Chapter 7 - bryongaskin.net

advertisement

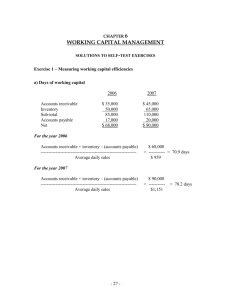

Chapter 7 Problems 7-2. Oscar's checkbook shows a balance of $600. A recent statement from the bank (received last week) shows that all checks written as of the date of the statement have been paid except numbers 423 and 424, which were for $62and $40, respectively. Since the statement date, checks 425, 426, and 427 have been written for $32, $70, and $44, respectively. There is a 75 percent probability that checks 423 and 424 have been paid by this time. There is a 40 percent probability that checks 424, 426, and 427 have been paid. a. What is the total value of the five checks outstanding? b. What is the expected value of payments for the five checks outstanding? c. What is the difference between parts a and b? This represents a type of float. Solution: Oscar's Checkbook a. $62 + $40 + $32 +70 +44 = $248 b. Probability check Amount has cleared $62 * 75% 40 * 75% 32 * 40% 70 * 40% 44 * 40% Expected value $ 46.50 30.00 12.80 28.00 17.60 $134.90 expected value of payment for 5 checks outstanding c. (a – b) = $248.00 – $134.90 = $113.10 float S-215 7-6. Barney's Antique Shop has annual credit sales of $1,080,000 and an average collection period of 40 days in 1996. Assume a 360-day year. What is the company's average accounts receivable balance? Accounts receivable are equal to the average daily credit sales times the average collection period. Solution: Barney's Antique Shop $1, 080, 000 annual credit sales = $3, 000 credit sales a day 360 days per year $3,000 average daily credit sales 7-8. * 40 average collection period = $120,000 average accounts receivable balance Mervyn's Fine Fashions has an average collection period of 40 days. The accounts receivable balance is $80,000. What is the value of its credit sales? Solution: Mervyn's Fine Fashion S-216 Average collection period = 40 days = Accounts Receivable Average daily credit sales $80,000 Credit sales 360 credit sales $80,000 = 360 40 Credit sales/360 = $2,000 Credit sales = $2,000 × 360 = $720,000 7-11. Fisk Corporation is trying to improve its inventory control system and has installed an on- line computer at its retail stores. Fisk anticipates sales of 75,000 units per year, an ordering cost of $8 per order, and carrying costs of $12.0 per unit. a. b. c. d. What is the economic ordering quantity? How many orders will be placed during the year? What will the average inventory be? What is the total cost of ordering and carrying inventory? Solution: Fisk Corp. a. EOQ = 2SO 2 × 75,000 × $8 = = 1,000 units C $1.20 b. 75,000 units/1,000 units = 75 orders c. EOQ/2 = 1,000/2 = 500 units (average inventory) d. 75 orders * $8 ordering cost 500 inventory * $1.20 carrying cost per unit Total costs S-217 = $ 600 = 600 = $1,200 S-218