Upstart Siluria Technologies Turns Shale Gas Into Plastics And

advertisement

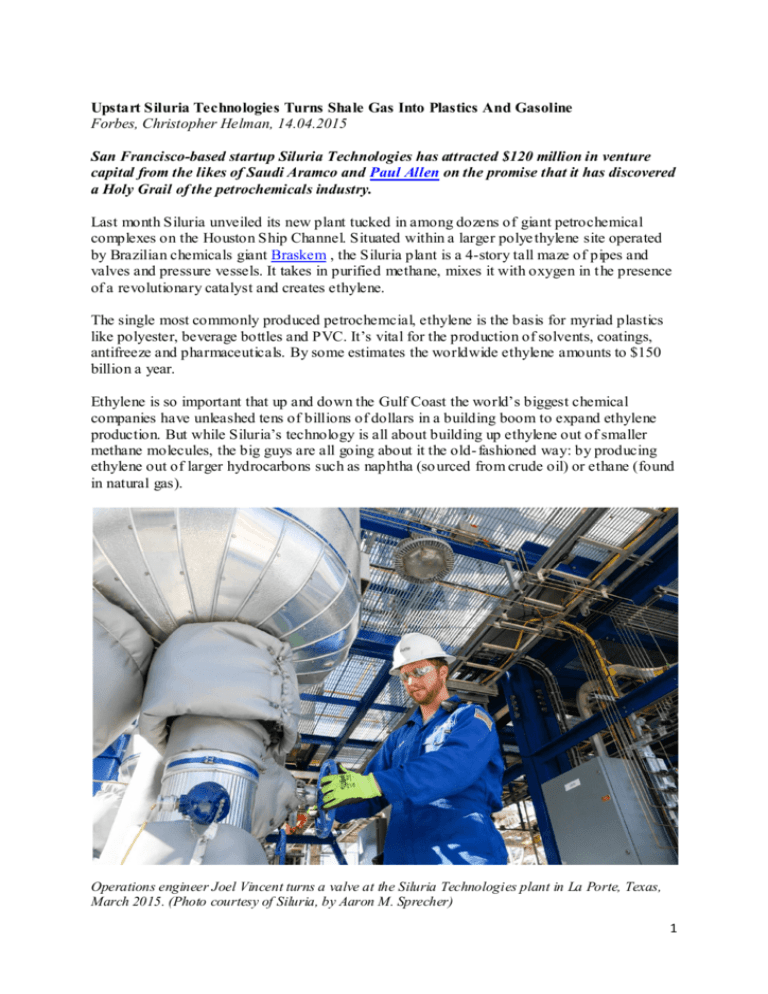

Upstart Siluria Technologies Turns Shale Gas Into Plastics And Gasoline Forbes, Christopher Helman, 14.04.2015 San Francisco-based startup Siluria Technologies has attracted $120 million in venture capital from the likes of Saudi Aramco and Paul Allen on the promise that it has discovered a Holy Grail of the petrochemicals industry. Last month Siluria unveiled its new plant tucked in among dozens of giant petrochemical complexes on the Houston Ship Channel. Situated within a larger polye thylene site operated by Brazilian chemicals giant Braskem , the Siluria plant is a 4-story tall maze of pipes and valves and pressure vessels. It takes in purified methane, mixes it with oxygen in t he presence of a revolutionary catalyst and creates ethylene. The single most commonly produced petrochemcial, ethylene is the basis for myriad plastics like polyester, beverage bottles and PVC. It’s vital for the production of solvents, coatings, antifreeze and pharmaceuticals. By some estimates the worldwide ethylene amounts to $150 billion a year. Ethylene is so important that up and down the Gulf Coast the world’s biggest chemical companies have unleashed tens of billions of dollars in a building boom to expand ethylene production. But while Siluria’s technology is all about building up ethylene out of smaller methane molecules, the big guys are all going about it the old- fashioned way: by producing ethylene out of larger hydrocarbons such as naphtha (so urced from crude oil) or ethane (found in natural gas). Operations engineer Joel Vincent turns a valve at the Siluria Technologies plant in La Porte, Texas, March 2015. (Photo courtesy of Siluria, by Aaron M. Sprecher) 1 ChevronPhillips Chemical Company is investing $6 billion to build an ethane cracker. Near Lake Charles, Sasol is spending $8 billion on an ethane cracker and six chemical plants. OxyChem is building its own billion-dollar cracker in Ingleside. ExxonMobil is constructing one at Baytown. Why does the world even need a new way to make ethylene when the old way is good enough to attract so much investment? Because Siluria thinks its process, called the oxidative coupling of methane, can do it cheaper. That’s mainly because methane is the cheapest, most plentiful part of the natural gas stream. At about $3 per mmBTU, you can spend just $20 to get the same amount of energy content in methane as there is in a barrel of oil — which even at current low prices costs more than twice as much. And also because there are massive supplies of “stranded” natural gas far from petrochemical centers like the Gulf Coast — gas that in places like the Bakken shale too often just gets flared off because the costs of building out pipelines and processing plants is prohibitively expensive. Gas-rich Qatar has invested more than $50 billion in the past decade trying to squeeze more value out of its methane — both by chilling it to -260 degrees and exporting it as LNG as well as by backing the construction of enormous gas-to-liquids plants. Royal Dutch Shell built the $20 billion Pearl GTL plant in Qatar, while Sasol constructed the smaller Oryx plant. Both utilize the 90-year-old Fischer-Tropsch Process to turn natural gas into a whole bucket of products including waxes, lubes, super-clean diesel and jet fuel. Sasol, which perfected its F-T technique in South Africa turning coal into fuels, announced in 2012 that it would build a $10 billion gas-to- liquids plant in Louisiana, but shelved the plans last year after deciding it would cost too much. Siluria could some day be a more economically viable alternative. “Anywhere you’re making a bunch of methane, you’ll have synergies with our technology,” says CEO Ed Dineen. “And it’s a better alternative than LNG for moving gas long distances.” Dineen claims that with oil prices at $50 a barrel, the Fischer-Tropsch process “just doesn’t make money,” whereas Siluria’s tech should be able to generate a 40% rate of return even with oil at $40 a barrel, and a 100% return at $90 a barrel. That could upend the business plan for the likes of Cheniere Energy LNG +0.55%, which has already invested more than $10 billion building out new natural gas liquefaction plants that next year will begin exporting American shale gas to the world. To be sure, Siluria is far away from displacing the old ways of making ethylene, let alone supplanting LNG or even Fischer-Tropsch. The new plant — financed in large part by a recent $30 million equity injection by Saudi Aramco Venture Partners — is capable only of making a ton of ethylene a day. Compare that with the 4,000 tons per day or mor e that those world-scale plants under construction will churn out. And Siluria won’t even be selling the output from its plant, because the volumes aren’t big enough to justify the expense of adding in all the ethylene purification equipment. “Data is the main product,” says Dineen. 2 Right now, Siluria’s engineers are working to replicate in the new plant all the experiments and results from their pilot plant near San Francisco. That’s where they concocted the secret sauce of their process: the catalyst. Catalysts are substances that increase the rate of chemical reactions without reacting themselves. They are vital to virtually every industrial chemical process, especially those that crack ethane or naphtha into ethylene. For decades engineers had tinkered with catalysts that could help couple together oxygen and methane to make ethylene by enabling the chemical reaction to occur at a low enough temperature that the methane wouldn’t simply get burned off. Another challenge is getting the reaction to stop with ethylene rather than continuing on to yield nothing but carbon dioxide and water. CEO Dineen used to work at ARCO (since acquired by BP ) as part of a team that tried and failed in the 1990s to perfect the process. Siluria’s head engineer Greg Kohler is also exARCO as well as the former head of global engineering at Lyondell-Basell. Kohler says the best catalysts they came up with at ARCO only lasted a day. When they talk to former colleagues, “they are surprised we’ve cracked this nut,” says Kohler. You get the same story from Clinton Bybee, managing director of Arch Venture Partners and a co-founder of Siluria in 2009. Early on in Siluria’s history Bybee was talking their catalyst breakthrough with a senior exec of an engineering company. “His response was, ‘That’s not possible; I’ve had a team working on this for a decade.’ But now they’re one of our commercial partners.” The catalyst breakthrough originated in the M.I.T. and University of Texas laboratories of Angela Belcher. She had no background at all in catalysts, but was fascinated by how molluscs like the abalone had evolved the ability to create proteins that selectively binded with inorganic minerals dissolved in seawater to help form amazingly strong shells. Wondering how humans could somehow mimic that miraculous manufacturing process, Belcher discovered that some bacteriophages — viruses that infect bacteria — also had a tendency to attach themselves to inorganic materials. She placed viruses in a solution with a variety of materials. She found one that liked to grab onto cobalt oxide. Another that preferred carbon nanotubes. To make more of these viruses, she simply gave them a bunch of bacteria to infect so they could reproduce. Belcher found that if she put enough such viruses together with sufficient material to grab onto, they would assemble the material into long strings, dubbed nanowires. The application to catalysis wasn’t obvious when Bybee and Arch licensed Belcher’s technology from M.I.T. and the University of Texas. “It was good at making nanostructures that you couldn’t make in any other way,” says Bybee, who first leveraged the tech to launch a company called Cambrios, which uses it to make a silver nanowire “ink” solution now used in electronic touch screens and “e-paper.” It turns out these virus-assembled nanowires are a big help in building catalysts because ounce for ounce they provide so much more surface area for reactions to occur. “A lot of chemistry happens in that catalyst,” says Dineen. 3 To further perfect their catalyst, Siluria’s engineers have emp loyed the kind of highthroughput testing utilized in pharmaceutical discovery to so far test 70,000 unique formulations. Dineen explains that the catalyst they now use is “not some exotic metal” but is a modified form of the mineral zeolite. “The art is more in the nanowire construction, and the doping with other elements.” So where does Siluria go from here? Proving that they can turn methane into ethylene at commercial scale is just the first step. At their pilot plant in Menlo Park they have also devised a catalyst to enable the next step in their process: turning that ethylene into gasoline. Siluria has already partnered with gas-engineering giant Linde Group to partner on designing and marketing a package using Siluria’s tech. Their initial targets are companies in the gasprocessing industry, which have been busy building plants to handle the output from giant shale gas fields like the Marcellus and Haynesville. Dineen predicts that within months they will have convinced some deep pocketed partners to license Siluria technology for use in a world-scale plant. Both Dineen and Bybee, of Arch (which owns 17% of the company) say their objective is to IPO Siluria, hopefully before the end of 2016. Other investors include billionaires Paul Allen’s Vulcan Capital, Kleiner, Perkins, Caulfield & Byers and The Wellcome Trust. Bybee is confident that that Siluria will not meet the same fate of so many flaky green energy companies that have tried and failed to with woefully uneconomic approaches for making lackluster fuels. “This is different from turning corn stover into ethanol,” Bybee says. “This is not a cleantech company. We are bringing a capability to use methane for something other than just burning it in a power plant.” F 4