Progressive Loses Appeal of Boston Municipal

advertisement

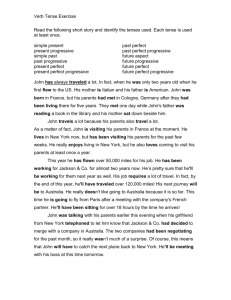

MAIA News: Young Agents Raise Money for Make-A-Wish Foundation ... This fall the Young Agents Committee participated in the Third Annual Night of Wine & Wishes, a wine and spirits tasting to benefit Make-A-Wish MA & RI. Held on October 16th at the Winter Garden Atrium at Morton’s The Seaport, over 250 young professionals from the Boston area gathered to get a taste of the Make-AWish mission while enjoying wine and whiskey tastings from around the globe. December 31, 2015 In this Issue ... MAIA News: • Young Agents Raise Money for Make-A-Wish Foundation MAIA Auto News: • Progressive Loses Appeal of BMC Decision on Auto Policy Recission Case • • • On-hand for the event were (pictured clockwise from the top left) Melissa Murphy, MAIA; Sara Giguere, Murray McDonald Insurance Services; Alexis Kimball, Deland Gibson Insurance; Rob Barresi, Starkweather & Shepley Insurance; Mike Dye, Marsh & McLennan; Frank Mancini, MAIA President & CEO; Steve Monaco, Granite Insurance Agency; AJ Marchionne, Marchionne Insurance Agency; and Jes Walsh, Homer T. Brown Insurance Agency. Since the event’s inception in 2013, Wine & Wishes has raised over $100,000 and helped to grant wishes for 12 children with life-threatening medical conditions. This is the 3rd year that MAIA’s Young Agents have applied a grant made available from Trusted Choice to use in conjunction with our local chapter of Make-A-Wish. The committee looks forward to participating with Make-A-Wish in the future and assisting with plans for the 2016 event. More photos from the evening can be accessed on the Make-A-Wish Facebook page. MA Auto News: Progressive Loses Appeal of Boston Municipal Court Decision on Auto Policy Rescission Case ... The Boston Municipal Court Appellate Division recently affirmed the decision of the District Court against Progressive Direct Insurance Company (Progressive) regarding rescission of an auto policy. The trial court had previously allowed a motion by Source One Financial Corp. (Source One) against Progressive for recovery on a claim under an automobile insurance policy on which Source One was listed as the lienholder. (continued on page 2) Comp. Corner: 1 1-3 Circular Letter No. 2271 Rate Filing, Pending Premium Change Endorsement 3 Special Bulletin No. 12-15 Updated Information on Residual Market Share 3-4 Recent Circulars, Bulletins and Notices 4 CAR News: • Commissioner Schedules Hearing on Performance Standards • Proposed Changes to Rule 21 4-5 5 Thanks Company Partners 5 December 31, 2015 2 MA Auto News ... continued from page 1 The facts leading up to the district court case are: • • • On January 28, 2013, Progressive issued a “Verification of Insurance” for [the named insured] which was provided to Source One in connection with Source One’s position as first lienholder on the vehicle to be insured. A policy number and effective date were assigned by Progressive. It is clear from a plain reading of the statute, G.L. c. 175, § 113A, that its provisions, including the required cancellation procedure, apply to such binders.” The insured’s first premium payment was dishonored, and on February 8, 2013, Source One received a “Notice of Rescission,” dated February 1, 2013, from Progressive and purportedly effective on January 20, 2013. On March 3, 2013, the vehicle was towed as the result of a loss, following which, on March 28, 2013, Source One received possession of the vehicle. Source One filed a claim under the policy which was refused by Progressive on the ground that the policy had been rescinded. In the lawsuit that followed, Progressive argued that, since no premium was ever paid, the policy was rescinded as of the day the binder was issued. Source One contended that Progressive did not follow the statutory cancellation requirements and, therefore, the coverage remained in effect at the time of the loss. In its decision, the appeals court noted: • • It is clear from the record that Progressive did not follow the cancellation procedure prescribed by G.L. c. 175, §113A(2). The relevant provisions of the statute state that “no cancellation of the policy whether by the company or by the insured, shall be valid unless written notice thereof is given by the party proposing cancellation . . . at least twenty days in each case prior to the intended effective date there.” Id. Failure of a motor vehicle insurer to comply with the mandatory provisions of this section renders the attempted cancellation ineffective. Fields v. Parsons, 353 Mass 706 (1968); Maia v. United States Fid. & Guar. Co., 56 Mass. App. Dec. 28, 32-33 (1975). Failure to comply with the requirements for cancellation means that the parties are in the same position as if no notice were ever sent. There is no language providing for rescission of a policy in the statute. It is the general rule that conditions imposed with respect to giving notice of cancellation of insurance must be strictly followed. Fields, supra; White v. Edwards, 352 Mass. 655, 657 (1967). See Also Pierce v. Sentry Ins. Co. 12 Mass. App. Ct. 124, 125 (1981) Progressive argues that the insurance policy was a nullity due to the failure of consideraton. In contract law, failure of consideration is a valid defense to enforcement of a contract. The requirement of consideration is satisfied if there is either a benefit to the promisor or a detriment to the promisee. Marine Contrs. Co. v. Hurley, 365 Mass. 280, 286 (1974). Consideration was present at the formation of the contract, the policy here. The promise to purchase the policy made by the insured at the time the binder was issued satisfied that contract law requirement. See Statewide Ins. Corp. v. Dewar, 143 Ariz. 553 (1984). 5 The failure of consideration is not available to Progressive to avoid this policy. The failure of performance, that is, insured’s failure to pay the promised premium, is different even under contract law than the utter lack of consideration. Progressive points to the insured’s acknowledgment in his application for insurance, which read: “If I make my initial payment by electronic funds transfer, check, draft, or other remittance, the coverage afforded under this policy is conditioned on payment to the Company by the financial institution. If the transfer, check, draft, or other remittance is not honored by the financial institution, the Company shall be deemed not to have accepted the payment and this policy shall be void.“ • • • Contract law allows the parties to negotiate freely the terms of a contract. However, the statutes applicable to automobile insurance contracts in Massachusetts require such contracts to contain specific language and provide specific coverage. Default in the payment of the premium is specifically addressed in the cancellation requirements, which do not provide for retroactive cancellation of a policy. Progressive argues that it should have the benefit of rescission or that there was a mutual rescission of the insurance contract by it and the insured. Rescission is an equitable remedy sought for annulling a contract and rendering it as though it does not exist. See H.J. Alperin, Summary of Basic Law §9.34, at 1146 (4th ed. 2006). Rescission is available under circumstances of fraud, accident, mistake, or some type of gross inequity. Id. The record here does not support an argument that there was fraud, an accident, or a mistake, unilateral or otherwise, so “fundamental to the contract as to ‚take away its foundation.“‘ Browning-Ferris Indus., Inc. v. Casella Waste Mgt. of Mass., Inc., 79 Mass. App. Ct. 300, 313 (2011 ), quoting De Angelis v. Palladino, 318 Mass. 251, 257 (1945). As we have noted, the contractual relationship between the insured and the insurer is bound by the statutes and the regulations of the Division of Insurance. We therefore hold that Progressive‘s failure to follow the statutory cancellation procedure did not result in cancellation of the policy and that the ruling on the motion for summary judgment was correct. The appeal is dismissed. Editor’s Note: We at MAIA have always believed that coverage is in place once the insurer or its agent has accepted an application, and the only way for the insurer to “end” coverage is with a legal notice of cancellation. While the initial case against Progressive was brought by a lienholder on the policy, the facts of the case would be the same if it was brought by the named insured. December 31, 2015 3 MA Auto News ... continued from page 2 As a result of the dismissal of Progressive’s appeal of the case, we believe that the Division of Insurance will have to take a second look at some forms/rules already placed on file including new procedures put in place which would permit policies to simply expire with no action required by the insurer. Because of our compulsory liability statute, insurers have never been permitted to allow policies to simply expire. Failure to pay the renewal premium has always resulted in the issuance of a legal notice of cancellation by the insurer including an electronic cancellation notice to the Registry of Motor Vehicles to begin the plate revocation process. Comp. Corner: Circular Letter No. 2271 - Rate Filing, Pending Premium Change Endorsement ... The WCRIBMA has submitted a rate filing to the Division of Insurance on behalf of its members recommending a 6.4% increase in average rates for industrial classes and an 8.8% decrease for F-Classes. The WCRIBMA filed no change to expense constants. The proposed effective date of this filing is July 1, 2016. The Commissioner of Insurance will issue a hearing notice soon and the WCRIBMA will then issue another Circular Letter attaching a copy of that notice. They will also post additional information at www.wcribma.org as it becomes available. In anticipation of the Rate Filing, the WCRIBMA has been issuing ratings effective on July 1, 2016 and subsequent with a preliminary status. At the conclusion of the rate case, the WCRIBMA will revise the preliminary ratings. Until a decision is received, carriers should attach the Massachusetts Pending Premium Change Endorsement (WC 20 04 01) to all new and renewal policies effective on or after July 1, 2016. The wording of the endorsement appears below for your convenience. Special Bulletin No. 12-15 - Updated Information on Residual Market Share ... The information in this bi‐monthly Special Bulletin is provided as an indicator of the directional movement of the “Residual Market Share.” Residual Market Share as used in this report is defined as: Residual Market Share = (SCwp + VDACwp) / (SCwp + VDACwp + VOLwp) SCwp ‐ Servicing Carrier Written Premiums VDACwp ‐ Voluntary Direct Assignment Written Premiums VOLwp ‐ Voluntary Written Premiums The basis for the written premiums used in this report is the sum of Standard Premium plus ARAP plus Expense Constant as contained in the WCRIBMA’s Policy File Information System which reflects reported estimated values as of policy issuance. The estimated policy year ultimate residual market share for the 12 months ending October, 2015 is 21.2%. 4 December 31, 2015 Comp. Corner ... continued from page 2 The estimated ultimate market shares for the September and October policy months of 2013 through 2015 are as follows. ± Estimated Ultimate Written Premium incorporates an estimate of subsequent audit premium as reflected in the development factor. Scheduled review and adjustments are being made to the development factors as a policy year develops. Similar ratios calculated using written premium at the Annual Statement Basis as reported on the Aggregate Financial Calls would tend to be higher because of the impact of deviations and schedule rating. Recap of Recent Circulars, Bulletins and Notices ... RELEASE DATE 12/24/15 12/23/2015 TITLE DESCRIPTION CL2273 - Notice of Hearing A Hearing on the Admiralty - FELA Filing will be held at 10:00 A.M., on Wednsday, January 20, 2016 at the Division of Insurance, 1000 Washington Street, Boston, MA. cl2272 - Important Filing Requirements for Workers‘ Compensation Rate Deviation Filings that are Currently in Effect The Division of Insurance (DOI) has issued instructions that outline the filing requirements for company rate deviation filings that are currently in effect. CAR News: Commissioner Schedules Hearing on Proposed Changes to CAR‘s Private Passenger and Commercial Performance Standards for the Handling and Payment of Claims ... The Commissioner of Insurance has issued a Notice of Hearing regarding proposed amendments to the Private Passenger and Commercial Claims Performance Standards. A public hearing will be held on January 22, 2016, at 10:00 a.m. at the offices of the Division of Insurance, Hearing Room E, 1000 Washington Street, Boston, MA 02118-6200. The purpose of the hearing is to afford all interested persons an opportunity to provide oral and/or written comment on proposed amendments to the Performance Standards for the Handling and Payment of Private Passenger Claims by Assigned Risk Companies and to the Performance Standards for the Handling and Payment of Commercial Claims by Servicing Carriers ( collectively, “Performance Standards“) adopted by Commonwealth Automobile Reinsurers (“CAR“). On November 18, 2015, the CAR Governing Committee voted to amend the Performance Standards. Pursuant to G.L. c. 175, §113H, the Commissioner must review, and approve or modify, proposed amendments to the Performance Standards. The proposed amendments to the Performance Standards may be examined at the Division of lnsurance during regular business hours. This proceeding has been designated as Docket No. C2016-01. Any person who wishes to provide oral comment on the proposed amendments to the Performance Standards is requested to submit to the Division of lnsurance a Notice of (continued on page 5) CAR News ... continued from page 4 lntent to Comment no later than January 20, 2016. All other interested persons will be heard after those who notify the Division in advance of the hearing. All notices and submissions must be sent to the Docket Clerk, Hearings and Appeals, Division of lnsurance, 1000 Washington Street, Suite 810, Boston, Massachusetts 02118-6200, doidocket@state.ma.us and refer to Docket No. C2016-01. Proposed Changes to Rule 21 - General Provisions ... Proposed changes to the Rules of Operation amending Rule 21 were filed with the Commissioner of Insurance on November 19, 2015. Under the provisions of Article X of the Plan of Operation, a proposed Rule of Operation becomes effective either upon approval by the Commissioner of Insurance, or upon expiration of 30 days from the time of submission, provided that no public hearing was requested within 5 days by an interested party and the Commissioner has not otherwise disapproved the Rule change within the 30-day period. Insomuch as no public hearing was requested by any interested party within 5 days of Rule 21 being submitted and the proposed Rule has not been disapproved by the Commissioner of Insurance within 30 days of submission, Rule 21 as amended is deemed approved effective December 22, 2015, as provided in Article X of the Plan of Operation. The purpose of the amendment of Rule 28 is to extend the Clean-in-Three non-renewal provisions for an additional year to March 31, 2017 for those producers that did not have a voluntary contract or a brokerage agreement with any Member as of April 1, 2010 and did not subseqently receive a voluntary contract or brokerage agreement with a Member prior to October 7, 2015. Further, the amendment requires that the March 31, 2017 end date will be ratified no later than December 1, 2016. A copy of the revised rule is available on the CAR website. MAIA Holiday Hours: The MAIA office will close at 2 PM on December 31, 2015.