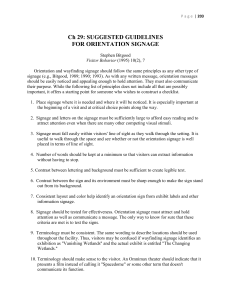

the economic value of on-premise signage

advertisement