HCC Medical Insurance Services

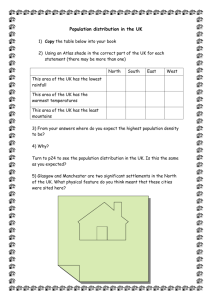

advertisement