Latin American Equity Research

Flashnote

Mexico City, August 19, 2010

Mexico — Retail

ALSEA

BUY

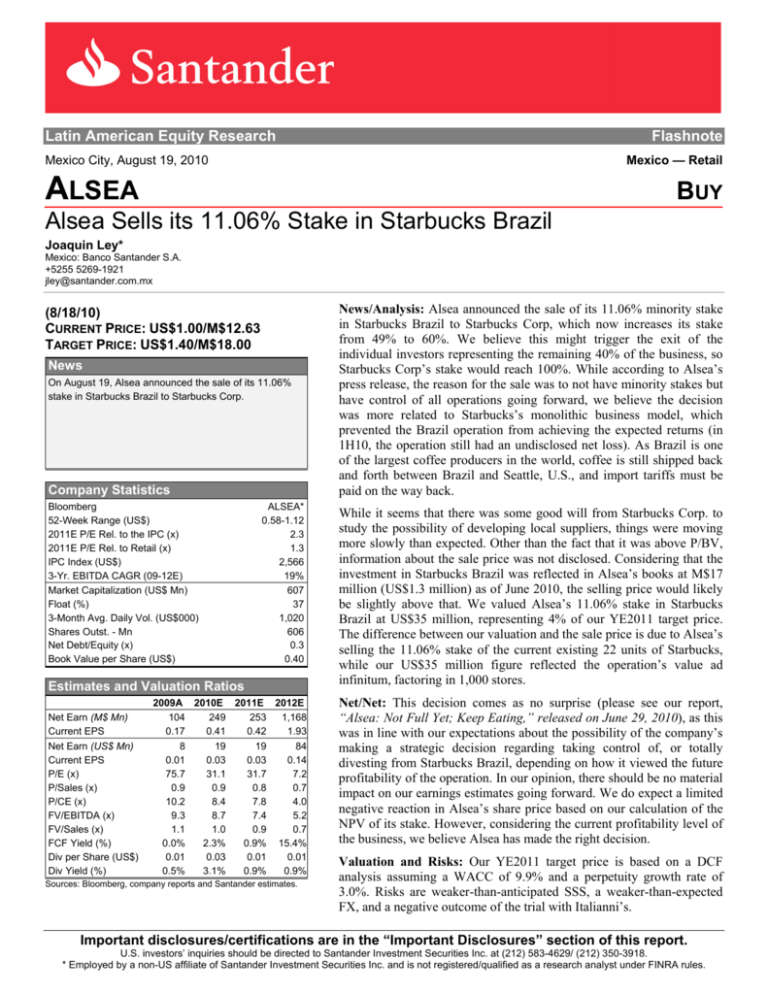

Alsea Sells its 11.06% Stake in Starbucks Brazil

Joaquin Ley*

Mexico: Banco Santander S.A.

+5255 5269-1921

jley@santander.com.mx

(8/18/10)

CURRENT PRICE: US$1.00/M$12.63

TARGET PRICE: US$1.40/M$18.00

News

On August 19, Alsea announced the sale of its 11.06%

stake in Starbucks Brazil to Starbucks Corp.

Company Statistics

Bloomberg

52-Week Range (US$)

2011E P/E Rel. to the IPC (x)

2011E P/E Rel. to Retail (x)

IPC Index (US$)

3-Yr. EBITDA CAGR (09-12E)

Market Capitalization (US$ Mn)

Float (%)

3-Month Avg. Daily Vol. (US$000)

Shares Outst. - Mn

Net Debt/Equity (x)

Book Value per Share (US$)

ALSEA*

0.58-1.12

2.3

1.3

2,566

19%

607

37

1,020

606

0.3

0.40

While it seems that there was some good will from Starbucks Corp. to

study the possibility of developing local suppliers, things were moving

more slowly than expected. Other than the fact that it was above P/BV,

information about the sale price was not disclosed. Considering that the

investment in Starbucks Brazil was reflected in Alsea’s books at M$17

million (US$1.3 million) as of June 2010, the selling price would likely

be slightly above that. We valued Alsea’s 11.06% stake in Starbucks

Brazil at US$35 million, representing 4% of our YE2011 target price.

The difference between our valuation and the sale price is due to Alsea’s

selling the 11.06% stake of the current existing 22 units of Starbucks,

while our US$35 million figure reflected the operation’s value ad

infinitum, factoring in 1,000 stores.

2009A 2010E 2011E 2012E

104

249

253

1,168

0.17

0.41

0.42

1.93

Net/Net: This decision comes as no surprise (please see our report,

“Alsea: Not Full Yet; Keep Eating,” released on June 29, 2010), as this

was in line with our expectations about the possibility of the company’s

making a strategic decision regarding taking control of, or totally

divesting from Starbucks Brazil, depending on how it viewed the future

profitability of the operation. In our opinion, there should be no material

impact on our earnings estimates going forward. We do expect a limited

negative reaction in Alsea’s share price based on our calculation of the

NPV of its stake. However, considering the current profitability level of

the business, we believe Alsea has made the right decision.

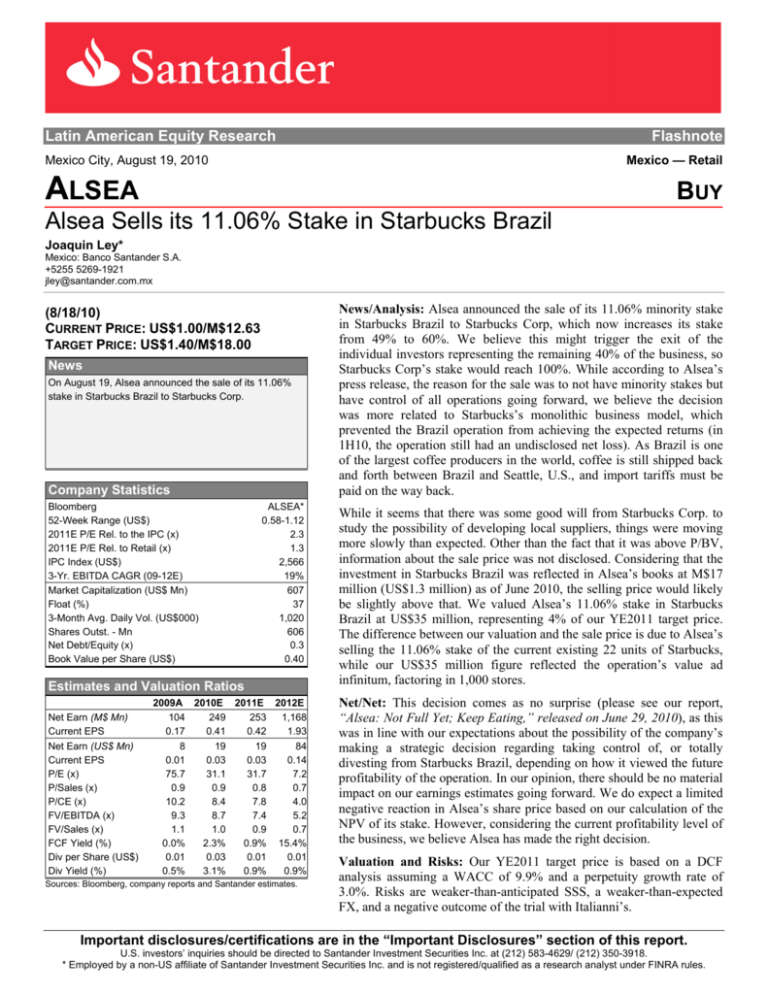

Estimates and Valuation Ratios

Net Earn (M$ Mn)

Current EPS

Net Earn (US$ Mn)

Current EPS

P/E (x)

P/Sales (x)

P/CE (x)

FV/EBITDA (x)

FV/Sales (x)

FCF Yield (%)

Div per Share (US$)

Div Yield (%)

News/Analysis: Alsea announced the sale of its 11.06% minority stake

in Starbucks Brazil to Starbucks Corp, which now increases its stake

from 49% to 60%. We believe this might trigger the exit of the

individual investors representing the remaining 40% of the business, so

Starbucks Corp’s stake would reach 100%. While according to Alsea’s

press release, the reason for the sale was to not have minority stakes but

have control of all operations going forward, we believe the decision

was more related to Starbucks’s monolithic business model, which

prevented the Brazil operation from achieving the expected returns (in

1H10, the operation still had an undisclosed net loss). As Brazil is one

of the largest coffee producers in the world, coffee is still shipped back

and forth between Brazil and Seattle, U.S., and import tariffs must be

paid on the way back.

8

0.01

75.7

0.9

10.2

9.3

1.1

0.0%

0.01

0.5%

19

0.03

31.1

0.9

8.4

8.7

1.0

2.3%

0.03

3.1%

19

0.03

31.7

0.8

7.8

7.4

0.9

0.9%

0.01

0.9%

84

0.14

7.2

0.7

4.0

5.2

0.7

15.4%

0.01

0.9%

Sources: Bloomberg, company reports and Santander estimates.

Valuation and Risks: Our YE2011 target price is based on a DCF

analysis assuming a WACC of 9.9% and a perpetuity growth rate of

3.0%. Risks are weaker-than-anticipated SSS, a weaker-than-expected

FX, and a negative outcome of the trial with Italianni’s.

Important disclosures/certifications are in the “Important Disclosures” section of this report.

U.S. investors’ inquiries should be directed to Santander Investment Securities Inc. at (212) 583-4629/ (212) 350-3918.

* Employed by a non-US affiliate of Santander Investment Securities Inc. and is not registered/qualified as a research analyst under FINRA rules.

Alsea Sells its 11.06% Stake in Starbucks Brazil

IMPORTANT DISCLOSURES

Alsea—12-Month Stock Performance (U.S. Dollars)

200

180

Alsea

160

140

120

100

80

A-09

IPC

O-09

D-09

F-10

A-10

J-10

A-10

Source: Santander.

Alsea—Three-Year Stock Performance (U.S. Dollars)

3,500

1.8

B $1.40

6/29/10

1.6

1.4

B $0.65

12/1/08

1.2

B $0.90

6/4/09

2,500

1.0

2,000

H $1.90

10/1/07

0.8

0.6

0.4

B $0.95

12/8/09

0.2

0.0

J-07

3,000

B $1.25

4/22/10

Analyst Recommendations

and Price Objectives

B: Buy

H: Hold

UP: Underperform

UR: Under Review

1,500

1,000

500

S-07 D-07 M-08

J-08

Alsea (L Axis)

S-08

D-08 M-09

J-09

S-09

D-09 M-10

J-10

IPC (R Axis)

Source: Santander.

2

Important disclosures/certifications are in the “Important Disclosures” section of this report.

U.S. investors’ inquiries should be directed to Santander Investment Securities Inc. at (212) 583-4629/ (212) 350-3918.

IMPORTANT DISCLOSURES

Key to Investment Codes

Definition

Expected to outperform the local market benchmark by more than 10%.

Expected to perform within a range of 0% to 10% above the local market

benchmark.

Underperform/Sell Expected to underperform the local market benchmark.

Under review

Rating

Buy

Hold

% of

Companies

Covered with This

Rating

63.87%

% of Companies Provided

Investment Banking

Services in the Past 12

Months

63.41%

30.37%

36.59%

5.76%

--

---

The numbers above reflect our Latin American universe as of Tuesday, August 17, 2010.

For a discussion, if applicable, of the valuation methods used to determine the price targets included in this report and the risks to achieving

these targets, please refer to the latest published research on these stocks. Research is available through your sales representative and other

electronic systems.

Target prices are 2010 year-end unless otherwise specified. Recommendations are based on a total return basis (expected share price

appreciation + prospective dividend yield) unless otherwise specified.

Stock price charts and rating histories for companies discussed in this report are also available by written request to Santander Investment

rd

th

Securities Inc., 45 East 53 Street, 17 Floor (Attn: Research Disclosures), New York, NY 10022 USA.

Ratings are established when the firm sets a target price and/or when maintaining or reiterating the rating. Ratings may not coincide with the above

methodology due to price volatility. Management reserves the right to maintain or to modify ratings on any specific stock and will disclose this in the

report when it occurs. Valuation methodologies vary from stock to stock, analyst to analyst, and country to country. Any investment in Latin American

equities is, by its nature, risky. A full discussion of valuation methodology and risks related to achieving the target price of the subject security is included

in the body of this report.

The benchmark used for local market performance is the country risk of each country plus the 1-year U.S. Treasury yield plus 5.5% of equity risk

premium, unless otherwise specified. The benchmark plus the 10.0% differential used to determine the rating is time adjusted to make it comparable

with the total return of the stock over the same period. For additional information about our rating methodology, please call (212) 350 3974.

This research report (“report”) has been prepared by Santander Investment Securities Inc. ("SIS"; SIS is a subsidiary of Santander Investment I, S.A.

which is wholly owned by Banco Santander, S.A. ["Santander"]) on behalf of itself and its affiliates (collectively, Grupo Santander) and is provided for

information purposes only. This report must not be considered as an offer to sell or a solicitation of an offer to buy any relevant securities (i.e., securities

mentioned herein or of the same issuer and/or options, warrants, or rights with respect to or interests in any such securities). Any decision by the

recipient to buy or to sell should be based on publicly available information on the related security and, where appropriate, should take into account the

content of the related prospectus filed with and available from the entity governing the related market and the company issuing the security. This report

is issued in Spain by Santander Investment Bolsa, Sociedad de Valores, S.A. (“Santander Investment Bolsa”) and in the United Kingdom by Banco

Santander, S.A., London Branch. Santander London is authorized by the Bank of Spain. This report is not being issued to private customers. SIS,

Santander London and Santander Investment Bolsa are members of Grupo Santander.

The following analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed, that

their recommendations reflect solely and exclusively their personal opinions, and that such opinions were prepared in an independent and autonomous

manner, including as regards the institution to which they are linked, and that they have not received and will not receive direct or indirect compensation

in exchange for expressing specific recommendations or views in this report, since their compensation and the compensation system applying to Grupo

Santander and any of its affiliates is not pegged to the pricing of any of the securities issued by the companies evaluated in the report, or to the income

arising from the businesses and financial transactions carried out by Grupo Santander and any of its affiliates: Joaquin Ley*.

*Employed by a non-US affiliate of Santander Investment Securities Inc. and not registered/qualified as a research analyst under FINRA rules, and is not

an associated person of the member firm, and, therefore, may not be subject to the FINRA Rule 2711 and Incorporated NYSE Rule 472 restrictions on

communications with a subject company, public appearances, and trading securities held by a research analyst account.

Grupo Santander receives non-investment banking revenue from the subject company.

Within the past 12 months, Grupo Santander has received compensation for investment banking services from Alsea.

In the next three months, Grupo Santander expects to receive or intends to seek compensation for investment banking services from Alsea.

The information contained within this report has been compiled from sources believed to be reliable. Although all reasonable care has been taken to

ensure the information contained within these reports is not untrue or misleading, we make no representation that such information is accurate or

complete and it should not be relied upon as such. All opinions and estimates included within this report constitute our judgment as of the date of the

report and are subject to change without notice.

From time to time, Grupo Santander and/or any of its officers or directors may have a long or short position in, or otherwise be directly or indirectly

interested in, the securities, options, rights or warrants of companies mentioned herein.

Any U.S. recipient of this report (other than a registered broker-dealer or a bank acting in a broker-dealer capacity) that would like to effect any

transaction in any security discussed herein should contact and place orders in the United States with SIS, which, without in any way limiting the

foregoing, accepts responsibility (solely for purposes of and within the meaning of Rule 15a-6 under the U.S. Securities Exchange Act of 1934) for this

report and its dissemination in the United States.

© 2010 by Santander Investment Securities Inc. All Rights Reserved.

2010