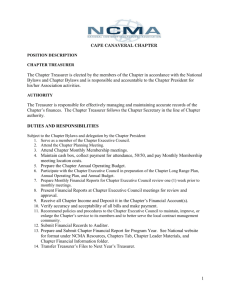

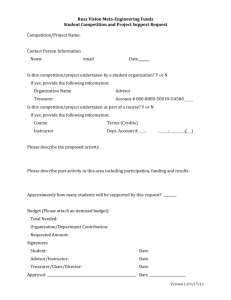

Treasurer's Manual - New Hanover County Schools

advertisement