Depreciable Property What Is Depreciation

advertisement

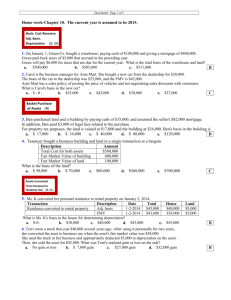

Depreciation and Section 179 Deduction Agriculture Handbook 718, pages 29-38 1 2 Depreciable Property What Is Depreciation Depreciation is the annual deduction to recover the cost (or other basis) of business or income-producing property with a determinable useful life of more than one year 3 Depreciation and Section 179 Deduction Property is depreciable if it meets the following requirements: It has a determinable useful life It wears out, decays, gets used up, becomes obsolete or loses value from natural causes It is either used in a business or held for the production of income 4 Depreciable Forestry Assets Examples Land and Land Improvements Depreciable Land Improvements: Bridges and culverts Fencing Temporary roads Equipment and Machinery Trucks Power saws Land is not depreciable Land improvements are depreciable, for examples: fences temporary roads surfaces of permanent roads bridges, and buildings 5 Modified Accelerated Cost Recovery System (MACRS) 6 General Depreciation System vs. Alternative Depreciation System For most forestry property, use the Modified Accelerated Cost Recovery System (MACRS) to calculate depreciation It is for most tangible property placed in service after 1986 (1986 Tax Reform Act) 7 Depreciation and Section 179 Deduction General depreciation system (GDS) generally allows faster cost recovery applicable to most properties Alternative depreciation system (ADS) typically allows longer recovery period and straight-line depreciation 8 MACRS Property Basis How to Figure the MACRS Deduction To figure MACRS deduction, you must first determine the property’s info: Its basis Its placed in service date Its property class and recovery period The convention The depreciation method Basis is the measure of your investment in the property for tax purposes For example, for property you buy, your original basis is usually its purchase cost 9 MACRS Property Information Property Class and Recovery Period Placed-in-service date Depreciation begins when your property becomes ready and available for a particular use, regardless of whether it is actually put into use at that time and whether the use is associated with a trade or business, production of income, or a personal activity 11 Depreciation and Section 179 Deduction 10 Each item of property is assigned to a property class The property class establishes the number of years over which the basis is recovered This period of time is called the recovery period 12 Quick References Recovery Period Recovery Period for Land Improvements (in Years) GDS ADS Computers and peripherals………… Automobiles………………………….. Office furniture………………………. Logging and road building equipment*.. Over-the-road (semi) tractors………. Nonresidential real property*………… 5 5 7 5 3 39 5 5 10 6 4 40 Land improvements such as Recovery Period (in Years) GDS ADS 15 20 Bridges Culverts Non-farm fences Temporary roads and surfaces of permanent road * Used by logging and sawmill operators for their own account * For property placed in service after 5/12/1993 See Table 5-1. Ag. Handbook No. 718, p.30 13 14 Conventions Which Convention to Use? Half-year convention – Treats all property as placed in service, or disposed of, at the midpoint of that tax year Mid-quarter convention – Treats all property as placed in service, or disposed of, at the midpoint of the quarter Mid-month convention – Treats all property as placed in service, or disposed of, at the midpoint of the month 15 Depreciation and Section 179 Deduction Generally, you use the half-year convention to figure the deduction for property other than residential rental and nonresidential real property 16 Mid-Quarter Convention Which Convention to Use? If during any tax year the total depreciable bases of all MACRS property placed in service during the last 3 months of the tax year exceeds 40 percent of the total depreciable bases of all MACRS property placed in service during the tax year, you must use the midquarter convention The mid-month convention is used for residential rental property and nonresidential real property 17 18 Depreciation Methods Depreciation Methods 200% declining balance method 150% declining balance method Used for non-farm property in the 3, 5, 7 or 10 year property classes Use the half-year or mid-quarter convention 19 Depreciation and Section 179 Deduction Used for farm business property (except real property) and all other property in the 15 and 20 year property classes apply the half-year or mid-quarter convention 20 Depreciation Method Depreciation Methods Straight-line method Used for residential rental and nonresidential real property apply the mid-month convention Straight-line election You may elect to use the straight line method instead of using the declining balance method Make the election by entering “S/L” in column (f) of part II of Form 4562 Once made, this election cannot be changed 21 22 Units-of-production Method Units-of-production Example You may elect to exclude certain timberrelated property – e.g. temporary logging roads – from MACRS and depreciate it using the units-of-production method The property is depreciated based on the number of units of timber harvested in a tax year compared to the total number of units harvested over the life of the property 23 Depreciation and Section 179 Deduction A good example is costs for temporary logging roads, bridges, and culverts constructed solely for use in harvesting a specified timber tract and On completion of harvesting, it will no longer be useful to the timber owner 24 Units-of-production Example Units-of-production Example Assume you spend $10,000 dollars to build a temporary road solely to harvest 480 MBF of timber. The logger harvests 300 MBF this year, and harvests the remaining 180 MBF next year. What are your depreciation deductions? Under the units-of-production, you can depreciate the cost of the road over 2 years $6,250 the first year: $10,000 x (300MBF/480MBF) $3,750 the next year: $10,000 x (180MBF/480MBF) From Example 5-5, Ag. Handbook No. 718, p.35 25 26 Calculating MACRS Deductions IRS Tables You can figure the depreciation in two options: You can use the IRS percentage tables, or You can compute deduction without the IRS tables 27 Depreciation and Section 179 Deduction There is a separate table for each depreciation method, recovery period, and convention Apply the table percentages to the unadjusted basis of the property each year of the recovery period 28 Sample MACRS 200% Table Half-year Convention Year 3-Year 5-Year 7-Year 1 33.33% 20% 14.29% 2 44.45% 32% 24.49% 3 14.81% 19.2% 17.49% 4 5 7.41% 11.52% 11.52% 12.49% 8.93% 6 5.76% Trailer Example Assume you buy a trailer for $12,500 that you will use entirely for your forestry operation. Calculate your depreciation using the MACRS tables. 8.92% 7 8.93% 8 4.46% From Example 5-4, Ag. Handbook No. 718, p.35 29 30 Trailer Example Trailer Example First, we need to determine the recovery period: First year: Second year: Third year: Fourth year: Fifth year: Sixth year: Trailers are 5-year property Next, determine the correct MACRS depreciation table by the convention. Use Table A-1 for rates on a 5-year non-farm property, 200% declining balance and a half-year convention. 31 Depreciation and Section 179 Deduction Depreciation is calculated as follows, using Table A-1: $12,500 x 20% = $ 2,500 $12,500 x 32% = $ 4,000 $12,500 x 19.2% = $ 2,400 $12,500 x 11.52% = $ 1,440 $12,500 x 11.52% = $ 1,440 $12,500 x 5.76% = $ 720 32 Mixed Use Bonus Depreciation Note: if you use the trailer only 70 percent for business purposes, you can only claim 70 percent of the above amounts You may take a 50% depreciation, on top of regular depreciation for 2009 Applies to new property placed in service in 2009 Taken in the first year the property is placed in service only Extended by American Recovery and Reinvestment Act of 2009 (ARRA) Originally enacted in 2008 33 34 Section 179 Deduction Section 179 Deduction You may deduct immediately up to $250,000 in 2009 of the cost of qualified personal property if your timber operation is an active trade or business. The $250,000 max limit is extended by the ARRA The deduction is limited to aggregate taxable income from your active trades or businesses: including income earned as an employee and certain timber income (Section 631 gains) Without ARRA extension, the deduction would be $133,000 for 2009 (Rev. Proc. 2008-66) If your investment is over $800,000, however, your Sec. 179 deduction will be reduced. 35 Depreciation and Section 179 Deduction 36 Example: Section 179 Deduction Example: Section 179 Deduction In 2009, you purchased $7,000 in a used heavy duty truck $20,000 in a used tractor both to be used 100 percent for your timber business You have $25,000 of aggregate taxable business income for the year. Your investment in section 179 property $27,000 is less than the $250,000 max deduction allowed However, your section 179 deduction for 2009 is limited to your $25,000 of aggregate business income You can divide it between the truck and the tractor as you choose 37 38 Section 179 Deduction Example: Section 179 Deduction Carry the remaining $2,000 ($27,000 – $25,000) forward to future tax years until it is used up The deduction is reduced one dollar for each dollar of investment in section 179 property over $800,000 for 2009 For example: You place $900,000 of section 179 property in service during 2009, your deduction is limited to $125,000 ($250,000 – ($900,000 – $800,000)) 39 Depreciation and Section 179 Deduction 40 Section 179 Deduction Carryover Section 179 Deduction The amount of eligible cost that is not deductible in one year due to the above limits may be carried forward indefinitely to later years until it can be deducted Property held for the production of income, such as an investment, is not eligible for the Section 179 deduction Neither is property held by an estate or trust 41 42 Section 179 Deduction Recapture Provisions Section 179 Deduction You must elect to take the deduction for the tax year in which the property is placed in service You can take the deduction on an amended return only within the time prescribed by law Report the Section 179 deduction on Form 4562 43 Depreciation and Section 179 Deduction Generally a portion of Section 179 deduction is recaptured as ordinary income if the property is not used in business more than 50 percent of the time before the recovery period expires Report the recapture of a Section 179 deduction on Form 4797 44 Multiple Depreciation Example I Order of Taking Depreciation Deductions Taxpayer Todd in 2009 spent $20,000 for a structure (39-yr non-residential real property) which he placed in service in his timber business in July purchased a $30,000 used skidder in September Purchased a $60,000 used over-the-road tractor in October (4th Quarter) His net taxable income from all his trade and businesses for 2009 exceeds $60,000. The bonus depreciation deduction was calculated after any section 179 deduction and before the regular depreciation deduction What are his total depreciation deductions for 2009? 45 Solution 46 Solution – Mid-Quarter Convention Section 179 deduction on the skidder The structure does not qualify for Section 179 because it is not personal property Since more than 40 percent of the basis in depreciable property was placed in service during the last quarter of the year, Todd must use the mid-quarter convention 47 Depreciation and Section 179 Deduction $ 30,000 Bonus Depreciation (elect out) $0 MACRS deduction on tractor (3-yr property) $60,000 x 0.0833 . . . . . . . . . . . $ 4,998 MACRS deduction on structure (39-yr property) $20,000 x 0.01177 . . . . . . . . . . $ Total Deduction 235 $35,233 48 Multiple Depreciation Example II Half-Year Convention Multiple Depreciation Example II What if Todd had placed the over-the-road tractor ($60,000) in service in September and the skidder ($30,000) in service in October? He would calculate his depreciation deductions using the half-year convention instead of the mid-quarter convention This would have resulted more in depreciation deductions for the tax year 49 50 IRS Publications Covering Depreciation Solution-Half-Year Convention Section 179 deduction on the skidder . . . . . $ 30,000 Bonus depreciation (elect out) . . . . . . . . . . . $0 MACRS deduction on tractor (3-yr property) $60,000 x 0.3333 . . . . . . . . . $ 19,998 MACRS deduction on structure (39-yr property) $20,000 x 0.01177 . . . . . . . . $ Total depreciation & sect. 179 deductions . . . $50,233 235 Pub. 17, “Your Federal Income Tax” Pub. 225, “Farmer’s Tax Guide” Pub. 334, “Tax Guide for Small Business” Pub. 534, “Depreciating Property Placed in Service Before 1987” Pub. 946, “How to Depreciate Property” * * Provides the most thorough coverage and all MACRS and CLDR tables 51 Depreciation and Section 179 Deduction 52 53 Depreciation and Section 179 Deduction MACRS Tables Depreciation and Section 179 Deduction Recovery Periods by Property Class Modified Accelerated Cost Recovery System MACRS General Depreciation System GDS GDS 3 Property Type Over-the–road (semi) tractors 5 Computers and peripherals, autos; pickup trucks; logging equipment and road building equipment used by logging and sawmill operators for their own account 5 Portable sawmills; over-the road trailers; typewriters, calculators, adding and accounting machines, copiers, and duplicating equipment 7 Office furniture, fixtures and equipment; farm machinery and equipment, such as tractors and planting machines, and farm fences; single-purpose agricultural or horticultural structures placed in service before 1989; any property that does not have a class life and is otherwise not classified under Section 168 (e) (2) or (3) 10 Single-purpose agricultural or horticultural structures placed in service after 1988; property with a class life of 16 years or more, but less than 20 years 15 Land improvements such as bridges, culverts, non-farm fences, temporary roads, and surfaces of permanent roads 20 Farm buildings (except single-purpose agricultural and horticultural structures) 27.5 Residential rental property 31.5 Nonresidential real property placed in service before May 13, 1993 39 Nonresidential real property placed in service after May 12, 1993 Page 69 of 110 of Publication 946 8:25 - 17-FEB-2006 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Table A-1. 3-, 5-, 7-, 10-, 15-, and 20-Year Property Half-Year Convention Depreciation rate for recovery period Year 1 2 3 4 5 3-year 5-year 7-year 10-year 15-year 33.33% 44.45 14.81 7.41 20.00% 32.00 19.20 11.52 11.52 14.29% 24.49 17.49 12.49 8.93 10.00% 18.00 14.40 11.52 9.22 5.00% 9.50 8.55 7.70 6.93 3.750% 7.219 6.677 6.177 5.713 5.76 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 6.23 5.90 5.90 5.91 5.90 5.285 4.888 4.522 4.462 4.461 3.28 5.91 5.90 5.91 5.90 5.91 4.462 4.461 4.462 4.461 4.462 2.95 4.461 4.462 4.461 4.462 4.461 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Table A-2. 20-year 2.231 3-, 5-, 7-, 10-, 15-, and 20-Year Property Mid-Quarter Convention Placed in Service in First Quarter Depreciation rate for recovery period Year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 3-year 5-year 7-year 10-year 15-year 20-year 58.33% 27.78 12.35 1.54 35.00% 26.00 15.60 11.01 11.01 25.00% 21.43 15.31 10.93 8.75 17.50% 16.50 13.20 10.56 8.45 8.75% 9.13 8.21 7.39 6.65 6.563% 7.000 6.482 5.996 5.546 1.38 8.74 8.75 1.09 6.76 6.55 6.55 6.56 6.55 5.99 5.90 5.91 5.90 5.91 5.130 4.746 4.459 4.459 4.459 0.82 5.90 5.91 5.90 5.91 5.90 4.459 4.460 4.459 4.460 4.459 0.74 4.460 4.459 4.460 4.459 4.460 0.557 Page 69 Page 72 of 110 of Publication 946 8:25 - 17-FEB-2006 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Table A-7. Nonresidential Real Property Mid-Month Convention Straight Line—31.5 Years Month property placed in service Year 1 1 2–7 8 9 10 2 3 4 5 6 7 8 9 10 11 12 3.042% 3.175 3.175 3.174 3.175 2.778% 3.175 3.174 3.175 3.174 2.513% 3.175 3.175 3.174 3.175 2.249% 3.175 3.174 3.175 3.174 1.984% 3.175 3.175 3.174 3.175 1.720% 3.175 3.174 3.175 3.174 1.455% 3.175 3.175 3.174 3.175 1.190% 3.175 3.175 3.175 3.174 0.926% 3.175 3.175 3.174 3.175 0.661% 3.175 3.175 3.175 3.174 0.397% 3.175 3.175 3.174 3.175 0.132% 3.175 3.175 3.175 3.174 11 12 13 14 15 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 16 17 18 19 20 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 21 22 23 24 25 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 26 27 28 29 30 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 31 32 33 3.174 1.720 3.175 1.984 3.174 2.249 3.175 2.513 3.174 2.778 3.175 3.042 3.174 3.175 0.132 3.175 3.174 0.397 3.174 3.175 0.661 3.175 3.174 0.926 3.174 3.175 1.190 3.175 3.174 1.455 9 10 11 12 Table A-7a. Nonresidential Real Property Mid-Month Convention Straight Line—39 Years Month property placed in service Year 1 1 2–39 40 Page 72 2.461% 2.564 0.107 2 2.247% 2.564 0.321 3 2.033% 2.564 0.535 4 1.819% 2.564 0.749 5 1.605% 2.564 0.963 6 1.391% 2.564 1.177 7 1.177% 2.564 1.391 8 0.963% 2.564 1.605 0.749% 2.564 1.819 0.535% 2.564 2.033 0.321% 2.564 2.247 0.107% 2.564 2.461