RETIREMENT & BENEFIT PLAN SERVICES

Self-Direct Brokerage

Provide participants greater investment flexibility

Provide your 401(k) plan participants the opportunity for greater investment flexibility and the ability to work with a Merrill Lynch

Financial Advisor to help achieve their retirement goals, or the option to design and manage their own retirement portfolios.

Choice of two programs to meet participant needs

sdb Direct Advantage

Participants can choose from two self-direct brokerage (sdb)

programs — sdb Advisor Advantage, which allows them access

to a Merrill Lynch Financial Advisor who can help service the

account, or sdb Direct Advantage, which allows them to trade

on their own, either online or over the phone.

Some participants are quite comfortable conducting their

own investment research and making their own investment

selections. However, for these individuals, the core investment

menu may not provide enough options, and sdb Direct Advantage

may be a good fit. With sdb Direct Advantage, participants can

execute trades online via the Benefits OnLine® website or over

the phone through a participant service representative.

sdb Advisor Advantage

Generally, the majority of 401(k) plan participants are

comfortable with the core investments chosen by the plan’s

investment committee and the retirement planning tools

offered in the plan, including Advice Access and GoalManager®.

However, for more sophisticated investors who would like access

to a Merrill Lynch Financial Advisor who can help service their

account, sdb Advisor Advantage may be a good fit. sdb Advisor

Advantage leverages the strengths of a global leader in separate

account management and personalized guidance.

Our Financial Advisors understand the challenges your employees

may face in planning for retirement and they can meet with

participants to help them assess their financial situation and

develop a strategy to work toward achieving their goals.

sdb Direct Advantage provides access to a comprehensive

range of investments, including:

• L

isted stocks on the major US exchanges (NYSE, AMEX

and NASDAQ).

• F

ixed-income investments (Corporate Bonds, Government

Securities and Certificates of Deposits).

• O

ver 75 alliance partner fund families with more than

1,600 mutual funds offered at Net Asset Value (NAV).

• T

ransaction fee mutual funds from a wide variety of mutual

fund families. This feature may be turned off for a plan

at a plan sponsor’s request.

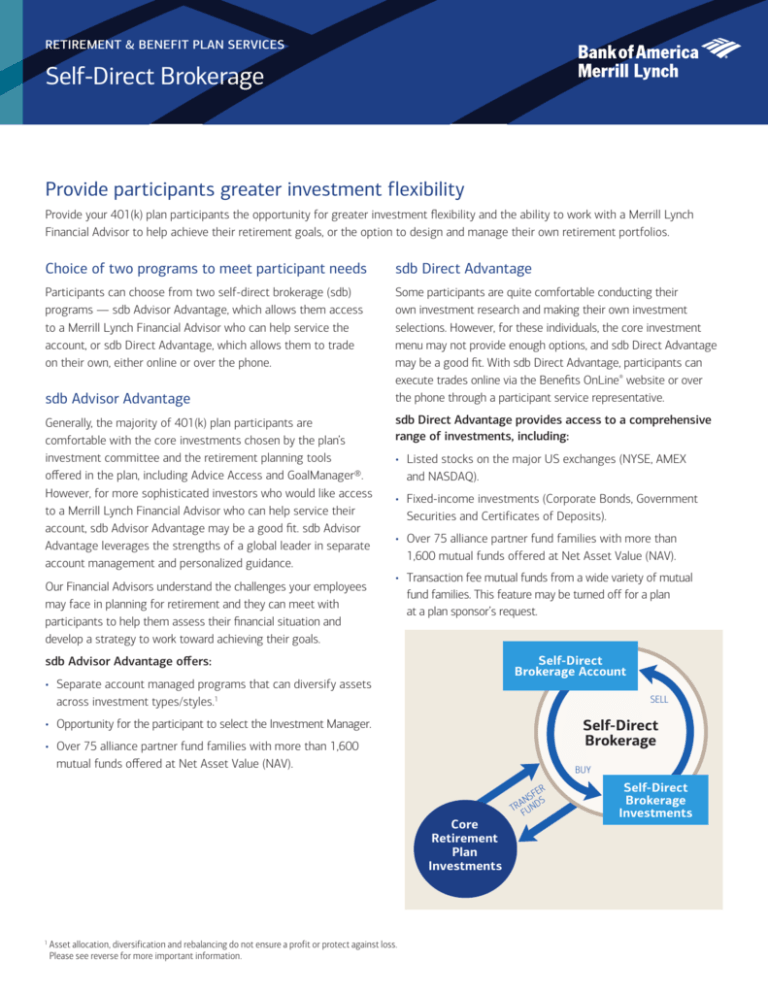

Self-Direct

Brokerage Account

sdb Advisor Advantage offers:

• Separate

account managed programs that can diversify assets

across investment types/styles.1

SELL

Self-Direct

Brokerage

• Opportunity for the participant to select the Investment Manager.

• O

ver 75 alliance partner fund families with more than 1,600

mutual funds offered at Net Asset Value (NAV).

BUY

Core

Retirement

Plan

Investments

1

sset allocation, diversification and rebalancing do not ensure a profit or protect against loss.

A

Please see reverse for more important information.

R

FE

NS D S

A

T R F UN

Self-Direct

Brokerage

Investments

Self-direct brokerage features

Self-direct brokerage accounts remain part of plan assets,

and as such are subject to the same rules and regulations as the

401(k) plan. The self-direct brokerage service is designed to

give participants more flexibility with their retirement planning

by offering a brokerage experience, while also allowing plan

sponsors the ability to maintain control. Participants pay an

annual recordkeeping fee, commissions and fees for trades,

but there is no cost to the plan sponsor for offering the service.

Plan sponsors can:

• Limit the offering by account type

• E

stablish a minimum participant core account balance

required prior to opening a self-direct brokerage account.

• E

stablish a maximum percentage of overall participant

account balance permitted to be invested in a self-direct

brokerage account.

• E

stablish a restriction on the maximum number of accounts a

participant can hold (not to exceed 10).

• R

eceive a data file transmission providing the daily trading

activity and account holdings to assist with plan audits and

Report 5500 filings.

The service is designed to help keep your plan, and

your participants, in compliance with applicable

regulatory requirements.

–– sdb Advisor Advantage

–– sdb Direct Advantage

• Restrict the types of investments participants can choose from:

–– Full investment capabilities

–– Mutual funds only

–– Equity investments only

–– Fixed income investments only

For more information on the self-direct brokerage service, or to add this feature to your plan, please

contact your Bank of America Merrill Lynch representative or Merrill Lynch Financial Advisor.

For Plan Sponsor Use Only. Not for Distribution to the General Public.

Investors should consider the investment objectives, risks, charges and expenses of investment options carefully before investing. This, and

additional information about the investment options that are mutual funds, can be found in the prospectuses, and, if available, the summary

prospectuses, which can be obtained by calling Merrill Lynch at 866.218.INFO (4636). Investors should read the prospectuses and, if available,

the summary prospectuses carefully before investing.

Bank of America Merrill Lynch and its representatives provide only general information and/or materials regarding retirement plans and do not

provide investment advice or recommendations. All retirement plan investment decisions are to be made by the plan sponsor.

A financial advisor is not permitted by law to provide recommendations or advice on a sdb account. However, when a participant enrolls in sdb

Advisor Advantage, managed account solutions typically available to Merrill Lynch brokerage accounts may be available for use within the sdb

account, within the legal guidelines. Certain conditions, including minimum balances, may apply. To learn more about these services, please contact

your Merrill Lynch Financial Advisor.

Bank of America Merrill Lynch is a marketing name for the Retirement Services business of Bank of America Corporation (“BAC”). Banking activities may be performed

by wholly owned banking affiliates of BAC, including Bank of America, N.A., member FDIC. Brokerage services are performed by wholly owned brokerage affiliates of BAC,

including Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), a registered broker-dealer and member SIPC.

Investment products:

Are Not FDIC Insured

Are Not Bank Guaranteed

May Lose Value

Unless otherwise noted, all trademarks and registered trademarks are the property of Bank of America Corporation.

© 2013 Bank of America Corporation. All rights reserved. 00-63-0647NSB | ARC915EA | 06/2013