The Total Asset Growth Anomaly: Is It Incremental to the Net

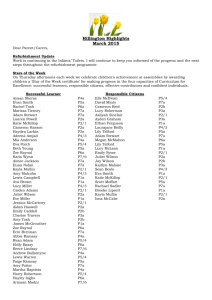

advertisement