Télécharger en PDF

advertisement

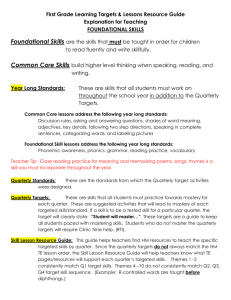

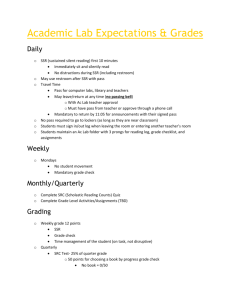

INVESTMENT, INVESTMENT, PROFIT MARGINS AND CASH POSITIONS IN INDUSTRY, INDUSTRY, CONSTRUCTION AND WHOLESALE TRADE Tuesday 10 January 2012 DGS Sectoral Surveys and Statistics Directorate 4th Quarter 2011 Quarterly synthetic indicators (financial situation, construction, wholesale trade) Investment, profit margins and cash position synthetic indicator 120 The synthetic indicator for investment, profit margins and cash positions stood at 98 in Q4 2011 after 99 in the previous quarter. 110 100 The synthetic indicator for construction improved to 98 in Q4 2011 after 96 the previous quarter. 90 The synthetic indicator for wholesale trade stood at 97 in Q4 2011 compared to 96 the previous quarter. 80 70 . 60 Q4/01 Q4/02 Q4/03 Q4/04 Q4/05 Q4/06 Q4/07 Q4/08 Q4/09 Q4/10 Q4/11 Investment, profit margins and cash positions indicator Synthetic indicator for construction Synthetic indicator for wholesale trade 120 120 110 110 100 100 90 90 80 80 70 70 60 Q4/01 Q4/02 Q4/03 Q4/04 Q4/05 Q4/06 Q4/07 Q4/08 Q4/09 Q4/10 60 Q4/11 Q4/01 Q4/02 Q4/03 Q4/04 Q4/05 Q4/06 Q4/07 Q4/08 Q4/09 Q4/10 Q4/11 Construction BUSINESS SENTIMENT INDICATORS Investment, profit margins and cash positions Construction Wholesale trade Wholesale trade Q3/ 10 Q4/ 10 Q1/ 11 Q2/ 11 103 104 102 103 99 98 95 96 99 98 96 98 110 109 112 104 96 97 BANQUE DE FRANCE - DGS – DESS – SEEC – + 33 1 42 92 29 39 – Quarterly Business Survey published on 10 January 2012 Q3/ 11 Q4/ 11 1 Period under review: Q4/2011 QUARTERLY BUSINESS SURVEY Investment, profit margins and cash positions in Industry Cash positions in industry appeared less satisfactory than in the previous quarter, slightly below their long-term average. Investment spending continued to grow, albeit at a slower pace than previously. Forecasts indicate that investment should continue to rise in the coming quarter. Profit margins contracted very slightly. Gross operating profits remained stable compared with the previous quarter. Investment Cash positions Balance of opinion, sa Balance of opinion, sa 25 25 20 20 15 15 10 5 10 0 -5 5 -10 0 -15 -20 -5 -25 -10 -30 Past investment Trend Investment forecast Long-term average since 1991 End-of-quarter position Trend Long-term average since 1991 Total margins Gross operating profit Balance of opinion, sa Balance of opinion, sa 2 15 0 10 -2 5 -4 0 -6 -5 -8 -10 -10 -15 -12 -20 -14 -25 -16 -30 -18 -35 Change compared with the previous quarter Trend Long-term average since 1991 Change compared with the previous quarter Trend Long-term average since 1991 Total Industry Q3/ 10 Q4/ 10 Q1/ 11 Q2/ 11 Q3/ 11 Q4/ 11 Investment Change compared with the previous quarter 10 8 10 9 6 3 Forecast for the next quater 12 20 11 12 7 6 Cash positions 15 18 20 19 14 11 Total margins (quarterly change) -2 -4 -4 -2 -4 -2 Export margins (quarterly change) -3 -3 -4 -4 -2 -1 4 4 3 4 1 -1 Gross operating profit (quarterly change) BANQUE DE FRANCE - DGS – DESS – SEEC – + 33 1 42 92 29 39 – Quarterly Business Survey published on 10 January 2012 2 Period under review: Q4/2011 QUARTERLY BUSINESS SURVEY Construction Activity in the construction sector improved in the quarter, both in the civil engineering and building sectors. Order books remained at a satisfactory level. Business leader expectations point to a deceleration of the activity. Construction activity Construction order books Balance of opinion, sa Balance of opinion, sa 80 40 60 20 40 0 20 -20 0 -40 Q4/05 Q4/06 Q4/07 Q4/08 Q4/09 Q4/10 -20 Q4/05 Q4/11 Past activity Long-term average since 1996 Trend Forecasts Q4/06 Q4/07 Q4/08 Q4/09 Level of order books Building activity Q4/10 Q4/11 Trend Building order books Balance of opinion, sa Balance of opinion, sa 80 40 60 20 40 0 20 -20 0 -40 Q4/05 Q4/06 Q4/07 Q4/08 Q4/09 Q4/10 -20 Q4/05 Q4/11 Past activity Long-term average since 1996 Trend Forecasts Q4/06 Q4/07 Q4/08 Level of order books Civil engineering activity Balance of opinion, sa 45 80 30 60 15 40 0 20 -15 0 -30 -20 Q4/07 Q4/08 Q4/09 Q4/10 Long-term average since 1996 Trend Forecasts Building Civil engineering Past activity Outlook Level of order books Past activity Outlook Level of order books Past activity Outlook Level of order books -40 Q4/05 Q4/11 Past activity Total Construction Q4/11 Trend Balance of opinion, sa 100 Q4/06 Q4/10 Civil engineering order books 60 -45 Q4/05 Q4/09 Q4/06 Q4/07 Q4/08 Level of order books Q3/ 10 11 14 11 12 14 13 2 14 -4 Q4/ 10 -2 25 11 -1 25 13 -7 16 0 Q1/ 11 27 9 16 25 10 19 39 13 5 BANQUE DE FRANCE - DGS – DESS – SEEC – + 33 1 42 92 29 39 – Quarterly Business Survey published on 10 January 2012 Q2/ 11 5 13 15 5 13 18 4 13 6 Q4/09 Q4/10 Q4/11 Trend Q3/ 11 6 11 14 6 12 14 1 10 8 Q4/ 11 15 9 15 14 8 16 20 9 13 3 Period under review: Q4/2011 QUARTERLY BUSINESS SURVEY Wholesale trade Purchase and sales volumes rose on the previous quarter, but at a slower pace compared with their long-term average. The level of order books remained unchanged and inventories appeared to be at normal levels. Forecasts point to a slight improvement in activity in the coming quarter. Purchase volumes Sales volumes Balance of opinion, sa Balance of opinion, sa 40 40 20 20 0 0 -20 -20 -40 Q4/05 Q4/06 Q4/07 Purchase volumes Q4/08 Forecasts Q4/09 Trend Q4/10 -40 Q4/05 Q4/11 Long-term average since 1996 Q4/06 Q4/07 Sales volumes Purchase and sales prices Q4/08 Forecasts Q4/09 Trend Q4/11 Long-term average since 1996 Inventories and order books Balance of opinion, sa Balance of opinion, sa 40 40 20 20 0 0 -20 -20 -40 Q4/05 Q4/10 Q4/06 Q4/07 Q4/08 Q4/09 Purchase prices Sales prices Trend Trend Total wholesale trade Purchase volume : change / previous quarter Sales volume : change / previous quarter Purchase prices : change / previous quarter Sales prices : change / previous quarter Level of order books Inventory level Sales : outlook / next quarter Q4/10 Q4/11 -40 Q4/05 Q3/ 10 18 23 17 12 10 9 16 Q4/06 Q4/ 10 6 12 22 16 10 4 20 Q4/07 Q4/08 Q4/09 Q4/10 Inventory level Level of order books Inventory trend Trend of order books Q1/ 11 24 20 17 7 14 8 18 BANQUE DE FRANCE - DGS – DESS – SEEC – + 33 1 42 92 29 39 – Quarterly Business Survey published on 10 January 2012 Q2/ 11 12 15 16 4 6 1 11 Q3/ 11 10 8 4 -8 -2 2 8 Q4/11 Q4/ 11 3 5 0 -6 1 3 11 4 Period under review: Q4/2011 QUARTERLY BUSINESS SURVEY Methodological note Balance of opinions The balance of opinions is calculated as the sum total of positive and negative opinions given by business managers, weighted by the number of staff in the company and adjusted for the value added of each sector for cash positions (average staff numbers for construction, turnover net of tax for wholesale trade). A positive balance of opinions indicates that the majority of respondents consider that there has been an increase in the measured variable. The balance of opinions, whose value is between -200 and +200, reflects the aggregate level of positive and negative replies from business managers surveyed using a rating scale with seven gradations (three gradations either side of the normal level). Series All of the series (seasonally adjusted data, trends and composite indicators) are available on the Banque de France website. Investment, profit margins and cash positions in Industry: http://webstat.banque-france.fr/fr/browseTable.do?node=5384285&start=&end=&snapshot=&trans=N&vf=&dvfreq=Q Construction: http://webstat.banque-france.fr/fr/browse.do?node=5384373 Wholesale trade: http://webstat.banque-france.fr/fr/browse.do?node=5384308 Seasonal adjustment The series are additively seasonally adjusted using the X12-ARIMA method. The unadjusted series (U) is broken down into three components: trend/cycle (T), seasonal factors (S) and irregular (I). The seasonally-adjusted series published correspond to the unadjusted series without the seasonal factors component (U-S), which is also the sum total of the trend and the irregular (T+I). Investment and cash positions indicator for industrial firms, and business sentiment indicators for construction and for wholesale trade These indicators summarise all of the answers to the quarterly survey on the financial situation of industrial firms, on construction and on wholesale trade. They are centered around 100 (long-term average) and have a standard deviation of 10. Technically, they correspond to the first factor axis from a static factor analysis of aggregate series. Outlook The replies to the questions on the outlook for production and activity over the coming month (T+1/T) are adjusted for identified biases. An econometric equation calibrates the two outlook variables (Production and Activity) in relation to the actual lagged variables. Long-term average The long-term average is calculated on the maximum length of the series. For Industry, the long-term average has been calculated since 1991, for Construction and Wholesale trade, since 1996. French Classification of Economic Activities (NAF révision 2) NAF Rév. 2, 2008 replaced, on 1 January 2008, NAF Rév.1, 2003. Access items and their description broken down by level : Level 1 21 sections Level 2 88 divisions Level 3 272 groups Level 4 615 classes BANQUE DE FRANCE - DGS – DESS – SEEC – + 33 1 42 92 29 39 – Quarterly Business Survey published on 10 January 2012 Level 5 732 sub-classes 5