The Fantastic Company AG Group Annual Report 2013

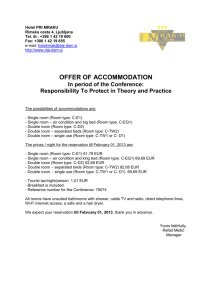

advertisement