to view our STEP document. - Gambit Corporate Finance LLP

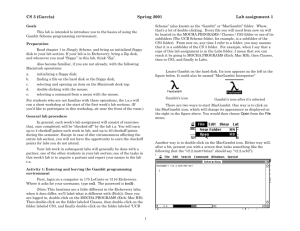

advertisement

For all business owners, it is important to address structural and continuity issues affecting the business’ future. Succession is the most arduous and critical challenge a business owner will face but can also be a great chance to maximise opportunities and create a multi-generational institution that sees continuity of the founder’s mission and values after his reign. Gambit Corporate Finance specialises in advising SMEs on matters relating to succession and is widely recognised as a market leader for corporate finance advisory services. Taking into consideration the company’s circumstances, the specific requirements of the individual shareholders, and the interests of both management and staff, we will fully explore all available options and then recommend the best possible exit strategy, including timing and grooming, with a view to maximising shareholder value. Our succession planning product STEP offers a carefully tailored review of the various exit options available to shareholders including refinancing, management buyouts and buy-ins, a total or partial trade sale, or flotation. Gambit assists family and closely held businesses in multi-generational planning by helping them address issues related to, not only the ownership succession, but management succession planning and leadership development as well. We would welcome the opportunity to meet with you in order to understand more about your plans, to discuss your strategic goals and objectives for the company and to explore areas in which Gambit could work with you to realise these. Please contact: “I had built the business up from a humble start in the back bedroom to having a head office in South Wales and subsidiaries in Australia, America and the UAE. My daughter was a shareholder with no aspiration to take the business forward and I had one chance of realising the family’s investment. Gambit provided us with excellent advice and guided us through the whole process with an international acquirer assisting with the collation of information, negotiating the transaction and supporting me with the emotional issues attached to the transition. I highly recommend Gambit not only for their technical knowledge in handling transactions but their commercial focus and approachability.” David Mitchell, Former Managing Director, Scafftag Limited “Gambit advised and assisted me in the transfer of my shares in Oakwood Theme Park, a business I had founded, to my brother, when I decided to concentrate on creating Bluestone, a new generation holiday village. The firm was instrumental in sourcing, negotiating and securing all financial aspects of the £110 million project with both private and public sectors. Gambit’s involvement with Bluestone over an eight year period is testament to their loyalty, tenacity and professionalism – they are a great team.” William McNamara, Chief Executive, Bluestone Resorts Limited “We were enjoying significant growth at a time of unprecedented sector consolidation by national competitors. Having reviewed the options with Gambit, we decided to sell the business. The firm’s extensive knowledge of the sector allowed them to create a highly competitive process and within a very tight timescale, they achieved a price which significantly exceeded our expectations.” Paul Ragan, Former Managing Director, ProtectaGroup “The business was offered to management to enable them to undertake a buy-out but they were unsuccessful in fundraising. That was when we got Gambit involved who found trade buyers and through a competitive process achieved a fantastic outcome.” Alan Rose, Founder & Former Managing Director, Hedges & Rose “We were undecided about committing to investing and growing the Company to take it to the next stage of development or to embark on a sales process. We had been approached but the potential purchaser had been slow to proceed and momentum had been lost. We brought in Gambit who examined the situation and persuaded us to go wider into the market to assess interest and to generate a competitive process. The timing and outcome of the sale was a great result for all stakeholders.” Bob Honey, Former Managing Director, Milbury Systems Limited “I feel daunted by the whole process of change of ownership of my business. Should I be?” “How do I go about putting value on a business?” Cardiff Office: Frank Holmes Tel: 029 2047 5500 Mobile: 07768 255194 Email: jfrank.holmes@gambitcf.com Birmingham Office: Adrian Jones Tel: 0121 262 4062 Mobile: 07899 905614 Email: adrian.jones@gambitcf.com “How long do I need to prepare for a change in ownership?” 3 Assembly Square, Britannia Quay, Cardiff Bay, Cardiff CF10 4PL Tel: +44 (0) 29 2047 5500 Fax: +44 (0) 29 2047 5501 Colmore Plaza, 20 Colmore Circus, Birmingham B4 6AT Tel: +44 (0) 121 262 4060 Fax: +44 (0) 121 262 4061 Email: info@gambitcf.com Web: www.gambitcf.com “How can I maximise the value of my business?” 1 What do we want them to think & do? Think 7 9 Do goals & targets 2 Aspirations? Personal: Financial: Timetable: 10 How should we involve the Stakeholders? planning 8 communication who are you? The Business: 3 What are the positives & negatives of doing something & doing nothing? Value Maximisation Business Assessment Doing Something + Valuation / Financial Analyses What do they currently think & do? Action: By Who: – By When: Think actions Do Doing Nothing + Key Stakeholders? 5 stakeholders 6 Likelihood of success? 4 Succession Route – What is the preferred option? – © Gambit Corporate Finance LLP