Journal of International Business Studies, 1–27

& 2010 Academy of International Business All rights reserved 0047-2506

www.jibs.net

First- and second-order effects of consumers’

institutional logics on firm–consumer

relationships: A cross-market

comparative analysis

Jagdip Singh1,

Patrick Lentz2 and

Edwin J Nijssen3

1

Weatherhead School of Management, Case

Western Reserve University, Cleveland, USA;

2

Department of Marketing, University of

Dortmund, Dortmund, Germany; 3Department

of Technology Management, Eindhoven

University of Technology, Eindhoven, the

Netherlands

Correspondence: EJ Nijssen, Department of

Technology Management, Eindhoven

University of Technology, PO Box 513, 5600

MB Eindhoven, the Netherlands.

Tel: þ 31 (0)40 2472170;

Fax: þ 31 (0)40 2468054;

E-mail: e.j.nijssen@tue.nl

Abstract

Consumers’ conceptions of a market’s institutional logic affect mechanisms

of firm–consumer relationships, but are generally neglected in comparative

studies of international marketing. This study bridges institutional and relationship marketing theories to examine two questions: do consumers hold

meaningful mental models of a market’s institutional logics, and do these

mental models explain differentiated patterns of market relationships across

international contexts? Building on contract-relational duality, we develop

a market-level construct for capturing consumers’ socially constructed mental

models for the institutional logics of market action. We theorize that differences

in consumers’ institutional logics will influence both their evaluation of a firm’s

capabilities (first-order effect) and the degree to which they reward a firm

through their commitment (second-order effect). These bridging predictions

are tested using data from the insurance industry across three international

markets. Our results show that the German insurance market is located in the

relatively high contracts–low relational quadrant, whereas the US and Dutch

markets are both located in the relatively low contracts – high relational

quadrant. Our results also suggest that consumer commitment conforms to a

principle of alignment such that commitment accrues to providers who align

their capabilities with consumers’ prevalent institutional logics of the market,

and penalizes those who deviate from it.

Journal of International Business Studies (2010) 1–27. doi:10.1057/jibs.2009.101

Keywords: institutional theory; relationship marketing; cross-cultural analysis; comparative analysis

Received: 22 August 2008

Revised: 29 August 2009

Accepted: 3 September 2009

Online publication date: 11 February 2010

INTRODUCTION

Understanding similarities and differences in mechanisms of

firm–consumer relationships is of fundamental interest for international marketing researchers and practitioners alike. Researchers

seek differentiating ‘‘patterns of exchange’’ that characterize

comparative marketing systems, while practitioners drive for

‘‘discretionary decision-making’’ that exploit disparate patterns

for strategic advantages in global markets (Iyer, 1997: 552).

Two dominant, but distinct, streams of research have emerged to

illuminate mechanisms of firm–consumer relationships across

markets. The institutional perspective emphasizes the embedded

Consumers’ institutional logics

Jagdip Singh et al

2

view of market exchanges, and theorizes the role of

‘‘constitutive norms’’ of the marketplace (Grewal &

Dharwadkar, 2002; Scott, 2001). In viewing institutional fields as social structures with isomorphic

force, this perspective acknowledges but subordinates the role of strategic action in individual firm–

consumer relationships. By contrast, relationship

marketing theory focuses on ongoing market

exchanges to identify firms’ capabilities critical to

earning consumers’ commitment (Morgan & Hunt,

1994; Sirdeshmukh, Singh, & Sabol, 2002). Consistent with its emphasis on managerial agency, this

approach accepts cross-market variability, but marginalizes the role of the larger context in which

exchanges develop and evolve. Both perspectives

can claim support within their literatures (Kostova

& Roth, 2002; Palmatier, Dant, Grewal, & Evans,

2006). However, few studies have attempted to

bridge these differing perspectives. Thus the concerns raised over a decade ago by Iyer (1997: 553)

that theories of international marketing ‘‘have y

failed to deal adequately with y the fundamental

nature of market [exchange] relations’’ and limit

our understanding of ‘‘buyer behavior under generalized [institutional] contexts’’ continue to persist

today.

We aim to bridge the institutional and relationship marketing perspectives, and make three specific contributions. First, we emphasize and develop

consumers’ conception of a market’s institutional

environment. Thus far, research grounded in institutional theory has tended to focus either on

managerial conceptions of institutional environments (Porac, Thomas, & Baden-Fuller, 1989;

Prahalad & Bettis, 1986) or on inter-firm relationships (business-to-business, B2B) (Grewal & Dharwadkar, 2002; Heide & Wathne, 2006), largely

ignoring the consumers’ perspective in businessto-customer (B2C) relationships (Brief & Bazerman,

2003). Our study addresses this imbalance. We

utilize institutional theory ideas of contractrelational duality to conceptualize consumers’

shared and socially constructed mental models for

the institutional ‘‘logics’’ of the marketplace. We

thus offer a more socialized view of ongoing firm–

consumer relationships. By focusing on the consumer perspective, we affirm that consumers are

critical market actors who shape and sustain

ongoing market relationships through their commitment to maintain (or terminate) exchanges.

Second, we theorize how consumers’ institutional

logics impact on mechanisms of consumer commitment in ongoing relationships with individual

Journal of International Business Studies

firms across international markets. We refer to

predictions from our theorizing as bridging hypotheses. We anticipate influences both on consumers’ evaluation of a firm’s capabilities and on

the degree to which they reward a firm through

their commitment, which we refer to as first- and

second-order effects respectively. Past research has

focused on describing rather than theorizing and

explaining variability across international markets.

For instance, Wulf, Odekerken-Schröder, and Iacobucci (2001) examine the mechanisms of relationship commitment across three international

markets (Belgium, the Netherlands, and the US),

but posit no a priori hypotheses for the variability in

modeled relationships. In their analysis, these

authors find significant variability for almost every

path in their model across the three markets (their

Table 4: 43). Our study addresses this gap, and

develops a priori institutional-theory-based predictions to account for the variability in exchange

relationships across market contexts.

Third, we operationalize consumers’ conceptions

of institutional logics, theorized as a market-level

construct – consumers’ institutional logics of market

action (CILMA) – and examine its potential to

capture variability in institutional environments of

the insurance industry for three contrasting markets

(Germany, the Netherlands, and the US). We also

examine the incremental contribution of the CILMA construct to explain variability in exchange-level

mechanisms of relationship marketing (i.e., firm–

consumer relationships) while remaining sensitive

to alternative explanations rooted in cultural differences. We specifically control for cultural variability

due to masculinity and uncertainty avoidance –

dimensions most closely related to contract-relational duality.

The paper is organized as follows. First, we review

the institutional perspective to establish that consumers, like managers, are also likely to develop

a shared mental model of a market’s institutional

logics. Thereafter, we develop and define the

CILMA construct to capture consumers’ conceptions of institutional logics, and outline its similarities and differences with respect to extant cultural

constructs. Next, we review the relationship marketing perspective on ongoing firm–consumer

relationships, and theorize the incremental contribution of the CILMA construct by developing

bridging hypotheses of first- and second-order

effects. Following this, we report on the empirical

study involving the insurance market in three

nations, organized in two subsections: the first

Consumers’ institutional logics

Jagdip Singh et al

3

relating to CILMA’s construct validity, and the

second to testing the bridging hypotheses. Finally,

we discuss our findings, and derive the theoretical

and managerial implications.

INSTITUTIONAL PERSPECTIVE ON

CONSUMERS’ LOGICS OF MARKET EXCHANGES

Institutional theory, generally viewed as one of the

leading perspectives for analysis of market action

and evolution, draws on three central premises

(Heugens & Lander, 2009; Lawrence & Suddaby,

2006). First, institutional theorists emphasize the

role of institutional fields as established and

prevalent social rules and norms structuring social

interactions among market actors with economic

objectives, thereby rejecting the atomistic and

‘‘undersocialized’’ view of neoclassical economics

and rational choice theorists (Heugens & Lander,

2009; Hodgson, 2006). Second, the institutional

view conceives ‘‘logics’’ as socially constructed

mental models that groups of individuals hold as

shared cognitions of socialized routines for action.

As Scott (2001: 57) noted, ‘‘compliance occurs y

[as] routines are followed because they are taken for

granted as ‘the way we do these things’.’’ Third,

institutional fields reproduce and sustain themselves through instruments of socialization, including word of mouth, stories, and artifacts that

engage and socialize new members, and allow

environmental changes to be incorporated into

pre-existing routines and patterns (Lawrence &

Suddaby, 2006).

Shared logics are ‘‘essential’’ to facilitate communication, order interactions, and promote learning

among market actors (Denzau & North, 1994: 4–5;

March & Olsen, 1998; Scott, 2001). Most markets

are too complex for an individual to independently

learn how they work, or what routines to enact for

successful market exchanges (Mantzavinos, North,

& Shariq, 2004). Social interactions and socialization processes help individuals learn efficiently

from the collective knowledge of institutional

logics, and store it as a shared mental model that

guides their market actions. Mental models are

neither static over time nor deterministic in shaping the actions of market actors. Rather, these

models are dynamically updated as individuals

learn through feedback from market exchanges,

and their normative influence waxes and wanes

as they compete with other cultural, social, and

economic forces influencing individual action.

Denzau and North (1994: 5) note that understanding shared mental models is the ‘‘single most

important step’’ for replacing the ‘‘black box of

rationality assumption used in economics and

rational choice models.’’

Past research has generally neglected consumers’

mental models of a market’s institutional logics.

This possibly reflects a misconception that communication across consumers is too diffused,

fragmented and infrequent to support meaningful

mental models. However, sufficient evidence exists

to suggest that consumers (1) are motivated

to engage in social learning and construct such

models, and (2) use them to navigate their action

for productive market exchanges (Mantzavinos

et al., 2004). For example, research on lay theories

suggests that, especially in uncertain environments, consumers actively learn from self, and

vicariously from others’ market experiences to

develop and share naı̈ve theories (Molden &

Dweck, 2006). Moreover, modern technologies are

rapidly enabling forums for social learning. This

includes online communities, consumer blogs and

forums, word of mouth through texting, e-mail and

phone, and public sources that reflect and frame

consumers’ market experiences and expectations.

Such shared experiences and learning promote and

explain the mental models that consumers collectively develop and share.

The CILMA Construct: Conceptualization and

Dimensions

We conceptualize CILMA as consumers’ shared

mental model for the institutional field of marketplace exchanges. Following Denzau and North

(1994), we posit that these logics are typically

organized around (1) categories that classify different types of market exchanges, and (2) concepts

that characterize distinctive features of market

exchanges. We develop each of these ideas in turn.

Denzau and North (1994) note that categories are

key architectural features of individuals’ mental

models. Categories define boundaries separating

entities that differ in the institutional logics

governing their social structure. Within a category,

entities are thought to be structured with common

institutional logics. Across categories, the structuring logics are likely to be differentiated. Categories

provide efficiency in negotiating market exchanges

by providing a common set of expectations for a

host of entities that are categorized similarly. For

instance, insurance providers in a given cultural

context (e.g., Germany) may be categorized

together, indicating that market exchanges with

them are characterized by common expectations

Journal of International Business Studies

Consumers’ institutional logics

Jagdip Singh et al

4

regarding service interactions, pricing, product, and

related features. How these common expectations

arise is probably a combination of cultural-historical factors relating to the nation (e.g., regulatory

governance in Germany) and the institutions

unique to the industry (e.g., professional governance of the insurance industry). In other words,

each industry is likely to be organized around

distinct technologies and processes, governed by

largely distinct regulatory codes, and to carry a

historical and cultural trace of negotiations among

marketers and consumers.

It is therefore inappropriate to presume that

institutional logics are common across different

industries within a nation (e.g., automobiles and

insurance in the US) or for similar industries across

different nations (e.g., insurance in the US and

Germany). Several studies indicate that the variability across industries within nations is substantial,

and comparable to cross-national variability (Dyer

& Chu, 2000; Kostova & Roth, 2002; Makhija &

Stewart, 2002), suggesting industry as a reasonable

basis for categorization.

Moreover, building on Denzau and North’s (1994)

notion of concepts as basic blocks of mental models,

we posit that, within a category, institutional logics

will be characterized by different combinations of a

few elementary concepts. While prototypical concepts offer theoretical clarity owing to their elementary focus, in practice no market is likely to be

completely defined by a single prototypical concept.

Markets are complex contexts of exchanges that

require a multi-conceptual space to specify their

distinct and sometimes competing logics (Jackson &

Deeg, 2008).

Within the institutional literature, two prototypical concepts that have received the most attention relate to March’s distinction between the logics

of ‘‘instrumentalism’’ and ‘‘appropriateness’’ (Kostova & Roth, 2002; Makhija & Stewart, 2002),

which, in turn, have their roots in the duality of

contracts and relational forms of governance

(Macaulay, 1963). These logics provide contrasting

or alternative mechanisms for reducing risk and

uncertainty in market exchanges, thereby promoting an orderly structure for the consummation of

exchanges and sustenance of ongoing relationships

(Macaulay, 1963; March & Olsen, 1998).

As per the logic of instrumentalism, market

exchanges are structured by institutions that

emphasize the rule of formal contracts in dictating the terms of firm–consumer relationships

(Macaulay, 1963; March & Olsen, 1998). Because

Journal of International Business Studies

the monitoring and enforcing of contracts are

critical to the instrumentality of market exchanges,

the role of contracts is often vested in agencies that

transcend firms and consumers involved in market

exchanges. Typically federal, state, or regulatory

agencies fill this institutional role (Griffiths &

Zammuto, 2005). For instance, in some nations,

regulatory agencies provide commercial firms with

a framework of mandatory contracts for different

levels of products and services (e.g., heating oil,

insurance) to consumers.

Contractually structured market exchanges are

intended to ensure that consumers have access to

the products and services they need, and safeguard

their interests from the opportunistic intentions of

firms to restrict consumer welfare or renege on

promised products or services. Contracts need not

always be mandated by regulatory agencies. Firms,

either individually or through collective action

(e.g., associations), can offer formal contracts that

detail terms of exchange with sufficient depth and

clarity to mitigate the risk and uncertainty of

market exchanges. Such contracts, however, are

unlikely to have pragmatic utility unless they are

evaluated to be fair and enforceable by a neutral

third party with superseding power.

Few agencies can match the state and federally

supported institutions as a credible third party. In

a nation such as Germany, for instance, where

formal contracts are historically preferred, the

insurance market is governed by Bundesanstalt für

Finanz-dienstleistungsaufsicht (BaFin), a federal

agency for the supervision of financial services.

The BaFin acts on federal laws that include detailed

legislation for insurance companies and its products/services, and monitors firms for financial

solvency and compliance with the official guidelines (see the Appendix for additional details).

An alternative mechanism for structuring market

exchanges is the logic of appropriateness (March &

Olsen, 1998), where relational codes of conduct are

institutionalized to emphasize trust and reciprocity

among market actors as a basis for reducing risk

and uncertainty (Macaulay, 1963). The notion of

trust, central to the relational codes exemplified by

appropriateness logics, is market actors’ (e.g., consumers’) confident expectation that other actors

involved in market exchanges (e.g., firms) will curb

opportunism and fulfill exchange promises. When

trust is one-sided, market exchanges may not be

sustainable. When trust is reciprocated, such that

trusted actors are committed to mutually satisfying

relationships, relational codes dominate market

Consumers’ institutional logics

Jagdip Singh et al

5

exchanges and become institutionalized through

scripts and routines for long-term relationships.

Formal institutional mechanisms of governance,

including regulatory agencies and written contracts, are avoided recognizing that such mechanisms may hinder the development of trust between

market actors (Griffiths & Zammuto, 2005).

The relational logics have received much attention as principles of relationship marketing in B2C

(in addition to B2B) markets (Garbarino & Johnson,

1999; Morgan & Hunt, 1994; Sirdeshmukh et al.,

2002). Relationship marketing asserts that markets

based on relational codes are self-reinforcing and

efficient because they obviate the need for costly

monitoring and legal enforcement of contractual

obligations. Relational codes commit market actors

to finding mutually acceptable solutions to problems that permit the relationship to continue over

time (Dyer & Chu, 2000; Heide & Wathne, 2006).

For example, in the US where relationship

marketing has taken hold, state and federal agencies set only minimum thresholds for insurance

products and services. Service and price levels vary

widely across insurance providers (www.iii.org) to

reflect different levels of customer relationships.

Consumer blogs emphasize the importance of

selecting a reputable company for a long-term

relationship to secure a comprehensive coverage

of insurance needs (www.insurance.ca.gov). Consistent with this, professional associations such

as the American Council of Life Insurers (ACLI)

petition for limiting regulatory oversight, relying

instead on self-regulation to stimulate competitiveness and emphasize relational modes of exchange

(see the Appendix for additional details).

Although we used the US and German insurance

markets as examples that evidence relational and

contractual logics respectively, we emphasize that,

in practice, institutional contexts of any market,

including the US and Germany, are likely to evidence both logics to different degrees (March &

Olsen, 1998). For example, while the contracts

logic is compatible with the historical evolution

of the German insurance industry, the industry

was deregulated in 1994 to promote competition,

reduce regulation, and favor relational orientation

between providers and consumers. Likewise, in the

US, where the insurance industry was deregulated

at least a decade earlier, formal regulatory mechanisms are assuming a greater role, with growing

evidence of fraudulent and opportunistic activities

of insurance providers (see the Appendix for additional details).

CILMA and Culture: Points of Distinction and

Similarities

The proposed CILMA construct is distinct from

cultural constructs available in the literature,

although it does share some common elements.

Hofstede (1993) defines culture as the collective

programming of the mind that distinguishes the

members of one category of people from those of

another. Culture is composed of certain values,

which shape behavior as well as one’s perception

of the world. Examining this definition in light of

the proposed conceptualization of the CILMA

construct suggests three points of distinction.

First, cultural constructs reflect higher-order (i.e.,

more general) programming of mental models

shared by all members of a cultural community,

and are ostensibly relevant across all situations.

For instance, uncertainty avoidance is a cultural

construct that reflects the ‘‘degree to which people

in a country [generally] prefer structured over

unstructured situations’’ (Hofstede, 1993: 90). By

contrast, CILMA is a lower-order (i.e., less general)

logic of the mental model that is specific to market

exchanges. Our theorizing of CILMA focuses specifically on the logics governing the social structure of exchanges among market actors. The

contract-relational duality is therefore unlikely to

be relevant for non-exchange situations such as

interpersonal and family relationships. In this

sense, CILMA is proximal to the phenomenon of

market exchanges, whereas cultural constructs

are located distally at a higher level of generality.

Second, the programming implied by cultural

constructs is ‘‘hardwired’’ as central to the identity

of its members (Hofstede, 1993). For instance,

German people are reportedly higher in uncertainty avoidance than those residing in the US,

indicating that to be an American (German) is to

have a general preference for less (more) structured

experiences. By contrast, the CILMA construct is

‘‘soft-wired’’ in the sense that mental models

develop with accumulating experience of market

exchanges in a particular industry/market. Because

the CILMA construct is not moored to either

individual or collective identities, it is more labile

and responsive to active constructions through

social mechanisms by market actors.

Third, the focus on values vs norms or expectations is another source of difference. The cultural

constructs tap into underlying values that define

and characterize members of a cultural group.

Germans are thought to prefer structure, not simply

because it enhances predictability and efficiency,

Journal of International Business Studies

Consumers’ institutional logics

Jagdip Singh et al

6

but because formal order and organization are

valued and aspired attributes by its members.

Likewise, Americans are thought to value unpredictability, and disdain formal structures. This is

not because they would rather be inefficient and

disorganized, but in spite of it.

By contrast, the CILMA construct’s theoretical

focus is on norms for market exchanges and,

as a result, is more closely related to expectations

that describe market actors’ behaviors in market

exchanges. Unlike values, such norms and behavioral expectations are more easily observable and

identifiable across markets because they are more

closely tied to behavior.

It is also useful, however, to recognize some

similarities between cultural constructs and CILMA.

The CILMA construct is posited to set contextual

contingencies for the behaviors of market actors.

Similarly, cultural constructs are thought to bound

the behaviors of members by what Poortinga (1992:

10) has noted as ‘‘constraints that limit the

behavioral repertoire available to members.’’ Given

this similarity, it is tempting to view cultural constructs and CILMA simply as competing mechanisms of influence. This would be inappropriate,

since CILMA is incompletely nested within the

higher-order cultural constructs. Cultural factors

play a role, along with a host of other categoryspecific factors, in shaping the institutional logics

conceptualized as CILMA. It is appropriate to ask,

for instance, whether the contract-relational duality of CILMA goes beyond the structured-unstructured duality represented by the uncertainty

avoidance construct. Also, unlike cultural constructs, CILMA is proximal to market exchanges,

and is conceptualized with lower-order specificity

to enhance its relevance for the study of institutional influence on relationship marketing mechanisms. We develop hypotheses for this influence

next.

INSTITUTIONAL LOGICS AND FIRM–

CONSUMER RELATIONSHIPS: FRAMEWORK

AND HYPOTHESES

Relationship Marketing and Firm–consumer

Relationships

Relationship marketing has emerged as ‘‘one of

the dominant mantras in business strategy circles’’

for understanding consumer–firm relationships

(Palmatier et al., 2006: 136), and has been successfully used for comparative international marketing

analysis (Wulf et al., 2001). Relationship marketing

Journal of International Business Studies

is defined as ‘‘all marketing activities directed

toward establishing and maintaining successful

relational exchanges’’ with a firm’s customers

(Morgan & Hunt, 1994: 22). It shifts the marketers’ frame from a transactional to a relationship

mode, and asserts a customer-centric orientation

(R. L. Oliver, 1997). A customer-centric orientation

brings into focus the critical role of sensing the

evolving needs and preferences of customers, and

making strategic decisions that enhance a firm’s

ability to gain customer commitment (Zeithaml,

Berry, & Parasuraman, 1996). Committed customers are motivated to maintain an ongoing

relationship with a specific firm through future

purchase intentions, increased share of wallet, and

positive word of mouth. A portfolio of committed

consumers ensures a revenue stream essential for

the sustainability of a firm’s capabilities. Sensing

and strategizing for sustained customer commitment are therefore key managerial responsibilities

for effective management of firm–consumer relationships.

A significant amount of work, in both national

and international contexts, supports relationship

marketing mechanisms for gaining customer commitment (Palmatier et al., 2006). Although several

competing theories exist (Wulf et al., 2001), most

studies appear to converge around three key

mechanisms for securing customer commitment:

(1) transactional satisfaction;

(2) social trust; and

(3) economic value (to be discussed).

With a few exceptions, relationship marketing

studies that examine contextual influences, such

as in comparative international marketing analysis, tend to describe rather than theorize and

explain variability across contexts (Nijssen, Singh,

Sirdeshmukh, & Holzmüller, 2003). As noted, Wulf

et al. (2001) examine the mechanisms of relationship quality and commitment across three international markets, and find significant variability

across almost every modeled path for the three markets (see their Table 4: 43). Consequently, there is

sufficient evidence to suggest that exchange

mechanisms of relationship marketing vary significantly across market contexts, but there is little

theorizing to predict and explain this variability.

We develop institutional-theory-based explanations for hypothesizing the differentiated patterns

of firm–consumer exchange mechanisms across

market contexts. Specifically, we use the CILMA

construct to explicate how consumers’ conceptions

Consumers’ institutional logics

Jagdip Singh et al

7

of a market’s institutional logics influence mechanisms leading to their decisions to maintain ongoing

relationships with individual firms. However, we

first outline a model that represents the extant

relationship marketing literature, and does not

consider the role of market context (referred to as

the ‘‘baseline’’ model). We do not posit formal

hypotheses for these well-established effects.

A Baseline Model of Firm–consumer Relationships

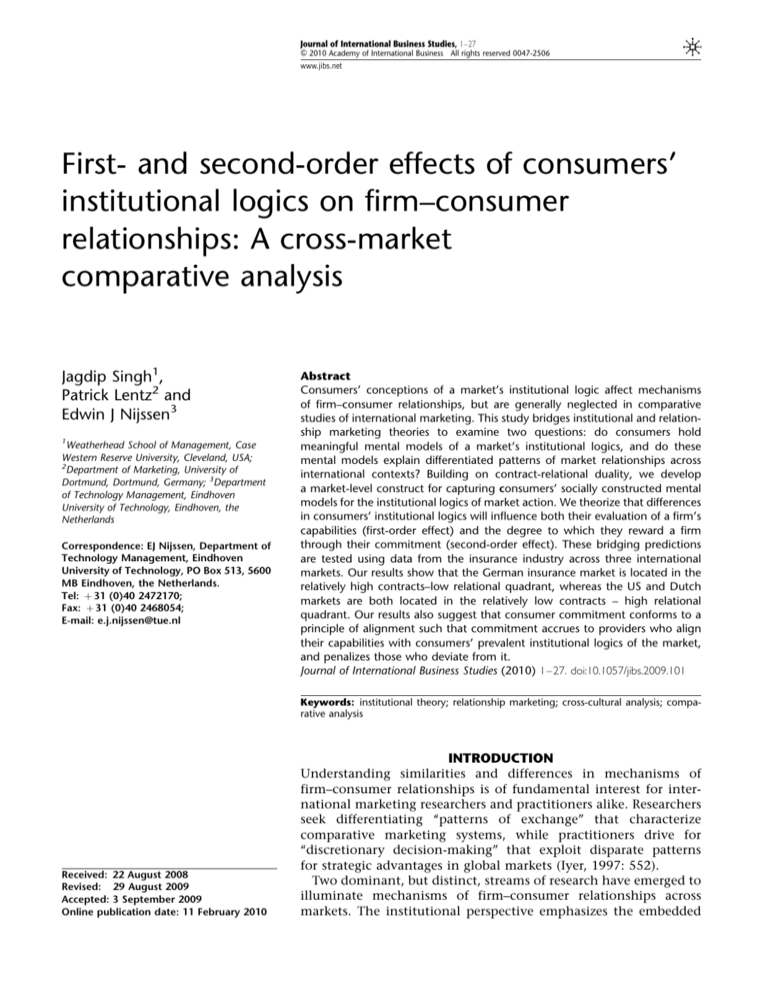

The central block in Figure 1 displays the baseline

model. The independent variables represent managerial agency for investing in mechanisms of

transactional satisfaction, social trust (firm and

frontline employee-based trust), and economic

value. Each mechanism is evaluated by consumers

and may subsequently be reciprocated with consumer commitment. Because these mechanisms are

well established in the literature, we provide only a

brief review.

Consumers’ evaluation of transactional satisfaction involves the degree of fulfillment of some

need, desire, goal, or other pleasurable end-state

in a specific exchange encounter with the firm

(R. L. Oliver, 1997). Consumers form expectations

of future market transactions based on prior

experiences and knowledge (e.g., what do I expect

to get?) and, when these expectations are fulfilled

or positively confirmed (did I get what I expected,

or more?), consumers perceive their exchange

to be satisfactory, thereby building commitment

(R. L. Oliver, 1997).

The social trust mechanism involves consumers’

evaluation that a firm can be relied upon to deliver

on its promises and curb opportunism in future

exchanges (Morgan & Hunt, 1994). Substantial

evidence suggests that consumers reward trusted

firms with their commitment (Palmatier et al.,

2006). Factors resulting in positive trust evaluations include initiating and building long-term

consumer relationships, making idiosyncratic

investments that foster consumer trust and resolve

conflicts, and developing frontline capabilities

that place consumers’ interests above the firm’s

Consumers’ Institutional Logics of Market Action (CILMA)

(shared and socially constructed mental model for the social structure of marketplace exchanges)

Transaction

satisfaction

First-order Effects

Firm

trust

First-order effects

First-order effects

First-order effects

Second-order effects

Ongoing firm–consumer relationships

Consumer

commitment

Frontline

employee

trust

Economic

value

Figure 1 First- and second-order effects of consumers’ institutional logics of market action on mechanisms of ongoing firm–

consumer relationships.

Journal of International Business Studies

Consumers’ institutional logics

Jagdip Singh et al

8

short-term revenue goals (Palmatier et al., 2006;

Sirdeshmukh et al., 2002). Consistent with recent

work, frontline employee and firm trust are distinguished.

Finally, consumers evaluate economic value by

considering the benefits enjoyed relative to the

costs incurred in ongoing relationships. Several

studies stress the importance of understanding

economic value from the consumers’ perspective

(Brief & Bazerman, 2003), and firms are increasingly focusing their efforts toward enhancing

tangible and/or intangible consumer benefits without concomitant increases in costs (Sirdeshmukh

et al., 2002).

Overall, relationship marketing theory posits that

each of the preceding three mechanisms directly

affects consumer commitment. However, these

effects are not necessarily linear. Recent studies

report curvilinear effects such that, for instance in

relational exchanges, trust has a ‘‘motivator’’ effect

(increasing exponentially) whereas transactional

satisfaction has a ‘‘hygiene’’ effect (decreasing

exponentially or leveling off). Only the effect of

economic value is reported to be linear (Agustin &

Singh, 2005). Thus, in the baseline model, we

include curvilinear effects of satisfaction and both

trust mechanisms.

Influence of CILMAs on Firm–consumer

Relationships

A key insight from institutional theory is the nontrivial influence of institutional logics on individual behavior (Scott, 2001). Such institutional

logics are ‘‘rules of procedures that actors employ

flexibly and reflexively to assure themselves and

those around them that their behavior is reasonable’’ (DiMaggio & Powell, 1991: 20).

We draw on this insight to hypothesize that

consumers are likely to weight exchange mechanisms more favorably if they are aligned with the

dominant institutional logic prevailing in the

market (referred to as the principle of alignment).

Two specific hypotheses are developed relating to

CILMA’s influence on: (1) the mean levels of

consumers’ satisfaction, trust, value, and commitment evaluations for the individual firm with

whom they maintain ongoing relationships (‘‘firstorder effects’’ in Figure 1); and (2) moderating the

effect of satisfaction and trust evaluations on

consumers’ commitment (indicated by ‘‘secondorder effects’’ in Figure 1). We discuss each in turn.

In positing first-order effects, we assert that

consumers’ normative expectations in market

Journal of International Business Studies

relationships (e.g., what should I expect?) are

shaped by the mental model of the market’s

institutional field. For instance, when CILMA is

contracts-dominated, consumers expect firms to

invest in transactional capabilities. Quality norms,

certifications, and other product guarantees mandated by formal bodies in this institutional field

mitigate the need for relational trust, and shift

the focus toward transactional satisfaction. Kollock

(1994) showed that when product quality is assured, or where ‘‘the experimenter served as a regulatory agency to insure the terms of the exchange,’’

relational trust between exchange parties was less

vital, and transactional factors assumed greater

importance.

By contrast, in relational-dominated CILMA,

consumers are likely to expect firms to invest in

capabilities that emphasize relational processes and

build trust (Agustin & Singh, 2005). The limited

monitoring and safeguarding against opportunistic

behavior of individual firms is likely to favor

consumers’ motivation to develop close relationships with their providers.

Moreover, we expect higher levels of consumer

commitment in a relational CILMA. Consumer

commitment is a forward-looking indicator of consumers’ intentions to maintain ongoing relationships (Dyer & Chu, 2000). In contracts-dominated

CILMA, substitutability among providers is likely

to be high because the greater emphasis on institutional standards for quality norms, certifications,

and product guarantees mitigates the need for

consumer commitment toward any single provider. By contrast, consumers in relational CILMA

are more likely to rely on close relationships to

police opportunistic firm behaviors, and to avoid

costs of locating trustworthy providers. Thus we

posit:

Hypothesis 1: Compared with contracts-dominated CILMA, relational-dominated CILMA will

be associated with (a) lower levels of transactional

satisfaction, and (b) higher levels of trust and

consumer commitment.

In support of second-order effects, the principle

of alignment also identifies conditions under

which consumers will reciprocate a firm’s investments with their commitment. When a market

is characterized by relational-dominated CILMA,

consumers are likely to weight the relational

capabilities of exchanges more favorably (Nijssen

et al., 2003). Research on how consumers process

Consumers’ institutional logics

Jagdip Singh et al

9

information about markets (e.g., brands) and

categorize it to cope with market decisions effectively (e.g., brand choice) provides support for this

assertion (Bettman & Sujan, 1987). As per categorization research, consumers differentiate among

brands on key attribute(s) that are relevant and

salient for a given market. Also, once brands are

differentiated, consumers are more sensitive to

variations along the attributes used for categorization. This increased sensitivity is found to enhance

the weighting of the categorizing attributes in

consumer decisions (Bettman & Sujan, 1987).

Building on the preceding research, we expect

that consumers in relational CILMA will be likely

to differentiate among firms based on the social

trust mechanism. This is because a relationaldominated CILMA primes consumers to attend to

the relational aspects of market exchange, making

social trust both relevant and salient. As a result,

consumers are expected to be more sensitive to

evaluations of relational trust, and to weight it

more favorably in making commitment decisions.

Also, the ‘‘motivator’’ role of trust is expected

to be amplified in relational CILMA (Agustin &

Singh, 2005). Thus the influence of trust is likely to

follow an exponentially increasing pattern in

relational CILMA, consistent with the motivator

hypothesis.

Similarly, when the institutional logic emphasizes

contracts, consumers are primed to attend to the

transactional qualities of market relationships,

including the degree to which firms meet or exceed

expectations when making commitment judgments.

As a result, transactional satisfaction assumes a more

salient and relevant role in differentiating firms,

while relational considerations of trust are given

less significance. Differentiation on the basis of

transactional capabilities is therefore likely to

bolster consumers’ sensitivity to evaluations of

exchange satisfaction in making commitment decisions. This implies that the influence of transaction

satisfaction on consumer commitment is relatively

stronger and more salient in contracts-dominated

CILMA. Consistent with this, we expect that the

influence of satisfaction in relational-dominated

contexts is likely to follow an exponentially

decreasing pattern to reflect its relatively weak

and hygiene effect in this context. Thus:

Hypothesis 2a: Compared with contractsdominated CILMA, relational-dominated CILMA

will be associated with a relatively stronger effect

of trust on commitment.

Hypothesis 2b: Compared with relationaldominated CILMA, contracts-dominated CILMA

will be associated with a relatively stronger

effect of satisfaction on commitment.

Based on the universal importance of value, we

do not expect the economic mechanism to be

sensitive to variability in CILMA. To consumers,

economic value represents a superordinate goal in

market relationships (Sirdeshmukh et al., 2002).

Firms lacking capabilities for providing consumerperceived value will be less likely to gain consumer

commitment, regardless of differences in institutional logics. Consequently, while we expect economic value to significantly influence consumer

commitment, we do not expect consumers’ CILMA

to have second-order effects on this influence.

Thus:

Hypothesis 3: Consumers’ perceived economic

value will have a significant effect on consumer

commitment that is invariant to CILMA.

RESEARCH DESIGN AND METHOD

Study Context

We selected a single industry and three contrasting

national contexts to examine empirically the

CILMA construct and the posited hypotheses. By

focusing on a single industry across markets, we

aimed to provide variation in institutional fields

while controlling for confounding effects due to

cross-industry variation. Because services are an

increasingly important aspect of leading economies, we chose the insurance industry, particularly

life, home, and automobile insurance services.

Health insurance was not included because the

selection of a healthcare provider is often at the

discretion of an employer.

We used secondary data sources to identify the

German, US, and Dutch markets as potential

contexts that offered contrasting institutional

logics for the insurance industry as well as feasibility of collecting data in a systematic and

coordinated manner (to be discussed). Our selection of these markets does not constitute an a priori

specification or predetermination of their location

in the institutional logics space. The secondary

data are intended only to ensure that we expect

variability across these markets for the institutional

logics of the insurance industry.

As stated earlier, the German insurance market

is governed by BaFin, a federal agency for the

Journal of International Business Studies

Consumers’ institutional logics

Jagdip Singh et al

10

supervision of financial services. The BaFin acts

on federal laws that include detailed legislation

for insurance companies (VAG or VersicherungsAufsichts-Gesetz), products/services (VVG or Versicherungs-Vertrags-Gesetz), monitoring financial

solvency of firms, and imposing penalties, including voiding a firm’s license in the case of nonadherence or violations.

In the US, state and federal agencies set only

minimum thresholds for insurance products and

services. Service and price levels vary widely across

insurance providers (www.iii.org), and consumer

blogs emphasize the importance of selecting a

reputable company (www.insurance.ca.gov). Consistent with this, professional associations such

as the ACLI petition for limiting regulatory oversight and promote self-regulation to stimulate

competitiveness and emphasize relational modes

of exchange.

Finally, the Dutch insurance market is rather

complex, with two institutions sharing governance

responsibilities, the De Nederlandsche Bank and

Autoriteit Financiële Markten (AFM). While clearly

demarcated monitoring and standard-setting

responsibilities have yet to emerge, some progress

has been made, with the Dutch government

shifting responsibility for consumer affairs to AFM

(for further details see the Appendix).

Next, materials from Consumer Reports-type

agencies, as well as typical contracts for home and

auto insurance in the three markets, were collected.

Consistent with Faems, Janssens, Madhok, and van

Looy (2008), who examined the length of contractual documents to infer the degree to which contracts are important in alliance governance, we

used similar procedures to infer the importance

of contracts in individual insurance markets. Our

analysis indicated that typical contracts for home

and auto insurance were relatively longer in

Germany, and substantially shorter in the US

(19–30% less) and the Netherlands (30–70% less)

respectively (see the Appendix).

In accord with this trend, consumer organizations in Germany (e.g., Stiftung Warentest) focus

more on price comparisons. By contrast, leading consumer organizations in the US urge consumers to consider relational issues when selecting

an insurance provider, noting that ‘‘it may not be

wise to jump to an unknown company to save

a few dollars’’ (www.ohioinsurance.gov, Shopper’s

Guide, 7). Suggestions on how to select a provider are also present in the Netherlands (e.g.,

Consuwijzer) but the information is usually general

Journal of International Business Studies

and not specific. In sum, the secondary data suggest

that the three countries selected offer a reasonable

possibility of obtaining variability in institutional

logics for the insurance industry.

Sampling Procedures

The CILMA construct and the firm–consumer

exchange constructs are conceptualized at the

group and individual levels respectively. This

allows data to be collected for each level either

from two different groups of consumers or from

the same consumer. Obtaining data from the

same consumer about the institutional logics and

exchange constructs is likely to introduce samesource bias in testing hypotheses that relate these

two levels.

For instance, if the institutional logics construct

were measured first, it is likely that the respondents’ sensitivity to contractual and relational

issues would bleed into their evaluations of

exchange relationships. Likewise, if the institutional logics were measured subsequent to

exchange relationships, respondents might have

carried their evaluative frames over to assessments

of contractual and relational logics. Thus we

preferred data from two distinct samples, with each

focusing on one level of data, and subsequently

to combine them with the notion that the institutional data capture contextual characteristics

that are commonly shared across individuals that

belong to that context.

We refer to these two data sets as: (1) institutional

logics data, that is, the data set drawn from a random sample of key informants to evaluate CILMA;

and (2) firm–consumer relationships data, that is, the

data set drawn from a random sample of consumers

to capture measures of their ongoing relationships

with insurers. Sampling plans and field procedures

for both data collections were coordinated across

countries to achieve equivalence in data collection,

measurement, survey instrument, and data handling (Easterby-Smith & Malina, 1999).

Institutional logics data. Random samples of key

informants were selected from commercial lists of

consumers, using selection criteria to ensure

experience with insurance products. The surveys

were administered in two waves, with an overall

survey period covering 4–5 weeks. Customary

incentives were used to increase the response rate.

In all, 1000 consumers in each of the three

countries were selected as key informants for

Consumers’ institutional logics

Jagdip Singh et al

11

participation. Informants were asked to self-select

for participation if they met the following criteria:

(1) primary household responsibility for insurance

needs;

(2) at least 35 years old; and

(3) recent contact with insurance agent/company

to report problems and/or discuss changes to a

policy.

The numbers of qualified responses obtained

were: 227 in Germany, 128 in the US, and 139 in

the Netherlands. On average, about two-thirds

of all respondents were male, with an average age

of about 50 years, and 80% married. The majority

of the respondents had a college degree, and

an average yearly gross income of about $95,000

in the US and $50,000 in the other two countries.

Firm–consumer relationships data. Random samples

of consumers were selected from independent

commercial lists, avoiding overlaps with those

selected for institutional logics data. The surveys

were administered in a total of three waves spread

out over a 7–10-week survey period. Several

measures were taken to secure reasonable response

rates (e.g., reminder cards, follow-up calls, and

lottery drawing), allowing for small variations in

field methods per country. In all, 4000 consumers in

Germany, 3900 in the US, and 2850 in the

Netherlands were selected for participation. Respondents were qualified to complete the survey if

they identified an insurance company for which

they had at least (1) one auto, home or life

insurance policy, and (2) one contact in the last 12

months with a frontline employee regarding their

policy. Non-qualifying respondents were asked to

return their surveys unfilled.

Using information from responses of non-qualifying persons and follow up phone calls, a qualifying

rate was estimated at 47%, 55%, and 45% in

Germany, the US, and the Netherlands, respectively. A qualifying rate indicates the percentage of

respondents in a random sample of population who

are likely to meet the selection criteria established

for the study (i.e., at least one policy and interpersonal contact). Based on these qualifying rates

and the number of responses – 504 in Germany, 365

in the US, and 316 in the Netherlands – the

estimated response rates (corrected for qualifying

rates) were 26%, 21%, and 28% for Germany, the

US, and the Netherlands respectively.

Table 1 summarizes the demographic characteristics of the respondents, and shows that while

the Dutch and US data indicate a more even

distribution of gender groups (males¼55.6% and

61.4% respectively), the German data are dominated by males (87.2%, po0.01). Moreover, the

German respondent is likely to be older (mode X55

years) than the Dutch or US respondents (mode¼

35–44 years, po0.01). Although the household

size in the US (mode¼4) is larger than in Germany

and the Netherlands (mode¼2, po0.01), the respondents’ marital status is fairly consistent across

the three contexts, with the majority being married (478%). Comparisons for education and

income are not straightforward, owing to the

necessity of using country-specific categories. However, middle- to high-income households with

higher education dominate our sample, as may

be expected, based on the sampling design used.

To account for this variability in demographic

characteristics, gender, age, and income were included as control variables.

Measurements

Institutional logics data. Initially, we formulated a

set of 20 items to operationalize the CILMA

construct. Half the items pertained to the logic of

contracts, and the remaining items referred to

relational logic. The master version of the questionnaire was developed in English and translated–

back-translated into Dutch and German, using two

bilingual respondents. In addition, the German

version was translated into Dutch and triangulated

with the Dutch version derived from the English

master version. Discrepancies were discussed, and

jointly resolved for comprehension consistency

by either revising the master version or adapting

the translated version to accurately reflect the

intended meaning. The revised items were pretested using a think-aloud exercise with a sample of

18–30 consumer informants in each country.

Researchers met to discuss pretest results, and

aimed to select items that were robust across

contexts and sufficiently non-overlapping to provide a representative coverage of construct bandwidth. Based on this, a final list of 12 items was

retained (see Table 2).

Firm–consumer relationships data. To capture the

firm–consumer exchange constructs, we relied

mostly on existing scales for transactional satisfaction, firm and frontline employee trust, economic value and consumer commitment.

Most measures were drawn from the marketing

Journal of International Business Studies

12

Journal of International Business Studies

Table 1

Demographic profile of the respondents for the firm–consumer relationships data (all numbers are in percentages)

Gender (%)

Male

Female

Gb

US

NLb

87.2

12.8

55.6

44.4

61.4

38.6

US

NL

7.0

23.0

29.4

40.7

22.7

34.3

24.4

18.6

28.2

30.1

23.0

18.7

High school 1st level

High school 2nd level

Professional education

Some college

College

Graduate school

G

US

NL

32.7

8.7

28.0

—

—

30.6

—

19.3

—

30.5

30.5

19.8

14.4

12.0

27.8

27.3

14.8

3.8

Incomec (%)

Household size (%)

US

NL

No. of people

G

US

NL

81.6

5.8

10.2

2.3

82.7

9.1

6.6

1.6

78.5

14.4

4.3

2.9

1

2

3

4

5

46

10.2

46.4

17.8

17.5

6.4

1.7

7.4

25.5

21.0

26.7

12.8

6.6

16.7

41.1

12.0

20.6

6.7

2.9

o h12,000

h12,001–24,000

h24,001–36,000

h36,001–48,000

h48,001–60,000

h60,001–72,000

h72,001–84,000

4 h84,000

o $35,000

$35,001–54,999

$55,000–74,999

$75,000–94,999

$95,000–114,999

$115,000–134,999

4 $135,000

G

US

NL

5.7

33.3

31.2

13.2

6.9

3.9

2.4

3.3

—

—

—

—

—

—

—

—

—

—

—

—

—

—

—

8.3

30.7

25.9

17.6

8.3

2.7

6.6

3.1

39.8

34.0

13.1

6.8

—

—

2.1

—

—

—

—

—

—

—

a

The category labels for education categories were modified for relevance in each cross-national context. For the Dutch data, the categories labels were: (1) mavo/havo/vwo; (2) lbo; (3) mbo;

(4) hbo; (5) universiteit; (6) higher. For the US data, the categories labels were: (1) high school; (2) some college; (3) college; (4) graduate studies; For the German data, the categories labels were:

(1) high school (1 level), (2) high school (2 level), (3) professional education, and (4) university degree.

b

G¼Germany, NL¼the Netherlands, US¼United States.

c

Similarly, because income levels and currencies vary across nations, the category labels were adjusted for relevance for each cross-national data. For the German and Dutch data, net income is used

after tax deduction, whereas for the US data, gross income before tax deduction is employed.

Jagdip Singh et al

G

Consumers’ institutional logics

p34

35–44

45–54

X55

G

Marital status

Married

Single

Divorced/sep.

Widow/widower

Educationa

Age in years (%)

Consumers’ institutional logics

Jagdip Singh et al

13

Table 2

Operational measures and reliabilities of study constructsa

Consumer institutional logics of market actions (CILMA) dimensions

Relational dimension, five-point scale, Strongly disagree–Strongly agree, RelG¼0.93, AVEG¼0.70, HVSG¼0.10, RelUS¼0.95, AVEUS¼0.78,

HVSUS¼0.39, RelNL¼0.92, AVENL¼0.68, HVSNL¼0.35.

Interactions between consumers and insurance companies and agents are generally based on y

Trusting relationships (REL1)

Terms of doing business that are satisfying for both, insurer and customer (REL2)

Working through problems in a mutually satisfying manner (REL3)

Developing a mutual understanding (REL4)

Open and honest relationships (REL5)

Maintaining a long-term working relationship (REL6)

Contracts dimension, five-point scale, Strongly disagree–Strongly agree, RelG¼0.97, AVEG¼0.83, HVSG¼0.07, RelUS¼0.95, AVEUS¼0.76,

HVSUS¼0.22, RelNL¼0.95, AVENL¼0.75, HVSNL¼0.35.

Interactions between consumers and insurance companies and agents are generally based on y

Meeting only the requirements of the policy contract (CON1)

Following written rules of contract even when solving problems (CON2)

Strictly following contract guidelines (CON3)

Contractual details (e.g., fine print) rather than working flexibly to meet customer needs (CON4)

Procedures and practices spelled out in formal agreements (CON5)

Formal requirements set by the rules of the contract (CON6)

Consumer–firm exchange constructs

Satisfaction (R. L. Oliver, 1997), ten-point scale, RelG¼0.96, AVEG¼0.90, HVSG¼0.62, RelUS¼0.96, AVEUS¼0.88, HVSUS¼0.28, RelNL¼0.95,

AVENL¼0.86, HVSNL¼0.64;

Your overall feelings of satisfaction involving the recent interactions with the issuing insurance company:

Highly satisfactory/Highly unsatisfactory (SAT1)

Very pleasant/Very unpleasant (SAT2)

Delightful/Terrible (SAT3)

Frontline employee trust (Morgan & Hunt, 1994), ten-point scale, RelG¼0.96, AVEG¼0.91, HVSG¼0.62, RelUS¼0.98, AVEUS¼0.94,

HVSUS¼0.44, RelNL¼0.96, AVENL¼0.90, HVSNL¼0.57;

I feel that the representatives (e.g., agents/employees) of this company are:

Very dependable/Very undependable (FLE1)

Of very high integrity/Of very low integrity (FLE2)

Very trustworthy/Not at all trustworthy (FLE3)

Firm trust (Morgan & Hunt, 1994), ten-point scale, RelG¼0.97, AVEG¼0.93, HVSG¼0.58, RelUS¼0.99, AVEUS¼0.97, HVSUS¼0.45, RelNL¼0.97,

AVENL¼0.92, HVSNL¼0.45;

I feel that this insurance company’s management practices are:

Very dependable/Very undependable (FIRM1)

Of very high integrity/of very low integrity (FIRM2)

Very trustworthy/Not at all trustworthy (FIRM3)

Economic value (Sirdeshmukh et al., 2002), ten-point scale, RelG¼0.97, AVEG¼0.91, HVSG¼0.46, RelUS¼0.99, AVEUS¼0.96, HVSUS¼0.45,

RelNL¼0.96, AVENL¼0.90, HVSNL¼0.57;

Considering all of the insurance benefits you receive in exchange for the prices (premiums) you pay, how would you rate this company relative to

its competitors?

Very good value/Extremely poor value (VAL1)

Very good deal/Very poor deal (VAL2)

Very worthwhile/Not at all worthwhile (VAL3)

Consumer commitment (Zeithaml et al., 1996), seven-point scale, Very unlikely–Very likely, RelG¼0.91, AVEG¼0.77, HVSG¼0.37, RelUS¼0.87,

AVEUS¼0.75, HVSUS¼0.32, RelNL¼0.89, AVENL¼0.75, HVSNL¼0.19;

How likely are you to:

Use this company for most of your future insurance needs (COM1)

Use this company the next time you need to buy insurance (COM2)

Use this company for other financial services that you may require (COM3)

a

The psychometric properties of constructs are indicated by composite reliability (Rel) and average variance extracted (AVE), as well as by highest

variance shared (HVS), as per Fornell and Larcker (1981).

Journal of International Business Studies

Consumers’ institutional logics

Jagdip Singh et al

14

Establishing validity of CILMA construct and locating markets in CILMA space

Translate–back-translate

Initial set of 20 CILMA items

(10 each for constracts and

relational logics)

Translate–back-translate

Established scales for firmconsumer relationships

Pretestimg

using “think-alouds”

with 18–30 consumers

in United States

Pretestimg

using “think-alouds”

eith 18–30 consumers

in Germany

First- and second-order effects of CILMA on

firm–consumer relationships

Pretestimg

using “think-alouds”

with 18–30 consumers

in Netherlands

Match

samples

Triangulate

Final set of 12 CILMA items

(6 each for contracts and

relational logics)

Collect

institutional

logics data in

Germany

Control for

cultural differences due

to masculinity and

uncertainty avoidance

Collect

institutional logics

data in United

States

Metric and scalar invariance

of CILMA items using

multigroup means and

covariance structure

analysis (MACS)

Match

samples

Collect

institutional

logics data in

Netherlands

Control for

common method bias

and instrument out

differences due to

overall satisfaction

Establish validity and

locational map of Germany,

Netherlands, and United

States in a two dimensional

CILMA space

Collect

relationship data

in Netherlands

Metric and scalar invariance

of relationship construct

items using multigroup

means and covariance

structure analysis (MACS)

Translated–back-translate

Match

samples

Match

samples

Collect

relationship data

In Germany

Triangulate

Translated–back-translate

Collect

relationship data

in United States

Common

method bias

and experience

effects

Gender,

income and

age effects

Test of first-order effects

(H1): Do means of

relationship constructs vary

predictably with institutional

logics?

Test of second order effects

(H2 & H3): Do relationship

mechanisms vary predictably

with institutional logics?

Figure 2 Analytical procedures for establishing validity of CILMA construct, locating markets in CILMA space, and testing first- and

second-order effects of CILMA on firm–consumer relationships.

literature, and evidenced acceptable psychometric

properties (see Table 2). A translation–back-translation procedure and follow-up triangulation were

used for developing a final set of context-robust

operational measures for inclusion in the survey

instrument.

Analytical Approach

Figure 2 displays the overall analytical approach,

which we discuss below.

Institutional logics data. Initially, to test the

psychometric validity of the CILMA construct,

including its dimensions of contractual and relational logics, we use a procedure outlined by

Ployhart and Oswald (2004) for multiple group

mean and covariance structure analysis (MACS).

Journal of International Business Studies

The MACS provides simultaneous estimation of

(see left panel, Figure 2):

(1) factor loadings relating observed indicants and

hypothesized latent factors;

(2) latent factor and indicator means;

(3) constraints on factor loadings to test for measurement equivalence; and

(4) constraints on latent factor means to test for

differences in factor means across groups.

We adapted the MACS procedure as suggested

by Podsakoff, MacKenzie, Lee, and Podsakoff (2003)

to estimate a common method factor in each

group. Moreover, we examined whether CILMA

dimensions are distinct from cultural dispositions and evaluations. Hence we measured two

of Hofstede’s (1993) cultural dimensions that

were most likely to be relevant for the countries

Consumers’ institutional logics

Jagdip Singh et al

15

considered – masculinity and uncertainty avoidance – and included these as control variables in the

MACS analysis. Whereas the three countries are all

low on power distance, and similarly high on

individualism, Germany is relatively higher in

uncertainty avoidance than the US, and the US

and Germany are relatively more masculine than

the Netherlands.

Finally, we recognize that, despite our best efforts

to select random samples with identical research

designs across contexts, sampled respondents

may differ systematically. To control for this bias

we included respondents’ overall satisfaction with

insurance providers as an instrumental variable,

resulting in the following estimated equations:

Z1j ¼ l1j þ g1;1 c1j þ g1;2 c2j þ g1;3 c3j þ y1j

ð1Þ

Z2j ¼ l2j þ g2;1 c2j þ g2;2 c2j þ g2;3 c3j þ y2j

ð2Þ

Here, Z1 and Z2 correspond to latent constructs for

relational and contracts logics, respectively; l

represents the latent factor means; c1 refers to

overall satisfaction; c2 and c3 represent the cultural

dimensions of masculinity and uncertainty avoidance; and the subscript j indexes the market

context (1¼Germany, 2¼US, 3¼the Netherlands).

We selected Germany as the baseline group, constraining its latent means for both dimensions (i.e.,

Z11 and Z21) to 0. Finally, the results of the analyses

were plotted in a two-dimensional space of relational and contracts logics to facilitate interpretation and testing of first- and second-order effects (to

be discussed).

Firm–consumer relationships data. Initially, we used

the MACS approach to estimate the latent means

for the exchange constructs and test for differences

in latent means across CILMAs (see right panel,

Figure 2). To test for the first-order hypothesis,

we employed the LM test for multiple-group comparisons involving latent mean differences for the

Netherlands and US relative to the German data.

For this purpose, we used the multiple-group

structural equation modeling (SEM) procedure

outlined by Card and Little (2006), which explicitly addresses metric and scalar equivalence issues.

To control for other confounding effects and

alternative explanations, we included:

(1) common method factor, as noted above;

(2) consumer experience (i.e., number of contacts

with the provider in the last 24 months); and

(3) individual consumers’ gender, age, and income,

as samples differ on these demographic characteristics (see Figure 2).

For testing the second-order effects, we utilized a

two-step single-indicant approach by Ping (1995),

which controls for measurement error in curvilinear terms, and involved estimating the following

equation:

pj ¼kj þ B1 x1j þ B2 x2j þ B3 x3j þ B4 x4j þ B5 x1j x1j

þ B6 x2j x2j þ B7 x3j x3j þ B8 x5j þ B9 x6j

þ B10 x7j þ B11 x8j þ zj

ð3Þ

where p is consumer commitment construct, and

the vector n represents the exogenous variables

such that x1 to x4 correspond to satisfaction, firm

trust, frontline employee trust, and economic

value, respectively, and their corresponding quadratic terms are represented by product expressions

(e.g., x1 x1). In addition, x5 refers to the level of

consumer–firm interaction, while x6, x7 and x8

represent gender, age and income, respectively,

which are included to control for individual

characteristics.

We analyzed all three markets in a single,

simultaneous analysis. For this purpose, we estimated factor scores for each construct, and used

multiple group comparisons to identify patterns of

similarities and differences in estimated effects

across markets. If the respective test for such

comparison was significant, we released the constraint, and tested for bivariate equality. Separate

estimates were obtained for corresponding coefficients only if all tests were significant.

RESULTS

Institutional Logics Data

Overall psychometrics and model fits. Tables 3 and 4

summarize the results from the MACS analysis.

Regardless of the model estimated, the CILMA

items depict sound psychometric properties (see

Table 4). All items load significantly (40.4,

po0.05) on their corresponding contracts or

relational factors, which, in combination with

small residuals (SRMR¼0.01), provide evidence of

convergent validity. Table 4 also reports the average

variance extracted (AVE) and highest variance

shared (HVS), based on the final model (Fornell &

Larcker, 1981). The AVE are estimated at 0.70

(Germany), 0.78 (US), and 0.68 (the Netherlands)

Journal of International Business Studies

Consumers’ institutional logics

Jagdip Singh et al

16

Table 3

Model fit statistics and latent mean total effects estimates from MACS analysis of CILMA data

Model estimated: Constraints used

Model fit statistics

w

2

df

2

Dw (Ddf)

M1: fully unconstrained

924.9*** 615

—

M2: loadings fully constrained

970.0*** 647 45.1w (32)

M3: intercepts fully constrained

1094.2*** 693 124.2*** (46)

M3a: intercepts partially constrained

976.5*** 674

6.5 (27)

M4: latent means fully constrained

1031.9*** 684 55.4*** (7)

M4a: latent means partially constraineda 954.4*** 673 29.5 (58)

p-value for Dw2

—

0.06

o0.01

0.99

o0.01

0.99

CFI

NFI

TLI

0.99

0.99

0.99

0.99

0.99

0.99

0.98

0.98

0.98

0.98

0.98

0.98

0.99

0.99

0.99

0.99

0.99

0.99

RMSEA (90% CI)

0.032

0.032

0.034

0.030

0.032

0.029

(0.028;

(0.028;

(0.030;

(0.026;

(0.028;

(0.025;

0.036)

0.036)

0.038)

0.034)

0.036)

0.033)

a

Some loadings gave significant LM tests upon introduction of scalar constraints, which led to differences in degrees of freedom.

Significant at the 10% level; ***significant at the 0.1% level.

w

Table 4 Fit statistics, factor loadings, measurement properties and interfactor correlations of CILMA dimensions across contexts from

partially constrained multi-group confirmatory factor analysis

Itemsa

Germany (high contract,

low relational)

lb

Relations

1. REL1

2. REL2

3. REL3

4. REL4

5. REL5

6. REL6

1.00

0.92***

1.05***

1.10***

1.06***

0.86***

Int.c

Rel.d AVE e HVS f

US (intermediate contract,

high relational)

lb

0.00g 0.93 0.70 0.10

0.46***

1.00

0.49***

0.92***

0.52***

1.05***

0.45***

1.10***

0.53***

1.27***

0.37***

0.86***

Int.c

Rel.d AVE e HVS f

The Netherlands

(low contract,

high relational)

lb

0.85*** 0.95 0.78 0.39

0.46***

1.00

0.20*

0.92***

0.52***

1.05***

0.45***

0.89***

0.75***

1.06***

0.37***

0.73***

Int.c

Rel.d AVE e HVS f

0.77*** 0.92 0.68 0.35

0.46***

0.49***

0.39***

0.45***

0.35***

0.37***

0.00g 0.97 0.83 0.07

0.64*** 0.95 0.76 0.22

0.81*** 0.95 0.75 0.35

0.47***

1.00

0.47***

1.00

0.30***

0.45***

1.08*** 0.45***

1.08*** 0.45***

0.45***

1.01*** 0.45***

1.17*** 0.45***

0.38***

0.90*** 0.38***

1.13*** 0.57***

0.49***

1.18*** 0.49***

1.18*** 0.49***

0.44***

1.18*** 0.62***

1.18*** 0.44***

Contracts

1. CON1

2. CON2

3. CON3

4. CON4

5. CON5

6. CON6

1.00

1.08***

1.17***

1.13***

1.18***

1.18***

Masculinity

1. MASC1

2. MASC3

0.00g 0.80 0.67 0.07

0.92*** 0.81 0.67 0.39

0.54*** 0.80 0.67 0.06

1.00

0.40***

1.00

0.40***

1.00

0.40***

1.06*** 0.42***

1.06*** 0.42***

1.06*** 0.42***

Uncertainty avoid.

1. UA1

1.00

2. UA3

0.55***

0.00g 0.64 0.59 0.16

0.31*** 0.79 0.65 0.14

0.60*** 0.58 0.53 0.16

0.27**

1.00

0.27**

1.00

0.27**

0.31***

1.11*** 0.16*

0.55*** 0.31***

Model fit statistics: w2(673)¼954.5 (po0.001); CFI¼0.99; NFI¼0.98; TFI¼0.99; SRMR¼0.05; RMSEA (90% confidence interval)¼0.03 (0.025–0.033).

a

Complete text of item statements is in Table 2.

b

Loading estimate (t-value); all significant at p¼0.01.

c

Intercept estimate for item level/latent mean estimate for construct level.

d

Estimated composite reliability (Fornell & Larcker, 1981).

e

Average variance extracted (Fornell & Larcker, 1981).

f

Highest variance shared (Fornell & Larcker, 1981).

g

Latent means for Germany have been constrained to 0 (baseline group).

Italic loadings non-invariant across contexts.

*significant at the 5% level; **significant at the 1% level; ***significant at the 0.1% level.

for relational logics, and 0.83 (Germany), 0.76 (US),

and 0.75 (the Netherlands) for contracts logics.

Without exception, each construct extracts

significantly more variance from its own items

Journal of International Business Studies

than it shares with any other construct. This

provides support for discriminant validity.

Specifically, the estimated correlations between

the dimensions of contracts and relational logics

Consumers’ institutional logics

Jagdip Singh et al

17

are estimated as 0.32 (Germany), 0.62 (US), and

0.59 (the Netherlands), suggesting less than 35%

shared variance. The preceding convergent and

discriminant

validity

evidence

is

largely

unperturbed across the different models estimated

and reported in Table 3.

Next, as reported in Table 3, we tested for metric

and scalar invariance before testing differences in

latent means (Card & Little, 2006; Steenkamp &

Baumgartner, 1998). The condition for metric

invariance is met, since constraining all loadings

to equal across the three market contexts yields

a non-significant change in w2 (M2: w2diff¼45.1,

dfdiff¼32, p¼0.06). However, the scalar invariance

condition is not met, since constraining corresponding observed means to equal across contexts

results in a significant increase in w2 (M3: w2diff¼

124.2, dfdiff¼46, po0.01). To test for partial scalar

invariance, we released some constraints in accord

with Steenkamp and Baumgartner (1998: 81) to

obtain a non-significant increase in w2 over M2

(M3a: w2diff¼6.5, dfdiff¼27, p¼0.99).

To examine whether the latent means for CILMA

construct vary across market contexts, we compared a fully constrained model (M4) with a model

that meets metric and scalar (partial) invariance condition (M3a). This comparison yields a