CARICOM - Costa Rica

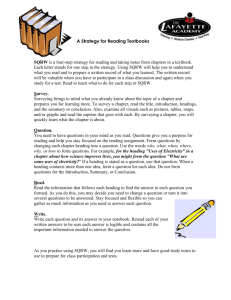

advertisement