®

PAYROLL CS DIRECT DEPOSIT

Guide to Handling Direct Deposit

version 2009.x.x

TL20765

(7/10/09)

Copyright Information

Text copyright 1998 – 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

Video display images copyright 1998 – 2009 by Thomson Reuters/Tax & Accounting. All rights reserved.

®

Thomson Reuters hereby grants licensees of CS Professional Suite software the right to reprint this document solely for their

internal use.

Trademark Information

The trademarks used herein are trademarks and registered trademarks used under license.

All other brand and product names mentioned in this guide are trademarks or registered trademarks of their respective holders.

Contents

Introduction............................................................................................................... 1

Terms and definitions .......................................................................................................... 1

ACH ................................................................................................................................ 1

ACH files ........................................................................................................................ 2

ACH operator ................................................................................................................. 2

Effective date .................................................................................................................. 2

EPS files ......................................................................................................................... 2

InterceptEFT ................................................................................................................... 2

NACHA ........................................................................................................................... 2

Originator ........................................................................................................................ 3

Originating Depository Financial Institution (ODFI)......................................................... 3

Prenote files ................................................................................................................... 3

Processing window ......................................................................................................... 3

Receiver ......................................................................................................................... 3

Receiving Depository Financial Institution (RDFI) .......................................................... 3

Overview of Payroll CS Direct Deposit .................................................................. 5

Options for handling ACH processing ................................................................................. 6

Working with InterceptEFT ............................................................................................. 6

Advantages ................................................................................................................ 6

Disadvantages ........................................................................................................... 6

Working directly with individual banks ............................................................................ 7

Advantages ................................................................................................................ 7

Disadvantages ........................................................................................................... 7

Working with InterceptEFT ...................................................................................... 9

Establishing services with InterceptEFT ............................................................................ 10

Application and agreements ......................................................................................... 10

Fees for ACH processing services ............................................................................... 11

File submission and transmission testing ..................................................................... 11

Transmission schedules and deadlines ........................................................................ 12

Standard 4-day processing window ......................................................................... 12

Premium 3-day processing window ......................................................................... 13

Payroll CS Guide to Handling Direct Deposit

iii

Contents

Vendor and tax payment 5-day processing window................................................. 13

Billing and tax impound processing ......................................................................... 13

Payroll impound processing ..................................................................................... 14

InterceptEFT processing days with example scenarios .................................................... 14

Standard 4-day processing window examples ............................................................. 14

Scenario one............................................................................................................ 14

Scenario two ............................................................................................................ 14

Premium 3-day processing window examples .............................................................. 15

Scenario one............................................................................................................ 15

Scenario two ............................................................................................................ 15

5-day processing window examples (for tax payments and vendor checks only) ........ 15

Scenario one............................................................................................................ 15

Scenario two ............................................................................................................ 16

Transaction types ......................................................................................................... 16

Setup steps in Payroll CS and the Direct Deposit module ................................................ 17

Request and install the Direct Deposit Transmission license from Thomson Reuters .. 17

Complete the global setup steps .................................................................................. 17

Complete the client and employee setup steps ............................................................ 18

File / Client Properties dialog ................................................................................... 18

Setup / Checkbook dialog ........................................................................................ 19

Setup / Employees window ...................................................................................... 20

Complete the vendor setup steps ................................................................................. 20

Setup / Vendors window .......................................................................................... 20

Impound transaction setup ...................................................................................... 21

Alternate accounts for employee direct-deposit setup ............................................. 22

Setup of calculation profiles when using alternate accounts .................................... 22

Processing steps ............................................................................................................... 23

Prenoting test files ........................................................................................................ 23

Recording the payroll information ................................................................................. 23

Reviewing the transactions in the EPS file before creating the ACH file ...................... 24

Editing the ACH file before you transmit ....................................................................... 24

Creating the ACH direct deposit file.............................................................................. 24

Transmitting the ACH file to InterceptEFT .................................................................... 25

Receiving file confirmations from InterceptEFT ............................................................ 27

Connecting to InterceptEFT without transmitting files................................................... 27

Using the Impound features ......................................................................................... 28

Setting up bank information ..................................................................................... 28

Setting up the Impound checkbook .......................................................................... 28

Enabling the Impound checkbook ............................................................................ 28

Assigning the client impound checkbook ................................................................. 29

Adding direct deposit information to the withdrawal checkbook ............................... 29

Specifying required information in the Impound Funding dialog .............................. 29

Setting up processor information ............................................................................. 31

Setting up vendors for impound ............................................................................... 31

Prefunding checks for impound ............................................................................... 32

Post funding checks for impound ............................................................................. 33

Creating manual fund transactions for impound ...................................................... 33

Child support direct deposit overview................................................................................ 34

Setting up the deduction item ....................................................................................... 34

iv

Payroll CS Guide to Handling Direct Deposit

Contents

Setting up direct deposit information ............................................................................ 34

Setting up the disbursement unit as a vendor .............................................................. 35

Creating a zero balance test file ................................................................................... 35

Processing payroll and child support payments ........................................................... 35

Working Directly with Individual Banks ............................................................... 37

Establishing bank services ................................................................................................ 37

Direct Deposit with Individual Banks Setup Example ........................................ 41

Working directly with individual banks ............................................................................... 41

Restoring the sample data ................................................................................................ 42

Direct deposit scenario ...................................................................................................... 43

Adding banks for direct deposit ......................................................................................... 43

Setting up the client checkbook for direct deposit ............................................................. 45

Setting up the client properties for direct deposit .............................................................. 46

Modifying the Header record in the ACH file ................................................................ 48

Setting up the direct deposit deduction items .................................................................... 48

Setting up employee direct deposit information................................................................. 50

Exercise for setting up employee direct deposit information ......................................... 53

Creating a Prenote test file for direct deposit .................................................................... 54

Creating the ACH Detail Report ........................................................................................ 56

Updating the account status .............................................................................................. 58

Entering payroll data for direct deposit .............................................................................. 58

Using alternate accounts for direct deposit ....................................................................... 59

Displaying the list of checks .............................................................................................. 60

Printing the Unprinted Checks report ................................................................................ 61

Printing the direct deposit payroll checks .......................................................................... 64

Printing the payroll reports ................................................................................................ 65

Creating the ACH file ........................................................................................................ 67

Reversing transactions ...................................................................................................... 71

Viewing the ACH file ......................................................................................................... 72

Removing a transaction .................................................................................................... 73

Working with vendor direct deposit ................................................................................... 74

Making electronic depository tax payments....................................................................... 77

Child support direct deposit overview................................................................................ 78

Setting up the deduction item ....................................................................................... 78

Setting up direct deposit information ............................................................................ 78

Setting up the disbursement unit as a vendor .............................................................. 78

Creating a zero balance test file ................................................................................... 78

Processing payroll and child support payments ........................................................... 79

Removing the setup example direct deposit banks ........................................................... 79

Payroll CS Guide to Handling Direct Deposit

v

Contents

Appendix: InterceptEFT Contract Package ......................................................... 81

InterceptEFT agreement forms ......................................................................................... 81

General information forms ............................................................................................ 81

Processor forms ........................................................................................................... 82

Client forms .................................................................................................................. 82

vi

Payroll CS Guide to Handling Direct Deposit

Introduction

This guide covers the unique benefits and features available when using

Payroll CS® and its optional add-on Direct Deposit module, which are both part of

the Creative Solutions Accounting™ (CSA) software.

This guide also provides assistance in setting up and processing direct deposit for

your payroll clients and includes the following:

A brief overview of the features and functionality of the Payroll CS Direct

Deposit module.

An overview of options for handling ACH processing for direct deposit —

working with InterceptEFT,™ or working with individual banks.

Detailed information about direct-deposit setup and processing for Payroll CS

and Direct Deposit module users who choose InterceptEFT as their ACH

processor.

An overview of the setup and processing steps that are typically required by

individual banks (for users who prefer to choose this option for ACH

processing).

A walkthrough example covering setup and processing issues for a client with

employees who have elected direct deposit for all or a portion of their payroll

checks.

Note: This guide assumes that you are a licensed user of both Payroll CS and the

Direct Deposit module, and that you’ve already reviewed the Payroll CS Getting

Started guide and the Payroll CS Tutorial.

Terms and definitions

ACH

The Automated Clearing House (ACH) network is a nationwide system for

interbank transfers of electronic funds. It serves a network of regional Federal

Reserve Banks processing the distribution and settlement of electronic credits and

debits among financial institutions. ACH payments include direct deposit of payroll;

Payroll CS Guide to Handling Direct Deposit

1

Introduction

business-to-business payments; and federal, state, and local tax payments, as well

as other types of electronic funds transfers.

ACH files

An ACH file is a simple ASCII-format file that adheres to Automated Clearing

House specifications. A single ACH file holds multiple electronic transactions —

much like a manila file folder that is used to store and transmit dozens of sheets of

paper with information related to a single topic.

Each transaction within an ACH file carries either a credit or a debit value. Typically,

a payroll ACH file contains many credit transactions to employees’ checking or

savings accounts, as well as a balancing debit transaction to the employer’s (that is,

your client’s) payroll account.

ACH operator

An ACH operator is a central clearing facility operated by a private organization or

a Federal Reserve Bank on behalf of participating financial institutions, to or from

which financial institutions transmit or receive ACH transactions.

Effective date

An “effective date” is attached to each and every ACH transaction. For payroll

transactions, the effective date represents the day when debit amounts would

actually be withdrawn from the employer’s payroll account and credit amounts

would be deposited to an employee’s bank account.

An effective date cannot fall on a weekend or on a Federal Reserve holiday. If a

transaction were to be sent with an effective date falling on a weekend or bank

holiday — or on a date that has already passed (known as a “stale date”) — the

transaction would automatically be tagged to settle on the next business day. What

that means for your firm as payroll processor is that you need to monitor effective

dates carefully because those dates affect when you must transmit your ACH files.

EPS files

EPS (electronic payment system) files are commonly referred to as “transaction

files” or “ACH transactions.” They store, for example, employees’ net pay amounts

and financial account information. Typically, multiple EPS files make up what is the

more well known direct-deposit file, the ACH file.

InterceptEFT

InterceptEFT (intercepteft.com) is a third-party processing agent that has

specialized in moving money electronically via the Automated Clearing House since

1993. InterceptEFT currently serves hundreds of payroll processors and thousands

of direct-deposit customers. Thomson Reuters has developed a preferred-partner

relationship with InterceptEFT specifically to accommodate the needs of Payroll CS

user firms that process payroll direct deposit for their clients.

NACHA

The National Automated Clearing House Association (NACHA) oversees the

ACH network and is primarily responsible for establishing and maintaining operating

2

Payroll CS Guide to Handling Direct Deposit

Introduction

rules for the network. All financial institutions moving electronic funds through the

ACH system are bound by the NACHA Operating Rules, which cover everything

from participant relationships and responsibilities to implementation, compliance,

and liabilities. The NACHA rules are specific and quite detailed — but with nearly

seven billion transactions and a combined dollar value of $20 trillion having moved

through the system during the year 2000 alone — it’s clear that adhering to a strict

set of rules is crucial to the smooth and successful operation of the ACH system. To

learn more about NACHA and the ACH rules, point your Internet browser to

nacha.org.

Originator

An ACH Originator is typically a company that directs a transfer of funds to or from

a consumer account.

Originating Depository Financial Institution (ODFI)

The ODFI is the financial institution that deposits ACH files, on behalf of the

Originator, into the ACH network.

Prenote files

Prenote (or prenotification) files are zero-dollar entries sent prior to the first live

entry to notify the Receiving Depository Financial Institution (RDFI) of future

payments and to test the validity of account information.

Processing window

“Processing window” refers to the time period required to initiate and complete the

instructions included within an ACH file. The processing window begins when ACH

files are submitted to ODFIs and ends when transferred funds are posted to the

receivers’ accounts.

Processing window example

To illustrate the scheduling time frame, a weekly payroll schedule for a Friday pay

date is shown below. A schedule for a standard 4-day processing window would

look like the following:

Monday

Tuesday

Wednesday

Thursday

Friday

Processor sends

file to

InterceptEFT

InterceptEFT

pulls funds

(collects money)

InterceptEFT

sends payroll

credits to banks

Banks pay

employees

Receiver

The Receiver is the person or organization that has authorized the Originator to

initiate an ACH entry (for example, a direct deposit transaction) to the Receiver’s

account with an RDFI.

Receiving Depository Financial Institution (RDFI)

The RDFI is the financial institution that receives ACH entries from the ACH

Operator and posts the entries to the Receiver’s accounts.

Payroll CS Guide to Handling Direct Deposit

3

Introduction

4

Payroll CS Guide to Handling Direct Deposit

Overview of Payroll CS Direct

Deposit

The Direct Deposit module is a seamlessly integrated add-on module to the Payroll

CS software within CSA. It enables you to process and manage electronic payroll

check deposits for your payroll clients. In addition, it offers the convenience of

making electronic payments to vendors, tax deposit agencies, 401(k) plan

administrators, and so forth.

The Direct Deposit module functions by automatically creating electronic transaction

files (called EPS files) from paycheck information in Payroll CS. The program then

combines these electronic transactions into larger files that are formatted to meet

the required Automated Clearing House specifications for electronic transmission to

banks and other institutions within the ACH network.

The Direct Deposit module enables you to easily create ACH files that hold

payroll transactions not only for multiple employees, but for multiple clients as

well.

The Direct Deposit module creates standard, NACHA-format ACH files that are

complete and ready for electronic transmission through the ACH system. Client

and employee bank account information and employee-specified direct deposit

amounts are entered into the program during the setup process within the CSA

software.

The check printing process in Payroll CS automatically triggers the creation of

the EPS files within the Direct Deposit module. During check printing, the

program looks for all employees for whom direct deposit information has been

previously set up and approved and then automatically creates the electronic

transactions for those employees. The payroll administrator within your

accounting firm can then use the commands within the Direct Deposit module to

select one or more client transaction files to include within the ACH file.

After the ACH file has been created, Direct Deposit module users electing to

use the ACH processing services provided by InterceptEFT (who have already

requested and received the Direct Deposit Transmission license from Thomson

Reuters and who have already established the required written agreements with

InterceptEFT) can transmit their ACH files directly to InterceptEFT from their

Payroll CS software.

Alternatively, users may opt to send their ACH files via some other method to a

bank or other processing agent for transmission though the ACH system.

Payroll CS Guide to Handling Direct Deposit

5

Overview of Payroll CS Direct Deposit

Options for handling ACH processing

The Payroll CS Direct Deposit module enables you to choose either of two options

for handling the transmission of ACH files on behalf of your payroll clients. These

two options are addressed separately in this guide, but please note that you may

choose either option on a client-by-client basis.

Working with InterceptEFT

Thomson Reuters has developed a preferred-partner relationship with

InterceptEFT specifically to accommodate the needs of Payroll CS user firms that

process payroll direct deposit for their clients. InterceptEFT (intercepteft.com) is a

third-party processing agent that specializes in moving money electronically via the

Automated Clearing House (ACH). InterceptEFT currently serves hundreds of

payroll processors and thousands of direct-deposit customers.

Working with InterceptEFT offers a seamlessly integrated way to process your

Payroll CS direct-deposit files. The Direct Deposit module enables you to

automatically transmit ACH files directly to InterceptEFT, literally with the click of a

button. InterceptEFT then oversees and ensures the secure transmission of your

clients’ direct-deposit data through the ACH system.

Advantages

Direct Deposit module users who process direct deposit for multiple clients can

enjoy the convenience and efficiency of sending ACH files to a single

processor (InterceptEFT) that will move the files through the ACH system. As a

result, your firm can spend far less time keeping track of file submission dates,

cutoff times, file status and confirmations, and fee structures — as well as far

less time ensuring that files meet the special requirements of individual banks.

In addition to handling automatic transmissions of direct-deposit payroll

information to InterceptEFT, the Direct Deposit module can automatically

transmit business-to-business (vendor) payments and payments to federal,

state, or local taxing authorities via the InterceptEFT direct transmission

service.

Direct Deposit module users with an established Internet connection never

need to purchase or use any additional software for ACH file transmission. All

transmissions of electronic files are made directly from your Payroll CS and

Direct Deposit module software to InterceptEFT.

InterceptEFT provides daily file confirmations, transaction reports, detailed

monthly statements of transaction processing, and free technical support

regarding any file adjustments or corrections that you may need to make.

InterceptEFT offers a special pricing package to Payroll CS Direct Deposit

module users.

Thomson Reuters stands behind InterceptEFT and its reputation for providing

the most professional, reliable, and comprehensive ACH services available in

the market.

Disadvantages

If you’ve already set up relationships with individual banks and have been

successfully handling direct-deposit processing for your clients, you may not want to

alter a process that has already been working well for you.

6

Payroll CS Guide to Handling Direct Deposit

Overview of Payroll CS Direct Deposit

Note: For step-by-step instructions on working with InterceptEFT to set up and

process direct deposit for your Payroll CS clients, see the section in this guide

entitled “Working with InterceptEFT” that begins on page 9.

Working directly with individual banks

Working with individual banks has long been the most common avenue for

processing direct deposit for payroll clients. The client’s bank has traditionally been

the initiator of direct-deposit transactions through the ACH network — primarily

because banks (Depository Financial Institutions, or DFIs) owned the original rights

to participate in the ACH system. But even though times have changed and

companies like InterceptEFT make the offering of direct-deposit services more

streamlined, many times clients feel more comfortable working with their own

banks.

For Payroll CS Direct Deposit module users, choosing this option for your payroll

clients involves establishing a separate relationship with each client’s bank to

accept ACH files, or having one bank to agree to handle the ACH processing for all

of your payroll clients and then following the specific requirements of each bank

regarding file setup information and structure as well as the mode of transmission.

Advantages

If your firm has already set up agreements with individual banks, you’ve been

successfully handling direct-deposit processing for your payroll clients, and

those processes are working well for you and for your clients, there is no need

to make any change at all.

If your firm prefers to establish one-to-one relationships with individual banks,

you may find that choosing this option would more closely fit your interests than

would choosing to work with InterceptEFT as your single ACH processing

agent.

Disadvantages

Accounting firms that process direct deposit for a large number of clients typically

find dealing with several different banks cumbersome and inefficient. Scheduling

dates and cutoff times for file submissions on behalf of multiple clients, making

certain that ACH file header records meet the requirements of individual banks,

keeping track of different fee structures, sometimes having to purchase and use

additional software for file transmission, and often having to use various methods to

transmit files (as required by the various banks) are some of the difficulties that

have been reported by large payroll processors who have used this option.

Sometimes bank personnel do not fully understand how to communicate to a payroll

processor how their own bank’s ACH processes function, or do not clearly

understand the full requirements for ACH file structure, transmission deadlines, and

so forth. It has even occasionally been reported that the personnel in some banks

have trouble knowing who in their own organization handles setting up ACH

processing for their clients.

Note: For details about using this option for handling direct deposit for your payroll

clients, as well as for instructions on setup and processing within Payroll CS and the

Direct Deposit module, see the section in this guide entitled “Working Directly with

Individual Banks,” which begins on page 37.

Payroll CS Guide to Handling Direct Deposit

7

Overview of Payroll CS Direct Deposit

8

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

In this chapter we walk you through the actions necessary to establish an account

with InterceptEFT and then to set up and process your direct-deposit clients through

InterceptEFT.

Please keep in mind that to accomplish direct transmission of ACH files from Payroll

CS to InterceptEFT, you must first request and install the Direct Deposit

Transmission license from Thomson Reuters and also establish services with

InterceptEFT. You then need to complete the client and employee setup in

Payroll CS in the specific manner described in this chapter, so please review

the following sections very carefully.

Payroll CS Guide to Handling Direct Deposit

9

Working with InterceptEFT

Establishing services with InterceptEFT

There are several important components involved in establishing services with

InterceptEFT, and each of these components is discussed in greater detail within

this section:

Completing and submitting the application form and associated materials.

Preparing and submitting the agreement forms.

Understanding the file submission and testing requirements.

Understanding and complying with the required transmission schedules and

deadlines.

Understanding the specific requirements and procedures for each type of

transaction.

After carefully reviewing this section as well as the documents that are listed and

linked in the appendix to this guide, please feel free to contact the Sales

Department at InterceptEFT(866-341-0595 or info@intercepteft.com) to let them

know that you are user of the Payroll CS Direct Deposit module within the CS

Professional Suite® and to discuss any questions that you may have about the

application process, processing services, and fee schedules.

When you’re satisfied that all your questions have been addressed and that

InterceptEFT will meet your needs, you can print and complete the appropriate

forms and submit them to InterceptEFT by mail. The mailing address for

InterceptEFT is provided on all of the forms.

Application and agreements

To establish an account with InterceptEFT, an application form, a processor

agreement, and an authorized signature form are required. Note that links to all

required InterceptEFT documents are available in the Appendix: InterceptEFT

Contract Package section of this guide, which begins on page 81.

ACH Application. This form includes general information about your

accounting firm and lists all of the additional documents that need to be

submitted to InterceptEFT. InterceptEFT will use this information when

reviewing your firm for account approval.

Note: Failure to provide all requested supporting documentation will result in

denial of the application.

10

Processor Agreement. This is a two-party processing authorization agreement

between InterceptEFT and your accounting firm as the payroll processor. The

processor agreement identifies the terms (including liabilities and fees) under

which you agree to send payroll transactions to InterceptEFT on behalf of your

direct-deposit clients.

Authorized Individuals Signature Form. This form should list the names,

titles, and signatures of all employees of your accounting firm who are

authorized to send information to InterceptEFT and to change account or ACH

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

file information. This information must be kept current, and all changes should

be sent to InterceptEFT as soon as they occur.

To begin processing on behalf of your direct-deposit clients, the following are

required:

Client Information Form. This form (to be used as a cover sheet when

sending the Company Authorization Agreement described below) provides

InterceptEFT with the client company’s address, contact, types of transactions

that will be submitted, and processing window requirements.

EIN verification. InterceptEFT is required to have EIN numbers on file for all

companies processing through them. You will need to provide InterceptEFT

with EIN numbers for your firm and for all your processing clients.

InterceptEFT Company Authorization Agreement. This is a three-party

processing authorization agreement between InterceptEFT, your accounting

firm, and your client. By signing this agreement, the client authorizes your

accounting firm (the payroll processor) to transmit direct-deposit transactions to

InterceptEFT on the client’s behalf. This agreement also warrants to

InterceptEFT that the client company will honor all debits and credits forwarded

by your accounting firm (as payroll processor) for purposes of providing payroll

direct deposit for the client’s employees. You must submit a signed Company

Authorization Agreement to InterceptEFT for each client prior to submitting

transactions on their behalf.

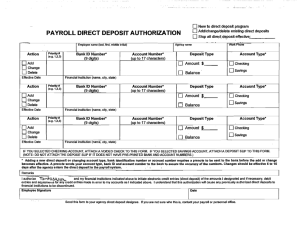

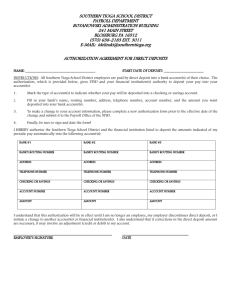

InterceptEFT Automatic Debit and Credit Agreement. Each employee of the

client company must sign a copy of this form to authorize direct deposit of his or

her payroll check. This form authorizes the direct credit/debit of payroll funds to

the employee’s bank account(s). Bank names, account numbers, social security

numbers, and a signature must be completed on this form. Your accounting firm

will need to keep these authorization forms on file. (Please do not send these

employee forms to InterceptEFT.)

The approval process typically takes less than two weeks after you have completed

and submitted the EFT Application and supporting agreements. Upon approval,

InterceptEFT will provide your firm with all reference information needed to use their

service.

Fees for ACH processing services

InterceptEFT charges a monthly per-client maintenance fee, plus per-transaction

processing fees. (For specific fee amounts, please refer to Schedule B of the

Processor Agreement form.)

File submission and transmission testing

Thomson Reuters has worked with InterceptEFT to design a system that

automatically connects your Payroll CS Direct Deposit module software to the

InterceptEFT servers for immediate file submission. No transmission testing is

necessary because that has already been done for you.

Sending your ACH files from Payroll CS to InterceptEFT for processing is easy.

After you have finished creating the ACH file, simply click the Transmit button* on

* The Transmit button appears on the dialog only after you have requested, downloaded, and

applied the Direct Deposit Transmission license, as described on page 18 of this guide.

Payroll CS Guide to Handling Direct Deposit

11

Working with InterceptEFT

the Maintain ACH Files dialog. You need only supply an active Internet connection

and enter the personal login ID, password, and PIN provided to you by

InterceptEFT. The file ID modifier is automatically incremented each time you click

the Transmit button to send an ACH file to InterceptEFT.

Note: The ID modifier is used in the filename to help InterceptEFT track the number

of files it receives for processing. Because InterceptEFT can accept up to 36 files

from the same PIN per day, the file ID modifier automatically increments first from 0

to 9 and then from A to Z. Please do not make manual edits in this field.

Transmission schedules and deadlines

NACHA rules state that if an ACH Operator makes a credit entry available to a bank

by 5:00 p.m. (bank’s local time) on the banking day prior to the Effective Date, the

bank must make that credit available to the Receiver (the employee, for example) at

the opening of business on the Effective Date. Opening of business is defined as

the later of 9:00 a.m. (bank’s local time) or the time the bank’s teller facilities and

ATMs are open for customer account withdrawals.

The daily deadline for transmitting ACH files to InterceptEFT from the Payroll CS

Direct Deposit module is 7:00 p.m. Central Time. This allows time for InterceptEFT

to check transmission files for proper effective dates and to make adjustments if

necessary. There is no restriction on the number of times throughout the day that

you may transmit ACH files from Payroll CS to InterceptEFT.

InterceptEFT also adheres to the processing schedule of the Federal Reserve

Banks. Each year, the Federal Reserve Banks issue a calendar of bank holidays

throughout the year that are non-ACH processing days (that is, invalid effective

dates). These “closed” dates should be incorporated into your processing window

just as if they were Saturdays or Sundays. A calendar of the Federal Reserve Bank

holidays can be obtained from the InterceptEFT website (intercepteft.com).

Standard 4-day processing window

To meet a Friday pay day using the standard four-day schedule would require that

files be submitted to InterceptEFT by the cutoff time on Tuesday, however earlier

12

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

ACH transmissions would be required during holiday periods. A schedule example

for a Friday payday is shown in the following table:

Monday

Tuesday

Wednesday

Thursday

Friday

Processor sends

file to

InterceptEFT

InterceptEFT

pulls funds

(collects money)

InterceptEFT

sends payroll

credits to banks

Banks pay

employees

Premium 3-day processing window

If you or your payroll clients require a faster turnaround, InterceptEFT also offers a

premium service to enable a three-day schedule. A schedule example for a Friday

payday is shown in the following table:

Monday

Tuesday

Wednesday

Thursday

Friday

Processor sends

file to

InterceptEFT.

InterceptEFT

pulls funds

(collects money);

sends payroll

credits to banks.

Banks pay

employees.

Note that if a bank holiday were to fall on the Friday, the ACH files would need to be

transmitted to InterceptEFT one day earlier (Tuesday) for a Thursday rather than a

Friday pay day. Otherwise, InterceptEFT would be required to change the effective

date to the next business day and employees would not get paid until Monday.

To specify the processing window required for your client, mark the appropriate

option in the Direct Deposit tab of the File / Client Properties window. The complete

setup and processing steps are covered in the section of this document entitled

“Setup steps in Payroll CS and the Direct Deposit module” that begins on page 17.

Vendor and tax payment 5-day processing window

For vendor and tax payment transactions, InterceptEFT requires a 5-day processing

window. To ensure processing can be completed without any unexpected delays,

send vendor and tax payment transactions in an ACH file separate from payroll

transactions. The effective entry date must be 5 days from the submission date to

InterceptEFT. For example, if you submit a file on Monday, the effective entry date

would be Friday, as shown in the following table.

Monday

Tuesday

Processor sends

file to

InterceptEFT

InterceptEFT

pulls funds

(collects money).

Wednesday

Thursday

Friday

InterceptEFT

sends collected

funds to banks.

Collected funds

post to Vendor /

Tax Agency

accounts.

Billing and tax impound processing

For billing or tax impound transactions, the effective entry date is handled

differently. The effective entry date can be as soon as the next available banking

business day. However, there is a 3-day hold on the funds after the effective entry

date. Make sure you set the effective entry date as early as necessary to

accommodate the 3-day hold on the funds.

To ensure processing can be completed without any unexpected delays, send

billing and tax impound transactions in an ACH file separate from payroll, vendor

payment, or tax payment transactions.

Payroll CS Guide to Handling Direct Deposit

13

Working with InterceptEFT

Payroll impound processing

Similar to billing and tax impound transactions, for payroll impound transactions the

effective date can be as soon as the next available banking business day. However,

there is a 2 day hold on the funds after the effective entry date. Be sure to set the

effective entry date as early as necessary to accommodate the 2 day hold on the

funds.

InterceptEFT processing days with example scenarios

These scenarios are provided to help you more clearly understand the InterceptEFT

processing windows. InterceptEFT begins counting transmission days based on the

date you send the file. The transmission days are numbered below the illustrations.

First, here is a glossary list of terms in the InterceptEFT calendar.

Processor sends file to InterceptEFT. This is when the client takes the payroll

file created in CSA and sends it to InterceptEFT.

InterceptEFT pulls funds (collects money). This is when InterceptEFT takes

the money from your client’s bank.

InterceptEFT sends payroll credits / collected funds to banks. This is when

InterceptEFT forwards the funds to the Federal Reserve for disbursement to

banks.

Banks pay employees. This is when employees are paid.

Standard 4-day processing window examples

Scenario one

In this scenario, you send a direct deposit file to InterceptEFT on Tuesday for

employees to be paid on Friday. On Wednesday, InterceptEFT pulls funds from the

client’s bank, on Thursday the credits are sent to the Federal Reserve for

disbursement to banks, and on Friday, the banks pay the employees.

Monday

Tuesday

Wednesday

Thursday

Processor sends

file to

InterceptEFT

InterceptEFT

pulls funds

(collects money)

InterceptEFT

sends payroll

credits to banks

1

2

3

Friday

Banks pay

employees

4

Scenario two

In this scenario, you send a direct deposit file to InterceptEFT on Wednesday to be

paid on the effective date (based on the check date) of Tuesday of the following

week. Thursday is a hold day, on Friday, InterceptEFT pulls the funds from the

clients bank. On Monday of the following week, credits are sent to the Federal

Reserve for disbursement to banks, and on Tuesday the banks pay the employees.

Monday

Tuesday

Wednesday

Processor sends

file to

InterceptEFT

14

Thursday

Hold day

Friday

InterceptEFT

pulls funds

(collects money)

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

1

Monday

Tuesday

InterceptEFT

sends payroll

credits to banks

Banks pay

employees

3

Wednesday

1 (hold)

Thursday

2

Friday

4

Premium 3-day processing window examples

Scenario one

In this scenario, you send a direct deposit file to InterceptEFT on Wednesday for

employees to be paid on Friday.

Monday

Tuesday

Wednesday

Thursday

Friday

Processor sends

file to

InterceptEFT

InterceptEFT

pulls funds

(collects money)

and sends payroll

credits to banks.

Banks pay

employees

1

2

3

Scenario two

In this scenario, you send a direct deposit to InterceptEFT on Monday for

employees to be paid on the effective date (based on the check date), which is

Friday. In this case, Tuesday and Wednesday would be considered hold days. Then

on Thursday, credits are sent to the Federal Reserve for disbursement to banks,

and on Friday the employees are paid.

Monday

Tuesday

Wednesday

Processor sends

file to

InterceptEFT

1

1 (hold)

1 (hold)

Thursday

Friday

InterceptEFT

pulls funds

(collects money)

and sends payroll

credits to banks.

Banks pay

employees

2

3

5-day processing window examples (for tax payments and vendor checks only)

A 5-day processing window is used only for tax payments and vendor checks.

Scenario one

In this scenario, you send a tax payment to InterceptEFT on Monday to be paid to

the agency on Friday. On Tuesday, InterceptEFT pulls the funds from the client’s

bank, Wednesday is a hold day, on Thursday InterceptEFT sends credits to the

Federal Reserve for disbursement to the bank, and on Friday the bank pays the tax

agency (posts the payment to the account).

Payroll CS Guide to Handling Direct Deposit

15

Working with InterceptEFT

Monday

Tuesday

Wednesday

Thursday

Friday

Processor sends

file to

InterceptEFT

InterceptEFT

pulls funds

(collects money).

Hold day

InterceptEFT

sends collected

funds to banks.

Collected funds

post to Vendor /

Tax Agency

accounts.

1

2

3

4

5

Scenario two

In this scenario, you send a tax payment to InterceptEFT on Tuesday to be paid on

an effective date (based on a check date) of Friday of the following week.

Wednesday of this week through Monday of the following week are considered idle

days. On Tuesday, InterceptEFT pulls the money from the client’s bank,

Wednesday is a hold day, on Thursday InterceptEFT sends money to the Federal

Reserve for disbursement to the bank. On Friday, the bank pays the tax agency

(posts the payment to the account).

Monday

Tuesday

Wednesday

Thursday

Friday

Processor sends

file to

InterceptEFT

1

Monday

Tuesday

(Idle)

Wednesday

InterceptEFT

pulls funds

(collects money).

Hold day

2

3

(Idle)

(Idle)

(Idle)

Thursday

Friday

InterceptEFT

sends collected

funds to banks.

Collected funds

post to Vendor /

Tax Agency

accounts.

4

5

Transaction types

InterceptEFT accepts the following types of transactions for ACH processing:

16

Payroll

Child support withholding payments

Direct vendor payments

Tax payments

Impounding for taxes

Impounding for billing or other

Impounding for payroll

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

Setup steps in Payroll CS and the Direct Deposit module

Request and install the Direct Deposit Transmission license from

Thomson Reuters

Contact Thomson Reuters, Professional Software & Services, to ask for the free-byrequest Direct Deposit Transmission license that is required to activate the

InterceptEFT functionality in your Payroll CS and Direct Deposit module software.

To purchase the Direct Deposit module as well as to request the Direct Deposit

Transmission license that enables you to transmit ACH files directly to

InterceptEFT, contact your CS Sales Representative at 800-968-8900 or via our

website at CS.ThomsonReuters.com.

If you are already a licensed user of the Direct Deposit module but want to

request just the Direct Deposit Transmission license to add the ability to

transmit ACH files directly to InterceptEFT, contact a CS Sales Representative

at 800-968-8900 or via our website at CS.ThomsonReuters.com.

Thomson Reuters will provide you with an updated software license for your CS

Professional Suite Accounting Products software. When that file becomes available,

complete the following steps to download it via CS Connect.™

1. Open your CSA software and choose File / CS Connect.

2. In the CS Connect dialog, mark the Retrieve licenses checkbox and then click

the Call Now button to begin the download process.

Note: The Direct Deposit Transmission license is not required if you are already a

licensed user of both Payroll CS and the Direct Deposit module and you choose to

work with individual banks rather than with InterceptEFT.

Important! To ensure that your ACH files will be transmitted to InterceptEFT

correctly, you need to complete the steps outlined below exactly as described.

Complete the global setup steps

You first need to set up InterceptEFT as one of your direct-deposit “banks” that will

be sending or receiving electronic payments on behalf of you and your clients. The

steps in this section will make InterceptEFT available for selection as the

Immediate Destination Bank for any of your payroll clients.

1. From the CSA main window, choose Utilities / Direct Deposit.

2. From the Maintain Electronic Transaction Files dialog, choose Setup / Bank

Information.

Payroll CS Guide to Handling Direct Deposit

17

Working with InterceptEFT

3. In the Bank Information dialog, click the Add button and enter the following

information for InterceptEFT:

Description

InterceptEFT

Bank name

InterceptEFT

RTN (routing/transit number)

0912-14847

4. Click the Enter button to save the record.

5. Continue adding a bank information record for each bank used by any of your

clients or their employees. Remember to verify the bank’s routing number prior

to clicking the Enter button.

Notes

Because each bank has a unique routing number (RTN), any bank needs to

be set up only once in Payroll CS to make that global bank information

available for all clients and employees.

By default, the ACH banks list is sorted by Description, but you can click on

any column heading to modify the sort order.

6. Click the Done button to return to the Maintain Electronic Transaction Files

dialog.

7. Click the Done button to return to the CSA main window.

Complete the client and employee setup steps

File / Client Properties dialog

1. Open the client in CSA and then choose File / Client Properties.

2. In the Client Properties dialog, click the Direct Deposit tab and enter from the

following table. (Also see the following illustration.)

18

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

Field

Enter the following information:

Immediate destination bank ID

InterceptEFT

Immediate origin

<Enter your own accounting firm’s 9-digit tax ID

number.>

Immediate origin name

<Enter your own accounting firm’s name, using up

to 23 characters.>

Originating DFI bank ID

<From the drop-down list, select the bank from

which the funds will be debited.>

Processing window

<Specify the processing window appropriate for the

selected client.>

Important! All other fields in the Direct Deposit tab of the Client Properties dialog

must be left blank.

3. Click OK to return to the CSA main window.

Setup / Checkbook dialog

1. From the CSA main window, choose Setup / Checkbook.

2. In the Checkbook Setup dialog, select the appropriate checkbook and then click

the Edit button.

3. In the Direct Deposit tab, specify the withdrawal bank (client), account type, and

status by selecting the appropriate information from the drop-down lists.

4. Click the Enter button to save the information, and then click the Done button to

close the Checkbook Setup dialog.

Payroll CS Guide to Handling Direct Deposit

19

Working with InterceptEFT

Setup / Employees window

Repeat the following for each employee who requests payroll direct deposit.

1. From the CSA main window, choose Setup / Employees.

2. In the Employees window, highlight the employee who will receive the direct

deposit and click the Edit button.

3. In the Tax Withholdings and Deductions tab, verify that the employee record

includes a deduction item for direct deposit.

4. If you are using journal entries, enter a GL number for the deduction item in the

G/L Acct column. This is generally the same net pay GL number used for the

checkbook from which the deduction is being taken.

button for the direct deposit deduction item and enter or verify the

5. Click the

information in the Item Properties dialog.

Note: If you have created a new direct deposit deduction item (rather than

using the default CSA Direct Deposit deduction item), the item must be

specified for the CSA direct deposit calculation in order to prompt creation of

the EPS file. Choose Setup / System Configuration / Deduction Items. Edit the

item you are using for direct deposit, click the Calculations tab, and then mark

the CSA direct deposit checkbox.

6. In the Direct Deposit tab, enter or select the appropriate information as

specified by the employee:

Select the employee’s bank ID from the drop-down list.

Enter the employee’s bank account number.

Select the employee’s account type from the drop-down list.

Enter either the amount or the percentage for the direct-deposit deduction.

Select the status from the drop-down list. (You may choose Approved,

Suspend, Waiting, or Prenote / Zero Balance. Note that a “Suspend”

status is used if the employee wants to temporarily stop the direct-deposit

deduction. For Prenote information, please refer to the processing section

below.)

7. If the employee is having funds direct deposited in more than one account, use

the additional lines to enter the required information for those accounts.

Note: There is no limit for the number of accounts you can set up into which

funds can be deposited.

8. Click the Enter button to save the information for the selected employee.

Complete the vendor setup steps

Setup / Vendors window

If appropriate for your client, use the following procedure to set up a payroll agent

vendor for direct deposit or, if applicable, for discretionary tax payments. (Please

refer to the CSA help topics for more details about vendor setup, including

20

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

information about the automatic creation of vendor checks for payroll agents using

GL account triggers.)

1. From the CSA main window, choose Setup / Vendors.

2. In the Vendors window, select the vendor, click the Edit button, and then click

the Direct Deposit tab.

3. In the Direct Deposit tab, enter or select the appropriate information as

specified by the vendor:

To have payroll agent checks posted to a direct deposit account, mark the

Process electronic payment checkbox.

Select the vendor’s deposit bank from the drop-down list.

Enter the vendor’s deposit account number.

Select the vendor’s account type from the drop-down list.

Select the status from the drop-down list. (You may choose Approved,

Waiting, or Prenote / Zero Balance. For Prenote information, please see

the “Processing steps” section that begins on page 23.)

Impound transaction setup

Use the following procedure if you plan to impound money for tax, billing, or other

purposes for your client:

1. In the CSA main window, choose Utilities / Direct Deposit.

2. In the Maintain Electronic Transaction Files dialog, choose Setup / Processor

Information.

3. In the Processor Information dialog, enter your company name and tax ID

number.

4. Click OK to save your information and close the Processor Information dialog

and then click Done to close the Maintain Electronic Transaction Files dialog.

5. Choose Setup / Vendors to open the Vendors window and then set up your firm

as a vendor for your client. Please refer to the CSA help topics for more details

about vendor setup.

6. In the Direct Deposit tab of the Vendors window, be sure to mark the

Commercial account checkbox, which will activate the Impound type dropdown list. Select the appropriate impound option from this list.

7. When you have finished entering information, click the Enter button to save the

vendor record and close the Vendors window.

Payroll CS Guide to Handling Direct Deposit

21

Working with InterceptEFT

Note: To impound money for tax purposes as well as for billing or other purposes,

you must set up your firm as two separate vendors, one for each impound type.

Alternate accounts for employee direct-deposit setup

A checkbox option called Activate alternate accounts on the Direct Deposit tab of

the Employees window enables you to use a different direct-deposit setup

configuration for the employee, and the Type field allows you to choose either the

primary or alternate configuration when specifying the information for direct deposit.

For example, if an employee has a fixed direct deposit of $100.00 to pay a bill from

his normal payroll check, he may not want to make an extra payment if he receives

a bonus check; the alternate account type enables the employee to direct deposit

the bonus check into his regular checking account.

Use the following procedure to set up and use an alternate account for a check run:

1. In the CSA main window, choose Setup / Employees.

2. Select the appropriate employee and then click the Edit button.

3. Click the Direct Deposit tab.

4. Mark the Activate alternate accounts checkbox.

5. Select Alternate from the drop-down list in the Type field.

6. In the Direct Deposit Information grid, enter the employee’s information for the

special check run.

Note: If this information is not set up or does not have approved status when

paychecks are processed, a live check will be produced.

7. Click the Enter button to save the employee, and then close the Employees

window.

Setup of calculation profiles when using alternate accounts

1. Choose Setup / Calculation Profiles.

2. Click the Add button to create a new calculation profile and enter the

appropriate information on the General tab.

3. Click the Deduction and Withholding Overrides tab.

4. Mark the Use alternate direct deposit account checkbox.

Note: This checkbox will be available only if the Activate alternate accounts

checkbox in the Employees window has been marked for at least one

employee. The program automatically uses the primary direct deposit

information for employees who do not have the Activate alternate accounts

checkbox marked.

5. Click the Enter button to save your choices, and then click Done to exit the

Calculation Profiles dialog.

22

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

Processing steps

Prenoting test files

When setting up any new employee direct-deposit information and before sending

actual payroll data, the status for all accounts on the Direct Deposit tab of the Setup

/ Employees window should start as Prenote / Zero Balance. Prenote files are

used to verify the receiver’s account number, name, and bank routing number prior

to any transmissions of live payroll files for ACH processing.

Note: While sending prenote files is not mandatory, InterceptEFT does strongly

recommend using prenote files for file testing prior to transmitting live data. Please

allow 5 to 6 business days after transmitting a prenote file before sending ACH files

with live payroll data. This gives the RDFI time to respond if account information has

been recorded incorrectly.

After you have transmitted a prenote file, the status of all accounts associated with

the file automatically changes from Prenote to Waiting. However, if corrections are

needed, you can make those changes and transmit another prenote file. (To create

another prenote file, you must change the status of all accounts from Waiting back

to Prenote. This will prevent actual payroll information from being rejected.)

1. Choose Utilities / Direct Deposit.

2. From the menu bar in the Maintain Electronic Transaction Files dialog, choose

Tasks / Prenote Accounts. A message appears telling you the prenote file

was created successfully. Click OK to dismiss the message prompt.

3. Choose File / Refresh. Note that the prenote file you just created now appears

in the left pane of the dialog.

4. Double-click the file to move it to the right-hand (Selected) pane, and then click

the Create ACH File button.

5. In the Create ACH File dialog, enter Prenote as the file name. Note that the

effective entry date defaults to the system date.

6. Transmit the prenote file to InterceptEFT (by following the steps that begin on

page 25).

7. After the prenote account information for the client and for the employees has

been verified and prior to sending actual payroll data to InterceptEFT, you need

to change the status of all accounts from Waiting to Approved. From the

Maintain Electronic Transaction Files dialog, choose Tasks / Update Account

Status, mark the Approved Status option, and click OK.

Recording the payroll information

1. Choose Tasks / Payroll Check Entry.

Please note that if you’re using alternate accounts, you need to select the

appropriate calculation profile. Press F3 and choose Options from the context

menu. In the Data Entry Options dialog, choose the calculation profile

appropriate for this check run by selecting it from the drop-down list, and then

click OK to return to the Payroll Check Entry window.

2. Enter the payroll data for this check run and then print the payroll checks. The

check printing process in Payroll CS automatically triggers the creation of the

Payroll CS Guide to Handling Direct Deposit

23

Working with InterceptEFT

EPS files within the Payroll CS Direct Deposit module, which then automatically

creates the electronic transactions for employees with Approved-status directdeposit setup information. You can then select one or more EPS files to include

within the ACH file.

Reviewing the transactions in the EPS file before creating the ACH file

1. From the CSA main window, choose Utilities / Direct Deposit.

2. In the Maintain Electronic Transaction Files dialog, double-click the EPS file

corresponding to the payroll just processed to move it to the right-hand

(Selected) pane. Use the client ID, date, time, and type information to help you

select the correct file. Note that files still unprocessed are already selected.

3. To view or print the EPS file information for a final review before proceeding,

choose File / View / Detail.

Editing the ACH file before you transmit

If necessary, you may use the following procedure to delete one or more

transactions from a file.

1. From the CSA main window, choose Utilities / Direct Deposit.

2. From the Maintain Electronic Transaction Files dialog, choose Tasks / Remove

Transactions. (Note that this command is available only when a single file

appears in the pane on the right side of the Maintain Electronic Transaction

Files dialog.)

3. Enter the check number of the record you would like to delete.

4. After the check has been removed, the program displays a prompt reminding

you to void the check in the Payroll Check Entry window.

Creating the ACH direct deposit file

1. From the CSA main window, choose Utilities / Direct Deposit.

2. In the Maintain Electronic Transaction Files dialog, double-click each EPS file in

the left-hand pane that should be included in the ACH file to move those files to

the right-hand (Selected) pane. Files still unprocessed are already selected.

3. Click the Create ACH File button.

4. In the Create ACH File dialog, specify the file information, supplementary

information, and the effective dates, and then click OK.

Note: Although you can override the date in the Effective Date field of the Create

ACH File dialog, the program ignores those overrides and automatically assumes

the effective date according to your selection of either the standard 4-day or the

premium 3-day processing window (in the Direct Deposit tab of the Client Properties

dialog). However, you can override the effective date in the Transmission dialog,

prior to transmitting your files.

24

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

Transmitting the ACH file to InterceptEFT

1. From the Maintain Electronic Transaction Files dialog, choose File / Maintain

ACH Files.

2. From the Maintain ACH Files dialog, double-click the ACH file in the left-hand

pane that is to be transmitted to move it to the right-hand (Selected) pane. You

may need to click the Change File Location button on this dialog to view files in

a different folder. Please note that you can transmit only one ACH file at a time

to InterceptEFT.

3. Choose File / Transmission / Transmit ACH, or simply click the Transmit

button at the lower-right corner of the dialog.

4. In the Transmission dialog (shown in the following illustration), enter the login,

password, and PIN that have been provided to you by InterceptEFT, and then

click the Continue button.

Note: The File ID Modifier defaults to the next available number or letter and is

used within the ACH file name to enable InterceptEFT to track the ACH files

that you send; please do not edit this field.

5. The InterceptEFT interface opens automatically. At this point you will need to

enter the additional login information provided to you by InterceptEFT.

Payroll CS Guide to Handling Direct Deposit

25

Working with InterceptEFT

6. To submit the file you selected in step 2, click the Submit File button.

7. If you do not wish to submit the file at this time due to error messages from

InterceptEFT, click the Reject File button. To view details of the selected file

before submitting or rejecting the file, click View File Summary.

26

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

8. Once the file is submitted, you will receive confirmation that the file has been

submitted to InterceptEFT for processing. InterceptEFT will give you a

reference number to use when corresponding with them about this file.

Note: Additional options are available, such as the ability to run reports and to

request an online trace. For more information about these options, please

contact InterceptEFT Customer Service at (866) 341-0595.

9. When you have completed all relevant tasks in the InterceptEFT interface, click

the Close button at the bottom of the screen to return to CSA.

After you have successfully completed the transmission, InterceptEFT will oversee

all of the remaining processing steps through the ACH network.

Note: If you have questions about any issue related to ACH files that have already

been transmitted to InterceptEFT (including issues related to customer service,

technical support, billing, and so forth), please contact InterceptEFT Customer

Service at (866) 341-0595.

Receiving file confirmations from InterceptEFT

After receiving and processing your ACH file(s), InterceptEFT will provide to you via

email a File Confirmation Report, with specific information about your ACH files —

including processing date, company, and dollar amount.

Please refer to the “InterceptEFT Reference Guide” for a detailed description of the

reporting you can expect to receive, as well as other pertinent reference materials.

Connecting to InterceptEFT without transmitting files

If you would like to connect to the InterceptEFT interface when you are not

submitting files, follow these steps.

1. Choose Utilities / Direct Deposit.

2. From the Maintain Electronic Transmission Files dialog, choose File / Maintain

ACH Files.

3. From the Maintain ACH Files dialog, choose File / Transmission / Connect to

InterceptEFT.

4. In the Intercept Login dialog, enter your login and password, and click the

Continue button.

Payroll CS Guide to Handling Direct Deposit

27

Working with InterceptEFT

Using the Impound features

If you are a licensed user of the Impound features, there are a series of setup steps

required to begin using impound.

Setting up bank information

1. Choose Utilities / Direct Deposit.

2. In the Maintain Electronic Transactions dialog, choose Setup / Bank

Information.

3. Enter the description, bank name, and routing number for each bank you wish

to add.

Setting up the Impound checkbook

1. Choose Setup / System Configuration / Impound Checkbook.

2. In the Impound Checkbook dialog, fill in the appropriate fields in the General

tab. This will be the central checkbook into which funds from all the various

client accounts will be deposited.

3. If applicable, click the MICR tab and specify MICR numbers for the impound

checkbook.

4. Click the Direct Deposit tab, and select the bank and account type from the

drop-down lists. We also strongly recommend that you prenote the Impound

checkbook.

5. Click the Bank Reconciliation tab and enter the reference number that should

be used in GL Transaction export files during impound bank reconciliation.

6. Click Enter to save the checkbook. Note that multiple impound checkbooks can

be entered.

7. Click Done to save your information and close the Impound Checkbook dialog.

Note: When the Setup / Checkbook dialog is open in Browse mode, you have the

option to rename a checkbook. Highlight the checkbook name, right-click in the gray

area of the dialog (or press the F3 key), and then choose Rename checkbook from

the context menu that appears.

Enabling the Impound checkbook

1. Choose File / Client Properties.

2. In the Client Properties dialog, click the Calculating Payroll tab and then mark

the Enable impound checkbook checkbox.

3. Click the Direct Deposit tab and, if applicable, enter the information for the

withdrawal account, which is now the impound checkbook. The information you

enter here applies to the account to be debited.

4. Click OK to save your information and close the Client Properties dialog.

28

Payroll CS Guide to Handling Direct Deposit

Working with InterceptEFT

Assigning the client impound checkbook

1. Choose Setup / Checkbook.

2. Highlight (or add) the checkbook you want to assign as the impound

checkbook.

3. Mark the Impound checkbook checkbox and select the appropriate impound

checkbook from the drop-down list.

Note: Marking this checkbox disables most of the fields in this dialog, because

as the impound checkbook, the checkbook information can no longer be

modified at the client level. The GL account # field becomes the Holding

account # field.

4. Enter the appropriate GL number in the Holding account # field.

Note: The holding account will credit net pay with checks written from this

checkbook and then debit the funding value when the EPS file is created.

5. Click the Check Layout Information tab and enter or modify check layout

information as needed.

6. Click Enter to save your information and then Done to close the Checkbook

dialog.

Adding direct deposit information to the withdrawal checkbook

1. Choose Setup / Checkbook.

2. Highlight the checkbook that will be used to fund the impound transactions and

then click the Edit button.

3. Click the Direct Deposit tab and select the appropriate bank information.

4. Click Enter and then Done to save your changes and close the Checkbook

dialog.

Specifying required information in the Impound Funding dialog

1. Choose Utilities / Impound Funding.

2. If there are multiple impound checkbooks, choose the appropriate one from the

Impound Checkbook Selection dialog and click OK.

3. In the Impound Funding dialog, select the appropriate withdrawal checkbook

from the drop-down list.

Note: The withdrawal checkbook is the checkbook to be debited for fund