Subordinated bonds

Restating conviction - Capital Securities theme | 19 November 2015

CIO WM Research

Rebecca Clarke, Credit Strategist, rebecca.clarke@ubs.com; Frank Sileo, CFA, Taxable Fixed Income Strategist, frank.sileo@ubs.com

• We remain positive on the outlook for continued strong

performance of the Capital Securities theme, and maintain our

constructive view on the credit quality of financial issuers.

• Over it's 20-month life, the Capital Securities theme's 10.6%

return since inception has doubled that of its benchmark (the

broader investment grade index)

• In our last update (May 2015), we moved to include retail

USD 25 par preferred securities in our investable universe, and

switched to an index which included these.

• Our three-part rationale for including retail preferreds was

based on our benign expectations for US interest rates, our

desire to broaden the base of investable securities, and to

increase our allocation to bank and insurance issues.

• Although we maintain a Neutral recommendation on the

broad retail preferred market in our House View publication,

we continue to recommend financial sector capital securities

for the yield advantage of the asset class relative to senior

unsecured investment grade securities.

• The fundamentals of bank and financial sector credit quality

remain at very sound levels and are likely to remain wellanchored due to new regulatory requirements and oversight.

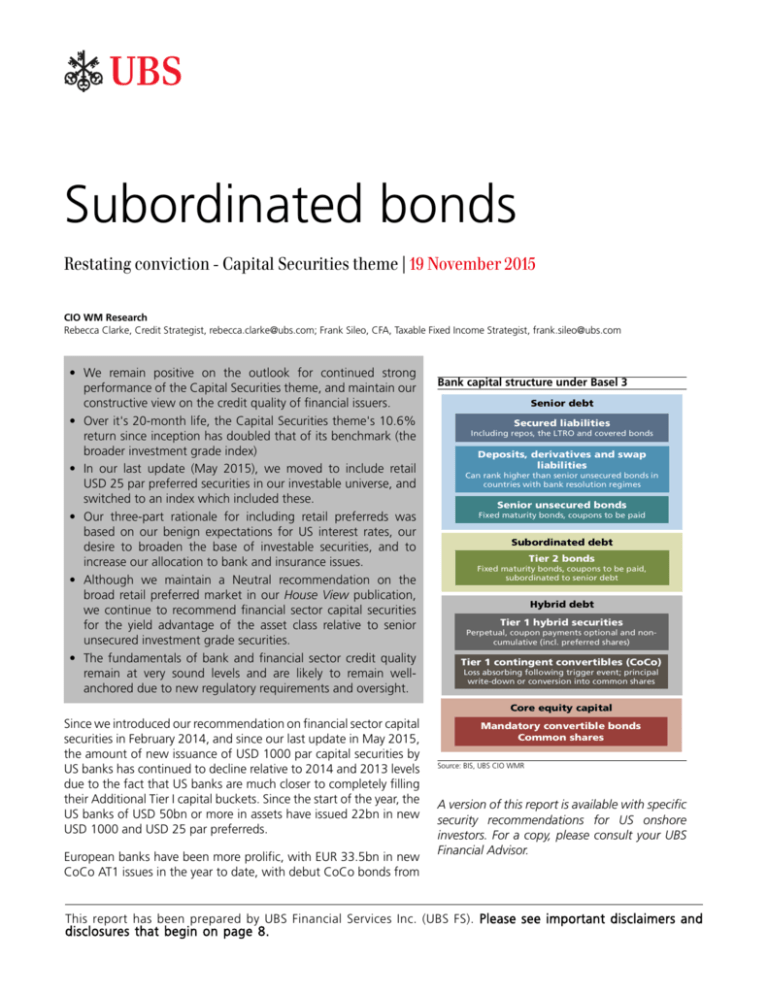

Bank capital structure under Basel 3

Senior debt

Secured liabilities

Including repos, the LTRO and covered bonds

Deposits, derivatives and swap

liabilities

Can rank higher than senior unsecured bonds in

countries with bank resolution regimes

Senior unsecured bonds

Fixed maturity bonds, coupons to be paid

Subordinated debt

Tier 2 bonds

Fixed maturity bonds, coupons to be paid,

subordinated to senior debt

Hybrid debt

Tier 1 hybrid securities

Perpetual, coupon payments optional and noncumulative (incl. preferred shares)

Tier 1 contingent convertibles (CoCo)

Loss absorbing following trigger event; principal

write-down or conversion into common shares

Core equity capital

Since we introduced our recommendation on financial sector capital

securities in February 2014, and since our last update in May 2015,

the amount of new issuance of USD 1000 par capital securities by

US banks has continued to decline relative to 2014 and 2013 levels

due to the fact that US banks are much closer to completely filling

their Additional Tier I capital buckets. Since the start of the year, the

US banks of USD 50bn or more in assets have issued 22bn in new

USD 1000 and USD 25 par preferreds.

European banks have been more prolific, with EUR 33.5bn in new

CoCo AT1 issues in the year to date, with debut CoCo bonds from

Mandatory convertible bonds

Common shares

Source: BIS, UBS CIO WMR

A version of this report is available with specific

security recommendations for US onshore

investors. For a copy, please consult your UBS

Financial Advisor.

This report has been prepared by UBS Financial Services Inc. (UBS FS). Please see important disclaimers and

disclosures that begin on page 8.

Subordinated bonds

ING Group, Royal Bank of Scotland, and Standard Chartered. In addition, we have seen new USD and EUR denominated subordinated

bond (Tier 2) issuance from both US and European banks. We continue to see out-performance for USD financial sector capital securities,

including US bank subordinated and preferred issues and European

bank subordinated and legacy Tier 1 issues relative to the broader US

investment grade index.

Our new performance measurement index is working out well

In May 2015, we shifted direction slightly, by adding in a component of USD 25 par denominated retail preferred securities. We originally focused exclusively on the institutional USD 1000 par securities market, primarily because they exhibit better liquidity and greater

price stability. However, in recent years we have seen US money center

and large regional banks issuing preferreds in both the retail USD 25

par market and the institutional USD 1000 par market, with relatively

large-sized issues in both cases.

By adding a component of retail preferreds, we have significantly

broadened the scope of the Capital Securities theme, which centers on capturing higher yields and greater capital appreciation from

investing in financial sector capital securities in a transitional regulatory environment. We still see good prospects for new issuance of both

bank and insurer Tier 1 and Tier 2 capital in response to Total Loss

Absorbing Capacity (TLAC) and Basel 3 capital requirements for US

and European banks, and in response to coming regulatory changes

under Solvency 2 for European insurers.

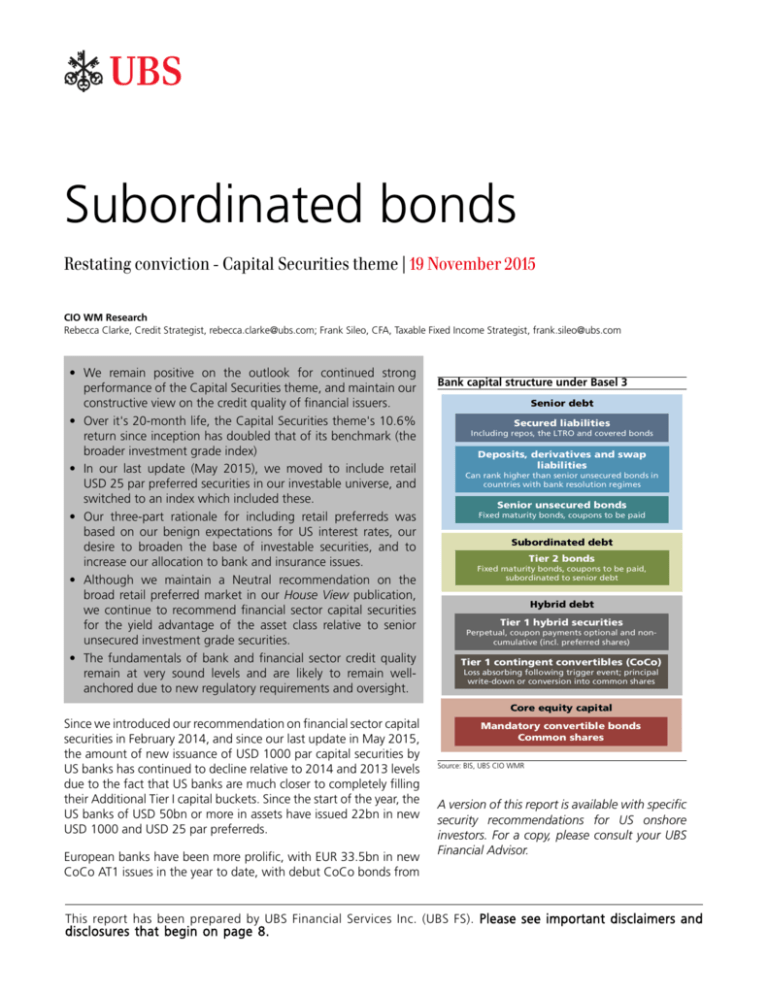

Simple insurance capital structure

Policyholders

Senior debt

Secured bonds

Bonds secured with insurance policies

Senior unsecured bonds

Final maturity, mandatory coupons,

subordinated to policyholders' claims

Hybrids

(Un)dated

Tier 2 bonds

debt)

(No) final maturity, deferrable, cumulative

coupons, minimum 5 year non-call period

Contingent capital notes

Loss absorbing following trigger event; principal

write-down or conversion into common shares

Tier 1 securities

Perpetual, coupon payments optional and noncumulative (incl. preferred shares)

Shareholders' equity

Common shares

Retained earnings

Source: NAIC, UBS

The largest US insurers are also subject to evolving regulatory capital requirements due to their status as non-bank Systemically Important Financial Institutions (SIFI's, affecting MetLife, Prudential Financial, and AIG). The legacy, non-compliant Tier 1 securities of banks

and insurers also continue to offer solid yields for existing holders,

while some issues with first call dates farther in the future may still

offer attractive purchase options on a yield to first call basis. We view

it as highly likely that these securities will be called.

How has performance been so far?

The total return on the Capital Securities Theme has been measured

using the recommended indicies; initially BofAML COCS (100% capital securities) and since May the BofAML COPS (blend of retail preferreds and capital securities) against the broader benchmark investment grade master index (BofAML C0A0). From inception to date, the

theme has returned 10.6%, versus the benchmark return of about

5.1%. The outperformance has come from the higher coupons on

the recommended indicies relative to the IG master, while spreads

have narrowed on the index and widened on the IG master due to

credit spread widening in non-financial sectors. Credit factors also

support the performance, with banks and financial issuers reflecting

their lower volatility and higher credit ratings relative to non-financial issuers where issues such as re-leveraging, shareholder friendly

policies, and fundamental credit weakness in energy, basic materials,

and commodities are having primary and derivative effects on credit

spreads in these are related sectors.

UBS CIO WM Research 19 November 2015

2

Subordinated bonds

Sticking to our financial sector roots

Our preference for financial sector capital securities is based on our

constructive view of the fundamental credit strength of bank and

insurance issuers in both the US and Europe. Most of these issuers

have largely completed the restructuring programs implemented following the financial crisis. While some larger European issuers still

have significant work ahead to complete the run-off and restructuring of businesses (eg. RBS, Deutsche Bank, Barclays and Credit Suisse)

they have made significant headway in building the required capital

under Basel 3. Banks and insurers and large cap diversified financials

are holding record levels of equity and liquid assets. By and large, they

have lowered leverage while the slow but steady recovery of the US

economy and the Eurozone and UK have helped securities valuations

recover and credit losses on loan portfolios are at very low or improving levels.

USD 25 par preferred allocation added in May 2015

With our May 2015 report, we introduced an alternative index to track

the performance of the theme: the BofAML US Preferred, Bank Capital & Capital Trust Securities Index (C0PS). This all investment graderated index includes about 30% market weight of USD 50 and USD

25 par preferreds, in addition to 70% market weight USD 1000 par

preferreds, Tier 2, and insurance hybrids that are similar to the Capital Securities index (C0CS) we originally used. We prefer the new

index due to its significantly higher banking component (about 58%

of market weight of securities), its significant insurance and diversified

financial services exposure (about 28%), and its lower component of

non-financial sector issues (about 14%).

Comparison of the indices

(index characteristics of the blended preferred and capital securities index C0PS

relative to the institutional capital securities index C0CS and relative to the broader

investment grade index C0A0)

As of 11/17/2015

C0PS

Number of Issues

212

Amount Outstanding (USD bn)

164,504

Market Value (USD bn)

172,392

Option Adjusted Spread (bps)

216

Par Wtd Price (%)

104.8

Mkt Wghted Rating

BBB

Yield to Worst (%)

4.60

Modified Duration to Worst (Yrs

5.86

Mkt Weighted Coupon (%)

6.40

C0CS

91

72,879

77,409

253

106.22

BBB

4.37

5.44

6.64

C0A0

6,907

5,178,833

5,348,090

162

103.27

A3

3.50

6.65

4.39

Source: BofAML, UBS CIO WMR as of 17 November 2015

What are financial sector capital securities?

Capital securities describes the broader asset class of banks, insurance

companies, and selected non-financial corporate securities that serve

as a source of capital after common equity is depleted. For financial

sector capital securities, Tier 1 capital securities, support the issuer's

capital needs when it is still a going concern. We include both USD

25 par and USD 1000 par issues of preferreds in this definition. Tier

2 securities generally are tapped in a liquidation of the issuer to serve

as a source of capital to support more senior creditor claims.

We continue to emphasize USD 1000 par capital securities for

their better price stability and greater liquidity

Institutional capital securities are traded in the over-the-counter USD

1000 par market, including both Tier 1 and Tier 2 capital issues.

These USD 1000 par issues are sold through syndicates to institutional

investors when launched. The combined USD denominated market

of institutional and retail capital securities is nearing USD 750bn. We

still favor the institutional market, as we feel institutional investors will

more consistently invest for yield and total return purposes, such that

prices are likely to be less volatile, while the markets for these securi-

Related reports:

An update on the Capital Securities

theme - 20 May 2015

An update on the Capital Securities

theme - 10 November 2014

Capital securities redux - stability

carries on - 28 August 2014

Opportunities in financial sector

capital securities - 28 April 2014

Opportunities in financial sector

capital securities - 20 February 2014

UBS CIO WM Research 19 November 2015

3

Subordinated bonds

ties are deeper, and more liquid. While we continue to see the USD

25 par retail preferred market as susceptible to some volatility due to

investment flows and ETF positioning, we expect the asset class to

provide attractive risk-adjusted returns over a longer time horizon.

Basel 2 & 3 comparative capital structures

Buffers

Sifi (1-2.5%)

Countercyclical (2.5%)

We see room for some tactical positioning in retail preferreds

We like the structural diversification of the retail preferred market,

where issues can be categorized based on their coupon and call

features in addition to issuer and rating differentiators. Given the

exchange-traded market structure of retail preferreds, as well as the

lower sums needed to invest, we believe investors can tactically position their portfolios to capture the benefits of new issue spread compression.

The deliberate move into smaller retail preferreds will also allow the

investor to gain exposure to a greater number of issuers, thus increasing diversification. In addition, investors can use floating or fixed-tofloat preferred share structures to reduce interest rate sensitivity, and

to modify overall portfolio interest rate exposure. This is true as well

for fixed to float and pure floating rate preferred shares in USD 1000

par size, but it may be easier for retail investors to diversify issuers in

fixed to float and floating rate structures due to the lower dollar size

commitment needed.

Tier 2 capital

Tier 2 (2%)

Tier 3 capital

Tier 2 capital (4%)

Tier 1 capital (8.5%)

Lower Tier 2 (2%)

Additional

Tier 1 (1.5%)

Upper Tier 2 (2% )

Conservation Buffer

(2.5%)

Tier 1 capital (4%)

Innovative Tier 1 (0.6)

Non-innovative Tier 1

(1.4%)

Equity and retained

earnings (2.0%)

Equity and retained

earnings (4.5%)

(Minimum Common

Equity Tier 1)

Basel 1 / 2

Basel 3

Source: BIS, UBS CIO WMR

Some structural recommendations for both retail and institutional Tier 1 securities

We maintain our preference for certain types of structures in Tier 1

capital securities. These include preferreds, European legacy Tier 1

bank issues, and insurance Tier 1 hybrids from both US and European

issuers. All are issued as either callable perpetuals or as longer dated

maturity callable Tier 2 securities. Insurance hybrids and bank TruPS

fit into the longer dated maturity callable Tier 1 category, but most of

these have been called, as their Tier 1 capital status is now down to

50% principal credit, and will phase out of Tier 1 capital completely

in 2016, for US banks.

Relative performance of the indices

(C0PS relative to C0CS and C0A0, total return % with

indices rebased to 100 at 12/31/2013)

114

112

110

Total return index

In the Tier 1 bank capital arena, we favor legacy (non-CoCo) Tier 1

issues and dated Tier 2 issues of European insurers and US bank Tier 1

(Basel 3 compliant) perpetual, non-cumulative preferreds for the best

total return and yield potential relative to senior bank bonds. Within

the perpetual Tier 1 capital class, we favor those structures with less

interest rate sensitivity, and the highest possible potential of being

called at their first call dates, and/or interest rate protection if these

are not called at first call dates.

108

106

104

102

100

98

96

We continue to favor fixed-to-float rate structures with the highest

credit spread available on their floating rate component, as those with

a high back end spread are more likely to be cheaper to replace at

call dates. Moreover, the form of Basel 3 compliant Tier 1 bonds and

preferred shares now requires that these issues not be callable for at

least the first five years. We are seeing banks and insurers issue noncall five year and non-call ten year issues more often.

94

92

2/20/2014

6/20/2014

10/20/2014

2/20/2015

6/20/2015

10/20/2015

US Preferred Bank Capital&Cap Trust (C0PS)

US Corp Master (C0A0)

U.S. Corp All Capital Securities (C0CS)

Source: BofAML, UBS CIO WMR as of 17 November 2015

UBS CIO WM Research 19 November 2015

4

Subordinated bonds

What are the return expectations?

We maintain our return expectations on the theme as the coupon on

the securities plus a stable credit spread environment, such that our 6

month return expectation on an absolute basis is 3%, and our positive scenario is for further spread tightening in capital securities relative to the broad investment grade credit spread (or widening in IG

spreads). Our anticipated performance versus the IG benchmark index

is plus 1% with upside potential based on spread movements reflecting better credit quality in financials. We recommend that investors

take advantage of any price weakness in capital securities to increase

or tactically improve positions, focusing on fixed to float securities

with a high fixed component and high floating rate credit spreads,

which exhibit lower price volatility in a rising rate environment, and

where floating rate spreads are high, increasing the probability that

these are called at first call dates, and increasing the attractiveness of

the securities as a floater if they are not called.

What is the outlook for the theme?

Our current House View forecast for US interest rates envisions a more

moderate and orderly pace of interest rate increases. We believe this

will decrease the likelihood of widespread selling in the retail preferred

market akin to what we saw during the "taper tantrum" in 2013, or at

least make the duration of any sell-off relatively short-lived. We have

seen preferred securities outperform in the year-to-date and continue to view solid income and stable credit spreads as likely to lead to

ongoing good performance for capital securities including preferreds

in the near-to-medium term supported by:

Year to date price volatility of C0PS and C0A0

• Regulatory capital requirements continuing to phase in, with the

fully implemented Basel 3 capital requirements largely met by the

large regional and money-center US banks, with comparable capital

positions among the larger European banks under our coverage, and

relatively long phase-in period for Solvency 2 for European insurers.

Capital requirements are increasing as the capital conservation buffer

and full global systemically important bank buffers phase in, and new

issuance and fine tuning will continue.

Source: BofAML, UBS CIO WMR as of 17 November 2015

112

Price over par

110

108

106

104

102

100

98

12/31/2014

3/31/2015

6/30/2015

9/30/2015

US Preferred Bank Capital&Cap Trust (C0PS)

US Corp Master (C0A0)

U.S. Corp All Capital Securities (C0CS)

• Pricing on new issues is improving as rates rise, with higher recent

fixed rate components on fixed to float preferred issues, and more

generous floating rate credit spreads due to higher spreads overall as

well as negative swap spreads.

• Bank credit ratings are more stable, following S&P and Moody's

recalibration of ratings earlier this year to reflect removal of government support notching for US and European banks.

How to invest?

For those investors seeking the diversification and active management

of a fund, we recommend investors consider closed end funds which

focus on institutional capital securities. These funds generally invest

in capital securities and retail preferred shares, with the goal of high

yield and some capital appreciation.

UBS CIO WM Research 19 November 2015

5

Subordinated bonds

What are the risks?

We already have credit and equity market evidence of the fundamental improvement in the financial sector, particularly in banks, as

seen in the performance of their equities and credit spreads in 2013.

We will emphasize bank issues in our recommendations, as we see

these as the most likely to generate the returns we expect. The rules

themselves, under the Basel 3 framework, are already being instituted in the US and Europe, and in the larger and more developed EM

countries. For European insurers, Solvency II requirements begin their

implementation in 2016, and we see market pressure for these companies to comply early with most having already initiated the process.

Extension risk - A main risk for investors is extension risk. If securities

are not called at their first call date, they may remain outstanding for

some time, affecting returns and potentially causing realignment of

prices (downwards) in recognition of the longer maturity profile. This

could happen if a bank determines that a security is a source of reasonably priced subordinated capital and retains in its capital structure

on its original terms.

We believe this risk is manageable because we expect most old-style

Tier 1 and 2 securities to be called at their first call date, mainly due

to economics. These securities are transitioning out of Tier 1 status,

and most banks can issue lower cost debt as senior debt and have

good access to markets. Old style Tier 1 securities will generally phase

out from Tier 1 to Tier 2 status, and then from Tier 2 to senior status. We think most banks are likely to issue fresh, Basel 3 compliant

securities to fulfill the specific functions of Tier 1 and Tier 2 in their

capital structures. Bank issuers may write into these new securities

terms which enable these to adapt to rising capital standards over

time, as we think it likely that for the largest global banks, capital and

leverage requirements will be more likely to rise from current levels

than to decline.

Regulatory par calls - We see limited scope for further regulatory

par calls under Basel 3 for the banks, as most banks in Europe and

the US have only a limited number of legacy TruPS or Tier 1 securities

(that are non-CoCo for European banks) remaining on their books.

However, we see increasing room for calls on those non-compliant

securities currently outstanding that are beyond their first call dates.

This would include the remaining TruPS outstanding, as these will no

longer receive any credit as Tier 1 capital next year (from their current 50% of principal credit position). European banks have a slightly longer phase out period, until 2022 for their grandfathered Tier 1

securities, but these lose 10% of par value credit for the total principal

balance of legacy Tier 1's each year from this year through 2021.

Price volatility - Given the House View outlook for rising interest

rates, capital securities may be more volatile in the near term in due

to their subordinated status. That said, we expect capital securities to

outperform senior unsecured bank issues due to the lower coupon

and longer average duration of the senior bank issues. We also expect

lower price volatility in the blended index of institutional capital secu-

UBS CIO WM Research 19 November 2015

6

Subordinated bonds

rities and retail preferred securities relative to the pure retail preferred

securities market.

Interest rate risk - A good number of the newly issued Tier 1 securities may be non-callable for 10 years. A security issued at today's rates

that is fixed and non-callable for ten years may be subject to higher

price risk as interest rates gradually rise. To mitigate this risk, we will

look for compliant fix to float structures, as well as higher coupon

fixed structures as the latter offer some additional credit spread which

could potentially offset some of the yield variance due to rate changes

from the security's issue date.

UBS CIO WM Research 19 November 2015

7

Subordinated bonds

Appendix

Disclaimer

Chief Investment Office (CIO) Wealth Management (WM) Research is published by UBS Wealth Management and UBS

Wealth Management Americas, Business Divisions of UBS AG (UBS) or an affiliate thereof. CIO WM Research reports

published outside the US are branded as Chief Investment Office WM. In certain countries UBS AG is referred to as UBS

SA. This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell

any investment or other specific product. The analysis contained herein does not constitute a personal recommendation or

take into account the particular investment objectives, investment strategies, financial situation and needs of any specific

recipient. It is based on numerous assumptions. Different assumptions could result in materially different results. We

recommend that you obtain financial and/or tax advice as to the implications (including tax) of investing in the manner

described or in any of the products mentioned herein. Certain services and products are subject to legal restrictions and

cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. All information

and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no

representation or warranty, express or implied, is made as to its accuracy or completeness (other than disclosures relating

to UBS and its affiliates). All information and opinions as well as any prices indicated are current only as of the date

of this report, and are subject to change without notice. Opinions expressed herein may differ or be contrary to those

expressed by other business areas or divisions of UBS as a result of using different assumptions and/or criteria. At any time,

investment decisions (including whether to buy, sell or hold securities) made by UBS AG, its affiliates, subsidiaries and

employees may differ from or be contrary to the opinions expressed in UBS research publications. Some investments may

not be readily realizable since the market in the securities is illiquid and therefore valuing the investment and identifying

the risk to which you are exposed may be difficult to quantify. UBS relies on information barriers to control the flow of

information contained in one or more areas within UBS, into other areas, units, divisions or affiliates of UBS. Futures and

options trading is considered risky. Past performance of an investment is no guarantee for its future performance. Some

investments may be subject to sudden and large falls in value and on realization you may receive back less than you

invested or may be required to pay more. Changes in FX rates may have an adverse effect on the price, value or income

of an investment. This report is for distribution only under such circumstances as may be permitted by applicable law.

Distributed to US persons by UBS Financial Services Inc. or UBS Securities LLC, subsidiaries of UBS AG. UBS Switzerland

AG, UBS Deutschland AG, UBS Bank, S.A., UBS Brasil Administradora de Valores Mobiliarios Ltda, UBS Asesores Mexico,

S.A. de C.V., UBS Securities Japan Co., Ltd, UBS Wealth Management Israel Ltd and UBS Menkul Degerler AS are affiliates

of UBS AG. UBS Financial Services Incorporated of PuertoRico is a subsidiary of UBS Financial Services Inc. UBS Financial

Services Inc. accepts responsibility for the content of a report prepared by a non-US affiliate when it distributes reports

to US persons. All transactions by a US person in the securities mentioned in this report should be effected through a

US-registered broker dealer affiliated with UBS, and not through a non-US affiliate. The contents of this report have not

been and will not be approved by any securities or investment authority in the United States or elsewhere. UBS Financial

Services Inc. is not acting as a municipal advisor to any municipal entity or obligated person within the meaning of Section

15B of the Securities Exchange Act (the "Municipal Advisor Rule") and the opinions or views contained herein are not

intended to be, and do not constitute, advice within the meaning of the Municipal Advisor Rule.

UBS specifically prohibits the redistribution or reproduction of this material in whole or in part without the prior written

permission of UBS and UBS accepts no liability whatsoever for the actions of third parties in this respect.

Version as per September 2015.

© UBS 2015. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

UBS CIO WM Research 19 November 2015

8