1 UNIVERSITY OF THE INCARNATE WORD HEB School of

advertisement

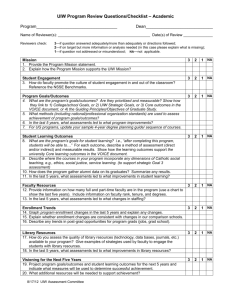

UNIVERSITY OF THE INCARNATE WORD HEB School of Business and Administration INTERNATIONAL BANKING AND FINANCE (BFIN 3355/BINT 3355) STUDY ABROAD-SUMMER I GENERAL INFORMATION Professor: Jose F. Moreno, Ph.D. Office: GB 203 Phone: (210) 930-8011 E-mail: jfmoreno@uiwtx.edu Office Hours: Appointments available Prerequisite: ACCT 2311, BFIN 3330 and BINT 3331 Curriculum: Elective for Banking and Finance specialization and required course for International Business specialization. OVERVIEW OF THE COURSE In this course, the students will learn financial concepts employed by international management to control risks related to international trading, international banking and international investments. Topics include exchange rate regimes, the determination of exchange rates, concepts on free trade, the foreign exchange market, the futures market and other derivative markets, purchase parity relationships, funding of international trade, country risk, and the international banking activity. COURSE OUTCOMES AND ASSESMENTS 1. A basic understanding of international financial management evaluated by 2 examinations. 2. Improved written and oral communication skills evaluated by 1 team presentation and 1 individual presentation, and visit reports. 3. Improved interpersonal skills evaluated by classroom activities and visits. 4. Improved technology skills evaluated by 3 homework assignments. REQUIRED MATERIAL 1. TEXTBOOK: International Financial Management. Jeff Madura. South-Western CENGAGE Learning, 11th Edition. 2. OTHERS: Calculator with Financial functions or Laptop with Microsoft Excel. Note: Students have the responsibility to read the chapters. The instructor recommends reading the chapter BEFORE the session. Then, you can participate most actively during the class. 1 GRADING CRITERIA Exams (2): Presentations (2) Visit Reports (5) Homework Assignments 40% 20% 30% 10% PRESENTATIONS: Presentations are activities designed to work on teams. The details of topic and format of these activities will be discussed during class. EXAMS: Questions and problems of the exam will be based mostly on exercises and material reviewed in class. However, some topics included in the textbook could not be mentioned in class but they will be part of the exam. Then, the instructor strongly recommends reading not only class notes but also the textbook. There is NO Make-up exams. ATTENDANCE Attendance is important for the success of the course and therefore is required, and it will impact directly the final grade of the course. Punctuality is required, late classes or leaving class early is absence. Courtesy and respect to your classmates is in the order of business. Please turn off your cell phone, iPod or pager. Texting or chatting during class is not allowed. ACADEMIC HONESTY STATEMENT The UIW is strongly committed to the nurturing of academic excellence. The UIW expects its students to pursue and maintain truth, honesty and personal integrity in their academic work. Forms of academic dishonesty include: cheating, plagiarism, counterfeit work, falsification of academic record, the unauthorized use of work, theft, collusion, and the facilitation of academic dishonesty. The faculty expects all students to maintain high ethical standards and adhere to the Code of Academic Integrity as stated in the UIW Handbook. DISABILITY ACOMMODATIONS The University of the Incarnate Word is committed to providing a supportive, challenging, diverse and integrated environment for all students. In accordance with Section 504 of the Rehabilitation Act – Subpart E and Title III of the Americans with Disabilities Act (ADA), the University ensures accessibility to its programs, services and activities for qualified students with documented disabilities. For more information, contact the Student Disability Services Office: Location Administration Building – Room 105 Phone (210) 829-3997 Fax (210) 829-6078 www.uiw.edu/sds 2 International Banking and Finance BFIN 3355/ BINT 3355 Instructor: Jose Francisco Moreno, Ph.D. SUMMER I 2016 Course Outline Week Topics Readings Assignments 1 San Antonio-Frankfurt 1 Frankfurt-Heidelberg 1 International Flow of Funds Ch.2 1 International Financial Markets Ch.3 2 Exchange Rate Determination Ch.4 HW 1: Chapter 2 2 Government Influence on ERs Ch. 6 PPT 1: Balance of Payments 2 VISIT TO FRANKFURT 2 VISIT TO FRANKFURT 3 Currency Derivatives Ch.5 3 International Arbitrage and IRP Ch. 7 3 International Arbitrage and IR/Exam 1 4 VISIT TO STUTGARTT 4 VISIT TO STUTGARTT 4 Inflation, Interest Rates and ERs 5 Measuring Exposure to ER Ch. 10 5 Managing Transaction Exposure/Exam 2 Ch.11 5 Heidelberg-Frankfurt-San Antonio PPT 2: Derivatives Contracts Ch.8 3 HW 2: Chapter 5 HW 3: Chapter 8