INSTITUTIONAL VARIETIES OF PRODUCTIVIST WELFARE

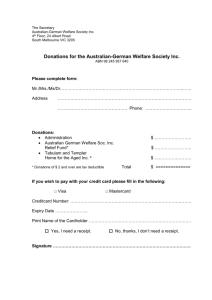

advertisement