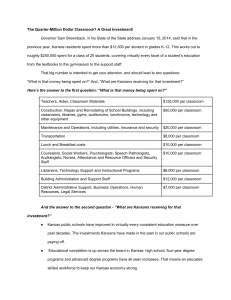

city budget tips bulletin - League of Kansas Municipalities

advertisement