Failures to Deliver, Short Sale Constraints, and Market Returns

advertisement

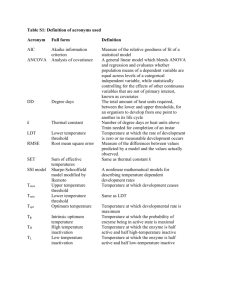

This article is forthcoming in The Financial Review. Failures to Deliver, Short Sale Constraints, and Stock Overvaluation Don M. Autorea, Thomas J. Boultonb,*, Marcus V. Braga-Alvesc a College of Business, Florida State University, Tallahassee, FL 32306, USA b Farmer School of Business, Miami University, Oxford, OH 45056, USA c College of Business Administration, The University of Akron, Akron, OH 44325, USA November 2014 Abstract Studying a large sample of publicly available data on failures to deliver, we find that stocks reaching threshold levels of failures become significantly overvalued. Where short sale constraints are especially binding, we report extreme overpricing and subsequent reversals. These findings support the overvaluation hypothesis, although the mispricing is likely to be difficult to arbitrage because of extreme shorting costs. In addition, threshold stocks with low short interest become more overvalued than threshold stocks with high short interest. This suggests that the short interest reflects supply-side effects when the examination conditions on the difficulty of borrowing shares. Running Head: Failures to deliver, short sale constraints, stock overvaluation JEL classification: D02; G14; G28 Keywords: Failures to deliver; short interest; institutional ownership; short sale constraints; stock returns * Contact author: Thomas Boulton; 3013 Farmer School of Business, Miami University, Oxford, Ohio 45056; Phone: +1.513.529.1563; Email: boultotj@miamioh.edu. The authors thank Robert Van Ness (editor), two anonymous reviewers, Matteo Arena, Robert Batallio, Leslie Boni, Brandon Carl, Jerry Dwyer, Larry Harris, Zsuzsa Réka Huszár, Terry Nixon, Sarah Peck, Adam Reed, Andrei Shleifer, Sorin Sorescu, James Upson, Steve Wyatt, Chad Zutter, and seminar participants at the American Finance Association Meetings (Chicago), Federal Reserve Bank of Atlanta, Financial Management Association Meetings (New York), Miami University, Midwest Finance Association Meetings (Chicago), and the University of Kansas for valuable comments. Financial support for this project was provided by the Florida State University College of Business. Any remaining errors or omissions remain the responsibility of the authors. 1. Introduction Short sale constraints can result in overpriced securities in the presence of investor heterogeneity (Harrison and Kreps, 1978; Duffie, Garleanu, and Pedersen, 2002) or less than fully rational investors (Miller, 1977; Scheinkman and Xiong, 2003). Studies often test the overvaluation hypothesis by identifying a sample of short sale constrained stocks and examining subsequent stock returns. For example, stocks with high short interest or low institutional ownership tend to experience negative future returns.1 Boehme, Danielsen, and Sorescu (2006) find that underperformance is especially severe for stocks with both binding short sale constraints and wide dispersion of opinion. Chang, Cheng, and Yu (2007) report that stocks that become eligible for shorting exhibit poor future stock performance. There is less attention paid to the predicted abnormal increases in stock prices when constraints are tightening. Jones and Lamont (2002) is one exception. They study loan crowd entrants during the 1920s and 1930s, a period in which New York Stock Exchange (NYSE) stocks entered a centralized loan list when shorting demand could not be met through traditional channels. They find that market-to-book ratios increase dramatically leading up to a stock’s entrance onto the loan list, peak at the point of entrance, and subsequently fall as the overvaluation subsides. The absence of additional studies that take a dynamic view of short sale constraints is arguably due to the fact that modern U.S. data provide limited opportunity to examine large samples of well-defined, firm-specific events that capture the tightening and subsequent easing of short sale constraints. A notable exception is the threshold lists of excessive failures to deliver 1 See, for example, Asquith and Meulbroek (1995), Desai, Thiagarajan, and Balachandran (2002), and Diether, Lee, and Werner (2009) for evidence on short interest and Asquith, Pathak, and Ritter (2005) and Nagel (2005) regarding institutional ownership. 1 released daily by the three major exchanges. Since 2005, securities with aggregate open failures to deliver equal to, or greater than, 10,000 shares and 0.5% of the total shares outstanding for 5 consecutive settlement days appear on their exchange’s daily threshold list. The exchanges’ threshold files enable us to identify both the addition date and the subsequent removal date for each threshold security. Evans, Geczy, Musto, and Reed (2009) suggest that the advent of threshold events “has the potential to alter the cost of short exposure, so its impact is an important new empirical question.” In this study, we conduct an empirical investigation of threshold events. Unlike proprietary data on loan fees, which are usually restricted to a particular lender who represents a fraction of the equity lending market, fails data is publicly available for all exchange-listed stocks which makes every listed firm a potential candidate for sample inclusion. This breadth of coverage, along with the identification of additions as well as removals, facilitates a more comprehensive and dynamic analysis of shorting constraints than is possible in prior studies that use proprietary data on loan fees to isolate the effects of shorting supply or shorting demand (e.g., Geczy, Musto, and Reed, 2002; Ofek, Richardson, and Whitelaw, 2004; Cohen, Diether, and Malloy, 2007; Engelberg, Sasseville, and Williams, 2012). Boni (2006) and Evans, Geczy, Musto, and Reed (2009) argue that failures tend to occur when an investor who short sells a stock does not borrow shares in time for settlement, and further that failures are more likely to occur in hard-to-borrow stocks that have high loan fees, reflecting the presence of binding supply-side short sale constraints. Following this logic that failures reflect short sale constraints, we argue that failures to deliver, and threshold events that reflect excessive failures, provide a unique opportunity to test for price appreciation when short sale constraints are tightening and test for price declines when constraints are easing. 2 Consistent with the overvaluation hypothesis, we report positive abnormal stock returns around threshold additions and negative abnormal returns when firms are removed from the threshold lists. We observe comparable patterns in abnormal returns when we match each threshold stock with a non-threshold stock that has similar levels of short interest and institutional ownership. This implies that threshold listings reveal information about the binding nature of short sale constraints that is not captured by short interest or institutional ownership. If failures to deliver capture the extent to which short sale constraints bind, then stocks with fails significantly above the minimum threshold listing requirement are expected to be more overvalued than stocks with fails that minimally meet the threshold listing requirement. This is indeed the case, as abnormal returns around threshold additions (removals) are three times larger (five times smaller) for threshold stocks in the highest quartile of fails than for stocks in the lowest quartile of fails. These findings suggest that threshold stocks are short sale constrained and become overpriced, and the extent of the overpricing is directly related to the level of fails. Also consistent with our assertion that fails reflect binding constraints, we find that option volume increases substantially around threshold additions, especially when fails are highest. Finer parsing of the data reveals that certain subsets of threshold stocks with tightly binding constraints exhibit extreme overpricing around threshold listings. For example, stocks that are in the highest quartile of fails and the lowest quartile of institutional ownership (indicating a limited supply of lendable shares) experience positive abnormal returns of 31.6% in the [–7, +5] addition window and negative abnormal returns of –21.6% in the [–4, +50] removal window. Similarly, stocks in the highest quartile of fails and the highest quartile of idiosyncratic volatility (reflecting high dispersion of opinion) are associated with abnormal returns of 26.2% and –13.4% in the same addition and removal windows. Since shorting these subsets of stocks is 3 very difficult, the extreme returns do not necessarily imply exploitable arbitrage opportunities. The excessive overpricing seems to be consistent with the prediction of Duffie, Garleanu, and Pedersen (2002) that close to completely binding short sale constraints could lead to greater overvaluation than complete short sale bans because expected lending fees may push the initial price of a security above the most optimistic buyer’s valuation. Our examination of threshold securities also provides insights about the impact of short interest on stock returns. Several studies find that high short interest predicts low future returns (e.g., Figlewski, 1981; Asquith and Meulbroek, 1995; Desai, Thiagarajan, and Balachandran, 2002; Boehmer, Jones, and Zhang, 2008). One explanation is that high short interest reflects binding short sale constraints, which cause overvaluation and poor future returns.2 However, the absence of short interest could also indicate that stocks are too difficult or costly to borrow, potentially explaining why studies that use short interest as a proxy for short sale constraints sometimes provide mixed evidence regarding the overvaluation hypothesis (Chen, Hong, and Stein, 2002). Thus, it is not clear that high short interest is a good measure of binding constraints. One reason for this discrepancy is that short interest reflects the intersection of supply and demand and can be influenced from either side. For example, using proprietary data, D’Avolio (2002) finds a U-shaped relation between short interest and the probability of being special, where both low and high short interest are associated with higher probabilities of being special as compared to average short interest.3 2 An opposing view is that short sale constraints do not lead to upwardly biased prices but reduce the informativeness of equity prices by reducing the speed of adjustment to private information (e.g., Diamond and Verrecchia, 1987). 3 Specials are stocks with negative rebate rates, that is, loan fees in excess of the risk-free rate, indicating high borrowing costs and more binding short sale constraints. 4 By examining threshold events, we are conditioning on supply side effects in that the entire sample consists of hard-to-borrow stocks. We find that, in relation to stocks with high short interest, stocks with low short interest exhibit greater overvaluation around threshold listings. A likely reason is that low short interest signals greater difficulty in borrowing shares, which is indicative of more binding constraints and leads to greater overvaluation. This is consistent with the view that high short interest dampens the price inflation that occurs around threshold events, and more generally that short selling contributes to pricing efficiency by preventing stocks from becoming too overvalued. An alternative interpretation of the finding that low short interest is associated with greater overvaluation around threshold listings is that short sellers are informed traders who can detect which stocks will become most overvalued and avoid these stocks. The results underscore the importance of conditioning on the difficulty of borrowing shares when assessing the impact of short interest. Finally, we examine the extent to which failures to deliver are related to future stock returns. If fails reflect the binding nature of shorting constraints, we expect that higher fails are positively related to overvaluation, predicting poorer future stock performance. Each month, we sort firms by the number of fails as a percentage of shares outstanding and calculate abnormal returns over the subsequent 12 months. We find that stocks in the top quartile of fails experience abnormal returns of approximately –1% per month during the following 12 months. By contrast, stocks in the bottom quartile of fails are associated with abnormal returns that are close to zero over the following 12 months. This finding provides further evidence in support of the overvaluation hypothesis and is particularly interesting in light of a recent study by Boehme, Danielsen, and Sorescu (2006), which finds that both conditions of the overvaluation hypothesis (i.e., binding short sale constraints and high dispersion of opinion) are required to provide 5 evidence of poor subsequent stock returns. The authors of that study note that “more aggressive parsing of the data may eventually reveal a subset of firms that are even more overpriced, and continued refinement of proxy construction by others may allow for better identification of firms with the requisite combination of overvaluation factors.” Our results suggest that fails are the most appropriate publicly available variable to assess the extent to which short sale constraints are binding and lead us to encourage other researchers to consider fails as a proxy for short sale constraints. The results have important policy implications in light of recent regulatory actions that make it more difficult for investors to fail. For example, on September 17, 2008 the SEC issued an Emergency Order prohibiting naked short sales for all securities under their jurisdiction.4,5 This regulation resulted in a sudden and significant decline in the number of securities on the threshold lists during the final months of our sample period. More recently, on July 27, 2009, the SEC made permanent Rule 204T of Regulation SHO, requiring broker-dealers to close-out fail positions resulting from a short sale by the beginning of the trading day immediately following the day on which the fail occurs. Our findings suggest that fails often represent short positions in stocks that are hard to borrow, and thus the SEC’s recent efforts to eliminate fails could lead to greater overpricing as investors are forced to either borrow costly shares or forgo short selling stocks that are too costly to borrow. 2. Failures to deliver: Background and sample of threshold events 4 Securities and Exchange Commission, Release No. 34-58572/ September 17, 2008. Select recent papers that analyze short selling during the recent financial crisis include Autore, Billingsley, and Kovacs (2011), Bailey and Zheng (2013), Battalio and Schultz (2011), Boehmer, Jones, and Zhang (2013), Boulton and Braga-Alves (2010), Gagnon and Witmer (2010), Harris, Namvar, and Phillips (2013), and Kolasinski, Reed, and Thornock (2013). 5 6 2.1. Failures to deliver and threshold events A fail occurs when a seller does not deliver securities to the buyer within the standard three-day settlement period. Fails occur for a number of reasons, including processing errors, delays in delivering securities held in certificate form, and naked short selling. In a naked short sale, a fail results if the seller does not obtain the shares necessary to make delivery within the three-day settlement period. Beginning in 2005 with Regulation SHO, securities with aggregate open fails equal to, or greater than, 10,000 shares and 0.5% of the total shares outstanding for 5 consecutive settlement days appear on their exchange’s daily threshold list.6,7 A sequence of events leads to a failure to deliver, subsequent threshold status, and the eventual removal of a security from the threshold list. Considering a firm’s appearance on a threshold list as the event day (day t), the transactions that push a firm above the threshold level of fails occur on day t-7. Trades that take place on day t-7 are expected to settle on day t-4, otherwise a fail occurs. If fails that initially occur on day t-4 result in threshold levels of fails that persist for 5 consecutive trading days, the security appears on the threshold list on day t. Securities are removed from the threshold lists when the aggregate level of open fails drops below threshold levels for 5 consecutive trading days. Therefore, day t+5 is the first day that a security can be removed. During our sample period, broker-dealers were required to close-out fail positions that persist for 13 consecutive trading days during which a security is on the threshold lists. 6 Regulation SHO was adopted in 2005 by the SEC to update short sale regulation. Regulation SHO included new borrowing and delivery requirements on short-sellers to “address problems associated with failures to deliver, including potentially abusive naked short selling”. 7 A small but growing literature examines threshold events and failures to deliver. For example, Boulton and BragaAlves (2012) study threshold listings for information on naked short sellers’ trading strategies, profitability, and the market’s reaction to information about their trades. Diether and Werner (2009) use threshold listings to study contrarian short selling strategies. Prado (2011) studies failures in closed-end funds to test the conjecture that the prospect of high lending profits can push stock prices up. 7 In Figure 1, we report the daily number of securities appearing on the Amex, NASDAQ, and NYSE threshold lists from 2005 through 2008. The average daily number of threshold securities reported by the Amex, NASDAQ, and NYSE are 60, 228, and 66, respectively. The higher number of fails reported by NASDAQ, a dealer market, is expected since market makers can short without first locating the shares to borrow as part of their bona fide market making activity. The broad trend over the sample period is a gradual increase in the number of threshold securities. A temporary pause in the upward trend occurred in August 2007, when the SEC announced the elimination of a grandfather exception that exempted failure to deliver positions established before a security reached threshold levels from the mandatory close-out requirement. On September 17, 2008 the SEC issued an Emergency Order prohibiting naked short sales for all securities under their jurisdiction.8 This regulation resulted in a sudden and significant decline in the number of securities on the threshold lists during the final months of our sample period. 2.2. Threshold events: Sample selection and event identification We use the threshold lists provided by the exchanges to identify our sample events between January 7, 2005 and December 31, 2008.9,10 Firms move on and off the threshold lists with great regularity. To capture informative events, we calculate the time between appearances on the threshold lists and define an event as a firm’s first appearance on the threshold lists or a reappearance after an absence of at least 30-days. We impose this 30-day restriction to be sure that a stock’s removal from the threshold lists is not due to mandatory close-out requirements. If 8 Securities and Exchange Commission, Release No. 34-58572/ September 17, 2008. Threshold lists are available through the following websites: Amex (http://www.amex.com/amextrader/tradingData/RegSHO/TrDa_RegSHO.jsp), Nasdaq (ftp://ftp.nasdaqtrader.com/symboldirectory/regsho), and NYSE (http://www.nyse.com/regulation/nyse/Threshold_Securities.shtml). 10 In light of the financial crisis of 2008, in unreported tests we verify the robustness of our results to sample periods ending December 31, 2007 and June 30, 2008. These tests produce qualitatively similar results. 9 8 a stock is off the list for 30 days, it is more likely that the removal is due to easing constraints rather than forced close-out requirements. We restrict the sample to ordinary common stocks covered by CRSP and exclude stocks with a share price less than $5 as of the threshold listing date to alleviate concerns about bid-ask bounce.11 Table 1 reports summary statistics for stocks that appear on the threshold lists. Of the 2,279 events we identify, nearly 45% (1,023) represent the first time a stock appears on the threshold lists. For the firms that reappear after an absence of at least 30 days, the average absence is 177 calendar days. The average firm remains on the threshold lists for slightly more than 22 days before being removed.12 The typical stock has fails equal to 1.3% of total shares outstanding as of the event date, a relatively high short interest equal to 14.4% of public float in the month prior to the event, a somewhat low value of institutional ownership equaling 42.7% of total shares outstanding as of the end of the quarter immediately preceding the event date, 13 and a market capitalization of approximately $570 million as of day t-11.14 We also report a measure of dispersion of investor opinions, sigma, which we define similar to Boehme, Danielsen, and Sorescu (2006) as the residual standard deviation from the market model, estimated over the 100 trading days prior to the threshold event.15 The sample mean value of sigma is 3.6%. 11 In tests not reported in detail, we minimize the influence of recent IPO firms by excluding ordinary common stocks from our sample that appeared in the CRSP database within 90 days (and 180 days) of the threshold event. We find that very few events occur within 90 or 180 days of a security’s first appearance in the CRSP database. When we exclude these events, our results are similar to those reported in the paper. 12 We delete events that last fewer than 5 days. Discussions with representatives at FINRA and NASD indicate that events lasting fewer than 5 days are most likely reporting errors. Robustness tests indicate that our results are unaffected by this filter. 13 We set observations with institutional ownership as a percentage of shares outstanding greater than 100% to missing. The results are qualitatively unchanged when values greater than 100% are (a) not adjusted and (b) set equal to 100%. 14 We acquire short sale data from Shortsqueeze.com and institutional ownership data from Thomson Institutional Holdings. 15 In an analysis not displayed in a table, we use share turnover as an alternative measure of dispersion. Turnover equals the average daily trading volume divided by total shares outstanding during the 100 trading days prior to the threshold event. The results are consistent with those we report for sigma. 9 While the typical stay on the threshold lists is about 22 days, about 54% of threshold listings last for 10 or fewer days, and the sample median is 9 days. The most common duration is 5 days, which corresponds to the minimum duration based on the SEC’s criteria for being removed from the threshold lists. Extended stays are less common as about 8.5% of threshold events last longer than 50 days. 3. Empirical results: Threshold events 3.1. Threshold events, fails, and the overvaluation hypothesis We calculate daily abnormal stock returns around threshold events using the market model estimated over the 255 trading days ending at least 46 days before the event. The market proxy is the CRSP equally weighted portfolio. We calculate cumulative abnormal returns (CARs) around threshold events by summing daily abnormal returns. Table 2 reports CARs around threshold additions and removals. The left side of each panel examines threshold additions in event windows that begin up to 20 days before and end up to 5 days after the threshold listing. Day t = 0 is the day that a firm first appears on the threshold lists or reappears after an absence of at least 30 days. The right side of each panel reports CARs around threshold removals, with event windows that begin 4 days before and end up to 50 days after the threshold removal. For these event windows, day t = 0 is the last day that a firm appears on the threshold lists. We first examine threshold additions. Panel A reports that mean and median market model CARs are positive and economically and statistically significant for each of the return windows. Mean (median) CARs range from 3.9% to 5.6% (1.2% to 2.5%). The [–7, +5] window is a particularly intuitive choice because excessive fails resulting from trades executed on day t-7 10 push a stock onto the threshold list on day t, where the stock remains for at least 5 days. During this window, mean (median) CARs are 4.7% (2.1%). The reported p-values from t-tests and Wilcoxon rank sum tests are always less than 0.001. The evidence that threshold additions are associated with abnormally high stock returns is consistent with the overvaluation hypothesis and supports the notion that threshold stocks are short sale constrained. According to our hypothesis, the degree of overvaluation should depend on the extent of fails. In particular, we should expect relatively less overvaluation for stocks that minimally meet the threshold list requirement and more overvaluation for stocks with fails substantially above the minimum threshold requirement. Panel B partitions the sample into quartiles based on fails as a percentage of shares outstanding. The quartile cutoffs are 0.66%, 0.87%, and 1.38%. Quartile 4 represents the highest quartile of fails. Consistent with the notion that the level of fails is positively correlated with the degree of short sale constraints, stocks in the highest quartile of fails exhibit the highest abnormal returns around threshold additions. In quartile 4, mean CARs range from 9.8% to 12.3%, but in quartiles 1 through 3 CARs are never higher than 4.0%. The last two rows in Panel B report the difference between the highest and lowest quartiles and the p-value (in parentheses) from a t-test of the difference. Differences range from 7.1 to 9.1 percentage points and are always statistically significant at the 1% level. Thus, threshold additions are associated with especially high abnormal stock returns when the level of fails is high. Turning to threshold removals, the final six columns in Panel A of Table 2 indicate that mean and median CARs in the days around removals are always negative and statistically significant. Mean CARs take values between –0.3% and –3.4%, whereas median CARs are between –0.3% and –1.3%. The decline in abnormal valuation occurs primarily after the firm is removed from the list. For example, over the [–4, +50] window, mean CARs are –3.4%. This is 11 consistent with the hypothesis that threshold removals represent easing short sale constraints that result in declines in abnormal valuation. Panel B provides some evidence that CARs around removals are significantly lower for firms in the top quartile of fails when compared to firms in the bottom quartile. In the [–4, +50] window CARs are 5.1 percentage points lower for firms in the top quartile of fails compared to firms in the bottom quartile of fails. Together, the evidence is consistent with the overvaluation hypothesis. We conduct a number of robustness tests (not shown in a table) to validate the figures reported in Table 2. First, we repeat the analysis using CARs that are calculated by matching each threshold stock with a comparable stock that is not on the threshold lists and has not appeared on the lists in the previous three months. Stocks are matched based on often-used measures of short sale constraints, namely, institutional ownership as a percentage of shares outstanding in the quarter prior to threshold listing and short interest as a percentage of public float in the month prior to listing. The results are similar to those reported in both statistical and economic terms. This evidence indicates that threshold events provide information about the tightening or easing of short sale constraints that is not observable via commonly used public proxies for short sale constraints. Second, for a little more than half of our sample events, there are 10 or fewer trading days between the threshold addition and removal dates. In these instances, the addition and removal event windows overlap and therefore CARs around removals are contaminated by CARs around additions, and vice versa. This contamination should, if anything, weaken our findings. For robustness, we conduct the tests reported in Table 2 using only the subsample of events that have more than 10 trading days between the addition and removal dates. The results are not tabulated, but provide further support for the overvaluation hypothesis. 12 Finally, a potential concern is that the timing of threshold events corresponds to the timing of corporate news events that are known to be associated with increased short selling. Of particular concern is the effect of earnings releases, which are associated with high shorting activity (Christophe, Ferri, and Angel, 2004). To address this concern, we verify the robustness of the results for a sample that excludes all threshold events that occur within five days of an earnings release. The results of these tests are not tabulated, but are virtually identical to those reported for the full sample. 3.2. The impact of short interest, institutional ownership, and dispersion of opinion Prior research finds that other measures of short sale constraints are associated with overvaluation. We hypothesize that, conditioning on threshold listings, stocks that have high fails combined with another indication of binding constraints experience the most overvaluation and largest subsequent price reversals. To test this conjecture, in Table 3 we report CARs around threshold additions and removals within two-way quartile sorts of fails as a percentage of shares outstanding and each of the following variables: short interest, institutional ownership, and dispersion of opinion. 3.2.1. Short interest Short interest is frequently used to proxy for short sale constraints, although this variable could reflect supply-side effects as well as demand. In the case of threshold stocks, in which borrowing is difficult, the supply-side effects are more likely to dominate. Table 3, Panel A reports CARs for two-way independent sorts of fails as a percentage of shares outstanding and short interest over the event windows [–7, +5] around additions and [–4, 13 +50] around removals.16 The short interest ratio is defined as the short interest in the month prior to the event divided by the total public float. The quartile cutoffs are 1.70%, 11.39%, and 22.49%, respectively. By conditioning on fails for threshold stocks, in which borrowing is difficult, we are able to provide a clearer picture of the supply-side effects of short interest. Three findings stand out. First, the effect of short interest on abnormal returns depends on the level of fails. Conditioning on low fails, stocks with high short interest become the most overvalued during the threshold event. But when fails are high, stocks with low short interest become the most overvalued. This indicates that short interest provides information about supply-side effects, but only when the examination conditions on hard-to-borrow stocks. Second, misvaluation during threshold events is extreme when fails are high and short interest is low. Roughly 8% of threshold stocks are in both the top quartile of fails and bottom quartile of short interest. These stocks experience average abnormal returns of 21.6% around threshold listings, and reversals of –9.2% around threshold removals. When we examine the two groups that have high fails and below median short interest, the reversals are almost as large as the price run-ups. Third, examining the intersection of fails and short interest, we observe a relatively large number of events in the intersection of high fails and low short interest. Consistent with this, we find a significantly negative correlation of –0.08 between fails and short interest. This suggests that, on average, high fails are not caused by heavy shorting activity. Instead, perhaps it is excessively costly to short stocks that have high fails, or maybe short sellers are informed and know to avoid stocks with high fails especially when there is extreme abnormal price appreciation. The latter possibility is consistent with the explanation by Boehmer, Huszár, and Jordan (2010) of their finding that low short interest predicts positive future returns. From either standpoint, the 16 Sequential (dependent) sorts produce qualitatively similar evidence. 14 evidence indicates that greater shorting activity dampens the overvaluation that we observe around threshold events. The findings do not support the argument that threshold stocks with high short interest ratios are most overvalued.17 3.2.2. Institutional ownership D’Avolio (2002) finds that the probability of a stock being special decreases with institutional ownership. Institutional ownership is negatively related to the likelihood of being special because institutional investors serve as a significant source of supply in the stock lending market, making stocks held by institutions less costly to borrow. In Panel B of Table 3, we report CARs for two-way independent sorts of fails and institutional ownership over the event windows [–7, +5] around additions and [–4, +50] around removals. Institutional ownership is measured as the aggregate percentage of shares outstanding held by institutions at the end of the quarter immediately prior to the threshold event. The quartile cutoffs are 17.0%, 39.6%, and 66.7%, respectively. We find that CARs are most extreme when fails are high and institutional ownership is low. In these extreme cases, average abnormal returns are 31.6% around threshold additions and –21.6% around threshold removals. This suggests that overvaluation and subsequent reversals around threshold events are exacerbated for stocks with a low supply of borrowable shares (i.e., low institutional ownership).18 3.2.3. Dispersion of opinion 17 We also examine firms whose short interest levels are moving toward the extremes. Such an analysis could yield a sample of firms that more convincingly represents tightening / easing constraints. We find that securities tend to stay in the same quartile from one month to the next. With this in mind, the average CAR when a security moves from the lowest to the highest quartile of short interest just prior to a threshold listing is 14.1% (N=23). 18 In unreported tests, we find a similar effect if we substitute market capitalization for institutional ownership. 15 Miller (1977) predicts that overpricing due to binding short sale constraints is most pronounced when there is greater dispersion of opinion among investors. D’Avolio (2002) argues that the mechanism for short selling is most constricted when opinions among investors vary the most. We examine the association between dispersion of opinion and CARs around threshold events using our measure of dispersion, sigma. Higher values of sigma are indicative of greater dispersion of opinion. In Table 3, Panel C we find that sigma has a significant impact on CARs around threshold additions and removals. The panel reports CARs for two-way independent sorts on fails and sigma. When fails and sigma are both high, mean CARs over the addition and removal windows are 26.2% and –13.4%, respectively. The extreme price run-up and reversal for high dispersion threshold stocks is consistent with the predictions of Miller (1977) and D’Avolio (2002). The magnitudes we report in Table 3 are large in relation to those reported around the U.S. short sale ban in 2008. These extreme returns are consistent with the prediction of Duffie, Garleanu, and Pedersen (2002) that close to binding short sale constraints (where short selling is still possible) can lead to greater overvaluation than complete short sale bans because potential owners have the prospect of receiving high lending fees. 19 Although threshold listings and fails are public information, arbitraging the large price run-ups and subsequent reversals reported in Table 3 is unlikely because shorting costs are certainly extreme and high idiosyncratic volatility limits the opportunity for arbitrage (Shleifer and Vishny, 1997; Engelberg, Sasseville, and Williams, 2012). 19 The Table 3 results are even more pronounced if we include only events that have more than 10 days between threshold addition and removal. For example, CARs for high fails combined with low institutional ownership increase in magnitude to 49.4% around additions and –33.2% around removals. The respective figures for high fails and high sigma are 39.0% and –27.0%. 16 3.3. Multivariate analysis In Table 4, we report the results of ordinary least square regressions where the dependent variable is the CAR around threshold additions (Panel A) and removals (Panel B). The primary variables of interest are the factors that reflect the degree of short sale constraints: fails as a percentage of shares outstanding, short interest ratio, institutional ownership, and sigma. In the estimations of CARs around additions, we include a binary variable set to one for first-time threshold listings (First time), and zero otherwise, and the natural log of the number of days since the firm last appeared on a threshold list (Absence). When CARs around removals are the focus, we include the natural log of the length of the threshold listing in calendar days (Duration). To control for time effects, we follow Petersen (2009) and report standard errors clustered by event month. Panel A of Table 4 reports estimations that explain threshold additions. For the sake of parsimony, we focus on the [–7, +5] CAR window since fails resulting from transactions executed on date t-7 push the stock onto the threshold list on date t, where it remains for at least 5 days. In Model 1 we include only First time and Absence and report virtually no explanatory power. In Model 2 we expand the baseline model by adding fails as a percentage of shares outstanding. The coefficient of fails is significant at the 5% level, and the adjusted R2 increases to 8.82%. This result is consistent with the hypothesis that fails proxy for short sale constraints and that high fails correspond to greater stock overvaluation. Models 3 and 4 test the incremental effects of short interest and institutional ownership, respectively. In Model 3, the short interest ratio enters negatively, indicating that higher levels of short interest correspond to less overvaluation around threshold additions. The estimate indicates that a one standard deviation 17 decrease in the short interest ratio results in a 1.4% increase in CARs. This finding supports our prior evidence that low short interest corresponds to more binding short sale constraints and greater overvaluation, potentially because there is little short interest in hard-to-borrow stocks. The short interest ratio, however, adds very little additional explanatory power to the estimation of CARs around threshold additions. In Model 4, institutional ownership enters negatively, consistent with previous studies that find a negative relation between institutional ownership and short sale constraints (e.g., Asquith, Pathak, and Ritter, 2005; Nagel, 2005). The estimate indicates that a one standard deviation decrease in institutional ownership is associated with a 1.6% increase in CARs. Nevertheless, the incremental explanatory power of institutional ownership is small. In each model, fails has incremental explanatory power beyond the effect of commonly used measures of constraints. In Model 5, we include sigma and in Model 6 we also add the interaction of sigma and fails. Sigma enters with a highly significantly positive coefficient, indicating that greater dispersion of opinion is associated with higher abnormal returns around threshold listings. The adjusted R2 of 27.59% indicates that sigma has considerable incremental explanatory power. In Model 6 the interaction term also enters significantly positive, indicating that the impact of fails on CARs is especially pronounced when there is greater dispersion of opinion. The inclusion of this interaction term increases the adjusted R2 to over 30%. This result supports Miller’s (1977) prediction that binding constraints lead to greater overvaluation when dispersion of opinion is high. Finally, we study the impact of the removal of the grandfather exemption on October 15, 2007. The exemption allowed fails to persist indefinitely as long as the delivery failure occurred before the security was placed on the threshold list. Our primary hypothesis regarding this 18 regulatory change is in the case of threshold removals but for completeness we also study its effect for threshold additions. Model 7 includes a binary variable called grandfathered, which takes the value of one for threshold events that take place before October 15, 2007 and zero for events that occur on or after that date. This variable enters insignificantly in the models for threshold additions, but we further discuss the effects of the grandfather exemption elimination in the models that explain CARs around threshold removals. In Table 4, Panel B, we report similar estimations around threshold removals. The dependent variable is the CAR over the [–4, +50] window. In Model 2, the coefficient of fails is negative and weakly significant, providing some evidence that fails are negatively associated with CARs around threshold removals. This suggests that when short sale constraints are relaxed, firms for which the constraints were most binding exhibit the lowest returns. The subsequent models display positive coefficients on short interest and institutional ownership, respectively, indicating that firms with greater short sale constraints experience a larger decline in abnormal valuation when constraints are relaxed due to the threshold removal. Sigma is inversely associated with CARs, indicating that greater dispersion is associated with more negative abnormal returns when constraints become less binding. Nevertheless, Models 1 through 6 indicate that we are able to explain only a relatively small amount of the variation in CARs around threshold removals. Of particular interest is the effect of the grandfathered variable in Panel B. We conjecture that, before the elimination of the grandfather exemption, securities that hit threshold levels were more difficult to remove because some fails could persist indefinitely. If this is so, threshold removals prior to the elimination of the exemption are stronger signals that short sale constraints are easing than they are after the elimination of the exemption. This is because short sellers are 19 essentially forced to resolve their fails after the exemption is eliminated. In essence, this regulatory change affects the extent to which threshold removals signal easing short sale constraints. In Model 7, the grandfathered variable enters significantly negatively, indicating that CARs around threshold removals are more negative before the removal of the exemption. This result is consistent with our underlying premise. 20 In tests not reported in a table, we repeat our multivariate analysis after excluding sample events with fewer than 10 trading days between the threshold addition and removal dates (the size of this sample is slightly less than half of the full sample). This ensures that the CARs are not contaminated due to overlapping addition and removal event windows. We believe this subsample of non-overlapping events provides sharper tests that can better isolate the separate valuation effects of threshold listings versus removals. The results are generally similar for additions, although the coefficients of our main variables are usually larger and the explanatory power of the models is greater, as expected. For removals, the effect of fails on CARs becomes significant in several of the models. Thus, when a threshold addition is associated with a higher level of fails, the subsequent removal coincides with larger price declines. 4. Additional results 4.1. Option volume around threshold events A potential alternative explanation of our findings is that increases in stock prices cause high fails and lead to threshold listings. Perhaps a short seller who incurs a loss from a large 20 Fails, short interest, and institutional ownership are included individually in the regressions to limit the effect of multicollinearity. When we estimate models that include all three variables (unreported), fails continue to exhibit a positive and significant relation with abnormal returns around threshold additions. The coefficient on short interest is not statistically significant, while institutional ownership continues to have a negative and significant coefficient. Around threshold removals, fails is not significantly related to abnormal returns while both short interest and institutional ownership are positively correlated with abnormal returns. 20 price increase is less likely to close out his position than a short seller who gains from a price decline. For example, market makers may choose to fail when facing imbalanced buy orders, as suggested by Boni (2006), especially in dealer markets such as NASDAQ. The short seller who incurs the loss might be more inclined to fail given the likelihood that he will choose to maintain the open short position waiting for a price decline. We believe the evidence reasonably rules out this concern. This alternative explanation also predicts that price declines should precede threshold removals because a price decline would encourage close-outs. Our evidence, however, suggests that abnormal price declines follow threshold removals, consistent with the idea that threshold removals indicate the easing of constraints. However, to further address this issue, we study option volume around threshold listings. A finding that option volume increases around threshold additions would provide additional support for the notion that threshold events reflect tightening short sale constraints. For optionable stocks, investors seeking short exposure can create synthetic short positions by writing calls and buying puts. Thus, for optionable stocks it seems plausible that tightening short sale constraints is associated with increased option market activity, and easing constraints is associated with decreased option market activity. Accordingly, we expect that threshold additions are associated with an increase in option volume and removals are associated with a decrease in option volume. These effects are likely to be more pronounced for stocks that have higher levels of fails. To examine these associations, we collect option data from OptionMetrics and provide graphical illustrations of option volume (call, put, and total) around threshold additions and removals. We follow Mayhew and Mihov (2005) and report option share volume (contract volume times 100) as a percentage of shares outstanding. Option data is available for nearly 550 of the 2,279 threshold events. 21 In Figure 2, Panels A and B display call and put option volume in the [–20, +5] addition window, and Panels C and D show call and put option volume in the [–4, +50] removal window. In each graph, option volume is displayed by fails quartile. In Panels A and B, we observe that stocks in the highest quartile of fails are associated with a large increase in call and put volume around threshold additions, with a large spike occurring 7 days prior to the threshold listing. Recall that fails resulting from trades executed on day t-7 push a stock onto the threshold list on day t. The spike in option volume is consistent with pessimists creating synthetic short positions in the options market for stocks with tightening short sale constraints. The results are also consistent with threshold additions reflecting binding short sale constraints, and threshold stocks with the highest levels of failures being the most constrained. In Figure 2, Panels C and D show that threshold removals are associated with a slight decline in option volume, consistent with easing short sale constraints. There is no clear evidence that higher fails correspond to a steeper decline in option volume. This seems to be consistent with our main findings, in particular, that fails do a better job explaining abnormal stock returns around threshold additions than they do around removals. Figure 2 illustrates that both put and call option volume spike around threshold listings. The increase in put volume is consistent with potential short sellers moving to the options market when facing binding short sale constraints. The increase in call volume, however, is also consistent with a predatory trading strategy (i.e., Brunnermeier and Pedersen, 2005) that exploits the mandatory closeout of failing positions. Nevertheless, it seems that the binding short sale constraint caused by a threshold listing is the mechanism that potentially creates the opportunity 22 for predatory trading, and thus the listing itself appears to be the underlying reason for the price patterns we observe.21 4.2. Fails and future stock returns The analysis to this point has focused on threshold events. In this section we use a broader test of the extent to which fails reflect short sale constraints and lead to overvaluation. Specifically, each month we sort firms by fails and examine future stock returns. If fails reflect how tightly short sale constraints are binding, we expect that high fails predict poor future stock returns. We include all stocks that appear in the U.S. Securities and Exchange Commission’s failure to deliver files. Each month we calculate a firm’s average fails as a percentage of shares outstanding. A firm is required to be in the files at least one day in a given month to be considered. Since many firms appear in these files on multiple days in a given month, we average daily figures during the month. On average, approximately 2,600 different stocks are included in each calendar month. Each calendar month, we sort firms by the number of fails as a percentage of shares outstanding and calculate market-adjusted returns over the subsequent 12 months. We use the CRSP value-weighted index to measure market returns. Panel A of Table 5 presents the results. The first column of return results (sort month) reflects the month in which we sort the data, and the subsequent columns reflect the following twelve months. In Panel A, we report that stocks in the highest quartile of fails in a given month subsequently underperform by 1.19% to 1.44% per month over the next 12 months. Stocks in the lowest quartile of fails exhibit substantially less underperformance over the subsequent year. 21 Whereas our evidence suggests that naked short sellers can be exploited by predatory trading, Shkilko, Van Ness, and Van Ness (2012) find that traditional short sellers often act as predator. 23 Differences in abnormal performance between the highest and lowest quartiles are between 1.06 and 1.37 percentage points per month and the p-values for these differences are highly significant. On an annualized basis, these differences in abnormal returns amount to approximately 15%. We find similar evidence using the equal-weighted index as the benchmark. In sum, we report severe underperformance when we partition the data by failures to deliver, suggesting that this measure is a well-suited publicly available variable to assess the extent to which short sale constraints are binding. For comparison, in Panel B of Table 5 we conduct similar sorts in which we examine short interest ratios instead of fails. The figures reveal that high short interest predicts low returns over the subsequent two months. This result is generally in line with prior research that examines monthly short interest, and could be interpreted to imply that high short interest reflects more binding short sale constraints. However, our tests that condition on threshold events indicate that low short interest appears to reflect more binding constraints. This is suggestive of a U-shaped pattern in the relation between short interest and the extent to which constraints are binding. 5. Conclusions We argue that failures to deliver, more specifically the threshold events that reflect excessive fails, provide a unique opportunity to test for price appreciation when short sale constraints are tightening. If fails are associated with hard-to-borrow stocks, as prior research and our investigation of options data suggests, the overvaluation hypothesis predicts that abnormal returns will be positive when fails are increasing (constraints are binding) and negative when fails are decreasing (constraints are easing). Consistent with the overvaluation hypothesis, threshold additions are associated with significantly positive abnormal returns and removals are 24 associated with significantly negative abnormal returns. When short sale constraints are especially binding, we find evidence of extreme overpricing and subsequent reversals. Abnormal valuations around threshold events are also consistent with predatory trading strategies, which are made possible due to binding short sale constraints and mandatory close-out requirements. We also consider fails without conditioning on threshold events, and provide evidence that high levels of fails predict subsequent underperformance of more than 1% per month for the following year. Together, our results suggest that fails are a good proxy for short sale constraints and that such constraints impact security prices in a manner consistent with the overvaluation hypothesis. Finally, we provide evidence that is suggestive of a U-shaped relation between short interest and short sale constraints. In threshold stocks (where it is hard to borrow shares), low short interest predicts greater overvaluation than high short interest. This relation is driven by the subsample of threshold stocks associated with the highest level of fails, indicating the tightest supply-side constraints. In contrast, without conditioning on threshold events, we find that high monthly short interest predicts low future returns. The findings suggest the importance of conditioning on the difficulty of borrowing shares when studying the effect of short interest on returns. 25 References Asquith, P., and L. Meulbroek, 1995. An empirical investigation of short interest, Working paper, Massachusetts Institute of Technology. Asquith, P., P. Pathak, and J. Ritter, 2005. Short interest, institutional ownership, and stock returns, Journal of Financial Economics 78, 243–276. Autore, D., R. Billingsley, and T. Kovacs, 2011. The 2008 short sale ban: Liquidity, dispersion of opinion, and the cross-section of returns of U.S. financial stocks, Journal of Banking and Finance 35, 2252–2266. Bailey, W., and L. Zheng, 2013. Banks, bears, and the financial crisis, Journal of Financial Services Research 44, 1–51. Battalio, R., and P. Schultz, 2011. Regulatory uncertainty and market liquidity: The 2008 short sale ban’s impact on equity option markets, Journal of Finance 66, 2013–2053. Boehme, R., B. Danielsen, and S. Sorescu, 2006. Short-sale constraints, dispersion of opinion and overvaluation, Journal of Financial and Quantitative Analysis 41, 455–487. Boehmer, E., Z. Huszár, and B. Jordan, 2010. The good news in short interest, Journal of Financial Economics 96, 80–97. Boehmer, E., C. Jones, and X. Zhang, 2008. Which shorts are informed? Journal of Finance 63, 491–527. Boehmer, E., C. Jones, and X. Zhang, 2013. Shackling short sellers: The 2008 shorting ban, Review of Financial Studies 26, 1363–1400. Boni, L., 2006. Strategic delivery failures in U.S. equity markets, Journal of Financial Markets 9, 1–26. Boulton, T., and M. Braga-Alves, 2010. The skinny on the 2008 naked short sale restrictions, Journal of Financial Markets 13, 397–421. Boulton, T., and M. Braga-Alves, 2012. Naked short selling and market returns, Journal of Portfolio Management 38, 133–142. Brunnermeier, M., and L. Pedersen, 2005. Predatory trading, Journal of Finance 60, 1825–1863. Chang, E., J. Cheng, and Y. Yu, 2007. Short-sale constraints and price discovery: Evidence from the Hong Kong market, Journal of Finance 62, 2097–2121. Chen, J., H. Hong, and J. Stein, 2002. Breadth of ownership and stock returns, Journal of Financial Economics 66, 171–205. 26 Christophe, S., M. Ferri, and J. Angel, 2004. Short-selling prior to earnings announcements, Journal of Finance 59, 1845–1875. Cohen, L., K. Diether, and C. Malloy, 2007. Supply and demand shifts in the shorting market, Journal of Finance 62, 2061–2096. D’Avolio, G., 2002. The market for borrowing stock, Journal of Financial Economics 66, 271– 306. Desai, H., K. Ramesh, S. Thiagarajan, and B. Balachandran, 2002. An investigation of the informational role of short interest in the Nasdaq market, Journal of Finance 57, 2263–2287. Diamond, D., and R. Verrecchia, 1987. Constraints on short-selling and asset price adjustment to private information, Journal of Financial Economics 18, 277–311. Diether, K., and I. Werner, 2009. When constraints bind, Working paper, Dartmouth College and Ohio State University. Diether, K., K. Lee, and I. Werner, 2009. Short-sale strategies and return predictability, Review of Financial Studies 22, 575–607. Duffie, D., N. Garleanu, and L. Pedersen, 2002. Securities lending, shorting, and pricing, Journal of Financial Economics 66, 307–339. Engelberg, J., C. Sasseville, and J. Williams, 2012. Market madness? The case of Mad Money, Management Science 58, 351–364. Evans, R., C. Geczy, D. Musto, and A. Reed, 2009. Failure is an option: impediments to short selling and options prices, Review of Financial Studies 22, 1955–1980. Figlewski, S., 1981. The informational effects of restrictions on short sales: Some empirical evidence, Journal of Financial and Quantitative Analysis 16, 463–476. Gagnon, L., and J. Witmer, 2010. Short changed? The market’s reaction to the short sale ban of 2008, Working paper, Bank of Canada. Geczy, C., D. Musto, and A. Reed, 2002. Stocks are special too: an analysis of the equity lending market, Journal of Financial Economics 66, 241–269. Harris, L., E. Namvar, and B. Phillips, 2013. Price inflation and wealth transfer during the 2008 SEC short-sale ban, Journal of Investment Management 11, 1–23. Harrison, J., and D. Kreps, 1978. Speculative investor behavior in a stock market with heterogeneous expectations, Quarterly Journal of Economics 92, 323–336. 27 Jones, C., and O. Lamont, 2002. Short-sale constraints and stock returns, Journal of Financial Economics 66, 207–239. Kolasinski, A., A. Reed, and J. Thornock, 2013. Can short restrictions actually increase informed short selling? Evidence from the 2008 regulations, Financial Management 42, 155–181. Mayhew, S., and V. Mihov, 2005. Short sale constraints, overvaluation, and the introduction of options, Working paper, U.S. Securities and Exchange Commission. Miller, E., 1977. Risk, uncertainty and divergence of opinion, Journal of Finance 32, 1151– 1168. Nagel, S., 2005. Short sales, institutional investors and the cross-section of stock returns, Journal of Financial Economics 78, 277–309. Ofek, E., M. Richardson, and R. Whitelaw, 2004. Limited arbitrage and short sales restrictions: Evidence from the options markets, Journal of Financial Economics 74, 305–342. Petersen, M., 2009. Estimating standard errors in finance panel data sets: Comparing approaches, Review of Financial Studies 22, 435–480. Prado, M., 2011. The price of prospective lending: Evidence from short sale constraints, Working paper, Erasmus University. Scheinkman, J., and W. Xiong, 2003. Overconfidence and speculative bubbles, Journal of Political Economy 111, 1183–1219. Shkilko, A., B. Van Ness, and R. Van Ness, 2012. Short selling and intraday price pressures, Financial Management 41, 345–370. Shleifer, A., and R. Vishny, 1997. The limits of arbitrage, Journal of Finance 53, 35–55. 28 Figure 1 Daily threshold securities This figure details the number of securities appearing on the threshold lists released by the Amex, NASDAQ, and NYSE on a daily basis over the January 7, 2005 through December 31, 2008 sample period. 29 Panel A: Call volume/Shares outstanding by fails quartile around additions Panel B: Put volume/Shares outstanding by fails quartile around additions Panel C: Call volume/Shares outstanding by fails quartile around removals Panel D: Put volume/Shares outstanding by fails quartile around removals Figure 2 Option volume around threshold additions and removals Panels A and B display call and put option volumes (contract volume times 100) as a percentage of shares outstanding in the [–20, +5] addition window, partitioned by quartile of fails. Panels C and D display the corresponding call and put option volumes in the [–4, +50] removal window. 30 Table 1 Descriptive statistics This table reports descriptive statistics for threshold events. Threshold events are defined as (a) first time appearances on the threshold lists and (b) reappearances after an absence of at least 30 days. First time listing is a dummy variable set to 1 for firms appearing on the threshold list for the first time and zero otherwise. Absence is the number of days since a firms’ previous appearance on the threshold lists. Duration is the number of days a firm spends on the threshold lists. Fails as a percentage of shares outstanding is the ratio of fails to total shares outstanding as of the threshold listing date. The short interest ratio equals short interest in the month prior to the event divided by the total public float. Institutional ownership is the ratio of aggregate institutional holdings to total shares outstanding as of the end of the quarter immediately preceding the threshold event. Market capitalization is stock price multiplied by total shares outstanding as of 11 days prior to the threshold event. Sigma is defined as the residual standard deviation from the market model, estimated over the 100 trading days prior to the threshold event. Variable First time listings Absence Duration Fails as a percentage of shares outstanding Short interest ratio Institutional ownership Market capitalization ($MM) Sigma N 2,279 1,256 2,279 2,256 2,279 1,990 2,220 2,279 Mean 0.449 177.131 22.179 0.013 0.144 0.427 569.980 0.036 Standard deviation 0.497 195.579 44.434 0.016 0.144 0.292 1,154.025 0.025 Minimum 0.000 30.000 5.000 0.001 0.000 0.000 3.231 0.001 Maximum 1.000 1,222.000 760.000 0.295 0.986 0.999 18,710.134 0.373 31 Table 2 Cumulative abnormal returns around threshold events and the impact of fails This table reports cumulative abnormal returns (CARs) around threshold events. Threshold events are defined as (a) first time appearances on the threshold lists and (b) reappearances after absences of at least 30 days. Abnormal returns are calculated using the market model. The first six results columns report results around additions to the threshold lists where day t=0 is the day a firm first appears on the list. The final six results columns report results around removals from the threshold lists where day t=0 is the last day a firm appears on the list. In Panel A, means and medians are reported and p-values from t-tests and Wilcoxon tests that CARs are equal to zero are reported in parentheses. Panel B presents CARs within quartiles of fails as a percentage of shares outstanding. Quartile 4 (1) has the highest (lowest) percentage of shares outstanding reported as fails. The bottom two rows report the difference between quartiles 4 and 1 and the p-value from a t-test that the difference is zero. Panel A: Market model CARs Mean Median [–7, 0] 0.039 (0.000) [–10, 0] 0.048 (0.000) Threshold additions [–20, 0] [–7, +5] [–10, +5] 0.044 0.047 0.056 (0.000) (0.000) (0.000) [–20, +5] 0.052 (0.000) [–4, 0] –0.003 (0.074) [–4, +5] –0.015 (0.000) Threshold removals [–4, +10] [–4, +20] [–4, +30] –0.018 –0.019 –0.021 (0.000) (0.000) (0.000) [–4, +50] –0.034 (0.000) 0.012 (0.000) 0.017 (0.000) 0.017 (0.000) 0.025 (0.000) –0.003 (0.003) –0.012 (0.000) –0.013 (0.000) –0.011 (0.002) 0.021 (0.000) 0.025 (0.000) Panel B: Market model CARs in quartiles of fails Threshold additions Quartile N [–7, 0] [–10, 0] [–20, 0] [–7, +5] 4 562 0.098 0.115 0.105 0.106 3 562 0.023 0.027 0.025 0.031 2 564 0.018 0.024 0.024 0.019 1 564 0.019 0.024 0.025 0.035 Quartile 4-1 0.079 (0.000) 0.091 (0.000) 0.080 (0.000) 0.071 (0.000) –0.011 (0.000) –0.010 (0.002) [–10, +5] 0.123 0.036 0.025 0.040 [–20, +5] 0.112 0.034 0.026 0.040 [–4, 0] –0.007 –0.003 –0.005 0.003 [–4, +5] –0.022 –0.016 –0.011 –0.010 Threshold removals [–4, +10] [–4, +20] –0.023 –0.024 –0.016 –0.010 –0.018 –0.028 –0.012 –0.012 [–4, +30] –0.021 –0.017 –0.034 –0.009 [–4, +50] –0.061 –0.026 –0.038 –0.009 0.083 (0.000) 0.072 (0.002) –0.010 (0.059) –0.011 (0.157) –0.011 (0.294) –0.012 (0.485) –0.051 (0.036) –0.012 (0.382) 32 Table 3 The impact of short interest, institutional ownership, and dispersion of opinion This table reports market model cumulative abnormal returns (CARs) around threshold events within two-way quartile sorts. Quartile 4 represents the highest values. Threshold events are defined as (a) first time appearances on the threshold lists and (b) reappearances after absences of at least 30 days. Panels A–C report CARs within independent two-way sorts of fails and short interst (Panel A), fails and institutional ownership (Panel B), and fails and sigma (Panel C). Fails is the ratio of fails to total shares outstanding as of the threshold listing date. The short interest ratio equals short interest in the month prior to the event divided by the total public float. Institutional ownership is the ratio of aggregate institutional holdings to total shares outstanding as of the end of the quarter immediately preceding the threshold event. Sigma is defined as the residual standard deviation from the market model, estimated over the 100 trading days prior to the threshold event. The CAR windows are [–7,+5] around appearances where day t=0 is the day a firm first appears on the list, and [–4,+50] around removals where day t=0 is the last day a firm appears on the list. P-values for differences from zero and the number of observations are reported below the CARs. Panel A: CARs in two-way sorts of fails and short interest Threshold additions [–7, +5] Short interest quartile Fails quartile 4 3 2 1 4 0.051 0.028 0.076 0.216 (0.009) (0.117) (0.029) (0.000) 132 123 112 184 Threshold removals [–4, +50] Short interest quartile Fails quartile 4 3 2 1 4 0.039 –0.015 –0.169 –0.092 (0.218) (0.630) (0.003) (0.003) 131 124 116 191 3 0.001 (0.906) 166 0.030 (0.010) 139 0.049 (0.037) 135 0.052 (0.020) 121 3 0.027 (0.280) 166 –0.010 (0.744) 138 –0.052 (0.043) 134 –0.085 (0.030) 124 2 0.017 (0.181) 143 0.021 (0.132) 130 0.023 (0.069) 171 0.011 (0.540) 117 2 0.013 (0.610) 143 –0.048 (0.059) 130 –0.042 (0.146) 172 –0.083 (0.006) 119 1 0.050 (0.013) 125 0.052 (0.000) 173 0.009 (0.418) 140 0.025 (0.034) 120 1 0.020 (0.540) 125 0.051 (0.089) 173 –0.053 (0.070) 142 –0.072 (0.033) 124 33 Panel B: CARs in two-way sorts of fails and institutional ownership Threshold additions [–7, +5] Institutional ownership quartile Fails quartile 4 3 2 1 4 0.042 0.039 0.107 0.316 (0.008) (0.012) (0.020) (0.000) 125 110 122 115 Threshold removals [–4, +50] Institutional ownership quartile Fails quartile 4 3 2 1 4 0.038 –0.035 –0.077 –0.216 (0.186) (0.229) (0.021) (0.001) 125 110 122 125 3 0.029 (0.007) 135 0.024 (0.039) 119 0.038 (0.033) 123 0.057 (0.095) 106 3 0.016 (0.535) 135 –0.013 (0.661) 118 –0.072 (0.028) 122 –0.085 (0.040) 109 2 0.020 (0.124) 124 0.043 (0.000) 138 0.014 (0.289) 129 0.002 (0.933) 115 2 –0.018 (0.497) 124 0.001 (0.963) 138 –0.016 (0.547) 129 –0.162 (0.000) 118 1 0.038 (0.002) 108 0.046 (0.007) 126 0.038 (0.019) 117 0.020 (0.137) 134 1 0.012 (0.739) 108 –0.029 (0.309) 126 0.019 (0.568) 118 –0.076 (0.021) 139 Panel C: CARs in two-way sorts of fails and sigma Threshold additions [–7, +5] Fails quartile 4 4 0.262 (0.000) 190 Sigma quartile 3 0.031 (0.045) 132 2 0.016 (0.199) 107 1 0.023 (0.004) 122 Threshold removals [–4, +50] Fails quartile 4 4 –0.134 (0.003) 197 3 –0.009 (0.750) 133 2 –0.015 (0.594) 109 1 –0.038 (0.083) 123 Sigma quartile 3 0.066 (0.051) 117 0.024 (0.056) 152 0.013 (0.210) 153 0.028 (0.005) 139 3 –0.111 (0.009) 120 –0.051 (0.097) 151 0.027 (0.279) 153 0.018 (0.338) 138 2 0.009 0.017 0.014 0.032 2 –0.181 0.004 0.009 0.002 34 1 (0.686) 130 (0.278) 137 (0.174) 136 (0.000) 158 0.052 (0.036) 109 0.024 (0.067) 141 0.035 (0.000) 165 0.033 (0.002) 143 1 (0.000) 130 (0.872) 137 (0.689) 138 (0.929) 159 –0.043 (0.361) 110 –0.007 (0.836) 144 –0.011 (0.672) 166 0.016 (0.452) 144 35 Table 4 Regressions that explain cumulative abnormal returns around threshold events This table reports regressions of cumulative abnormal returns (CARs) around threshold events using the full sample of events. Threshold events defined as (a) first time appearances on the threshold lists and (b) reappearances after absences of at least 30 days. Abnormal returns are calculated using the market model. Panel A reports results for additions to the threshold lists for the interval [–7, +5] where day t=0 is the day a firm first appears on the list. Panel B reports results for removals from the threshold lists for the interval [–4, +50] where day t=0 is the last day a firm appears on the list. First time listing is a dummy variable set to 1 for firms appearing on the threshold list for the first time and zero otherwise. Absence is the natural log of the number of days since a firms’ previous appearance on the threshold lists. Fails is the ratio of fails to total shares outstanding as of the threshold listing date. The short interest ratio equals short interest in the month prior to the event divided by the total public float. Institutional ownership is the ratio of aggregate institutional holdings to total shares outstanding as of the end of the quarter immediately preceding the threshold event. Sigma is defined as the residual standard deviation from the market model, estimated over the 100 trading days prior to the threshold event. Grandfathered equals one for threshold events that take place before October 15, 2007, and zero for events that take place on or after this date. The table presents coefficient estimates and t-statistics based on standard errors that are clustered by event month. Panel A: CARs around threshold additions Intercept First time Absence Fails Short interest Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7 –0.022 –0.060 –0.033 –0.054 –0.246*** –0.192** –0.059 (–0.49) (–1.30) (–0.77) (–1.18) (–3.75) (–2.96) (–1.22) 0.069 0.038 0.023 0.059 0.099** 0.108** 0.038 (1.53) (0.90) (0.56) (1.31) (2.23) (2.50) (0.91) 0.015 0.010 0.008 0.014 0.019** 0.020** 0.010 (1.48) (1.05) (0.84) (1.37) (2.11) (2.31) (1.05) 5.016** 4.953** 5.184** 1.905 –1.449 5.020** (2.66) (2.64) (2.67) (1.48) (–1.46) (2.67) 4.863*** (5.02) 3.860*** (4.02) 29.308*** (6.12) –0.097* (–2.00) Institutional ownership Sigma Sigma * Fails Grandfathered –0.054** (–2.33) –0.002 (–0.14) 36 Adjusted R-square Number of observations 0.15% 2,254 8.82% 2,231 9.08% 2,231 10.09% 1,946 27.59% 2,231 30.52% 2,231 8.82% 2,231 Model 1 Model 2 Model 3 Model 4 Model 5 Model 6 Model 7 0.013 0.011 –0.021 –0.079** 0.079* 0.072* 0.064 (0.39) (0.34) (–0.64) (–2.37) (2.01) (1.75) (1.68) –0.019 –0.011 –0.016 –0.008 –0.009 –0.009 –0.014 (–1.48) (–0.89) (–1.31) (–0.62) (–0.72) (–0.77) (–1.12) –1.266* –0.941 –1.090 0.289 0.768 –1.017 (–1.74) (–1.26) (–1.36) (0.42) (1.01) (–1.39) –2.602*** (–3.91) –2.458** (–3.40) –4.173 (–0.82) Panel B: CARs around threshold removals Intercept Duration Fails Short interest 0.281*** (4.71) Institutional ownership 0.162*** (5.13) Sigma Sigma * Fails –0.080*** (–3.91) Grandfathered Adjusted R-square 0.20% 0.39% 1.51% 1.95% Number of observations 2,273 2,252 2,252 1,966 ***, **, and * denote statistical significance at the 0.01, 0.05, and 0.10 levels, respectively. 3.05% 2,252 3.08% 2,252 1.43% 2,252 37 Table 5 Fails, short interest, and future stock returns This table reports future stock returns within quartiles of fails as a percentage of shares outstanding (Panel A) and the short interest ratio (Panel B). Quartile 4 is the highest quartile. The sample includes all stocks that appear in the SEC’s failure to deliver files. Each month we calculate a firm’s average fails as a percentage of shares outstanding. A firm is required to be in the files at least one day in a given month to be included. Each calendar month, we sort firms by the number of fails as a percentage of shares outstanding (Panel A) or the short interest ratio (Panel B) and calculate market-adjusted returns over the subsequent 12 months. We use the CRSP value-weighted index to measure market returns. The first column of return results (sort month) reflects the month in which we sort the data, and the subsequent columns reflect the following twelve months. The last two rows report differences between Quartiles 4 and 1 and the associated pvalue (in parentheses) from a t-test that the difference is zero. Panel A: Fails and future returns Fails Sort quartile month +1 4 –0.153% –1.186% (0.230) (0.000) 3 –0.046% –0.617% (0.599) (0.000) 2 –0.023% –0.393% (0.743) (0.000) 1 –0.085% –0.120% (0.113) (0.038) +2 –1.275% (0.000) –0.742% (0.000) –0.390% (0.000) –0.213% (0.000) +3 –1.280% (0.000) –0.761% (0.000) –0.300% (0.000) –0.019% (0.765) +4 –1.222% (0.000) –0.469% (0.000) –0.357% (0.000) 0.004% (0.954) +5 –1.245% (0.000) –0.566% (0.000) –0.389% (0.000) –0.047% (0.499) +6 –1.296% (0.000) –0.662% (0.000) –0.287% (0.001) –0.135% (0.039) +7 –1.437% (0.000) –0.767% (0.000) –0.408% (0.000) –0.063% (0.383) +8 –1.313% (0.000) –0.885% (0.000) –0.415% (0.000) –0.171% (0.016) +9 –1.282% (0.000) –0.736% (0.000) –0.559% (0.000) –0.028% (0.719) +10 –1.327% (0.000) –0.698% (0.000) –0.506% (0.000) –0.115% (0.111) +11 –1.315% (0.000) –0.425% (0.000) –0.402% (0.000) –0.148% (0.052) +12 –1.336% (0.000) –0.603% (0.000) –0.381% (0.000) –0.159% (0.038) –0.069% (0.620) –1.062% (0.000) –1.261% (0.000) –1.226% (0.000) –1.199% (0.000) –1.161% (0.000) –1.373% (0.000) –1.142% (0.000) –1.254% (0.000) –1.212% (0.000) –1.166% (0.000) –1.177% (0.000) Panel B: Short interest and future returns Short Sort quartile month +1 +2 4 –0.713% –0.816% –0.962% (0.000) (0.000) (0.000) 3 0.111% –0.294% –0.537% (0.150) (0.000) (0.000) 2 –0.107% –0.633% –0.633% (0.153) (0.000) (0.000) 1 0.424% –0.560% –0.467% (0.000) (0.000) (0.000) +3 –0.809% (0.000) –0.321% (0.000) –0.463% (0.000) –0.746% (0.000) +4 –0.668% (0.000) –0.332% (0.000) –0.423% (0.000) –0.599% (0.000) +5 –0.770% (0.000) –0.380% (0.000) –0.543% (0.000) –0.526% (0.000) +6 –0.750% (0.000) –0.465% (0.000) –0.654% (0.000) –0.476% (0.000) +7 –0.802% (0.000) –0.528% (0.000) –0.635% (0.000) –0.671% (0.000) +8 –0.744% (0.000) –0.523% (0.000) –0.667% (0.000) –0.818% (0.000) +9 –0.741% (0.000) –0.399% (0.000) –0.631% (0.000) –0.799% (0.000) +10 –0.732% (0.000) –0.485% (0.000) –0.661% (0.000) –0.731% (0.000) +11 –0.685% (0.000) –0.328% (0.001) –0.681% (0.000) –0.556% (0.000) +12 –0.796% (0.000) –0.351% (0.000) –0.550% (0.000) –0.743% (0.000) –0.063% (0.650) –0.069% (0.625) –0.244% (0.094) –0.275% (0.063) –0.131% (0.380) 0.075% (0.626) 0.058% (0.711) –0.001% (0.996) –0.130% (0.432) –0.053% (0.751) 4-1 4-1 –1.137% (0.000) –1.066% (0.000) –0.256% (0.054) –0.495% (0.000) 38