Conversion from Loss Elimination Ratios to Premium Reduction

Conversion from Loss Elimination Ratios to Premium Reduction Percentages

(Information provided to ICRB by NCCI in April 2004.)

This document contains advisory information on how to convert loss elimination ratios to premium reduction (deductible credit) percentages.

In states where NCCI files only loss costs for the voluntary market, premium reduction

(deductible credit) percentages will not be calculated. Instead, NCCI will provide advisory loss elimination ratios only. Individual carriers adopting these ratios will then be required to develop the credits based on their own expense needs and assumptions.

In an effort to lend some guidance to carriers on this process, the following pages explain a general formula for converting loss elimination ratios to deductible credits. It is strictly an advisory formula that carriers do not have to adopt or use.

SAMPLE DEDUCTIBLE PRICING

Introduction

The following summarizes one possible procedure that can be used by carriers to price deductible discounts for workers compensation insurance. The formula and assumptions are based on the methods described in Part III of Fundamentals of

Individual Risk Rating (1992) by Richard Snader and William R. Gillam.

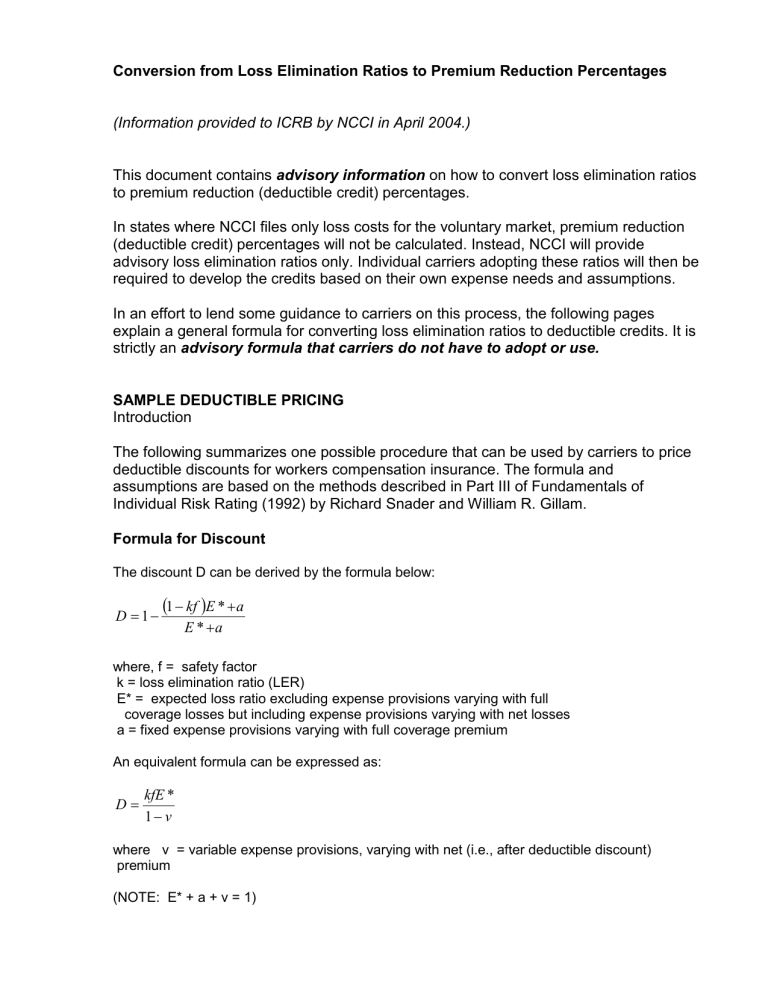

Formula for Discount

The discount D can be derived by the formula below:

D

=

1

−

(

1

− kf

)

E

E *

+ a

*

+ a where, f = safety factor

k = loss elimination ratio (LER)

E* = expected loss ratio excluding expense provisions varying with full

coverage losses but including expense provisions varying with net losses

a = fixed expense provisions varying with full coverage premium

An equivalent formula can be expressed as:

D

= kfE

1

− v

* where v = variable expense provisions, varying with net (i.e., after deductible discount)

premium

(NOTE: E* + a + v = 1)

Explanation of Formula Components

Safety Factor (f)—A safety factor might be included for the following reasons:

1. Adverse selection against insurer.

2. Collection difficulties or delays after the carrier indemnifies the injured worker.

3. Obligation of insurer to pay full coverage if the insured becomes bankrupt or is otherwise unable to pay.

4. Variance associated with the losses excess of the deductible is greater than the variance associated with full coverage losses. Consequently, the associated risk (retained by the insurer) is higher.

Loss Elimination Ratio (k)—The advisory LERs are determined using the following process

(assuming the deductible is applied to the total loss):

1. NCCI calculates the state’s average cost per case for each hazard group.

2. NCCI estimates the state’s loss distribution curve, by hazard group, by modifying NCCI’s excess loss factor (ELF) procedure in the following ways: a. For each injury type, the ratio-to-average index is converted from a per-occurrence basis to a per-claim basis. b. Using the same parameters and distribution previously determined for the ELF procedure, the excess ratios are recalculated for each converted ratio-to-average from item a. c. Using a “medical only” average severity and the same distribution used for the

Minor/Temporary Total (Minor/TT) portion, a “medical only” distribution is added. This is necessary for deductibles (and not ELFs) because there are some “medical only” losses in excess of the smaller total deductible amounts.

3. NCCI uses the fitted loss distribution curve to determine the percentage of losses in the layer eliminated by the deductible. This percentage is the loss elimination ratio (equal to one minus the excess loss ratio).

Note that if the deductible applies to medical losses only, the loss elimination ratio calculation is further modified to represent the portion of total loss that is eliminated by a “medical only” deductible.

Expected (or Permissible) Loss Ratio (E*)—This represents the ratio to premium of losses as well as any expense provisions that are expected to be eliminated by a deductible to the same extent as losses. As carriers must typically investigate and settle all claims under deductible programs, loss adjustment expenses might not be expected to be reduced and thus E* might exclude the LAE provision.

Fixed Expense Provisions (a)—This component accounts for all expense dollars that are unaffected by the selection of a deductible by an insured. An example of this would be home office expenses.

Variable Expense Provisions (v)—This component accounts for all expenses that are generally incurred as a percentage of the final (net) premium. An example of this would be state premium taxes.

The following example illustrates the application of this formula.

EXAMPLE

Safety factor (f) = .7

LER (k) = .120

Expected loss ratio (E*) = .654 (from Exhibit II-B)

Fixed expense provision (a) = .135 (13.5% of full coverage premium, includes 8.8% for

LAE and 4.7% for general expense)

Variable expense provision (v) = .211 (21.1% of net premium, includes 16.6% for production expense, 2.0% for taxes, 2.5% P&C))

D

=

1

−

(

1

− kf

)

E

E *

+ a

*

+ a

=

1

−

(

1

−

.

( )( ) )(

.

654

) +

.

654

+

.

135

.

135

=

.

070

=

7 .

0 %

Using the equivalent formula:

D

= kfE *

1

− v

=

.

( ) ( )(

.

654

)

1

−

.

211

=

7 .

0 %