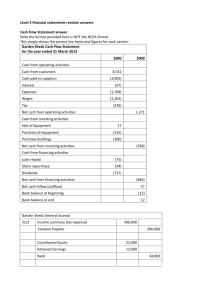

FAIR VALUE versus HISTORICAL COST

advertisement