Financial Analysis

advertisement

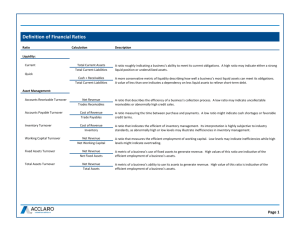

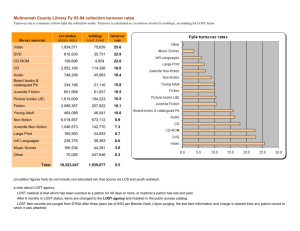

3. Financial Analysis 3.1 Financial Analysis from 2008 to 2012 (Unconsolidated) 2008 2009 2010 2011 2012 11.87 14.26 18.12 17.31 23.57 Capital Structure Analysis Debt Ratio (%) Long-term Fund to Fixed Assets Ratio (%) 219.72 196.27 157.73 142.52 136.93 Liquidity Analysis Current Ratio (%) 338.70 256.07 162.88 144.79 149.73 Quick Ratio (%) 312.83 228.94 140.07 122.41 122.85 Times Interest Earned (times) 312.95 669.76 789.71 325.54 195.29 Average Collection Turnover (times) 11.08 11.17 10.93 10.40 11.01 Days Sales Outstanding 32.93 32.66 33.40 35.09 33.14 Average Inventory Turnover (times) 10.86 10.06 9.44 9.61 9.13 Average Inventory Turnover Days 33.59 36.29 38.67 37.97 39.97 Average Payment Turnover (times) Operating Performance Analysis Profitability Analysis Cash Flow 20.40 18.46 16.89 18.17 18.23 Fixed Assets Turnover (times) 1.47 1.12 1.11 0.92 0.85 Total Assets Turnover (times) 0.60 0.49 0.58 0.55 0.53 Return on Total Assets (%) 18.35 15.98 25.31 18.40 19.56 Return on Equity (%) 20.74 18.37 30.23 22.30 24.57 Operating Income to Paid-in Capital Ratio (%) 41.48 36.49 59.76 53.60 68.20 Pre-tax Income to Paid-in Capital Ratio (%) 43.22 36.67 65.34 55.84 70.83 Net Margin (%) 31.06 31.22 39.71 32.09 33.24 Basic Earnings Per Share (NT$) (Note) 3.84 3.45 6.24 5.18 6.41 Diluted Earnings Per Share (NT$) (Note) 3.81 3.44 6.23 5.18 6.41 Cash Flow Ratio (%) 399.16 214.83 188.12 217.99 199.78 Cash Flow Adequacy Ratio (%) 134.79 122.02 109.98 99.13 93.47 12.95 6.99 11.20 11.07 11.53 Operating Leverage 2.50 2.46 2.17 2.54 2.37 Financial Leverage 1.00 1.00 1.00 1.00 1.01 Cash Flow Reinvestment Ratio (%) Leverage Analysis of deviation of 2012 vs. 2011 over 20% : 1. The debt ratio increased by 36% as a result of increase in bonds payable. 2. The times interest earned decreased by 40%, primarily due to increase in interest expense. 3. The operating income to paid-in capital ratio increased by 27%, mainly due to increase in operating income. 4. The pre-tax income to paid-in capital ratio increased by 27%, primarily due to increase in pre-tax income. 5. The basic and diluted earnings per share both increased by 24%, mainly due to increase in net income. Note: Retroactively adjusted for stock dividends for earning year 2008. *Glossary 1. Capital Structure Analysis (1) Debt Ratio (2) Long-term Fund to Fixed Assets Ratio 2. Liquidity Analysis (1) Current Ratio (2) Quick Ratio (3) Times Interest Earned 3. Operating Performance Analysis (1) Average Collection Turnover (2) Days Sales Outstanding (3) Average Inventory Turnover 4 = Total Liabilities / Total Assets = (Shareholders’ Equity + Long-term Liabilities) / Net Fixed Assets = Current Assets / Current Liabilities = (Current Assets - Inventories - Prepaid Expenses) / Current Liabilities = Earnings before Interest and Taxes / Interest Expenses = Net Sales / Average Trade Receivables = 365 / Average Collection Turnover = Cost of Sales / Average Inventory (4) Average Inventory Turnover Days (5) Average Payment Turnover (6) Fixed Assets Turnover (7) Total Assets Turnover 4. Profitability Analysis (1) Return on Total Assets (2) Return on Equity (3) O perating Income to Paid-in Capital Ratio (4) Pre-tax Income to Paid-in Capital Ratio (5) Net Margin (6) Earnings Per Share = 365 / Average Inventory Turnover = Cost of Sales / Average Trade Payables = Net Sales / Net Fixed Assets = Net Sales / Total Assets = (Net Income + Interest Expenses * (1 - Effective Tax Rate)) / Average Total Assets = Net Income / Average Shareholders’ Equity = Operating Income / Paid-in Capital = Income before Tax / Paid-in Capital = Net Income / Net Sales = (Net Income - Preferred Stock Dividend) / WeightedAverage Number of Shares Outstanding 5. Cash Flow (1) Cash Flow Ratio (2) Cash Flow Adequacy Ratio (3) Cash Flow Reinvestment Ratio 6. Leverage (1) Operating Leverage (2) Financial Leverage = Net Cash Provided by Operating Activities / Current Liabilities = Five-year Sum of Cash from Operations / Five-year Sum of Capital Expenditures, Inventory Additions, and Cash Dividend = (Cash Provided by Operating Activities - Cash Dividends) / (Gross Fixed Assets + Investments + Other Assets + Working Capital) = (Net Sales - Variable Cost) / Income from Operations = Income from Operations / (Income from Operations Interest Expenses) 3.2 Financial Analysis from 2008 to 2012 (Consolidated) 2008 2009 2010 2011 2012 14.05 16.08 19.50 18.37 24.01 Capital Structure Analysis Debts Ratio (%) Long-term Fund to Fixed Assets (%) 203.81 186.51 152.08 133.06 130.83 Liquidity Analysis Current Ratio (%) 444.70 328.31 212.29 192.52 177.12 Quick Ratio (%) 415.32 300.15 187.57 170.06 149.81 Times Interest Earned (times) 182.26 244.85 401.30 229.27 177.80 Average Collection Turnover (times) 10.73 10.78 10.57 10.06 10.77 Days Sales Outstanding 34.01 33.86 34.54 36.29 33.89 Operating Performance Analysis Average Inventory Turnover (times) Profitability Analysis Cash Flow 9.88 9.30 8.62 8.75 8.38 Average Inventory Turnover Days 36.94 39.25 42.36 41.70 43.55 Average Payment Turnover (times) 19.39 20.02 18.77 17.23 18.77 Fixed Assets Turnover (times) 1.37 1.08 1.08 0.87 0.82 Total Assets Turnover (times) 0.60 0.50 0.58 0.55 0.53 Return on Total Assets (%) 17.89 15.57 24.77 18.08 19.30 Return on Equity (%) 20.74 18.37 30.23 22.30 24.57 Operating Income to Paid-in Capital Ratio (%) 40.75 35.50 61.43 54.62 69.84 Pre-tax Income to Paid-in Capital Ratio (%) 43.50 36.85 65.72 56.01 70.03 Net Margin (%) 32.78 30.17 30.25 38.68 31.48 Basic Earnings Per Share (NT$) (Note 1) 3.84 3.45 6.24 5.18 6.41 Diluted Earnings Per Share (NT$) (Note 1) 3.81 3.44 6.23 5.18 6.41 202.94 Cash Flow Ratio (%) 389.91 202.15 186.28 211.60 Cash Flow Adequacy Ratio (%) 139.50 126.39 113.91 101.93 95.97 12.98 6.90 11.13 11.12 11.69 Cash Flow Reinvestment Ratio (%) Leverage Industry Specific Key Performance Indicator Operating Leverage 2.53 2.53 2.12 2.50 2.31 Financial Leverage 1.01 1.00 1.00 1.00 1.01 91 (Note 2) Billing Utilization Rate (%) 88 (Note 2) 75 (Note 2) 101 (Note 2) 91 (Note 2) Advanced Technologies (65-nanometer and below) Percentage of Wafer Sales (%) 21 33 46 56 62 Sales Growth (%) 3.3 -11.2 41.9 1.8 18.5 Net Income Growth (%) -8.5 -10.7 81.1 -17.0 23.8 Analysis of deviation of 2012 vs. 2011 over 20% : 1. The debt ratio increased by 31% as a result of increase in bonds payable. 2. The times interest earned decreased by 22%, primarily due to increase in interest expense. 3. The operating income to paid-in capital ratio increased by 28%, mainly due to increase in operating income. 4. The pre-tax income to paid-in capital ratio increased by 25%, primarily due to increase in pre-tax income. 5. The basic and diluted earnings per share both increased by 24%, mainly due to increase in net income. Note 1: Retroactively adjusted for stock dividends for earning year 2008. Note 2: Capacity includes wafers committed by Vanguard and SSMC. *Glossary 1. Capital Structure Analysis (1) Debt Ratio (2) Long-term Fund to Fixed Assets Ratio 2. Liquidity Analysis (1) Current Ratio (2) Quick Ratio (3) Times Interest Earned 3. Operating Performance Analysis (1) Average Collection Turnover (2) Days Sales Outstanding (3) Average Inventory Turnover = Total Liabilities / Total Assets = (Shareholders’ Equity + Long-term Liabilities) / Net Fixed Assets = Current Assets / Current Liabilities = (Current Assets - Inventories - Prepaid Expenses) / Current Liabilities = Earnings before Interest and Taxes / Interest Expenses = Net Sales / Average Trade Receivables = 365 / Average Collection Turnover = Cost of Sales / Average Inventory (4) Average Inventory Turnover Days (5) Average Payment Turnover (6) Fixed Assets Turnover (7) Total Assets Turnover 4. Profitability Analysis (1) Return on Total Assets = 365 / Average Inventory Turnover = Cost of Sales / Average Trade Payables = Net Sales / Net Fixed Assets = Net Sales / Total Assets = (Net Income + Interest Expenses * (1 - Effective Tax Rate)) / Average Total Assets (2) Return on Equity = Net Income / Average Shareholders’ Equity (3) Operating Income to Paid-in Capital Ratio = Operating Income / Paid-in Capital (4) Pre-tax Income to Paid-in Capital Ratio = Income before Tax / Paid-in Capital (5) Net Margin = Net Income / Net Sales (6) Earnings Per Share = (Net Income - Preferred Stock Dividend) / Weighted Average Number of Shares Outstanding 5. Cash Flow (1) Cash Flow Ratio (2) Cash Flow Adequacy Ratio (3) Cash Flow Reinvestment Ratio 6. Leverage (1) Operating Leverage (2) Financial Leverage = Net Cash Provided by Operating Activities / Current Liabilities = Five-year Sum of Cash from Operations / Five-year Sum of Capital Expenditures, Inventory Additions, and Cash Dividend = (Cash Provided by Operating Activities - Cash Dividends) / (Gross Fixed Assets + Investments + Other Assets + Working Capital) = (Net Sales - Variable Cost) / Income from Operations = Income from Operations / (Income from Operations Interest Expenses) 5