CHAPTER 16

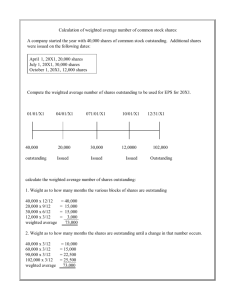

advertisement