which constitutes profit for that venue. 1 2 There are limited exemptions to this rule. Equity Trading The Fallout from Flash Boys Who is required to provide information to the SIP? National Market Exchanges register as such with the SEC. There are currently 16 exchanges in the United States. 3 These are often referred to as “Lit” markets as their prices are transparent unlike dark pools. A Brief History Current market microstructure can be traced back to multiple rule changes with the Regulation National Market System (Reg NMS), which was enacted in 2007, being the most important. The key rule change was the order protection rule or trade through rule. It essentially forced brokers to execute at the best price available across all markets (at this point in time the NYSE and NASD dominated total volume although regional exchanges existed and posted to the consolidated quote system). While executing at the best price seems obvious, high frequency trading (HFT) can trace its roots back to this rule. Consider the following quote for stock XYZ: (Venue: Bid – Offer | Shares Bid x Shares Offered) Venue 1: 100.00 – 100.10 |50,000 x 50,000 Venue 2: 100.01 – 100.09 | 100 x 100 Prior to the enactment of Reg NMS, most institutional traders who were looking to sell a block of XYZ would ignore Venue 2 and execute on Venue 1. They would ignore Venue 2 because there were only 100 shares bid for the stock while executing on Venue 1 would allow them to execute 50,000 shares in one transaction. Reg NMS effectively forced traders not to ignore Venue 2 and execute 100 shares at the superior price before routing to Venue 1 for the 50,000 shares. This rule change essentially transformed the US from two dominant market centers (NASDAQ and NYSE) to a much more fragmented market where startup electronic exchanges could compete on a level playing field with the two industry giants because their liquidity could no longer be ignored. In a similar timeframe, the exchanges transformed from nonprofit entities to for profit entities. As such, they were no longer unbiased utilities for execution. Two key changes that occurred due to the change in business model was the maker or taker pricing models and the business of selling preferential treatment to market participants. Preferential treatment comes in the form of direct data feeds and co-location space that are sold at a premium. The direct data feeds and colocation space have created an uneven playing field in the form of lower latency and the ability to react to market information quicker. Unintended Consequences Competition is the life-blood of free markets. The thought process behind Reg NMS was that increased competition will decrease bid/ask spreads for all investors. 4 This will lower transaction costs and essentially decrease the compensation currently being made by the market makers at the time and return this ‘tax’ to its rightful owner. What was never envisioned when this rule was adopted was latency arbitrage. Latency arbitrage is the advantage certain market participants from purchasing direct data feeds and co-location. The unfair playing field leads to what we call disappearing liquidity effect. The disappearing liquidity effect is illustrated below: Venue 1: 100.00 - 100.02 | 2,000 X 2,000 Venue 2: 100.00 - 100.02 | 2,000 X 2,000 Venue 3: 100.00 - 100.02 | 2,000 X 2,000 Venue 4: 100.00 - 100.02 | 2,000 X 2,000 Venue 5: 100.00 - 100.02 | 2,000 X 2,000 Five exchanges with the same quote would lead you to believe you can buy/sell 10,000 shares at the current bid or offer by taking the liquidity on all five venues. What actually happens however is when a trader attempts to purchase 10,000 shares, he or she would often transact on 2,000 or 4,000 shares (they would transact in the venue who receives that message first) but not be filled on the total 10,000 shares as the other volume disappeared in the microsecond it takes for an order to reach all exchanges. The price would then move away from where that trades wanted to execute. This happens because the It should be noted that spreads have decreased significantly since this time and transaction costs have declined as well. 4 3 http://www.sec.gov/divisions/marketreg/mrexchanges.shtml 2|Page Equity Trading The Fallout from Flash Boys HFT firm would see the buyer of 10,000 shares lift the first 2,000 shares (from the first venue it reaches) and then compete against that order. Competition for that order can manifest in many different manners such as cancelling orders the HFT firm is trying to execute in that stock or buying ahead of that order. The reason why each exchange is not accessed at the same exact time is due to the time it takes the information to travel through the cables carrying the information. Defense of HFT The antagonists of Flash Boys are all HFT firms 5 who are labeled as scalpers who have rigged the market at the cost of the small retail investor and pension plans across the globe. The one-sided nature of the story has led to a fierce defense from the high frequency industry. 6 The most common points noted by HFT firms are the following: I. The IEX Solution The protagonist of Flash Boys is Brad Katsuyama the former head of RBC’s trading desk and President of IEX (IEX is a shortened version of “Investors Exchange”). Katsuyama, like many market participants, was keenly aware of the disappearing liquidity issues that constantly occurred. IEX’s solution is to level the playing field for all investors executing within their dark pool. They would do this by: 1. 2. 3. Ensure no order has a latency advantage over others. All orders on IEX are delayed 350 milliseconds which eliminates any latency advantage. Limit the amount of order types. There are hundreds of orders types than can be used to release and order to a liquidity venue with some of these order types designed so no executions occur. Eliminate rebates associated with different order types. All orders executed on IEX pay the same rate for execution. This essentially eliminates the HFT strategy of attempting to profit from rebate arbitrage. IEX has been very successful as a startup dark pool executing over 40 million shares per day at last count. They have been able to attract this sizable market share because of both believers in their model, some of whom have invested in IEX, and the publicity from Flash Boys. 3|Page II. III. Everything they are doing is within the confines of the market and perfectly legal (for now!) There are many different HFT strategies that do not involve “latency arbitrage” and these strategies add liquidity to the market and lower transaction costs for everyone (Harbor agrees with this point and the issue associated with regulating abusive HFT strategies out of the market is to ensure liquidity creating strategies are not effected) High frequency strategies increase market efficiency by driving securities to their fair market value by removing short term pricing anomalies often caused by larger orders. (again we agree with respect to a limited number of strategies). Predatory HFT Strategies In general, HFT is a catch all term that defines automated trading strategies that rely on high speed execution and large volumes. These strategies attempt to make small profits as many times as possible in a given day (think a fractional of a penny millions of times a day). Holding periods are measured in seconds and rarely are positions held overnight. To improve the market microstructure we need to rid ourselves of predatory strategies that are simply a tax on investors. The most egregious strategies in our view include the following: While his name never appears in the novel, the climatic ending of Flash Boys in combination with some internet searching will lead you to the person who is believed to be the face of the HFT industry. 6 CNBC’s interview of Katsuyama and BATS (liquidity venue who is accused in Flash Boys of arming predatory HFT firms) President William O’ Brien demonstrates the animosity amongst market participants in this debate. http://www.cnbc.com/id/101544772 5 Equity Trading The Fallout from Flash Boys Latency Arbitrage – This is a fancy term for front running. The NBBO is determined by the SIP, which receives data from all protected exchanges. The SIP takes a certain amount of time to determine the NBBO. Firms executing latency arbitrage buy direct data fees from each of the execution venues and essentially calculate their own NBBO and do it quicker than the SIP. HFT firms know what the NBBO will be in the future as they are a fraction of a second quicker. It is essentially like betting on a Sunday football game while you are reading Monday’s paper. You cannot lose. Who wins from Latency Arbitrage? 1. 2. The firms who execute these strategies essentially have risk free profits. The exchanges benefit because their direct data feeds at co-location space are sold to HFT firms at a premium. Liquidity Providing HFT Strategies Not all HFT strategies are toxic and some add to the liquidity and efficiency of markets. For many years market makers and specialists were the liquidity providers for the market. In some respects, certain HFT strategies have replaced market makers in creating liquidity. This is done through high velocity strategies which we believe lower transactions costs for all participants. Some examples of these strategies are: 1. 2. Who loses? 1. All investors. It is a zero sum game – what they make is essentially a tax on anyone trading. Momentum Ignition Strategies – This is a fancy term for creating a lot of commotion in the market that could potentially trick traders/algorithms into thinking the stock is moving quickly. This is the equity trading version of yelling fire in a dark theater. HFT firms will create a staggering amount of orders in a short period of time giving the appearance of a potential shift in the momentum of a given stock (very few are executed as they are cancelled very quickly and many are activated with a market type that is designed not to be executed). This can often cause algorithms used by most market participants to increase its trading. HFT firms profit from the short term volatility. In less liquid stocks, HFT firms can trigger stop loss 7 orders which will further move a stock temporarily. There are many more HFT strategies that are not a tax on the investor. The more important point is that not all HFT strategies are bad and some have assisted in lowering transaction costs for all investors. Harbor Recommendations It is the view of Harbor Analytics that the following changes will limit the “tax” on trading caused by predatory HFT strategies: 1. Stop loss orders are limit orders entered below (above for short positions) the current value of a security which attempts to limit ones downside. Once the stock reaches the stop loss limit, the order becomes a market order which is immediately executed. Market orders can have large short-term impact for illiquid stocks. 7 4|Page Passive Market Making – Passive market making attempts to buy on the bid and sell on the offer constantly across many stocks across the trading day. The HFT firm also will attempt to profit from rebates from exchanges in these strategies. Security Arbitrage – Firms for many years have attempted to profit from fair value differences between futures, exchange traded funds and the physical stocks that underlie these products. Similarly, ADR’s that trade in the same market periods (US/Europe, US/ Canada etc.) can be simultaneously purchased and sold for small profits. Lastly, highly correlated securities that dislocate on a given day can create a temporary long/short trade until the aberration disappears. These strategies create liquidity to the market and lower transaction costs for all participants. A charge for cancel and replace orders which is based on the ratio of executions to orders placed. Many market participants are frustrated by disappearing liquidity. The disappearing liquidity is caused by HFT firms who have no intention of executing at the Equity Trading The Fallout from Flash Boys 2. 3. prices they have posted. They are simply fishing for information that can be used to step ahead of bona fide orders or trying to create an appearance of upcoming momentum. Our suggestion is to charge for cancel and replace orders once your ratio (Cancel and Replace Messages vs. Actual Executions) for a trading day reaches a certain point. Simply charging for cancel and replace of orders is unfair as market participants do this all the time as the market changes and their price level or strategy changes. Also charging for cancel and replace orders once they reach a certain point will be a tax on the largest firms who conceivably will have the largest amount of orders. The intent of this rule would be to eliminate trading strategies where firms are fishing for information and routinely cancel 9095% of their orders on a daily basis. This would be extremely difficult to implement given exchanges would have to band together to make this effective but something that would eliminate a powerful tool for predatory HFT firms. Ban flash orders. Many exchanges already have banned this order type which has no value to investors. End direct data feeds. The advantage firms have by creating a faster SIP is unfair. What can an Asset Owner do? There is very little direct action Asset Owners can take at this point because predatory HFT’s are not violating any regulations or laws. Unlike the FX scandal that is still playing out in courts, Asset Owners do not have much recourse in this debate. A prudent Fiduciary should: I. Join the debate. Because institutional asset owners have the largest amount of capital, and thus the largest tax from predatory strategies, they should be voicing concerns on what should be implemented to eliminate this cost. 5|Page II. III. IV. Measure your transaction costs and ensure your managers are aware that you monitor their trading closely. Transaction costs are the usually the largest cost associated with managing a strategy and a direct impact to alpha. Ensure trading is an important part of manager due diligence. Those managers who have limited resources and focus little on trading will ultimately fail. Understand the process each manager undertakes in routing of their orders. Our guess is some managers completely leave this to their brokers which can be a mistake. While we expect that the popularity of IEX will cause for copy-cat exchanges or potentially improvements to the IEX model, an Asset Owner should ensure that their managers are staying current on the routing of their orders and potential opportunities (i.e. block crossing networks) that will lower cost and completely avoid HFT. Litigation As with all controversy in financial services, the plaintiff bar will strike. Pension plans will soon, or already have, receive solicitations to sue their money managers for NBBO violations. While NBBO violations have little to do with the current HFT debate, the scrutiny will allow these firms to get more Asset Owners interested. The firms will assert that they have lost significant value due to these violations and are entitled damages. The problems we see with this approach are as follows: 1. Data. Custodian banks do not maintain time stamped trade data for all orders executed by money managers. Similarly, most money managers do not maintain accurate time stamps for all “child” orders it executes. A child order is essentially the individual executions that make up the large block that was purchased or sold. If this data is not readily available, it will make the analysis and ability to prove fault difficult. Equity Trading The Fallout from Flash Boys 2. 3. Culpability. Who will be sued? Managers are using best of breed algorithms to route their orders to the market for best execution. If NBBO violations occur, are they really the fault of the money manager? Broker Dealers. Broker dealers who internalize trading are required to enact policies and procedures to ensure all orders are compliant with Reg NMS. Because any violations that are not exempt must be reported, a process already exists to measure NBBO violations. The goal of many of these firms will be to create a large enough distraction for any financial services firm they engage to settle a lawsuit. We believe if there are any recoveries they will be small and not worth the effort. Summary Michael Lewis will sell a lot of books as he should. There is no doubt that Flash Boys is very entertaining particularly for those actively involved with equity trading. The regulatory response is less certain. Obvious cures for eliminating latency arbitrage will have consequences to other market participants (particularly the exchanges who profit from selling direct data feeds) who are not simply taxing other investors. What will change is that all market participants will become more sensitive to the issue and we expect new liquidity venues to arise that will protect client’s orders from the current market structure problems. About Us Harbor Analytics is a consulting firm that provides expert quantitative support to clients and investment consultants during the transition management process and the on-going monitoring of managers trading. We focus on the total cost of trading, the alpha impact caused by trading and the probability of the manager being able to consistently generate alpha given its management and trading style. 6|Page Contact: info@harboranalytics.com 781.875.1451 Legal Disclaimer You may only use this communication for internal purposes and you may not amend or forward without written consent from Harbor Analytics, LLC. The communication is background information and should not be considered a solicitation for any investment strategy nor are we providing investment advice. Our opinions are subject to change without advanced notice. These are solely the opinions of the author. © Harbor Analytics, 2014