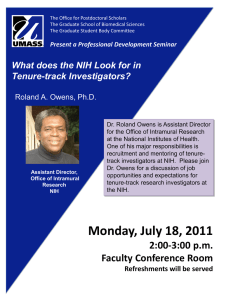

My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 1 My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 2 Copyright 2015 by Deborah Owens Distributing Publisher: Owens Media Group LLC Columbia, Maryland http://www.deborahowens.com Copyright 2011. All Rights Reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without written permission from the publisher. Request for reproduction or related information should be addressed to the author at Owens Media Group LLC. See www.deborahowens.com for mailing address. Owens Media Group LLC creates personal finance content for multimedia platforms. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 3 My Personal Success Plan Workbook This course is designed to provide you with the tools and insight needed to achieve both professional and financial success. The content is based on financial expert Deborah Owens ‘ critically acclaimed books where she shares the behaviors and attitudes that she observed in her financially successful clients as a financial advisor. She also credits her personal and professional success to adopting the seven wealthy habits that she shares in this course. You will be introduced to the seven wealthy habits of financially successful people in the introduction module. The textbook for this course is Nickel and Dime Your Way to Wealth, which profiles a gentleman from Baltimore, Maryland who applied these principles and amassed a small fortune despite his modest income. In each module you will be exposed to an attitude and behavior and will be given an opportunity to apply the principles to your specific situation. If you will commit to internalizing these concepts and making them habits you will think, act and become a wealthy person. “We are what we repeatedly do. Excellence, then, is not an act but a habit.” Aristotle. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 4 Personal Success Plan Workbook Module 1 Introduction 1.1 Are You Wealthy? 1.2 Personality Quiz 1.3 Personal Net Worth Statement 1.4 Money Story Module 2 Wealthy Habit #1: Outlook-­‐Getting Your Finances In Order 2.1 Spending Plan 2.2 Building Great Credit Module 3 Wealthy Habit #2: Vision-­‐Creating Your Path to Wealth 3.1 Your Comparative Advantage 3.2 Behaving Your Way To Wealth Module 4 Wealthy Habit #3: Appetite-­‐Learn to Earn. 4.1 How Money Works – Stock, Bonds, Bills, and Inflation. 4.2 The Rule of 72 – Doubling Your Money Module 5 Wealthy Habit #4: Mindset – Falling in Love With Stocks 5.1 Personal Portfolio 5.2 How to Research Stocks – NASDAQ Dozen Analysis Module 6 Wealthy Habit #5: Focus -­‐ Achieving Your Goals with Balance 6.1 Adding Bonds to Your Portfolio 6.2 Asset Allocator Module 7 Wealthy Habit #6: System -­‐ A Pooling of Portfolios 7.1 The Feeling is Mutual – Understanding Mutual Funds 7.2 Your Fund Fit: Matching the Fund to Your Needs Module 8 Wealthy Habit #7: Legacy -­‐ Paying It Forward 8.1 How Much Do You Need? My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 5 Module 9 Utilizing the 7 Habits in Harmony: My PSP Blueprint Module 1 – Introduction There is a difference between wealthy people and those who work for an income. Wealthy people think of money as a tool to help them achieve and maintain financial independence. This module will help you determine your first steps to becoming a wealthy person. Are You Wealthy? In this section you will learn: v The attitudes and behaviors of wealthy people v Identify patterns that prevent you from creating wealth v Create your own net worth statement v Write your Money Story THE 7 WEALTHY HABITS A WEALTHY OUTLOOK: This foundational habit gives us a macro or "big picture" view of the world. It is a habit that encourages adding value. It is a characteristic of successful people, and a core value of great companies, allowing them to move beyond boundaries. A WEALTHY VISION: Rather than the macro view required in the first habit, a Wealthy Vision encourages you to look inward and identify your comparative advantage—your unique gifts based upon a blend of innate characteristics. A WEALTHY APPETITE: The habit of acquiring knowledge. To add value, wealthy people continually increase their knowledge base. They gain insight by attending seminars, subscribing to periodicals, and reading books to stay abreast of the economy and to identify investment opportunities. A WEALTHY MINDSET: This habit keeps you going in the face of adversity. Everyone else might tell you something is impossible, but a Wealthy Mindset keeps you moving to the beat of your own drum. A WEALTHY FOCUS: This habit helps you remain determined, set priorities, and eliminate distractions as you pursue your goals. Wealthy people recognize that stating specific desired outcomes allows them to stay on course even when dealing with complications. A WEALTHY SYSTEM: Successful people set up a system that allows them to remain organized. This is the habit that allows them to track resources, manage their finances, and adopt money management and investment processes that allow them to monitor their progress. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 6 A WEALTHY LEGACY: Promotes the importance of paying your way forward. To receive, you must first give something of value. People who develop this habit recognize that it is in giving that they receive, and they relish the opportunity to leave a path for others to follow. 1.1 Do you think, act and do things like a wealthy person? “Really poor people think day to day. Poor people think week to week. Middle class people think month to month. Rich people think year to year. Very rich people think decade to decade,” says author Keith Cameron Smith. The fact is that wealthy people think generation to generation. Wealthy Outlook Wealthy people think of money as a tool to help them achieve what they want. Like a key, money is a tool that can be used to unlock doors, important doors that determine the way a person lives today and in the future. Wealthy people realize money is the tool that can help them to become financially independent and help fund their financial future. When wealthy people look at their money, they generally ask themselves: •

What’s the best use of this money? •

How can I make this money make more money? How does this compare to the way you think about money? Take out your banking or checking account statement. Write down your last three saving or investment decisions. 1. __________________________________________________________ 2. __________________________________________________________ 3. __________________________________________________________ How did your responses compare to how a wealthy person thinks about money? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 7 _________________________________________________________________________________________________________ What would you do differently? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Wealthy Vision Wealthy people think differently from others. They view money uniquely and develop patterns of behavior and thoughts that keep them in front financially. A wealthy person considers the following questions: •

How can I pay myself first? •

•

What kinds of opportunities are available for me to earn more money? Are their scholarships or grants available to me because of my unique gifts and talents? •

Does my employer provide opportunities for me to save or invest? •

Will my financial aid advisor review my choices with me? Do I need to schedule an appointment semi-­‐annually or annually? Review your financial aid package and your savings plans? List the amounts that you owe and the amount that you are saving. 1. _____________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 8 2. _____________________________________________________ 3. _____________________________________________________ Are you paying yourself at least ten percent of your income? ____________________ Are you taking advantage of scholarships and limiting your use of loans? How did your responses compare with what a wealthy person does? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ What would you do differently? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Wealthy Appetite The wealthy have developed the habit of acquiring knowledge. They read, observe, talk, and take classes. As their knowledge grows, so does their ability to earn and to identify opportunities to make their money work for them. If you acquire the habit of a Wealthy Appetite, you will see learning as your responsibility to yourself and will increase your future prosperity. Let’s see how a wealthy person satisfies their craving for information: •

They create a reservoir of information by reading newspapers such as The Wall Street Journal or The New York Times. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 9 •

They watch financial television networks like CNBC, Bloomberg and Shark Tank to keep abreast of the financial markets and stay aware of other successful people. •

They add financial sites such as www.financial.yahoo.com and www.cnn.money.com www.mint.com to their Internet home page. How does this compare with the way you think about learning? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ List your favorite financial website, magazine and television program. 1. ____________________________________________ 2. ____________________________________________ 3. ____________________________________________ Name the last seminar or workshop you attended to increase your financial I.Q. 1. ____________________________________________ 2. ____________________________________________ 3. ____________________________________________ How did your responses compare with how a wealthy person would act? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 10 What would you do differently? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Wealthy Mindset Wealthy people are continually presented with opportunities. Mr. Earl used several of the wealthy habits to filter opportunities. The wealthy learn from their mistakes and move on rather than vow never to invest again. They know that opportunities come and go; if they don’t catch this one, another will come along. They are patient. If you think about opportunities like a wealthy person, you will see them as choices that are good for you only if they fit your timetable, risk level, and current financial situation. Wealthy people evaluate opportunities by asking: •

If I take advantage of this opportunityby withdrawing money from another investment will it prevent me from achieving my objectives? •

What type of research will provide me with the information I need to be confident in selecting the best option? •

Is this opportunity aligned with my long-­‐term goals and objectives? How does this compare with your thinking about opportunities? My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 11 _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Write down the most recent opportunities that were presented to you. 1. ___________________________________________________________ 2. ___________________________________________________________ 3. ___________________________________________________________ Did you evaluate the opportunities like a wealthy person? How? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ What would you do differently? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Wealthy Focus My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 12 Wealthy people are optimistic about the future. They don’t worry because they have prepared for their future. Achieving goals are really just answers to the question of how they want their life to be, and that the important thing is to have enough money to support their choices. Wealthy people enjoy life. •

They spend joyfully today because they have set aside enough for tomorrow. •

They have a sense of control over their future, which enables them to be flexible. •

They set aside funds for their goals, which provides them with options and choices. How does this compare to the way you think about the future? List your top three financial goals. 1.___________________________________________________________ 2.___________________________________________________________ 3.____________________________________________________________ Have you determined how much you will need, and are you depositing funds into your future? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ What would you do differently? My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 13 _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Wealthy System Wealthy people spend their money on making more money before they spend it on things that won’t make them money. They resist instant gratification and do not make impulsive purchase decisions. They are intentional and strategic about where they put their resources. Here’s how wealthy people make decisions about spending. •

What goal will this help me achieve? •

Will today’s purchase sabotage my long-­‐term goals and prevent me from achieving what I really want most? •

How can I create a system that will allocate my funds automatically to give me the freedom that comes from planning towards the future? How does this compare to the way you think about spending? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Take out your banking or checking account statement. Write down your last three purchases over fifty dollars. 1. ____________________________________________ 2. ____________________________________________ 3. ____________________________________________ Did you spend your money like a wealthy person? My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 14 _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ What would you do differently? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Wealthy Legacy The wealthy person trusts him or herself. In addition to trusting themselves, they assemble a team to help protect their assets and pay it forward to future generations. A Wealthy person: •

Monitors their progress: The wealthy review their progress monthly, and at least annually with a mentor and advisor. •

Protects their assets: They protect their assets by having insurance and a will. •

Gets advice: The wealthy person gets their advice from professionals and avoids advice from well-­‐meaning family and friends. •

Manages their earnings/losses: The wealthy use professionals, but keep accurate and organized records. •

Prepares reports: More and more people use financial apps to track their money. Who is on your team? Name of your Academic Advisor: __________________________________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 15 Name of Your Financial Aid Counselor: ___________________________________________________________________ Name of your Mentor: _____________________________________________________________________________ Have you built your team? Are they meeting your needs? What else do you need to do? _________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________ Make a list of the next steps you need to take to adopt the seven wealthy behaviors. 1.____________________________________________________________ 2.____________________________________________________________ 3.____________________________________________________________ 4.____________________________________________________________ 1.2 Personality Quiz The following 12 prompts allow for a range of descriptions. Please note that this quiz is not scientifically designed. It has evolved over the years, based on feedback from a number of investors, when I asked them about skills that had come in handy in creating financial success, and which are not often recognized as such. After reading the prompt please select the answer that comes closest to representing you and mark the corresponding letter. No preparation is necessary—you only have to be yourself. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 16 1. You devise solutions to problems. a. Usually b. Occasionally c. Seldom 2. You give to charitable causes or volunteer to help relatives, friends, and/or strangers. a. Usually b. Occasionally c. Seldom 3. You would prefer a job in which you interact with others as opposed to working independently. a. Usually b. Occasionally c. Seldom 4. You keep in touch with loved ones via phone calls, instant messaging, emails, and/or snail mail. a. Usually b. Occasionally c. Seldom 5. Sometimes it seems as if you can almost read minds. a. Usually b. Occasionally c. Seldom 6. If you saw a defenseless person being mistreated, you would defend them. a. Usually b. Occasionally My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 17 c. Seldom 7. When you are busy you try to do several things simultaneously. a. Usually b. Occasionally c. Seldom 8. Strangers often smile at you or engage you in short conversations. a. Usually b. Occasionally c. Seldom 9. People often compliment your outfits or other things you have put together. a. Usually b. Occasionally c. Seldom 10. When looking at a house or an apartment you can imagine living there. a. Usually b. Occasionally c. Seldom 11. You prefer long-­‐term relationships to short term acquaintances. a. Usually b. Occasionally c. Seldom My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 18 12. You like updating your wardrobe or your home, and if you cannot afford much, you add stylish accessories. a. Usually b. Occasionally c. Seldom After you've completed the quiz, separately add up all the A responses you might have, B responses, and C responses. A responses:________ B responses:________ C responses:________ If you have 5 or more A responses: You possess many of the skills embodied in wealthy people. If you have 5 or more B responses: The strengths required for attaining wealth lie within you and will continue to be developed as you practice the wealthy habits. If you have 5 or more C responses: It may be that you are so busy that you rarely have time to do anything other than put one foot ahead of the other! These strengths may have become dormant in you after discouraging experiences. Reflect on how different your life can become as you create wealth and have the luxury of time to develop the wealthy habits. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 19 1.3 – Personal Net Worth Statement Assets Liabilities Cash on Hand $ Auto Loans $ Checking Accounts $ Signature Loans $ Savings Accounts $ Student Loans $ Certificates of Deposits $ Other Loans $ Mutual Funds $ Credit Cards $ Savings Bonds $ Credit Cards $ 401k, 403(b) $ Credit Cards $ Thrift Savings Plan $ Other $ College Funds $ Other $ Stocks/Bonds $ Other $ Life Insurance Cash Value $ Mortgages (Balance Due) Other $ Real Estate (Market Value) Home $ Home $ Rental Property $ Rental Property $ Other vacation home, time share, etc.) $ Other vacation home, time $ share, etc.) Personal Property Vehicles cars, motorcycles boats, trailers) $ Furniture $ Jewelry $ Other (collectibles) $ Total Assets $ Total Liabilities Net Worth (Total Assets Minus Total Liabilities) $ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 20 1.4 What’s your Money Story? Your ability to handle money is largely dependent on emotional factors that you can’t afford to ignore. Take this opportunity for reflection and then write your Money Story, i.e. emotional/financial histories. Psychologists have long known that we operate according to a narrative comprised of real facts, perceptions, and unconscious beliefs. If a story suggests, for instance, that no matter what you do, you’ll never get ahead, you will find it almost impossible to succeed. So it’s important for you to uncover the unconscious script, and if necessary, rewrite it. You’ll be able to identify your Money Story because it has revealed itself in recurring patterns throughout your life. Maybe you have trouble sticking to a budget, or you are always careening from one financial drama to another. This exercise requires you to be honest with yourself and follow the path back through your past to examine the events or relationships that have led to your current circumstances. You may also want to start listening to the way you talk to yourself. Perhaps you describe yourself as lazy or as a procrastinator. You might use phrases like “always a day late” or “not good enough.” In listening to yourself, you will want to search through your early experiences to understand why you’re convinced that you cannot succeed financially. Mr. Earl’s Story provides a great example. Mr. Earl did not come from a family of money nor was he a highly educated man, but his mother would often give him words of encouragement that eventually would shape his future. “My wise mother insisted that I save and tithe a portion of my pay. These early influences in stewardship and faith helped me establish my work ethic and habit of saving at a young age. I remember my mother telling me, ‘Save something from your pay every week. I knew my future job opportunities weren’t promising and the few dollars I earned at the open-­‐air market wouldn’t be enough to support a family. So I worked several odd jobs from My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 21 cutting lawns to cleaning the homes of the Catholic teachers at the school I [had] attended. As a single man, I made it work. All that changed when I met a girl named Delores at a church function. Eventually we got married and I needed something steady to support my family. My mother helped me find a janitorial job at a bank that her employer had told her about. Mr. Earl was promoted to parking attendant, and it was this opportunity that presented him with the opportunity to interact with the bank’s wealthy customers, stockbrokers, and banks executives who had offices in the building. Take this opportunity for reflection and then write your Money Story, i.e. an emotional/financial history, on the following page. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 22 My Money Story _________________________________________________ Name ______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________ ______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 23 ______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 24 ______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________ ______________________________________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 25 Module 2 Wealthy Habit #1:Outlook –Adding Value In order to get to where you want to be financially, it is important to know where you are financially. If you want to achieve your financial dreams, begin by making an emotional connection. Harness its fuel to make your dreams a reality. Of course, dreaming alone will not make it happen. This module will help you lay a solid financial foundation. In this section you will: v Track and create a spending plan. v Learn a strategy to build good credit 2.1 – Spending Plan Budget and Cash Flow A Budget is a record of the money you have coming in and how you plan to use it for your needs, i.e. bills, investments, food and clothing. Any money left after all of your needs have been budgeted is called Cash Flow. Budgets allow you to have a bigger picture of the money you have versus the money you spend, and your cash flow allows you to make decisions on how you will spend the remaining money, i.e. savings, investments. A great way to determine your financial standing is by doing a Budget Allocation. A Budget Allocation is simply the percentage of the items in your budget. A Budget Allocation Goal Example: 10% = Church or Charity 10% = Pay yourself (Emergency Savings) 75% = Lifestyles expenses 30% to 35% = mortgage/rent, utilities, food, & household items 5% to 10% = entertainment 15% = paying off debt & credit cards 10% = auto payments, gas, repairs, maintenance 5% = personal care and/or clothing = Investments 5% My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 26 Total: 100% -­‐

Money Diary – Tracking Your Money for Thirty Days A key factor in being financially independent is knowing where your money is and how it is being spent, saved, or invested. A Money Diary is a categorization of the money you have spent over a period of time. An example of a Money Diary category is Groceries. Let’s say you spend $150 at your favorite grocery store at the beginning of the month. On the 20th of the month you spend $100 at the local Farmer’s Market; in total you have spent $250 in the Groceries for the month. Technology has made this task a lot easier as there is software that will automatically categorize the money you spend when you use your debit or credit card. This allows you to get a current view of where your money being spent, saved, or invested. Below is a sample image of a Money Diary over a 30 day period. The image below is an excellent feature in Mint.com that shows a Money Diary over a 30 days. Visit http://mint.com and download the application. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 27 My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 28 2.2 – Debt and Building Great Credit We will also take a look at the current state of your credit and we’ll show you six steps you can take to build great credit. Understanding Your Credit Score Your Credit Score is a three-­‐digit number generated by a mathematical formula using information in your credit report. It is designed to predict risk, specifically the likelihood of you not paying off your credit obligations. Credit scores range from 300 to 850 in the predominantly used FICO credit score system. The higher your score, the lower the risk you are believed to be. Your credit score is used for the following: Interest -­‐ The amount of interest you will be charged on loans such as car or home purchases. The higher the credit score, the lower interest you will pay. Your high credit score can save you hundreds of dollars in interest fees per year. Employment decisions – Some companies believe your credit score is an indication of your character. If you have a high credit score, you are perceived to be responsible. Also, some employment opportunities require you to have a credit card for expenses that will be paid by the company. Your high credit score can be the deciding factor with a potential employer. Professional Advancement – In order to become qualified in certain professions, such as a Lawyer or receive military clearance (the ability to receive and use governmental secret information for work purposes), you need to have a good credit. Not paying your bills on time or not paying a debt at all can indicate that you don’t follow through with promises or are irresponsible. In some cases you can lose your job if your credit is bad. Housing – If you are renting, your potential landlord can request your credit report on your application. Their decision to rent to you can be determined by how much positive and negative credit you have on your report. You have three FICO scores, one for each credit report provided by the three major credit bureaus: Equifax, Experian and TransUnion. You have the right to receive one free credit report annually from www.annualcreditreport.com. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 29 Six Steps to Build Great Credit STEP ONE – Open a Checking and Savings Account (If you do not have one) • Having a checking account shows lenders that you have a means to pay bills. •

Having a savings account shows lenders you are planning for the future. STEP TWO – Get Your Credit Report – This will let you know what lenders have reported positive and negative, which other financial institutions and potential employers can see. STEP THREE – Fix any Errors or Omissions on Your Credit Report – There is the possibility that your credit report contains errors such as an account that does not belong to you, out of date information, or other incorrect information. Once you submit a request to verify that the account belongs to you, the credit reporting agency contacts the lender who reported the information about you. The item must be removed from your credit report if: 1. The lender cannot verify that the account belongs to you. 2. The lender does not notify the credit-­‐reporting bureau of the account verification within 30 days after your request to verify that the account belongs to you. STEP FOUR – Add Positive Information to Your Report – Some lenders view having the same job for a few years as a sign of stability and reliability. Your credit report lists your last known home address and name of employer. Make sure they are up to date and on the report. STEP FIVE – Apply for Credit – Remember your credit score is an indication of how likely you are to pay a loan back. In order to get the highest FICO credit score possible, it is important to have credit, and pay your bills on time, in the following types of loans: •

Mortgage – In addition to helping your credit, having a house has many other wealth building benefits. •

Credit Card – Credit cards prove to lenders that you are responsible in paying back money loaned to you. •

Vehicle STEP SIX – Use the Credit You Have Right – Pay all of your bills on time; do not charge more than 30% of the credit that has been extended to you IF you can’t pay it off each month. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 30 My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 31 Module 3 Wealthy Habit #2: Vision –Leverage Your Strengths A Wealthy Vision is the habit of leveraging your strengths. It means knowing who you are and what you stand for. Creating your wealthy vision requires you to change the patterns of behavior and thoughts about money. This module will help you identify your strengths and leverage them to achieve personal and financial success 3.1 – Your Comparative Advantage Adopting a Wealthy Vision means identifying your strengths. Your path to financial security will be paved by using your gifts and talents to serve others. It’s important to analyze and uncover your dominant gift. Let’s begin by identifying your strengths, which can serve as guideposts to your future wealth? •

What specific skills do people compliment you about? •

What are you doing when you lose sense of time? •

What is your first memory of feeling a sense of purpose? Please take this opportunity by asking yourself, which, among all your skills do you do better than most other people? This is not a time to be modest. If you don’t know, ask those who love you. List those skills. My Comparative Advantages 1. _______________________________________________________________ 2. ________________________________________________________________ 3. ________________________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 32 Now that we have identified your strengths it is time to isolate your dominant gift. The following exercise was excerpted from the book, The Big Leap by Gay Hendricks. He uses these questions to help people identify their “unique ability” or zone of genius. Complete the following sentences. 1. I am at my best when I am doing… ___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________ 2. When I am at my best, the exact thing I am doing is… ___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________ 3. When I am doing____________________, the thing I love most about it is… ___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________ After completing this exercise you should feel a sense of excitement and joy if you have identified your unique strength. Now you have to determine how to use your talents to serve others, and the result should bring you closer to paving your pathway to financial success. Now that you have identified your strengths and found the money to invest, it’s time to learn how to make your money work for you. Remember wealthy people think, act and do things differently in order to create wealth. 3.2 – Behaving Your Way to Wealth My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 33 Finding the Money to Invest—After you have tracked your money for thirty days, you should be able to identify “opportunities” to align your behavior with your goals. Review your tracking sheet and respond to the following questions. What purchases did you identify as not aligned with your goals? _______________________________________________________________________________________________ _______________________________________________________________________________________________ _______________________________________________________________________________________________ What patterns in your spending habits are you willing to change? _______________________________________________________________________________________________ _______________________________________________________________________________________________ _______________________________________________________________________________________________ Behaving Your Way To Wealth The key to finding money to save and invest can be found in Behaving Your Way to Wealth. This means changing your spending habits in order to redirect the money to savings. An example of Behaving Your Way to Wealth can be found in changing how much you spend on lunch at work. Let’s look at the following example in dollars: $6.00 for the average lunch x 5 days per week x 52 weeks = $1,560 That’s $1,560 that can be placed in a savings or investment account. Another way to find money to save and invest is by finding a lower-­‐cost alternative. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 34 Finding Money to Save and Invest Ideas Expense Cost per Month $150 Cable TV $60 Health Club Alternative Change to Basic Cable for 1 Year Planet Fitness $120 @ $6 per Brown lunch day (5 from home 3 day/wk.) days Lunch Totals $330 Cost per Month $30 $10 $48 $88 Savings per Month/Year $120 per month *12 months = $1440 per year $50 per month * 12 months = $600 per year $72 per month * 12 months = $864 per year $242 per month/$2904 per year Now it’s your turn to complete the exercise by identifying the changes that you are willing to make. Expense Cost per Month Alternative Cost per Month Savings per month/year $ Totals My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 35 You are on your way to making the changes that will allow you to create a wealthy lifestyle. Remember, wealthy people, think act and do things differently. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 36 Module 4 Wealthy Habit #3:Appetite –How Money Works Understanding how money works is critical to becoming financially independent. A Wealthy Appetite is nurtured by acquiring knowledge. To add value, wealthy people continually increase their knowledge base. They gain insight by attending seminars, subscribing to magazines, and reading books to stay abreast of the economy to identify opportunities. This module will help you understand the basic investment strategies and terminology used in investing. In this section you will: v Learn how money works v Discover the power of compounding v Find out where you shop for stocks 4.1 How Money Works – Stock, Bonds, Bills, and Inflation This section is designed to give you a basic understanding of the financial markets. This topic is really not as complicated as you may believe. There are really only two ways you can put your money to work: Income or Growth. Income: Savings accounts, Certificate of Deposits, Government bonds Growth: Stocks of companies like Coca Cola, Procter & Gamble, Wal-­‐Mart One of the first things I learned in my career as a stockbroker was that there were different ways to put your money to work. The only way that I knew to build wealth prior to that time was to save your money in a bank or to invest for income. I learned that wealthy people invested in all types of assets, and that was how they were able to build wealth. Now it’s time for you to learn the different ways that you can add value to your purse/wallet and the relationship between risk and reward. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 37 If you had invested one dollar in 1926 in each category by 2009 it would have grown to: Small Company stocks $9,549 Large Company stocks $2,049 Government bonds $99 Treasury Bills/ Cash $21 Market Risk Looking at the above chart it would be easy to assume that if you want to earn the highest return you should invest in small company stocks, right? Not necessarily. Although stocks have outperformed every other type of investment you assume "market risk." What those numbers don’t tell you is that during this eighty-­‐six year period small and large company stocks went up and down in value. Just think about the recent volatility in the stock market. Some companies’ stocks have fallen by more than 50% in one year and never recovered. For example: January 2000 October 2001 August 2011 Lucent Technology $34.00 $5.62 $2.67 Cisco Systems $59.00 $11.00 $16.03 Home Depot $55.00 $38.00 $31.46 My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 38 The fact is that stocks have outperformed more conservative investments, like savings accounts and certificates of deposit, over longer periods of time. If you invest in stocks you are exposed to “market risk” or the ups and downs of the stock market. However, on the other hand, savings accounts and certificates of deposit have other advantages in that you don’t risk your principal, or the amount of your original deposit, but you expose yourself to “inflation risk.” There is an upside and downside to any investment choice. The worst choice you can make however is to do nothing. Inflation Risk So let’s take a look at inflation, which is simply the increase in the cost of goods and services. Ten years ago a loaf of bread costs about $.99. Today, that same loaf of bread costs anywhere from $1.99 to $3.99, depending on the type of bread or store you purchase it from. In ten short years the cost has more than doubled in price and the historical average has been three percent a year. Now it’s your turn to see how inflation has impacted prices on other goods that are commonly used. Try researching prices using a search engine on the Internet and fill in the blanks for the items listed below. Item 1990 2011 Gallon of Gas $1.39 Pork Chops $1.98 Cell phone New Car $325.00 $16,000.00 $ $ $ $ Why is it important to understand inflation? Because in order for your money to maintain purchasing power you have to account for inflation and earn a rate of return above three percent that allows your money to earn a “real” return. I’m sure you’ve heard the term "You have to beat inflation." Now these numbers are averages, and in some years inflation may have been above 3%, and there have been a period like in the 1970’s when it went into the double digits. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 39 However, overtime it has averaged about 3%, which is what the Stocks, Bond, Bills and Inflation Chart illustrates. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 40 Shopping for Stocks on Wall Street Stocks, Bonds, and other investment products are purchased in a Stock Exchange. A Stock Exchange (also known as the Stock Market) is a place where people who want to buy stock connect with people who want to sell stock. There are many stock exchanges, however, the two major stock exchanges are: NYSE – New York Stock Exchange—The New York Stock Exchange is the most respected and largest stock market in the world. The NYSE is where the stock of the world’s largest companies in all industries is bought and sold. Unlike the NASDAQ, the NYSE has a physical location where buyers and sellers meet to trade stocks. NASDAQ – National Association of Securities Dealers Automated Quotations—The world’s oldest electronic stock market and the largest stock exchange in the United States. It has no central trading location. The stock of merging companies, as well as industry giants, especially in biotechnology, communications, financial services, media, retail, technology, and transportation, are bought and sold electronically in the NASDAQ. A person must have a securities license in order to buy and sell stock to the public or individual investors. Individual investors use a licensed Stock Broker to buy or sell stocks, bonds, and other investment products on their behalf. The companies’ trade in the stock market and their names are abbreviated with letters that are known as a Ticker or Stock Symbols. This is the series of letters you see in the finance section of your local newspaper. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 41 4.2 Rule of 72 – Double your Money? You just inherited twenty thousand dollars from your grandmother’s estate. You have decided to invest $10,000 in a one-­‐year Certificate of Deposit. Visit http://bankrate.com 1. What type of interest rate can you earn on your $10,000.00? _________________________________________________ 2. How long will it take your money to double? Answer __________Years Rule of 72 Formula Interest rate = Number of years money doubles Number 72 type of investment to make with this money? 3. Was this the right Yes: _______ No:_______ Why or Why not? __________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________ My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 42 Module 5 Wealthy Habit #4: Mindset-­‐ Problems are Opportunities Wealthy people think, act, and invest their money differently than most people. Do you see the glass as half empty or as an opportunity to fill the glass with more liquids? Those who achieve both professional and financial success have this type of mindset. They see downturns in the economy as a way to make more money in the long run. This module will help you learn the importance of perseverance in investing. In this section you will: v

Create your own portfolio and test your investment skill set v

Learn how to research stocks 5.1 Personal Portfolio In this exercise you will put shopping prowess to work as you create a portfolio that anyone would be proud of. We are all wired to be excellent investors. Are you ready to test your intuition and mad skills on putting together a portfolio? There is no right or wrong decision in this Porfolio exercise. Simply pretend that you have $10,000 and want to invest $1,000 each in ten of the companies listed below. Then place the numbers 1 through 10 beside each of your selections, in no particular order. After you’ve made your selection, you can discover how much you might have earned with these investments if you bought them in 1998, and allowed them to grow for 10 years. Don’t peek at the answers. The idea is to make your decisions as a reflection of your intuition and circle of competency. Select 10 companies: A. Aetna: Healthcare, dental and pharmacy coverage B. Altria: Owns Philip Morris USA, the world/s largest tobacco company C. Amgen: Biotechnology, maker of an osteoporosis drug D. Avon: Maker of skincare, makeup, bath and beauty products My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 43 E. Best Buy: Electronics and appliance retailer F. Cash America: Owner of a chain of pawnshops G. Clorox: Major maker of cleaning products H. Costco: Membership-­‐only warehouse shopping I. Dior: Makes and sells exclusive products, including handbags J. Disney: Owns theme parks, TV networks and produces animated films K. eBay: An e-­‐commerce auction website L. Green Mountain: is recognized as a leader in specialty coffee and coffee makers, M. Gymboree: Operates stores and play programs for infants through age five. N. Johnson & Johnson: Manufactures baby care, skin care, oral care, wound care, and women’s health care products. O. Jones Apparel Group: Designer, marketer and wholesaler of apparel, footwear and accessories P. Kohls: Department store chain selling discount clothing and goods Q. LVMH: Maker of Louis Vuitton purses and Dom Perignon champagne R. McDonalds: Fast food, famous for big Macs S. Medivation: Makes Alzheimer’s drug for those suffering mild and moderate symptoms T. Northrop Grumman: Provides systems and products in aerospace, ship building U. Phillips Van Heusen: Owners of the Calvin Klein, Arrow, Izod, Kenneth Cole brands V. Target: An upscale discounter of trendy merchandise W. Tiffany: A worldwide exclusive jewelry company X. United Healthcare: Provides healthcare Y. Varian: A maker of radiation therapy and X-­‐ray imaging equipment Z. Wynn Resorts: Owners of a gambling empire Once you’ve made selections, write the earnings figure beside the company and add the totals. Please note that I am not recommending that you buy or not buy stock in these companies. They were chosen purely at random. You will find a space below to record the total on your selections. By the way, the three-­‐ or four-­‐letter capped abbreviations following some company names are called “tickers,” symbols that identify publicly traded My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 44 shares of corporations. Tickers are named for the sound made by the old electronic machines that relayed stock information. A. Aetna (AET) -­‐ $5,148. B. Altria (MO) -­‐ $2,043 C. Amgen (AMGN) -­‐ $3,690 D. Avon (AVP) -­‐ $2,321 E. Best Buy (BBY) -­‐ $6,632 F. Cash America (CSH) -­‐ $2,916 G. Clorox (CLX) -­‐ $1,150 H. Costco (COST) -­‐ $2345 I. Dior (CHDRF) -­‐ $445 J. Disney (DIS) -­‐ $983 K. eBay (EBAY) -­‐ $25,030 L. Green Mountain (GMCR) -­‐ $51,549 M. Gymboree (GYMB) -­‐ $3,910 N. Johnson & Johnson (JNJ) -­‐ $4,139 O. Jones Apparel Group (JNY) -­‐ $806 P. Kohls (KSS) -­‐ $1,798 Q. LVMH (LVMHF) -­‐ $380 R. McDonalds (MCD) -­‐ $1,938 S. Medivation (MDVN) -­‐ $5,710 T. Northrop Grumman (NOC) -­‐ $890 U. Phillips Van Heusen (PVH) -­‐ $2,994 V. Target (TGT) -­‐ $2,258 W. Tiffany (TIF) -­‐ $2,258 X. United Healthcare (UNH) -­‐ $7,149 Y. Varian (VAR) -­‐ $11,652 Z. Wynn Resorts (WYNN) -­‐ $1,256 Total on your 10 stock selections: 1. (________) $____________ 6. (________) $____________ 2. (________) $____________ 7. (________) $____________ 3. (________) $____________ 8. (________) $____________ 4. (________) $____________ 9. (________) $____________ 5. (________) $____________ 10. (________) $____________ Add the total for your 10 stock selections and write the sum below. Subtract the $10,000 capital and the balance is the amount of your profit. Total: $________________ (minus capital) -­‐ $10,000 My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 45 Profit: $________________ So how did you do? Whatever your total, it can be put into perspective if you realize that if you’d deposited $10,000 into a savings account in 1998, at about two percent interest, you would now have approximately $12,000, and minus your $10,000 principal, you would have earned $2,000. How does that compare with your fictional investment profit? 5.2 How to research stocks – -­‐NASDAQ Dozen Analysis Before investing your money into a particular company’s stock, it is highly recommended that you conduct research by taking a look at their financials. The NASDAQ Stock Exchange has developed The NASDAQ Dozen Analysis: to help investors research stocks. 1. Revenue – At its basic level, stock growth starts with a company making money. Fundamentally, if a company isn't bringing in any money, it can't pass profits along to its shareholders. In other words, it all starts with revenue. • Pass—Give revenue a passing score if revenue is increasing. Start first by comparing the annual totals. However, if the most recent fiscal year is incomplete, compare the most recent quarter with the same quarter in the previous year. • Fail—Give revenue a failing score if revenue is decreasing. 2. Earnings per Share (EPS) – If revenue tells us how much money is flowing into the company, EPS tells us how much of that money is flowing down to stock holders. EPS tells you how much money the company is making in profits per every outstanding share of stock. The higher the EPS is, the more money your shares of stock will be worth because investors are willing to pay more for higher profits. • Pass –Give EPS a passing score if the EPS are increasing. Start first by comparing the annual totals. But if the most recent fiscal year is incomplete, compare the most recent quarter with the same quarter in the previous year. • Fail – Give EPS a failing score if the EPS are decreasing. 3. Return on Equity (ROE) – ROE gives us a glimpse into how efficiently company management is producing a return for the owners of the company—based on the amount of equity in the company. To calculate ROE, you divide the average shareholders equity during the past 12 months by the net profit the company has made during those same 12 months. • Pass–Give ROE a passing score if ROE has been increasing for two consecutive years. • Fail–Give ROE a failing score if ROE is decreasing My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 46 4. Recommendations – Analysts conduct extensive research on a stock and then issue a recommendation as to what they think the future holds for the company. If the company's future outlook is positive, the analysts recommend a "buy." If the company's future outlook is poor, then the analysts recommend a "sell." • Pass—Give analyst recommendations a passing score if the consensus recommendation is a buy or strong buy. • Fail—Give analyst recommendations a failing score if the consensus recommendation is less than a buy. 5. Earnings Surprises – Companies announce their earnings every quarter. Leading up to this event, analysts will make predictions as to what they think the earnings per share (EPS) will be. These predictions are often used as a benchmark by market participants. If the actual EPS comes in higher than the expected amount, this is generally good for the stock price. If the actual EPS comes in lower than the expected amount, this is generally bad for the stock price • Pass—Give the earnings surprises a passing score if the EPS surprises during the past four quarters have all been positive. • Fail—Give the earnings surprises a failing score if any of the EPS surprises during the past four quarters have been negative. 6. Forecast – While it is very important to research a stock's past earnings reports, it is also important to look at the future earnings forecasts to insure that the future profitability of the stock in question is strong. • Pass—Give the earnings forecast a passing score if the consensus EPS forecast numbers increase year over year. • Fail—Give the earnings forecast a failing score if the consensus EPS forecast numbers do not increase year over year. 7. Earnings Growth – The earnings growth number gives you an idea of how much analysts believe earnings are going to grow per year for the next five years. • Pass—Give earnings growth a passing score if the Long Term 5-­‐year number is greater than 8%. • Fail—Give earnings growth a failing score if the Long Term 5-­‐year number is less than 8%. 8. PEG Ratio – One of the more popular ratios stock analysts look at is the P/E, or price to earnings, ratio. The drawback to a P/E ratio is that it does not account for growth. A low P/E may seem like a positive sign for the stock, but if the company is not growing, its stock's value is also not likely to rise. The PEG ratio solves this problem by including a growth factor into its calculation. PEG is calculated by dividing the stock's P/E ratio by its expected 12-­‐ month growth rate. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 47 Pass—Give the PEG Ratio a passing score if its value is less than 1.0. Fail—Give the PEG Ratio a failing score if its value is greater than 1.0. 9. Industry Earnings – Most investors are interested not only in how much the company is earning but also how the company's earnings compare to the average earnings of companies in the industry. Typically, if a company is earning more than the average for the industry, it is a good sign for the company's stock. • Pass—Give Industry Earnings a passing score if the company's earnings are higher than the industry's earnings. • Fail—Give Industry Earnings a failing score if the company's earnings are lower than the industry's earnings. 10. Days to Cover-­‐Short interest – is the number of shares that investors are currently short on a particular stock. Days to cover is the number of days-­‐-­‐-­‐based on the average trading volume of the stock-­‐-­‐-­‐that it would take all short sellers to cover their short positions. For instance, if a stock has a short interest of 20 million shares and an average trading volume of 10 million shares, days to cover would be two days (20 million / 10 million = 2 days). • Pass—Give Days to Cover a passing score if the number of days is less than 2 days. • Fail—Give Days to Cover a failing score if the number of days is more than 2 days. •

•

11. Insider Trading – Insider trading can give you a glimpse into how confident the managers of the company are in the prospects for the company. If managers are confident in the company, chances are good that they will be buying stock in the company. Anytime you see insiders buying stock, it is typically a good sign • Pass—Give Insider Trading a passing score if the net activity for the past 3 months has been positive. • Fail—Give Insider Trading a failing score if the net activity for the past 3 months has been negative. 12. Weighted Alpha – is a measure of one-­‐years growth with an emphasis on the most recent price activity. A positive Weighted Alpha indicates the stock price is moving higher and a negative Weighted Alpha indicates the stock price is moving lower. Naturally, when you are looking at buying a stock, you want to see a stock that is increasing in value, not decreasing in value. • Pass—Give Weighted Alpha a passing score if the number is positive. • Fail—Give Weighted Alpha a failing score if the number is negative. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 48 Stock Selection:________________________________________ To score the 12 factors of the NASDAQ Dozen, you need to assign each factor either a passing or a failing grade. After you have scored all 12 factors, add up the passing grades and compare them to the failing grades. If you have a high ratio of passing grades compared to failing grades, you can be more confident in the stock. Conversely, if you have a low ratio of passing grades compared to failing grades, you would be less confident in the stock. Factors Categories 1. 2. 3. 4. 5. 6. 7. 8. 9. My Personal Success Plan Pass or Fail Revenue Earnings per Share (EPS) Return on Equity (ROE) Recommendations Earnings Surprises Forecast Earnings Growth PEG Ratio Industry Earnings Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 49 10. 11. 12. Days to Cover Insider Trading Weighted Alpha Ratio / Pass or Fail Ratio_____________/______________ Module 6 – Wealthy Habit #5: Focus: Goals The old investment cliché of not putting all of your eggs in one basket talks about the importance of having balance in the type of investments you have. Having a balanced, also known as diversified, portfolio acts as a protector of your investments in the event that the value of a particular stock, bond, or other investment product declines. This module will help you understand the importance of balancing your investments In this section you will: v

v

Learn how bonds can help you achieve your goals Learn how to achieve balance in your portfolio with bonds 6.1 Adding Bonds to Your Portfolio Bonds, the quiet sidekick of stocks, send out streams of interest income, while stocks spurt and tank their way up and sometimes down the charts. By holding steady when stocks fluctuate, bonds can stabilize your portfolio. 6.2 Asset Allocator My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 50 One of the most important steps to building a successful portfolio is properly dividing assets among different types of investments. Asset Allocation is distribution of your investment portfolio throughout the various asset classes, i.e. stocks, bonds, etc., to create a degree of balance within your portfolio. Asset Allocator What percentage of bonds should you have in your portfolio? Here’s a quick exercise that you can use to help you decide. Time Frame 1. I plan to start withdrawing money from my investments in? • Less than five years 2 Points • Five to ten years 6 Points • Eleven years or more 10 Points Score: ___________ 2. Once I begin withdrawing funds from my investments, I plan to use them over the next? • Five to 10 years 2 points • Ten to 20 years 6 points • Thirty or more 10 Points Score: ___________ Current Situation My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 51 3. My investment knowledge and experience could be described as: • No experience 2 Points • Some experience but I feel uncomfortable making decisions on my own 6 Points • Experienced, I have some investments but need assistance occasionally 8 Points • Very experienced, I make my own financial decisions 10 Points Score: ___________ 4. My current portfolio consists of (only one choice assume you own some or all of prior investments) • Bank Savings accounts and money market fund 2 Points • Treasury Bonds, CD’s or Bond Mutual fund 6 Points • Stocks and or Stock Mutual Fund 8 Points • International stocks and International Fund 10 Points Score: ___________ Risk Tolerance 5. Which one of the following statements best describes your feelings towards risk • I make investments that have a low degree of risk 2 Points • I take a balanced approach and invest equally in high and low risk 4 Points • I want to be aggressive and lean more toward high risk with some in lower risk 6 Points • I want the potential for the greatest return and only invest in higher risk. 8 Points Score: ___________ 6. If the stock market dropped 20% and your investments followed suit, what would you do? • Liquidate all of it and transfer to a money market 2 Points • Sell half of it and leave the rest 4 Points • I would leave it alone 6 Points • I would buy more 8 Points My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 52 Score: ___________ Now add up all of your points from questions 1–6. And find out where you fall in the legend below. Total Score: ______________________ Aggressive Portfolio 50 or more Growth Portfolio 40 to 49 Balanced Portfolio 30 to 39 Conservative 20 to 29 Now look at the following portfolios and identify which might best suit your situation based on your total score. Short Term 100% Short term Conservative Portfolio 50% stocks, 30% bonds, 20% cash Balanced Portfolio 50% stocks, 40% bonds, 10% cash Growth Portfolio 70% stocks 25% bonds, 5% cash Aggressive Growth Portfolio 85% stock and 15% bonds Module 7 – Wealthy Habit #6: System–Managing and Tracking Resources Creating a Wealthy System is all about assembling a safety net. This is the most pragmatic of the 7 Wealthy Habits. When you set up a Wealthy System, it can help you bring aspects of your life together to operate as a whole and keep you moving forward financially. In this section you will: v

Learn how pooling your funds with others can diversify your risk v

Choose the mutual fund that fits your needs v

Find a strategy to put your financial future on autopilot 7.1 The Feeling is Mutual -­‐ Understanding Mutual Funds Up to this point I’ve focused on offering you foundational knowledge about stocks and bonds. Now you will learn how to own those investments by My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 53 pooling your money with others. Buying specific companies, individual stock purchases offer a sense of control. Fund Match Answer the following questions to determine the fund that best suits your needs. Choose one, and assign the appropriate point. 1. What will you use the money for? Emergency Fund 2 points _______ Type of Fund

Money Market

Bonds

Objective

Time Frame

Liquidity

Short

Income & Capital

Intermediate

Preservation

Growth and Income Capital

Intermediate / Long

Appreciation/Income Term

Growth

Capital Appreciation Long Term

Home 3 points _______ College Savings 4 points _______ Retirement 5 points _______ Risk Level

Low

Moderate

Moderate

High

2. How much time are you giving yourself to achieve this goal? Immediately Short term (3-­‐5 years) My Personal Success Plan 2 points _______ 3 points _______ Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 54 Intermediate (5-­‐10 years) 4 points _______ Long term 5 points _______ (10-­‐20 years) 3. How much risk can you afford and are you willing to take? No Risk 1 points _______ Low Risk 3 points _______ Moderate Risk 4 points _______ High Risk 5 points _______ Total points: _______________ Money Market Mutual Funds 0–6 points Bond Mutual Funds 6–9 points Growth Mutual Funds 0–12 points Aggressive Growth Funds 13+ points Money Market Mutual Funds 0–6 pts Yes, you’ve got the money in hand for that transmission that just went out, in your car. Or if you’ve had it up to your neck with your frustrating boss, you’ll have a few dollars in hand to hold you over until you get a new gig. Bond Mutual Funds 6–9 pts You love your roommate, but year after year it seems your space is getting smaller, you’re ready to strike out on your own. This fund will give you the money for a down payment on your new digs. Or the market dropped 20% and your stomach dropped with it. Time to move a few dollars into a safer place. Growth & Income Mutual Funds 10–12 pts You’re 45 and you can’t believe you are still paying off college loans. You’re determined to have funds available for your 10 year old so she’s not mired in debt after college. Choose My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 55 this fund to help build a reserve so you’ll have enough by the time she’s ready for school, without risking too much. Growth Mutual Funds 12-­‐14 pts You just transferred jobs and you have a new benefit plan, choose this fund to invest in your companies plan or a Roth IRA. Aggressive Growth Funds 15+ pts Whoo Hoo! Just out of college the world is your oyster! Your determined to retired by 45.You can jump right in to these aggressive stocks and still have time to rebound if things don’t work out as planned. My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 56 Systematizing Wealth-­‐Building Strategies Now that you have reviewed your objectives and identified the type of mutual fund that would be appropriate for you, it’s time to pay yourself first. Systematic savings programs help you acquire, discipline, and focus on the savings habits needed to stay the course through the ups and downs of the economy. In this section, you will be able to identify a program that meets your needs and start investing an amount that you can afford. Mutual Fund-­‐ Automatic Account Builder programs-­‐Invest less than $25.00 a monthly. Sharebuilder.com -­‐ Invest in stocks and mutual funds for as little as 10.00 monthly. Stock Dividend Reinvestment programs. http://moneypaper.com My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 57 Module 8 – Wealthy Habit #7: Legacy-­‐Paying It Forward A Wealthy Legacy means paying it forward to your future and to others. Did you know that the average American has a retirement account of $10,000 or less? Why does this matter to you? Without a retirement plan, many people will find it difficult to maintain the lifestyle they are accustomed to once they stop working for a living. This module will help you learn the importance of investing for retirement. In this section you will learn: v

Learn how much you will need to save for retirement 8.1 How Much Do You Need? It’s time to crunch the numbers and come up with a Ball Park estimate of how much you need to take out of your purse/wallet when you retire. The Ballpark E$timate™ takes complicated issues like projected Social Security benefits and earnings assumptions on savings, and translates them into language and mathematics that are easy to understand at http://choosetosave.org/ballpark My Personal Success Plan Deborah Owens www.deborahowens.com ©2011 Owens Media Group LLC page 58 Get a Ballpark E$timate® of Your Retirement Needs.

The ChoosetoSave.org and American Savings Education Council’s Planning and Saving Tool

Forget, for a moment, the complexity of planning and saving for a comfortable retirement. Use this print form Ballpark E$timate®

worksheet to get an initial fix. Want a more “sophisticated” number? Go online at www.choosetosave.org and use the interactive

version with more assumptions that you can change. By simplifying some issues, such as projected Social Security benefits and

earnings assumptions on savings, the print version of Ballpark offers users a way to obtain a rough first estimate of what Americans

need for retirement. The worksheet assumes you’ll realize a constant real rate of return of 3% and that wages will grow at the same rate

as inflation; however, it does provide the user an opportunity to take into account longevity risk.

For example, let’s say Jane is a 35-year-old woman with two children, earning $30,000 per year. Jane has determined that she will

need 70% of her current annual income to maintain her standard of living in retirement. Seventy percent of Jane’s current annual

income ($30,000) is $21,000 (Question 1). Jane would then subtract the income she expects to receive from Social Security ($12,000 in

her case) from $21,000, equaling $9,000 (Question 2). This is how much Jane needs to make up for each retirement year.

Jane expects to retire at age 65 and if she is willing to assume that her life expectancy will be equal to the average female at that age

(86), she would multiply $9,000 by 15.77 for a result of $141,930 (Question 3). Since Jane does not expect to retire before age 65, she

does not answer Question 4. Jane has already saved $2,000 in her 401(k) plan. She plans to retire in 30 years so she multiplies

$2,000 x 2.4 equaling $4,800 (Question 5). She subtracts that from her total, making her projected total savings needed at retirement

$137,130. Jane then multiplies $137,130 x .020 = $2,742 (Question 6). This is the amount Jane will need to save in the current year for

her retirement (it is assumed the annual contribution will increase with inflation in future years).

It is important to note that the calculation above assumed Jane would have an average life expectancy for a female already age 65.

However, this will produce an amount that is too low in approximately ½ of all cases. If instead Jane wanted to have a sufficient amount

¾ of the time, she would base her calculations on a life expectancy of 92 (see the grid on step three of the calculation). This would

necessitate multiplying $9,000 by 18.79 for a result of $169,110. All the remaining calculations would be similar and the contribution for

the first year would increase to $3,286.

If Jane would prefer to save enough to have a sufficient amount 90 percent of the time, she would assume a life expectancy of 97. This

would require a first year contribution of $3,671.

Planning for retirement is not a one-size-fits-all exercise. The purpose of Ballpark is simply to

give you a basic idea of the savings you’ll need to make today for when you plan to retire.

If you are married, you and your spouse should each fill out your own Ballpark E$timate® worksheet taking your marital status into

account when entering your Social Security benefit in number 2 below.

1.

How much annual income will you want in retirement? (Figure at least 70% of your current annual gross income

just to maintain your current standard of living; however, you may want to enter a larger number. See the tips below.)

$_______________

Tips to help you select a goal:

70% to 80% — You will need to pay for the basics in retirement, but you won't have to pay many medical expenses as your employer

pays the Medicare Part B and D premium and provides employer-paid retiree health insurance. You're planning for a comfortable

retirement without much travel. You are older and/or in your prime earning years.

80% to 90% — You will need to pay your Medicare Part B and D premiums and pay for insurance to cover medical costs above

Medicare, which on average covers about 55%. You plan to take some small trips, and you know that you will need to continue saving

some money.

100% to 120% — You will need to cover all Medicare and other health care costs. You are very young and/or your prime earning years

are ahead of you. You would like a retirement lifestyle that is more than comfortable. You need to save for the possibility of long-term care.

2. Subtract the income you expect to receive annually from:

Social Security — If you make under $25,000, enter $8,000; between $25,000 - $40,000, enter $12,000; over

$40,000, enter $14,500 (For married couples - the lower earning spouse should enter either their own benefit based on their income or

50% of the higher earning spouse's benefit, whichever is higher.)

–$_______________

Traditional Employer Pension — a plan that pays a set dollar amount for life, where the dollar amount depends on

salary and years of service (in today's dollars)

–$_______________

Part-time income

–$_______________

Other (reverse annuity mortgage payments, earnings on assets, etc.)

–$_______________

This is how much you need to make up for each retirement year:

=$_______________

Module 9 Utilizing the 7 Habits in Harmony-­‐I Am Wealthy! A Wealthy Lifestyle—Now that you have been introduced to the wealthy habits, it’s time to Think, Act and Become Wealthy! Create the Blueprint for your future and write how you will adopt the seven wealthy habits and internalize all of the concepts and put them into practice. In this section you will learn to: v