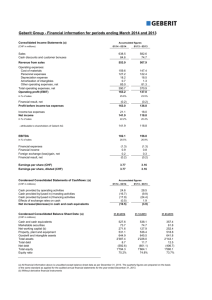

Annual Report eport

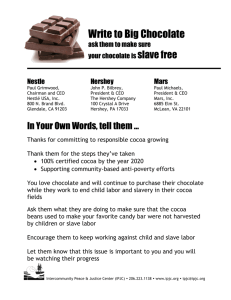

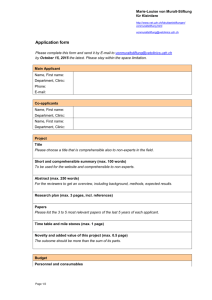

advertisement