BushBroker implementation evaluation after two years of operations

advertisement

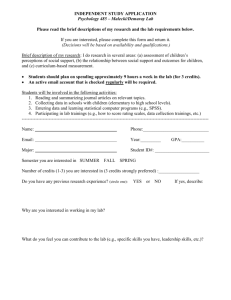

BushBroker Implementation Evaluation after two years of operations 2009 Prepared by O’Connor NRM Pty Ltd for the Department of Sustainability and Environment, Victoria BushBroker Implementation: Evaluation after two years of operations (2009) Prepared by O’Connor NRM Pty Ltd 20 Adelaide Street Maylands SA 5069 AUSTRALIA Tel + 61 8 83037190 for the Department of Sustainability and Environment, Victoria Although reasonable care has been taken in preparing the information contained in this publication, O’Connor NRM accept no responsibility or liability for any losses of whatever kind arising from the interpretation or use of the information set out in this report. 1 Executive Summary To date, the BushBroker program controls the quality of native vegetation credits, registers credits, brokers credit trading between permit holders and landowners and extinguishes credits to meet requirements for native vegetation credit trading in Victoria. Recently a Native Vegetation Credit Register has been developed which acts completely separate to BushBroker and is responsible for quality control and auditing of native vegetation credits, registering and extinguishing of credits. This evaluation reviews the experiences of clients of BushBroker over the first two years of implementing the scheme. The evaluation primarily seeks to determine how BushBroker is working to address issues the Department of Sustainability and Environment (DSE) sought to overcome by establishing the program. The demand for BushBroker services and the share of the native vegetation third party offset market are also considered. The evaluation approach included a review of program documents, discussion with BushBroker staff and interviews with 20 native vegetation credit permit holders and landowners who have been/still are clients of BushBroker. A number of clients reported challenges creating and trading credits which were due to the guidelines for native vegetation offsets and not due to the actions or responsibilities of BushBroker. Examples of this were delays in transfer of land and subsequent creation of credits, and difficulties finding credits which fit the like-for-like requirements of the referral authority and offsetting guidelines. Misattribution of difficulties in achieving credit trades sometimes skewed a respondent’s view of the effectiveness and efficiency of the BushBroker program. The evaluation revealed that a number of profit motivated landowners have established themselves and are operating in the offset credit market for profit. All permit holders report that they would seek offsets through BushBroker if they need them in the future; either as a sole mechanism of finding offsets or as part of a wider search. Almost all clients reported high levels of satisfaction with the friendliness, helpfulness and efficiency of BushBroker staff and the service. However, few landowner credit landowners sought advice about credit trading, the BushBroker program or credit pricing outside the advice offered by the BushBroker service, suggesting that auxiliary support and consultation services which could be useful to landowners are not adequately developed or accessed. The paucity of experienced support services from consultants and other private sector providers is also demonstrated by the uncertainty most permit holders and landowners reported about what represents value in the market. Permit holders and landowners report agreeing on credit prices based on expected costs for managing native vegetation but with a wide range of approaches to costing management actions, opportunity costs, risks and ongoing liabilities. Almost all permit holders and landowners reported that the time taken for the main stages of establishing and trading offset credits through BushBroker is longer than anticipated or desirable. Permit holders reported that optimal timing for establishing an offset is approximately 8 weeks. Transaction speed is significant for permit holders seeking to meet offset requirements as delays can increase the cost of development. A number of permit holders reported that they are prepared to pay a premium for rapid transactions. 2 Landowners reported that optimal timing for receiving management plans after assessments is approximately 4 – 6 weeks. Most landowners desired rapid turn-around of this information because they were enthusiastic about their native vegetation and anxious to have information about its condition and management requirements. Landowners had often initiated an Expression of Interest after a long period considering the merits of selling credits and were anxious to maintain the momentum of their interest. Both permit holders and landowners were positive about an online credit register and online searching. Permit holders and landowners viewed online information on credits as a way of potentially increasing the speed of transactions and increasing access to information about credit prices and competition for credits – depending on the information made available. There was general agreement that the ability to search online would suit landowners, however, there was concern that the trading environment be designed to be suitable for their level of expertise and experience. Landowners wanted some confidentiality so that only genuine permit holders would have access to their contact details. The risk of selling only part of the credits for a site but having management responsibility for the entire site is a major challenge for landowners. Landowners had employed different strategies to deal with the problem. Some had attempted to negotiate the site boundaries to better ‘package’ groups of saleable credits. Others had sought either a portion or full costs for whole site management from the first sale of credits from the site. The decision on how to deal with this problem was likely influenced by the landowner’s financial position, confidence in the market for the type of credits they held and private interest in managing the native vegetation. Almost all respondents thought that it was reasonable for BushBroker to recover the cost of assessing sites and preparing management plans. However, landowners thought that deferment of costs until sale of credits was a good approach. Permit holders were generally in favour of any action which increased supply and reduced transaction times, as long as costs remained reasonable. Recommendations The BushBroker program has been evolving since the beginning of implementation and some steps have already been taken, or are planned, to improve the efficiency of processes. The following recommendations are aimed at improving the efficiency of BushBroker processes to meet client expectations. Recommendations are drawn from the evaluation of client experiences of the BushBroker service. 1. Increase the supply of credits, especially for highly sought after credit types, by increasing the number of site assessors accredited to confirm native vegetation credit assets. This may be achieved by allocating current or increased BushBroker resources to site assessment or by accreditation of additional native vegetation service providers. 2. Increase the supply of credits by implementing a deferred payment option for landowners to pay all or part of the cost of having site assessments undertaken and management plans prepared. 3. Review Quality Assurance procedures for Habitat Hectares assessments and assessors to ensure consistency and accuracy of assessments is maintained. 3 4. Introduce online searching of native vegetation credits. Users of online searching services require access to the register of credits, information about past trades and information about costs of credits for sale. Credit trader contact information should be managed to maintain confidentiality. The current system of BushBroker manual search of the credit register can be phased out as familiarity with online register searching becomes for common. Online searching must be adequately supported with information and training for permit holders and landowners. 5. Ensure one of the guiding principles in credit creation is the provision of greatest flexibility for landowners (within reasonable constraints of site management activities and costs). This will include maximising the number of packages of credits created during site assessments. 6. Review the information available to clients on the role of BushBroker in native vegetation credit trading. Clients are not currently able to distinguish between the role of BushBroker and the roles of DSE as the development referral agency and the agent for land title transfer to the Crown. 7. Review information provided to landowners about ongoing management responsibilities after the 10-year management plan has expired. Some landowners are not clear about the type or level of their ongoing responsibilities. 8. Monitoring timelines for key tasks in the BushBroker process to ensure they meet the average timeframes below I. Acknowledgement letter sent within 5 working days after enquiry registered (ie. after registered enquiry or EOI on database and all relevant information received from enquirer). II. Enquiry response table sent within 10 working days (outlining potential matches for offset requirements from database) of enquiry registration. III. Landowner details given to enquirer within 5 working days of receiving enquiry response table (including preferred options from enquirer). IV. Credit trading agreements sent to enquirer for signature within 5 working days of receiving credit trade advice (including details of purchase ie. agreed price). 4 Table of Contents Executive Summary................................................................................................................................. 2 Recommendations................................................................................................................................... 3 Table of Contents .................................................................................................................................... 5 Introduction.............................................................................................................................................. 6 Methods................................................................................................................................................... 6 Results..................................................................................................................................................... 7 Client profile.................................................................................................................................... 7 BushBroker service delivery............................................................................................................ 9 Client experience of the service.................................................................................................. 9 Expectations of time in BushBroker trading .............................................................................. 10 Experience in the market .............................................................................................................. 12 Barriers to the use of BushBroker............................................................................................. 12 Future of the market ................................................................................................................. 14 Offset credit prices ........................................................................................................................ 14 Site assessment cost recovery ..................................................................................................... 16 Conclusions ........................................................................................................................................... 16 Appendix 1 – Background reports.......................................................................................................... 17 Appendix 2 – Interview guides............................................................................................................... 18 Interview guide for credit permit holders............................................................................................ 18 Interview guide for credit landowners ................................................................................................ 20 Appendix 3 – Case studies .................................................................................................................... 22 5 Introduction The BushBroker program commenced in 2006, with the first trade conducted in early 2007, following considerable design and testing. Since then, BushBroker has continued to respond to and process Expressions of Interest submitted by landowners willing to create native vegetation credits, and enquiries from developers looking to purchase credits. The BushBroker program is maturing and is soon to implement changes to operations and diversify resources to deal with the growing demand for third-party offsets and to provide a focus for regional communication and support for the program. This includes enabling external organisations to deliver BushBroker services and assist in responding to the anticipated demand for trading native vegetation credits. This evaluation provides a review of the experiences of clients of BushBroker over the first two years implementation period. The evaluation primarily seeks to determine how BushBroker is working to address issues DSE sought to overcome by establishing the program. This evaluation includes consideration of the demand for BushBroker services over the past two years and the share of the native vegetation third party offset market BushBroker trades represent. The evaluation recorded the experiences and opinions of BushBroker clients and the findings are summarised in this report. A set of case studies has also been developed to share the stories of a range of clients with different needs for and experiences of the program. BushBroker is a service aimed at ensuring efficient creation and trade in native vegetation credits within the offsetting market created by Victoria’s Native Vegetation Management - A Framework for Action (2002). Some of the challenges faced by permit holders and landowners in the offset market are due to the rules around native vegetation credit creation and trading and are beyond the control of the BushBroker program. However, a number of BushBroker clients interviewed for this evaluation did not differentiate between the BushBroker scheme and the offsetting rules. Some delays and difficulties experienced in creating or trading credits were mistakenly attributed to the operations of the BushBroker scheme. The main difficulties experienced by BushBroker clients that were mistakenly attributed to the broker scheme are delays in transfer of land and subsequent creation of credits, and difficulties finding credits which fit the like-for-like requirements of the offsetting guidelines. Methods The evaluation reviewed key documents which have shaped and described the BushBroker trading scheme and combined this information with discussion and direction from DSE staff to form interview guides for BushBroker market participants. A list of documentary sources used in the review is provided in Appendix 1. Two interview guides were developed to assess the experience of ‘landowners’ and ‘permit holders’ of native vegetation credits for trade in the BushBroker scheme. These traders are listed in Table 1 and are characterised as Landowners – Ten interviews representing eight private landowners, one developer providing native vegetation credits and two consultants advising landowners 6 Permit holders – Ten interviews representing three private developers, one institutional developer (VicRoads) and six consultants advising developers The interview guides were used as a prompt to ensure critical questions of interest to the evaluation were answered but also enabled free-flowing conversation with the interviewees. Interviewees were encouraged to talk about issues of interest and concern to them and specifically asked if they had further comments at the end of the interview. All interview guide points were checked during interviews to ensure that main topics were covered. The interview guides are provided in Appendix 2. Interviewees were selected to ensure adequate canvassing of issues relevant to all sides of BushBroker operations. Guiding principles for selection of stakeholder interviewees were • • • • • • Include some parties involved in multiple trades Where possible interview developers and landowners involved on both sides of trades Include at least one trade where supply of credits was limited or constrained the efficiency of trading Include stakeholders with the following characteristics Developers and development consultants o Representing government sector and private sector development o Who have used BushBroker in addition to alternative offset mechanisms in the past two years Landowners o who provided offsets through management of private land or through surrender of land to the crown o who provided tree offsets through revegetation for over-the-counter trades While interviewees in both the permit holders and landowners groups had different offset requirements, backgrounds and experience of the BushBroker program, many issues were common. A review of interviews was undertaken after the minimum sample number in each group had been reached. The review enabled some estimation of when data saturation would be reached. The final number of interviews represents approximate data saturation, with little new information arising in the final two interviews in each category. Results Client profile Landowners Landowners represent a very diverse group of people with different motivations and backgrounds. All landowners expressed some interest and concern for conservation of biodiversity. Profit motivation ranged from zero profit motivation (interest in information for management and some recovery of costs), through to at least four landowners with interest in making a profit above costs. The majority of native vegetation credit landowners were landowners interested in selling credits arising from management of remnant native vegetation (Habitat Hectares) and tree offsets. One landowner was creating credits for tree offsets through revegetation and another landowner was a developer who 7 was creating and selling credits through transfer of land to the conservation reserve system (several other developers were also contemplating the possibility of creating credits this way). The landowner group managing remnant native vegetation is characterised by landowners with little experience of markets for ecosystem services but some experience of management of native vegetation. The majority of landowners had been involved in a previous program to improve land management and manage native vegetation (eg. PlainsTender, Land for Wildlife, Landcare, Grow West, Trust for Nature, CMA programs), however, they had little experience of comprehensive native vegetation management planning or costing a comprehensive management plan. Four of the landowners interviewed had purchased land containing remnant native vegetation with the possibility of credit trading through BushBroker in mind (including the developer trading credits created through transfer of land to the conservation reserve system). Landowners had become involved in the BushBroker scheme through several pathways. The majority had been seeking funding for management actions to protect native vegetation and been directed to BushBroker. Only three of the landowners interviewed had first become aware of BushBroker after seeing an advertisement or general information about the service. Four landowners identified that they had become involved because they believed that they could make a profit from credit trading because credit supply would be limited. One landowner had used a native vegetation consultant to advise them in establishing and trading their credits and in their dealings with BushBroker. Additional information about landowner attitudes to and experience of the BushBroker service is available in the Case Studies (Appendix 4) Permit holders The majority of permit holders interviewed were development consultants / permit holder agents. Development consultants report that most developers use development consultants to assist them to meet development requirements and that requirements under Victoria’s Native Vegetation Management - A Framework for Action (2002) have been similarly passed on to development consultants. Exceptions to this were one small developer undertaking their first development of a small housing estate, two developers who had staff managing native vegetation offset compliance and VicRoads (an institutional developer with their own environment section and staff for dealing with offset compliance). Almost all permit holders were experienced in negotiating the acquisition and cost of services and in finding offsets for development impacts on biodiversity (both first- and third-party offsets). Several development consultants had been trained in the Habitat Hectare assessment methodology and four had experience in costing native vegetation management. Additional information about landowner attitudes to and experience of the BushBroker service is available in the Case Studies (Appendix 4) 8 BushBroker service delivery Client experience of the service Almost all clients reported high levels of satisfaction with the friendliness, helpfulness and efficiency of BushBroker staff and the service. However, the majority of respondents reported dissatisfaction with the length of time taken to buy or sell their credits. Only one permit holder had a strong negative experience of the BushBroker service (and this was related to a negative outlook on offsetting in general and the difficulty they experienced in understanding the offset requirements and finding an offset in the specific case). Landowners Almost all landowners reported that the process of creating and/or selling credits had taken longer than they anticipated. Landowners indicated that they did not know why some of the delays occurred and did not understand the size or segmented nature of the offsets market. Landowners were generally not in a hurry to sell all credits and concern around delays in processing their applications were more connected to the desire for information than haste to trade credits. One landowner reported that a trade was being delayed by the Shire Council because they want trades to occur within the Shire boundary. Almost all landowners supported the idea of searching the register being online. They reported that quick access to information on the availability of credits would assist them to formulate a price for their own credits. There was general support for having prices for previous trades online. There was general agreement that the ability to search online would suit landowners, however, there was concern whether the environment was suitable for their level of expertise and experience. Landowners wanted some confidentiality so that only genuine permit holders would have access to their contact details. Permit holders Almost all permit holders reported that the process of buying offsets was slower than they would like. Permit holders reported that they did not always understand why delays occurred. There was incomplete understanding of the size of the market and the readiness of credits for purchase, and of the work undertaken by the BushBroker team to try to find suitable assets not already on the register. Permit holders did not always distinguish between the offsetting rules under Victoria’s Native Vegetation Management - A Framework for Action (2002) and the functions and processes of the BushBroker service. Consequently, permit holders did not always understand the segmented nature of the market or the difficulties BushBroker has in finding offsets within the rules. For example, two permit holders reported that BushBroker was inflexible in not allowing a like-for-like offset in a different bioregion to the one where the offset was required – a rule set by the offsetting policy and not something that BushBroker can vary or avoid. Permit holders did not always distinguish between the functions of the BushBroker program and the role DSE (and its staff) plays in referrals. This led to some criticism of the slowness of the process which was not the responsibility of the BushBroker team. Two permit holders reported that the time 9 taken to get acceptance of their offset (by DSE or Council), after they had found an offset reported as suitable by BushBroker, was unexpectedly long. Several development consultants expressed the opinion that they could increase the efficiency of the BushBroker scheme if they were accredited to undertake site assessments. They believed that limited DSE capacity to undertake assessments was restricting the supply Almost all permit holders supported the idea of the register being online. They reported that quick access to information on the availability of credits would be more efficient for them. There was a mixed response to the idea of having prices for previous trades online, largely because of concern that it might force prices higher or reduce the opportunities for consultants. There was general agreement that the ability to search online would suit developers / developer consultants, but some concern about confidentiality and whether older developers would be interested in becoming familiar with online searching. Expectations of time in BushBroker trading BushBroker program The BushBroker program has undertaken an analysis of current timeframes to complete the different stages of registering and trading credits. This is summarised below. BushBroker Action Acknowledgement letter sent after enquiry registered (ie. after registered enquiry or EOI on database and all relevant information received from enquirer) Enquiry response table sent (outlining potential matches for offset requirements from database) after enquiry registered Landowner details given to enquirer (after receiving enquiry response table including preferred options from enquirer) Agreement on price between enquirer and landowner (price is negotiated independent of BushBroker) Credit trading agreements sent to enquirer for signature (to formalise the trade) Average Current Time (working days) Four Six Six Nine Four Landowners Landowners discussed three stages of the process which are important to them in creating and trading credits: Stage 1) from registering an Expression of Interest to receiving a site assessment Landowners had different experiences of the length of time this process takes but reported that once they had registered their interest they were keen to have something happen. Stage 2) from receiving a site assessment to receiving a management plan and a Habitat Hectares score 10 Landowners who intend to manage remnant native vegetation were generally highly motivated to action and reported enthusiasm for information about their property. They were keen to know what assets they have and what issues they should manage. Expectations of the time it should take to receive a management plan after site assessment varied but averaged around 1-2 months. Some landowners reported that they were frustrated about the length of time in this process, more because they did not know what to expect than because they needed the information to be available quickly. Stage 3) from receiving a management plan to receiving offers to buy credits Landowners had different experiences of the length of time to make a sale of credits. Several landowners reported taking more than six months to complete a sale. Landowner satisfaction with the time to make a sale of credits varied, however, there was general acceptance that once credits were created, the time to sale was largely governed by market forces One landowner who had created credits through transfer of land to the conservation reserve system reported that land transfer had taken approximately 8 months. They were frustrated by the length of this process and believed it had restricted their ability to trade. However, this issue relates to the processes for title transfer and not to the operations of BushBroker. There was no dissatisfaction reported for the time BushBroker takes to calculate credits once a transfer has been completed. Permit holders Permit holders all reported that they begin the process of finding an offset as soon as the offset requirements are clear. Critical timelines for permit holders varied but were all related to avoiding any delay in bringing the development into operation. There were two key stages to establishing the offset where permit holders expressed an opinion about their expectations: Stage 1) From registering an enquiry to receiving advice about the availability of appropriate offsets. Average expectations for this process was a two-week turnaround. Permit holders did not always demonstrate understanding of the availability of potential offset credits on the register or of the process DSE uses to find or confirm an appropriate asset. Stage 2) From registering an enquiry to purchasing the required credits. The amount of time available for this stage depends on the stage and speed of development, however, permit holders reported an average preferred time of eight weeks. A number of permit holders reported that delays were costly and that developers were likely to be willing to pay to avoid delays (up to a price point) as long as they could budget for the costs. Several permit holders did identify points in the process where they had slowed the process. Delays had occurred when it took more time than anticipated to • • Understand the consultant’s report on the offsets required Understand how to enter data when seeking an offset 11 Experience in the market Barriers to the use of BushBroker Landowners Landowners reported a range of challenges to participation which may act as barriers for future landowners (the challenges were different depending on the experience and expertise of the landowner) including. • • • • • • Uncertainty about whether their vegetation is in demand in the offset market Uncertainty about what impact selling credits or placing a covenant on part or all of their land might have for their right to use the land or sell it in the future (this includes the risk of losing rate rebates if land is rezoned from agricultural to another use) Uncertainty about costs for management, especially management in-perpetuity Risk of selling only part of the credits for a site but having management responsibility for the entire site Risk of selling only part of the credits for a site and being left with an unsaleable bundle of remainder credits Uncertainty as to whether available land management schemes might offer more flexibility or greater financial reward over time Several landowners offered opinions on why other landowners may not be getting involved in the BushBroker scheme. These included • • • Little awareness or knowledge of the scheme Little understanding of the prices for credits and the benefits of selling credits Suspicion of covenants No landowners thought that the identity of the permit holder would be an impediment to trade. Several landowners reported that they believed the offset and trading rules were robust enough to ensure that no net native vegetation loss resulted from offsets. One landowner thought knowing the identity of the permit holder was useful as they may adjust their price for a big or small permit holder. Permit holders Nine of the ten permit holders / permit holder consultants reported that it was easier to find offsets with BushBroker than without it. Only one respondent reported that they have not found BushBroker an effective way to find appropriate offsets in a reasonable time and have found it easier to find offsets through other mechanisms. Several permit holder consultants had sought offsets on council owned land and one had established offsets through Trust for Nature. All permit holders reported that they would seek to find future offsets through BushBroker as the sole mechanism or as one of several mechanisms (eg. Trust for Nature and Council land). Several permit holders were not aware that they could seek to establish an offset through any mechanism other than BushBroker. The main barrier to using BushBroker was reported as slowness in finding an appropriate offset, a problem related to the size and segmentation of the offset market. Where trades had been established within the range of time expected by the permit holder, they were satisfied with the result. Most permit 12 holders were experienced at using appropriate expertise to assist them to meet offset requirements and therefore faced fewer challenges. An inexperienced developer who did not contract consulting expertise, reported that the process was difficult to understand and inefficient. Only one permit holder thought that landowners knowing their identity might be an impediment to trade because landowners may ask a higher price if they thought the developer had a greater ability to pay. One permit holder wanted to know the identity of landowners so that they would be aware of whether they were likely to purchase credits from another developer (a competitor in the development business). Permit holders reported general satisfaction with the role of BushBroker in holding contracts with the offset provider. 13 Future of the market There was a general lack of knowledge about the size and segmentation of the offset market among both permit holders and landowners. Consequently, interviewees were uncertain about the future demand for or supply of credits. Landowners A number of landowner landowners who had established credits to manage remnant vegetation had additional sites of native vegetation which they had not yet registered for assessment and credit trading. This reflects both a ‘wait-and-see’ approach and also a concern about over committing to the management required at each site. Development consultants reported that they did come into contact with sites with native vegetation which they believed would be of interest to the offset credit market. Several consultants reported that they had recommended that landowners register their sites with BushBroker. Several consultants identified that many of their clients did not know how to value native vegetation or how to cost management and that this may restrict their entry into the credit market. Three landowners indicated that they are interested in purchasing additional land with potential for sale of offset credits. Two of these were primarily motivated to manage the land for conservation purposes and would sell offsets to pay for the management. The third landowner is interested in having offsets available for their own business and in selling credits in the offset market. Permit holders Permit holders were unwilling or unable to report on the offset credits they might want in the future, however, three consultants identified that Plains Grasslands and associated EVCs would be in demand. Permit holders reported high levels of uncertainty about future development at this time. Offset credit prices Landowners Landowners generally had a clear idea about what it was going to cost to manage offset sites once credits were sold. Most landowner landowners reported using the guidance from the BushBroker program to calculate management costs and to construct a credit price. Landowners also reported using the information on the range of prices paid for credits (available on the BushBroker website) as a guide to the value of their credits. Most credit prices were reported as being a mix of expected costs and a margin based on expectations of the permit holders’ willingness to pay. Most landowner landowners did make some provision for inflation; however, few could clearly report how they had made provision for management beyond the 10 year management agreement period. Some landowners did include opportunity costs for lost income from grazing or other income generating activities prevented or reduced under the management plan. However, no landowner discussed any calculation of the opportunity cost of placing a covenant over the land. 14 Landowners reported that they wanted flexibility and control over the sale of packages of credits at different times. Landowners reported that the requirement to implement management on all of a site once all or part of the credits from that site is sold was difficult for them to manage. Different landowners had dealt with the problem in different ways, including • • • • Negotiating site boundaries to better ‘package’ credits for sale Seeking full cost of managing the site from the first credit trade Seeking a portion of the total site management cost from the first trade to reduce the risk if further credits were not sold (eg. one landowner set the price for the first credits at approximately 30% of the total cost of management of the whole site for 10 years. They expected further credit sales in the next three years to stay ahead of management costs) Seeking to sell all or most of the credits from a site to the first permit holder (even if they originally only want part of the credits) – this approach was taken because the landowner believed they were not in as good a position to continue trading credits as the permit holder would be Most landowners were satisfied with the prices they had received for credit sales, though several were still in the process of negotiating with a permit holder. One landowner expressed a belief that they had sold their credits substantially below market value because there was little information about trading prices at the time they made their sale (the landowner was an early client of BushBroker). Several consultants involved in trades on behalf of developers reported that they believed some prices were below cost of management and were concerned about landowners being able to deliver on management responsibilities in the future. One landowner who had made several sales had a well developed cost model and had experimented with different prices in successive trades. Permit holders Permit holders reported having little to guide them as to what to pay for credits. Permit holders reported using the information on the range of prices paid for credits (available on the BushBroker website) as a guide to negotiating a price. They also reported comparing prices on those occasions when they were provided with several options for obtaining the offsets, though price sensitivity was reported to be influenced by the ease of the transaction and the estimated speed with which an offset could be found. Several permit holders had had unsuccessful attempts to negotiate a credit sale and reported being subsequently more willing to pay more for a quick, secure deal. Permit holders who had purchased over-the-counter tree credits were satisfied with the price, partially because of the ease of the transaction. 15 Site assessment cost recovery Almost all respondents thought that it was reasonable for BushBroker to recover the cost of assessing sites and preparing management plans. Landowners Some landowners did report that the requirement to pay for site assessments and management plans would be an impediment to registering with BushBroker, though many thought that they were now confident enough to pay some costs upfront with expectation of recovering the cost from sale of credits. Almost all respondents thought that deferment of costs until sale of credits was a good approach. Permit holders Permit holders were generally in favour of any action which increased supply and ensured timely access to appropriate offset credits – to a price point. Conclusions 1. 2. 3. 4. 5. 6. 7. Most permit holders and landowners are uncertain about what represents value in the market and report agreeing on prices which are based on expected costs for managing native vegetation. Almost all permit holders and landowners reported that the time taken for the main stages of establishing and trading offset credits through BushBroker is longer than anticipated or desirable. However, a review of BushBroker timelines reveals that recent operations have reduced timelines to acceptable limits. Permit holders reported that optimal timing for establishing an offset is approximately 8 weeks. Landowners reported that optimal timing for receiving management plans after assessments is approximately 4 – 6 weeks. Both permit holders and landowners were positive about an online credit register and online searching. The risk of selling only part of the credits for a site but having management responsibility for the entire site is a major challenge for traders. All permit holders would seek offsets through BushBroker if they need them in the future; either as a sole mechanism of finding offsets or as part of a wider search. 16 Appendix 1 – Background reports Reports BushBroker Institutional Arrangements: A study to identify the preferred arrangements for the establishment of the BushBroker in the State of Victoria. Prepared for Department of Sustainability and Environment (August 2003) by Price Waterhouse Coopers. Research on the need and demand for the BushBroker. Prepared for Department of Sustainability and Environment (15 August 2003) by OfforSharp and Associates Pty Ltd. Discussion Papers BushBroker Cost Recovery (discussion paper, 2009) Department of Sustainability and Environment BushBroker Online (project outline, 2009) Department of Sustainability and Environment Trading for Third Party Offsets in Victoria (discussion paper, 2008) Department of Sustainability and Environment Program Publications BushBroker: Native vegetation credit registration and trading (2007) Department of Sustainability and Environment Native Vegetation Guide for assessment of referred planning permit applications (2007) Department of Sustainability and Environment Native Vegetation Net gain accounting first approximation report (2008) Department of Sustainability and Environment Native Vegetation Sustaining a living landscape (2006) Department of Sustainability and Environment Victoria’s Native Vegetation - A Framework for Action (2002) (2002) Department of Natural Resources and Environment Native Vegetation: Vegetation Gain Approach Technical basis for calculating gains through improved native vegetation management and revegetation (2006) Department of Sustainability and Environment 17 Appendix 2 – Interview guides Interview guide for credit permit holders Background to involvement 1. 2. 3. What has been your involvement with BushBroker? What type of developments / what types of native vegetation clearance? • Level of vegetation priority etc? What are the details of any offsets you have established through BushBroker? • Use of offsets, type, number, size, any 1st party offsets? • Method of obtaining offsets (historical and now) Mechanism (part A) 4. 5. 6. 7. What mechanisms for finding offsets have you tried? • Direct, consultants, TfN, BushBroker, purchase land, council or other public land? other? Why? Is it difficult to find suppliers/landowners? More difficult with or without BushBroker? Are there parts of the process of working through BushBroker that you find complex or difficult? eg. paperwork, communications, contracts? If a developer came tomorrow what would you do? Timing 8. 9. 10. 11. 12. 13. What timelines are important for you when seeking an offset? How time effective has the process of finding/establishing an offset through BushBroker been? What do you consider is an acceptable amount of time for finding/establishing an offset? At what stage of your project do you start the process of finding an offset? What parts of the BushBroker process do you think are the bottlenecks? How do you think developers/consultants could improve the time effectiveness of using the BushBroker the process? 14. How do you think BushBroker could improve the time effectiveness of the process of finding an appropriate offset? • Eg. More landowners registered? Easier access to the register? More landowners with confirmed assets? The market 15. What do you understand about the current market for offsets in which BushBroker operates? 16. What types of offsets might you want in the future? 17. Have you experienced any impediments to operating in the offset market through BushBroker (other than those mentioned already)? 18. How has BushBroker helped you to find what you want in the market? 19. With other work, would you think about getting land managers to put up credits? 20. (for consultants) With other work you do assessing vegetation and writing management plans for landowners, do you/would you encourage them to register for BushBroker if they have potential for tradeable credits? 18 Costs 21. What things have you considered when making the decision about the value of a trade/offset credits? 22. Do you have any experience of whether trades through BushBroker offer value for money with respect to other ways of obtaining the same offsets? 23. Do you have any thoughts on what might happen as the market for credits grows in the future? More suppliers? More demand? 24. Do you have any thoughts about cost recovery for running the BushBroker program? eg. if landowners had to pay for assessments and management plans? • What if the recovery of costs could be deferred until sale of credits? • What would determine your/your client’s willingness to pay for the costs of establishing the credits on landowners property? 25. Would you/your client be willing to pay more to speed up the process of finding offsets? Mechanism (part B) 26. If you had to find an offset tomorrow what would be your preferred option/approach? • Would this depend on the type or size of offset? What in conditions would make the difference? 27. What do you think of the idea of having the trading register online and the ability to search online? 28. Would you like to search online? Do you have capacity to search online? What would be the benefits for you of being able to search online? 29. In trades you have done so far, have you known who the landowner is? 30. Is it important to you to know who the people providing the offset are? Why? 31. Do you have any other comments? 19 Interview guide for credit landowners Background to involvement 1. 2. 3. 4. 5. 6. 7. What has been your involvement with BushBroker? Why do you want to create credits to provide offsets by managing your native vegetation (or revegetating or transferring land to the crown)? Have you been involved in any programs to help you manage native vegetation before? What programs? How and when did you first hear about offset trading? What about BushBroker? What stage are you up to with creating and selling offset credits now? What type of native vegetation (or other asset) do you have? • Level of vegetation priority etc? How many EVCs? What are the details of any credits you have registered through BushBroker? • Have you sold any of these yet? • If so, what proportion of your credits have you sold? Mechanism (part A) 8. 9. 10. 11. 12. 13. 14. 15. Is BushBroker the only way you have provided offset credits? Have you tried to sell offset credits through a mechanism other than BushBroker?: • Direct or through consultants, TfN, other? Why? Is it difficult to find a permit holder for your offset credits? More difficult with or without BushBroker? (What would you do if BushBroker did not exist)? How well do you understand the BushBroker process? Registration of interest; site assessment; management plan; offset credits; trading; contracts and obligations? What area of creating and selling offset credits through BushBroker do you think you understand least well? Was (is) there any part of your obligations under a credit trade that you did not expect or understand? Are there parts of the process of working through BushBroker that you find complex or difficult? eg. paperwork, communications, contracts? Timing 16. How long has it taken to get to each stage of creating and selling credits? • Registration of interest; site assessment; management plan; offset credits; trading negotiation; contracting? 17. What timelines are important for you when you want to create and sell credits? 18. What do you consider is an acceptable amount of time for creating credits? i.e. from Expression of Interest to Confirmed Asset stage? 19. What do you consider is an acceptable amount of time for selling credits? i.e. after credits are created until you have your first payment? 20. (If a sale has been made) How long has it taken to get to this point? 21. Are there any parts of the process of creating and trading offset credits through BushBroker that you think are bottlenecks? 22. How do you think you (offset credit landowner) could improve the time effectiveness of using the BushBroker? 23. How do you think BushBroker could improve the time effectiveness of the process of finding permit holders for your credits? • eg. Easier developer access to the register? Faster to confirm the assets? 20 The market 24. What do you understand about the current market for offset credits in which BushBroker operates? i.e. how rare do you think the credits you have are? How much demand for credits like yours do you think there is / will be in the future? 25. Do you have any other credits to sell or native vegetation not yet registered that you would like to create credits for and sell them? 26. What is your preferred way of selling credits? All at once, on a piece by piece basis, some other arrangement? 27. How confident are you that you will be able to sell your credits (in the future)? 28. Have you experienced any impediments to operating in the offset market through BushBroker (other than those mentioned already)? 29. How do you think BushBroker has helped you to sell your credits in the market? Costs 30. What things have you considered when making the decision about the value of your offset credits? 31. Did you have any experience about setting a price for these type of credits? Where did you seek advice about the price? 32. Do you have any experience of whether trades through BushBroker offer value for money for you? 33. Do you think offset credits will become more valuable, less valuable or about the same value in the future? 34. Are you happy with the arrangement of payment for credits through BushBroker (check how payments are staged)? 35. Do you have any thoughts about cost recovery for running the BushBroker program? eg. if landowners had to pay for assessments and management plans? • Would you have become involved if you had to pay up front for site assessment and preparation of the management plan? • What if the recovery of costs could be deferred until sale of credits? Would you be prepared to start the process under these circumstances? • How would you factor any establishment costs you owe into your price for selling credits? • Would you expect your first trade to pay for all the establishment costs? • How much of the cost for implementing the whole management plan would you want to recover in the first sale of credits? Mechanism (part B) 36. Have you considered or been approached to provide offsets directly to a developer and not through BushBroker? What happened? 37. What do you think of the idea of having the trading register online and the ability to search online? 38. If you could search online, what information would you like to be made available (ie. type and amount of credit, prices, owner details etc.) 39. Would you like to search online? Do you have capacity to search online? What would be the benefits for you of being able to search online? 40. In trades you have done so far, have you known who the permit holder/developer is? 41. Is it important to you to know who the people buying the offset are? Why? 42. Do you have any other comments? 21 Appendix 3 – Case studies 22 The Keynes Family1 – Native Vegetation Credit Landowners Background The Keynes family are landowners who manage a cattle grazing enterprise on their property. They do not live fulltime on the property but manage the farm in their spare time and using contract labour. Mr Keynes is a professional experienced in costing work and in trading in cattle, real estate and share markets. A portion of the property has native vegetation on it, and the Keynes see the native vegetation as an asset for the property. The native vegetation was assessed as two parcels of potential credits; one classed as having a very high conservation significance rating and the other as having a high conservation significance rating. The parcels also contain several hundred large old trees. The combined area of native vegetation for which credits have been created is approximately 20 ha. Motivation to create and sell native vegetation credits The Keynes family had not been involved with any land management program before BushBroker. They had been attracted to a BushTender trial in their area in the past but registered their interest too late to be able to participate. Their enquiries led them to information about BushBroker, and they registered their interest in 2007. They thought BushBroker was a sensible project that could help them improve the condition of their native vegetation. “It’s our property so if we have 2 million frogs in 10 years and don’t have blackberries in there… it’s ultimately going to benefit me” 1 Benefits of involvement The site assessment was a highlight of being involved in the program and the Keynes were excited by the very detailed and professional assessment information they received. They learned things about the native vegetation they hadn’t realised, including that they had two distinct plant communities and that a threatened species of frog was present on the property. The family like being able to set their own price for selling their native vegetation credits. “I think it’s a good activity, it will be a reasonable income for what we can do ourselves” Mr Keynes found the paperwork was easy to understand and the administration of the process was efficient and helped them get into the market in reasonable time. Challenges of involvement The Keynes family have not sold any native vegetation credits yet but have had an offer for part of the credits on their property. They had hoped that they could sell all their credits in one sale and found it difficult to calculate a price to sell only part of the credits when they want to manage the whole parcel of native vegetation. Mr Keynes developed a cost model to calculate allocations for his own time, contract labour, CPI for each year and the estimated cost of materials. He would have liked more information about the time needed for different land management activities and made some estimates for costs based on his experience of doing similar work in the past. He did not contact any land management advisers for assistance. The Keynes family would like to sell all their credits as soon as possible and will have to charge more for credits if they can only sell a portion in their first sale. They would like to at least be able to cover their costs for the first three years of management from their first trade if it is for only a portion of their credits. Keynes is not the real name of these landowners 23 Information and advice The Keynes did not contact any land management advisers for assistance in setting their price because they believed they had a reasonable understanding of the costs. However, they are looking for information on the value and likely saleability of their credits as they don’t want to take on too much management liability if they have only sold a portion of the credits for their native vegetation. More information about benchmark prices for past credit trades would have made it easier for the Keynes to negotiate a price with developers. Future considerations The Keynes family are changing their plan for the property now that they see the possibility of receiving some payment for managing their important native vegetation. They are a bit unsure of how they will manage the site after the 10 year management plan is finished and hope there will be other programs to help them in the future. They hope to get enough money for their native vegetation credits to cover future costs but know that the price will depend on the market. “I had to consider who would be the next owner of the property” The Keynes family do not have any plans for selling the property but did consider the cost of losing some rights to manage the land for grazing. They were concerned that the real estate value of the site might change if it can’t be used for grazing and that a future owner may end up with a liability for management that they don’t understand. However, they realised that they might be able to sell the native vegetation portion of the property to lifestyle landowners who will want to look after it in the future. 24 The Newman Family2– Native Vegetation Credit Landowners The Newmans were able to sell all their credits to the first permit holder who made an offer and the sale process only took a few months. Background Challenges of involvement The Newman family own a grazing property west of Melbourne with some areas of relatively undisturbed high value native vegetation on it. The Newmans have a reasonable understanding of the process of creating and selling native vegetation credits but found it difficult to understand how a Habitat Hectare was defined and calculated. They accepted the scoring system used but felt that they would have liked a better understanding of the assessment and scoring process. The Newmans sold all the native vegetation credits for their patch of native vegetation in early 2008. The site where the credits were created is about 15 Ha in area and has vegetation with a very high conservation significance rating. Motivation to create and sell native vegetation credits Mr Newman has always been interested in land management and has been involved in activities with his local Catchment Management Authority, Landcare groups and the Farmer’s Federation. The Newmans fenced about 4 Ha of native vegetation some years ago, as part of a local land management scheme, and keep themselves informed about new initiatives and programs to help landowners to manage native vegetation. They know that some of the native vegetation on their property is quite rare and in good condition and have managed it conservatively but have never sought to place a conservation covenant on any part of their land before. The Newmans are pleased to be paid for protecting and managing their native vegetation. Benefits of involvement The Newmans wanted to be able to set the price for managing their native vegetation. They were able to include all the costs of management for the period of the management plan in their price for the credits they created. The Newmans included the cost of rates, weed and pest management and loss of returns from reduced grazing access in the price. 2 At the time of sale, there was not much information around about the value of the type of native vegetation credits the Newmans owned. They were very unsure of the market price for their credits and felt that they were pioneering the scheme for others. However, they are happy that they sold their credits and think the process worked well for them. There is still some uncertainty about how they will manage the site when the payments stop after 10 years but did make some provision for ongoing management. Information and advice The Newmans found the information provided by the BushBroker program to be informative and useful and they were able to understand their obligations. They found the calculation of Habitat Hectares scores difficult to understand and trusted the field officers to make a fair assessment of their native vegetation assets. Calculating the costs of materials, management and loss of income from changed land use were not difficult. The Newmans knew the basic costs of land management actions and asked an old friend from the Department of Sustainablity and Environment to help them calculate their costs. The Newmans felt that the lack of information about the market price for credits like theirs made it difficult to know if they were making a good Newman is not the real name of these landowners 25 trade. They could not find any information about credit prices at the time but have seen some information on the BushBroker website since. property and they are considering creating and selling additional native vegetation credits in the future. Future considerations There are other patches of native vegetation with high conservation significance on the Newmans 26 Mr Peake3– Native Vegetation Credit Landowner Background Mr Peake owns 400 Ha of native vegetation which he bought with the expectation that he would be able to create and sell native vegetation credits through BushBroker. The property contains a large amount of native vegetation with a very high conservation significance rating. Mr Peake has completed 4 credit trades through BushBroker and has another 2 trades in process. Mr Peake has an ongoing relationship with a natural resource management consultant who manages the credit trading process for him (ie. paperwork, negotiations, risks of bidding, contracting and program obligations). Motivation to create and sell native vegetation credits Mr Peake has owned land in different places in the past and has always had an interest in conservation. He bought 400 Ha of native vegetation with the aim of managing and improving the condition of the vegetation and conserving it as a native sanctuary. Benefits of involvement The chance to trade native vegetation credits in a secure and well ordered market has given Mr Peake confidence to buy and manage his property for the purpose of conservation. Mr Peake did have a native vegetation credit trade initiated outside the BushBroker program but has channelled that trade through BushBroker because of the benefits. These benefits include the management plans produced for the native vegetation, contract security and risk management through DSE and financial backing for payments. 3 Peake is not the real name of this landowner Mr Peake and his advisors found BushBroker to be a clear system for all parties involved and like the way contract risks are managed. They have looked at other methods of creating and trading credits but were left with many questions about risk management. Challenges of involvement The requirement to manage a parcel of land once a portion of the attached native vegetation credits for parcel have been sold has been a challenge. However, Mr Peake has been able to negotiate with BushBroker for some flexibility about the boundaries of land parcels to ensure good matching of credit trades to land management parcels. Estimating the market value of different credits has been very difficult and Mr Peake has paid considerable attention to understanding prices. Mr Peake is anticipating selling all of the credits from his property and knows that he is relying on a growing market to ensure all his credits will be wanted. It will be difficult to fund the necessary property management if all the credits do not sell. Mr Peake found the time between entering a landowner agreement and getting the first payment to be longer than expected. He thought this process would only take a few weeks but it has taken several months in at least one case. Information and advice Mr Peake and his advisor found the information provided by BushBroker to be easy to understand. They did face some challenges understanding everything in the first trade but now they are experienced it is straightforward. Mr Peake and his advisor had enough previous experience to calculate costs of management and modelled costs based on expected CPI, risks and forecasting of future costs. It has been difficult to find information about prices for native vegetation credits. Mr Peake wants more information about trade prices to 27 help him to be sure he is getting the most for his assets. Future considerations There are several trades pending for other patches on Mr Peake’s property and he intends to stage the sale of credits to allow staging of management on the property. Mr Peake holds some credits in excess of those purchased by developers in some of the completed trades. He wants to sell these credits when a permit holder is available. Sale of these credits will be relatively simple as the landowner agreements are already signed. 28 Developer A – Native Vegetation Credit Permit holder Background Developer A is a private development company who purchased native vegetation credits through BushBroker to meet a third party offset requirement on a development. They had some previous experience of finding offsets before the Victoria’s Native Vegetation Management ‐ A Framework for Action (2002) was brought into effect. The vegetation which was impacted by the development had a high conservation significance rating and a suitable trade was established for a smaller area of native vegetation of very high conservation significance. Developer A used an environmental management consultant to advise them on the offsetting process and the purchase of native vegetation credits. Reason for using BushBroker Developer A had no experience in land management and did not want the responsibility of managing land themselves. They did not know of any suitable vegetation available to provide the offset and were advised by their environmental management consultant to contact BushBroker. The developer also contacted other native vegetation brokers but BushBroker found what they were looking for first. Benefits of involvement The developer liked the limited liability offered by trading through BushBroker. When offered a direct trade with a landowner they opted to work through a BushBroker trade to ensure that the credit purchase they made was final and carried no undesirable future liability “The BushBroker program is great its just got teething problems” Challenges of involvement The time it took BushBroker to find a suitable landowner was longer than desirable for the development. However, other avenues for finding the offset were equally slow and ultimately fruitless.4 At the beginning of the process Developer A did not understand the steps to finding and buying suitable native vegetation credits. They also felt that BushBroker program staff they were dealing with did not fully understand the program in the beginning but have confidence in them now. Developer A thought that BushBroker had a ‘bank’ of credits waiting for purchase and was surprised by the process required to find and secure the necessary credits. The process from inquiry to signed contract took approximately 3 months when less than 2 months is desirable. Developer A had little idea about what the price for credits would be and little to guide them in agreeing to the price the landowner asked. Having one failed attempt to make a trade helped because the second offer was considerably cheaper. It was difficult to know what to pay without more information on previous trade prices for similar credits. Observations Developer A would was in favour of anything that would increase the supply of appropriate credits in the market and would have been prepared to pay more to have security of available credits and to shorten the time taken to meet the offsetting requirement. Developer A suggested publishing the times taken for making trades to help manage expectations. “You’d rather be under promised than under delivered” 4 Delay in finding a landowner was due to the like‐for‐like rules of credit trading and beyond the control of the BushBroker program. 29 Developer C – Native Vegetation Credit Permit holder and Landowner Background Developer C is a private development company who have created native vegetation credits by donating their own land to the Crown. This change in land tenure provides protection for the native vegetation and results in saleable offset credits that the developer can use themselves or sell in the offset credits market. Developer C realised that there was a demand for native vegetation credits when Victoria’s Native Vegetation Management ‐ A Framework for Action (2002) was being promoted. They believed that the market for credits would need a reliable supply of some types of credits and recognised that many developers would like the option of buying credits quickly and efficiently. The developer has three parcels of land they want to create credits from – totalling approximately 120 Ha. They have created some credits already and intend to create and sell more credits to supply a broad range of offset demand including mature trees and vegetation of high and very high conservation significance rating. Reason for using BushBroker Developer C understands the operating environment of developers and the need for meeting regulatory requirements as quickly and cost‐effectively as possible. They know that the market for native vegetation credits is in it’s infancy and that it is difficult for permit holders to find the required credits and challenging for new entrants to the market to understand the rules, paperwork and timelines for purchasing credits. The developer has used BushBroker because they needed registration of their native vegetation credits after transfer of their land to the Crown. They also like the security of the BushBroker system, the arrangements for paperwork to be processed by BushBroker and the backing of DSE. Benefits of involvement BushBroker has directed permit holders to Developer C as an option for purchasing credits. By providing this brokerage service BushBroker has helped keep costs of marketing credits down for the Developer C. BushBroker filters permit holders and only directs genuine permit holders seeking the types of credits Developer C holds to contact the landowner. BushBroker has made it easy to register, buy (from themselves) and sell credits which meet the offset requirements of development. The quality assurance offered by BushBroker has provided confidence to Developer C to take opportunities to operate in the native vegetation credits market. Developer C and BushBroker have discussed options for undertaking training in the requirements for trading native vegetation credits. Once trained, the developer will be able to conduct trades directly with permit holders and work through the Native Vegetation Credit Register for the registering and extinguishment of native vegetation credits. Because of the nature of credits held by Developer C (created through change in land tenure by transfer of land to the Crown), Developer C is paid the full value for the credits on completion of sale. Challenges of involvement It has been challenging to transfer land titles to the Crown and has taken much more time than the developer expected. Title transfers are outside the control of the BushBroker program but have hindered trading through BushBroker. Developer C has found the processing of credits to be slow and would like to be able to complete trades within a week. 30 Without an online register for permit holders to view it is difficult to know if all potential permit holders are able to quickly find Developer C as a potential landowner. Developer C believes that the process of matching landowners and permit holders is slower than desirable. Developer C understands that developers want a rapid process for purchase of native vegetation credits and will pay a premium for a trade that meets their timelines. Observations Developer C is still learning about prices that are acceptable in the market and is unsure about the current competitiveness of the market for the types of credits they are selling. 31