Dow Jones U.S. Dividend 100 Index

TM

Fact Sheet

Stated Objective

To measure the stock performance of high dividend yielding U.S. companies with a record of consistently paying dividends, selected for

fundamental strength relative to their peers, based on financial ratios.

Key Features

—

One hundred stocks are selected to the index based on four fundamentals-based characteristics (cash flow to total debt, return on

equity, dividend yield and five-year dividend growth rate) and are subject to screens for dividend payment consistency, size and liquidity.

—

Components are weighted based on a modified market capitalization approach.

—

The Dow Jones U.S. Dividend 100TM Index was first calculated on August 31, 2011.

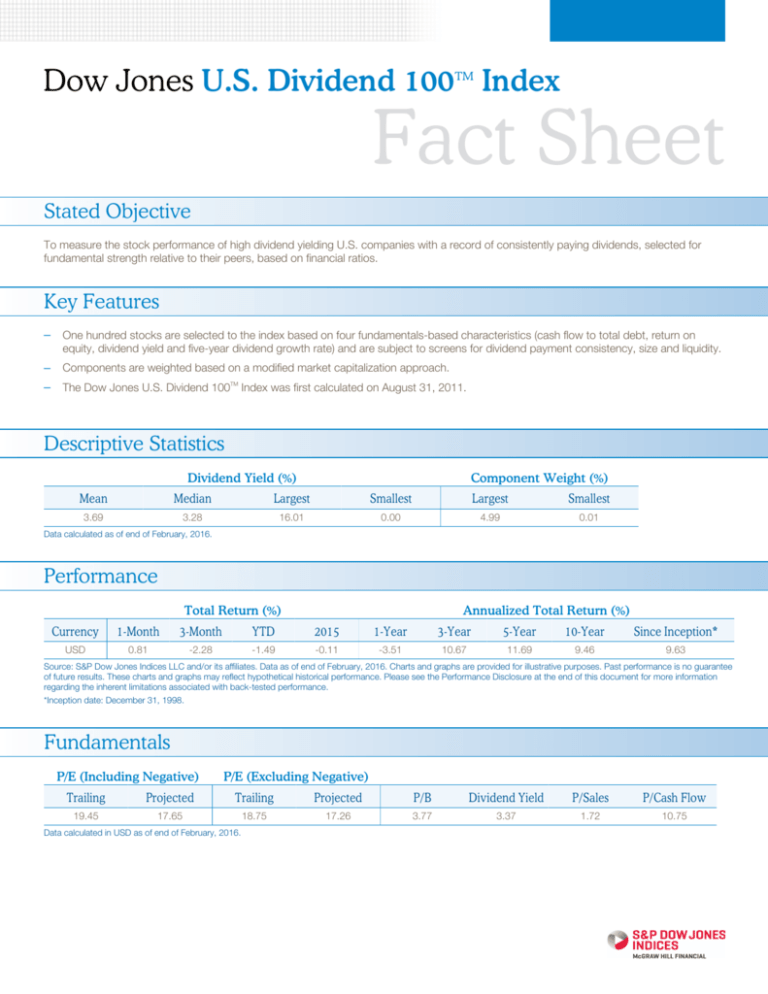

Descriptive Statistics

Dividend Yield (%)

Component Weight (%)

Mean

Median

Largest

Smallest

Largest

Smallest

3.69

3.28

16.01

0.00

4.99

0.01

Data calculated as of end of February, 2016.

Performance

Total Return (%)

Annualized Total Return (%)

Currency

1-Month

3-Month

YTD

2015

1-Year

3-Year

5-Year

10-Year

Since Inception*

USD

0.81

-2.28

-1.49

-0.11

-3.51

10.67

11.69

9.46

9.63

Source: S&P Dow Jones Indices LLC and/or its affiliates. Data as of end of February, 2016. Charts and graphs are provided for illustrative purposes. Past performance is no guarantee

of future results. These charts and graphs may reflect hypothetical historical performance. Please see the Performance Disclosure at the end of this document for more information

regarding the inherent limitations associated with back-tested performance.

*Inception date: December 31, 1998.

Fundamentals

P/E (Including Negative)

P/E (Excluding Negative)

Trailing

Projected

Trailing

Projected

P/B

Dividend Yield

P/Sales

P/Cash Flow

19.45

17.65

18.75

17.26

3.77

3.37

1.72

10.75

Data calculated in USD as of end of February, 2016.

Dow Jones U.S. Dividend 100TM Index

Fact Sheet

Symbols

Total Return

USD

Price Return

USD

Suggested Symbol

DJUSDIVT

DJUSDIV

Bloomberg

DJUSDIVT

DJUSDIV

Bridge

US&DJUSDIV.T

US&DJUSDIV

Reuters

.DJUSDIVT

.DJUSDIV

Thomson

.DEIVT

.DEDIV

Telekurs

DJUSDIVT

DJUSDIV

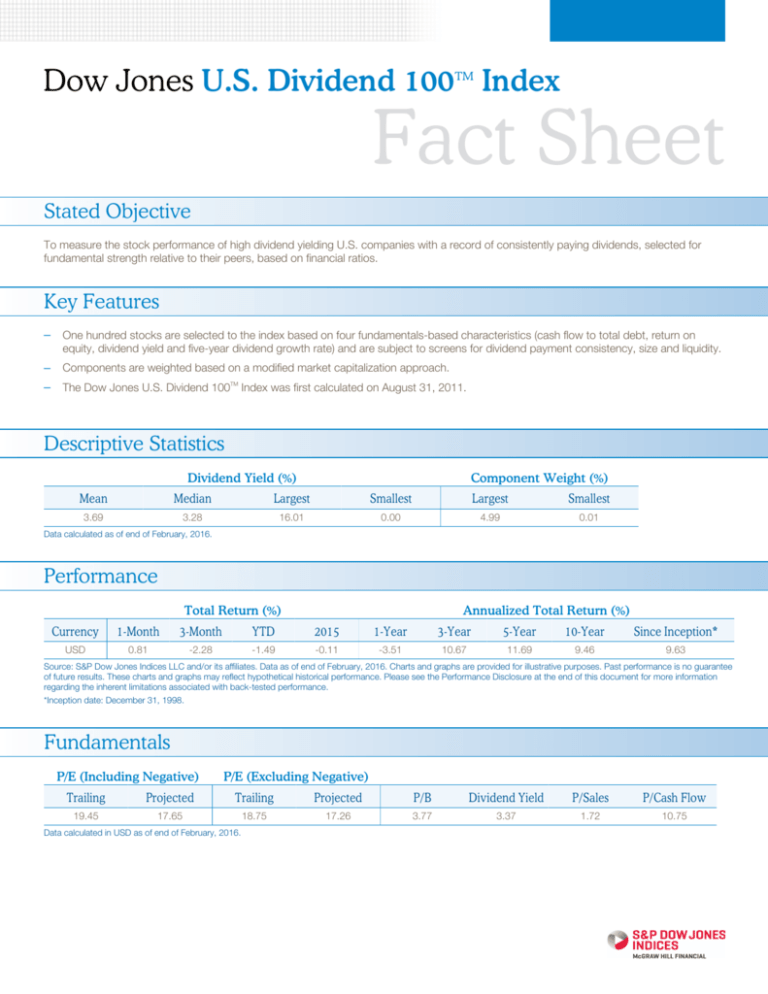

Sector Allocation

Consumer Goods

21.95%

Industrials

17.23%

Technology

15.75%

Consumer Services

12.27%

Health Care

11.42%

Oil & Gas

11.09%

Telecommunications

4.99%

Basic Materials

2.75%

Financials

1.82%

Utilities

0.72%

Data calculated in USD as of end of February, 2016.

Sectors are based on the ten industries defined by the proprietary

classification system as described at www.djindexes.com

Top Components

Company

Country

ISIN/Ticker

Industry

Supersector

Adjusted Weight (%)

Verizon Communications Inc

United States

VZ

Telecommunications

Telecommunications

4.99%

Exxon Mobil Corp

United States

XOM

Oil & Gas

Oil & Gas

4.86%

Procter & Gamble

United States

PG

Consumer Goods

Personal &

Household Goods

4.74%

Johnson & Johnson

United States

JNJ

Health Care

Health Care

4.73%

Microsoft Corp

United States

MSFT

Technology

Technology

4.25%

Pfizer Inc

United States

PFE

Health Care

Health Care

4.22%

Coca-Cola Co

United States

KO

Consumer Goods

Food & Beverage

4.09%

Home Depot Inc

United States

HD

Consumer Services

Retail

3.86%

Chevron Corp

United States

CVX

Oil & Gas

Oil & Gas

3.80%

PepsiCo Inc

United States

PEP

Consumer Goods

Food & Beverage

3.48%

Copyright © 2016 by S&P Dow Jones Indices LLC, a subsidiary of The McGraw-Hill Companies, Inc., and/or its affiliates.

Dow Jones U.S. Dividend 100TM Index

Fact Sheet

Quick Facts

Component Number

100

Weighting

Modified market capitalization approach

Review Frequency

Annually, in March

Base Value/Base Date

1000 as of December 31, 1998

Calculation Frequency

Every 15 seconds during U.S. stock exchange trading hours

Dividend Treatment

Price return and total return versions are available. The total return version of the index is calculated with gross

dividends reinvested.

Estimated Back-Tested

History Availability

Available daily back to December 31, 1998

Launch Date

August 31, 2011

For more information on the Dow Jones U.S. Dividend 100TM Index,

email index_services@spdji.com

or call Americas +1.212.438.2046 | Asia +86.10.6569.2770 | EMEA : +44.20.7176.8888

Learn more at www.djindexes.com.

Dow Jones U.S. Dividend 100TM Index

Fact Sheet

All information as of end of February, 2016

Source: S&P Dow Jones Indices LLC.

The launch date of the Dow Jones U.S. Dividend 100TM Index was August 31, 2011.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are

based on the same methodology that was in effect when the index was officially launched. Past performance is not a guarantee of future results. Please see the Performance

Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more information regarding the inherent limitations associated with back-tested performance.

© S&P Dow Jones Indices LLC, a part of McGraw Hill Financial 2016. All rights reserved. Redistribution, reproduction and/or photocopying in whole or in part are prohibited without

the written permission of S&P Dow Jones Indices. Standard & Poor’s and S&P are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”), a part of McGraw Hill

Financial, Inc. Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). S&P Dow Jones Indices LLC, Dow Jones, S&P and their respective

affiliates (“S&P Dow Jones Indices”) make no representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector

that it purports to represent and S&P Dow Jones Indices shall have no liability for any errors, omissions, or interruptions of any index or the data included therein. Past performance

of an index is not an indication of future results. This document does not constitute an offer of any services. All information provided by S&P Dow Jones Indices is general in nature

and not tailored to the needs of any person, entity or group of persons. It is not possible to invest directly in an index. S&P Dow Jones Indices may receive compensation in

connection with licensing its indices to third parties. Exposure to an asset class represented by an index is available through investable instruments offered by third parties that are

based on that index. S&P Dow Jones Indices does not sponsor, endorse, sell, promote or manage any investment fund or other investment vehicle that seeks to provide an

investment return based on the performance of any Index. S&P Dow Jones Indices LLC is not an investment advisor, and S&P Dow Jones Indices makes no representation

regarding the advisability of investing in any such investment fund or other investment vehicle. For more information on any of our indices please visit www.spdji.com .

Ed 03-03-16, FACT-296-649-022916