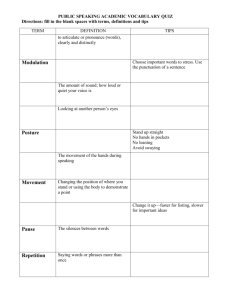

Print a quiz - State Bar Of Nevada

advertisement

ANSWER

FOLLOWING

TIPS ONTHE

TIPS

– Answer eachQUESTIONS

statement with “True” or “False.”

Respond

to each“TIPS”

of thestands

following

statements

with “True”

or “False.”

1. The acronym

for Treasury

Investor

11. The

Fed’s stated target inflation rate is 5 percent.

Protection Securities. TRUE

OR factors

FALSE The

Brunzell

are mandatory and must be

considered in every award of attorney fees.

2. TIPS are currently very popular with investors due

to their inflation protection feature.

TRUE OR FALSE

2. The Brunzell factors must be reflected within the

3. written

An investment

in TIPS

is always

preferable to an

order granting

attorney

fees.

investment in a regular (non-inflation-protected)

Treasury security. TRUE OR FALSE 1.

inflation

usednot

to determine

the final

3.4. AThe

written

orderindex

that does

state the basis

for

value

of

TIPS

may

not

match

up

with

the

actual

which attorney fees are granted is always void.

inflation experienced by the investor.

TRUE OR FALSE 4.5. IfThe

the annual

Beattie/Yamaha

factors

by the

interest rate

paidare

onweighed

recent issuances

district

court,

but

not

reflected

within

the

written

of TIPS is near zero. TRUE OR FALSE order granting attorney fees, the Supreme Court is

6. permitted

TIPS canto

sometimes

less to

than

theirthe

face

value.

review thecost

record

affirm

award

of

TRUE

OR

FALSE fees on the basis of these factors.

7. TIPS can sometimes cost more than their face value.

TRUE OR FALSE

5. Orders denying a request for attorney fees must

8. The cost of a TIPS depends primarily on investors’

always provide a reason for the denial.

expectation of future inflation. TRUE OR FALSE 9. Recent TIPS auctions have sold at unusually large

discounts

their

faceapplicable

value.

6. The

Yamahafrom

factor

is only

when the offer

TRUE

OR

FALSE of judgment is the basis for the award of attorney

and the defendant

is theexpect

prevailing

offeror. rate

10.fees

An investor

in TIPS should

an inflation

of at least 2.5 percent. TRUE OR FALSE TRUE OR FALSE

7. A district court’s consideration of the Beattie/

12. A

TIPS investor

can

be liable for

anorders

annual income

Yamaha

factors is

mandatory

in all

tax

on

any

annual

increase

in

the

TIPS

value due

granting attorney fees.

to the inflation index even when the investor has

not received any money from the TIPS investment. TRUE OR FALSE 8. When there are multiple possible legal grounds

for offset

an award

of or

attorney

fees,

a district

court of

13. To

some

all of the

annual

tax liability

when

it doesand

not deduct

state a the

aabuses

TIPS, its

an discretion

investor can

amortize

basis for an

of attorney

premium

thataward

was paid

for the fees.

TIPS.

TRUE OR FALSE 14. The IRS has provided a TIPS premium

9. A district court judge always has the discretion to

amortization procedure that is readily adaptable

determine the reasonableness of the amount of

to actual TIPS purchases. TRUE OR FALSE requested attorney fees.

15. Premium amortization affects the amount of

capital gain or loss at TIPS maturity.

FALSE court considers

the Beattie/

10. TRUE

When a OR

district

Yamaha factors for an award of attorney fees

16. All

TIPSupon

investors

should

amortize the

anydistrict

TIPS

based

an offer

of judgment,

OR FALSE premiums

paid. TRUE

court is excused

from considering

the Brunzell

factors.

17. All things considered, a TIPS investment can still

be a desirable investment. TRUE OR FALSE

18. So long as held to maturity, an investment in a

TIPS will not result in a loss. TRUE OR FALSE

19. TIPS are best suited for tax-free or tax-deferred

accounts. TRUE OR FALSE

CERTIFICATION: This self-study activity has been approved for one hour of continuing legal education credit by the Nevada Board of Continuing Legal Education.

THREE EASY STEPS TO CLE CREDIT – $45

TEST 29 TIPS ON TIPS

1) Read the article on pages 16-17

2) Answer the quiz questions above. Each question has only one correct answer.

14-16

3) Mail completed form and a $45 processing fee to: STATE BAR OF NEVADA

Make checks payable to

the State Bar of Nevada.

P.O. BOX 50

LAS VEGAS, NV 89125-0500

or fax to: (702) 463-5730

Name

Law Firm/Organization

Address

State/ZIP

NV Bar Number (Required)

Check Enclosed OR Please bill my:

Card #:

VISA

MC

AMEX

DISCOVER

Exp:

Signature:

Articles for CLE credit are valid up to the end of the third calendar year after publication

Articles

for CLE

credit

are valid

up the

to the

end of

the thirdwhichever

calendar year

after publication

or until

a rule

change

renders

article

outdated,

is comes

rst.

or until a rule change renders the article outdated, whichever is comes first.

{ Test 29}

Test 23

1 HOUR CLE CREDIT

1 HOUR CLE CREDIT