Linking the Strategy Execution System to Continuous Improvement

advertisement

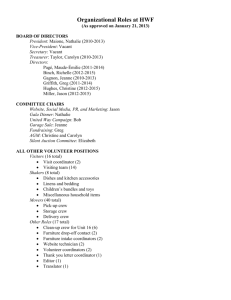

Linking the Strategy Execution System to Continuous Improvement and Risk Management Robert S. Kaplan Marvin Bower Professor of Leadership Development, Emeritus Copyright © President & Fellows of Harvard College Stage 4 of the Management System: Plan Operations TRANSLATE THE STRATEGY 2 • • • • 3 DEVELOP THE STRATEGY Strategy Map/Themes Measures / Targets Initiative Portfolios Funding / Stratex 1 • Mission, Values, Vision • Strategy Formulation TEST & ADAPT ALIGN THE ORGANIZATION • Profitability Analysis • Strategy Correlations • Emerging Strategies • Business Units • Support Units • Employees MONITOR & LEARN 4 6 PLAN OPERATIONS • Strategy Reviews • Operating Reviews • Establish priorities for process improvement initiatives • Risk Management EXECUTION Process Initiative 5 Initiatives Are Short-Term Programs to Help Close the Performance Gap . OBJECTIVE Improve Order Fulfillment Objectives articulate the components of our strategy MEASURE / TARGET Target Time from order to shipment INITIATIVE 18 Time (hours) Measure 12 12 hours Actual A gap Implement automated order management system Target Measures and targets track our progress toward achieving and communicating the intent of the objective. Initiatives help close the gap between our current and desired performance. Link process improvement programs to strategic objectives Strategy Map Balanced Scorecard Theme: Operating Excellence Financial Profits & RONA Grow Revenues Customer Fewer Planes Attract & Retain More Customers On-time Service Internal Lowest Prices Achieve Fast Ground Turnaround Objective Profitability • Market Value • 30% CAGR • Grow revenues • Seat Revenue • 20% CAGR • Fewer planes • Plane Lease Cost • 5% CAGR • Flight is on-time • • #1 • Lowest prices • FAA On-Time Arrival Rating Customer Ranking • #1 • Attract and retain more customers • • # Repeat Customers # Customers • • 70% Increase 12% annual • Achieve fast ground turnaround Ground Crew Alignment • Strategic Systems Crew Scheduling Strategic Job Ramp Agent Target • • Learning Measurement • Ground crew aligned with strategy • On Ground Time • 30 Minutes • On-Time Departure • 90% • % Ground Crew Stockholders • 100% • Strategic Awareness • 100% Develop the necessary skills • Strategic Job Readiness • Develop the support system • Yr 1 - 0% Yr 3 - 90% Yr 5 - 100% • 100% Info System Availability 4 Can process improvements close the performance gap? Ground Turnaround Activities Turnaround time between flights Current minutes per step Wait for airline door to open Unload passengers Wait for cleaning crew to board Clean airplane Wait for cabin crew to board Wait for first passenger to board Load passengers Wait for passenger info list Close aircraft door Detach boarding ramp Total cycle time 3:16 5:14 0:24 10:48 4:11 4:06 17:32 1:58 0:57 1:39 50:05 Process improvements Best practice minutes per step 0:00 4:38 0:18 7:40 0:00 0:00 14:00 0:13 0:09 0:43 27:41 A. Agent anticipates plane arrival time; waiting at jetway for plane to dock B. Stricter controls on carry-on bags, fewer passengers moving back in aisle to find bags C. Cleaning crew in position ahead of time D. Standardized workflow, timing and methods, such as prearranged kits E. Visual signal from cabin crew to agent when plane is ready to board F. Active management of overhead storage bins by flight crew G. Passenger information list delivered by agent following last passenger on board H. Agent ready at aircraft to close door 5 Using the BSC and Quality Assessment Models (Baldrige, EFQM) Together Business Processes Strategic Balanced Scorecard (Competitive Advantage) Vital (‘Hygiene’) Improve to levels of quality excellence Maintain high quality levels Improve to minimum acceptable quality levels Potential to cut back current investment Weak Strong Quality Assessment Model 6 Dashboards articulate the critical link between strategy management and operations management. Cause-and-Effect Model of Each Key Process Strategy Map Web-based Dashboard of metrics used to manage a Key Process THEME linked to PROCESS PROCESS linked to PROCESS METRICS METRICS improve supports THEME PROCESS Identify operational processes key to executing strategy and manage those processes with frequent feedback on dashboard KPIs A dashboard for Discount Airline’s ground turnaround process Task Task Time Open airline door 2:30 Unload passengers 5:10 Cleaning crew boards 0:20 Clean airplane 10:00 Cabin crew boards 4:00 First passenger boards 4:00 Boarding process complete 16:30 Passenger list confirmed 2:00 Close aircraft door 1:00 Detach boarding ramp 1:30 Total boarding time 8 47:00 VW do Brasil posts a dashboard of operational indicators on the wall of its assembly plant A display of Top 500 dealer performance indicators is posted in the hall of VWB’s senior executive office suite. With advances in technology, next-generation dashboards can now fulfill the role of full-fledged performance management tools Advanced visualization methods, with ability to represent large, complex data sets, makes information “actionable” Alignment to strategy – focused on processes that are key to overall strategy execution Pre-defined navigation paths to facilitate analysis and improve user experience, improved audit trails and data transparency Ability to display data from multiple sources, mix of quantitative and qualitative information 11 Integrating Risk Management into the Strategy Execution System A emerging framework for risk management: Category I: Preventable Risks from Employees’ Undesirable and Unauthorized Actions; Breakdowns in Routine Operational Processes Enterprises should strive to avoid having Category I risks occur. The organization gets no benefits from allowing Category I risks to occur. They should strive, in cost-efficient manner, to reduce their likelihood to zero. Category II: Strategy Risks: Failing to Achieve the Enterprise’s Strategic Objectives The risks that the enterprise accepts to generate superior returns The organization must identify the principal risk events from their strategy and estimate their likelihood and impact It can then reduce the likelihood and impact of Category II risks through use of key risk indicator scorecards and cost-effective initiatives Category III: External Risks from Uncertain, Uncontrollable Events Events that managers can neither predict nor influence; often managers “don’t know they don’t know” about such risk events Managers, however, can take prior actions to mitigate the impact of these events should they occur (e.g., build earthquake-proof structures; backup data centers in a distant region; insure; hedge) 13 A emerging framework for risk management: Category I Risks: Employees’ Unauthorized Behavior and Actions o o o o o o o o o o theft of cash and information unauthorized trading failure to follow standard operating procedures accounting irregularities fraud bribery and corruption breakdowns in privacy and security loss or destruction of information discrimination and harassment illegal and unethical behavior 14 Failures in Controlling Category I risks • Siemens Bribery and Corruption Scandal: 2007-09 o Pay $1.6 billion in fines and profit returns to US and German authorities o Pay $850 million for internal investigations by outside lawyers and accountants. o Nine former members of Managing Board sued for $28.3 million for breaching fiduciary duties o Two former CEOs agree to pay more than $10 million to settle cases brought against them. • Société Générale: The Jérôme Kerviel Affair o Upon discovery of Kerviel’s unauthorized positions, the bank privately and quickly closes out the account, realizing losses of about €7 billion and books the loss against 2007 income. o Société Générale has to raise €5.5 billion in new capital to cover the losses. • UBS: Kweku Adoboli arrested in an illegal trading scheme that loses $2.3 billion o UBS shares declined to the lowest level in two-and-a-half years; CEO, Oswald Gruber, resigns on Sept. 24, 2011. o “the rogue trader incident is merely the tip of the ‘casino mentality’ iceberg that has existed at UBS for years.” 15 Managing Category I Risks: Events caused by employees deviating from desired, legal, and ethical behavior, or failing to use standardized operating procedures These are risks that companies want to complete avoid. The goal is to reduce the probability of their occurrence to ZERO! Clear and frequently communicated Beliefs and Boundary Systems • Mission, Values, Codes of conduct Strong internal controls (e.g., segregation of duties), monitored by internal audit department, combined with standardized operating procedures, should drive the probability of compliance and businessas-usual risks essentially to zero 16 Category II Risks: Events that threaten the achievement of strategic objectives The risks the company accepts to execute its strategy and generate superior returns • BP drills for oil and gas 3 miles below surface of Gulf of Mexico • Boeing develops an entirely new aircraft, the Dreamliner: • o Plane will be constructed with more than 50% composite materials (plastic) o Much of the design, engineering, fabrication and assembly shifted to Tier-1 suppliers Jet Propulsion Laboratory launches unmanned missions to explore for life on the surface of Mars 17 Companies accept Category II risks to execute their strategies and generate superior returns “Building great things means taking risks. This can be scary and prevents most companies from doing the bold things they should. However, in a world that’s changing so quickly, you’re guaranteed to fail if you don’t take any risks. We have another saying: “The riskiest thing is to take no risks.” We encourage everyone to make bold decisions, even if that means being wrong some of the time.” 18 18 Failures in controlling Category II Risks BP drills for oil and gas 3 miles below surface of Gulf of Mexico 19 One Post Mortem about the Explosion on the Deepwater Horizon rig An investigative panel recently concluded: “The disaster … can be attributed to “an organizational culture and incentives that encourage cost cutting and cutting of corners – that reward workers for doing it faster and cheaper, but not better” 20 Boeing’s Dreamliner: another strategy risk failure In January 2011, Boeing announced the seventh delay in the delivery schedule for its first 787 Dreamliner, pushing its initial delivery back at least three years later than originally planned. The causes can be traced back to two problems. First, Boeing decided to outsource both the design and the manufacturing of the 787 to shift the economic risk onto those suppliers. By outsourcing both the design and the manufacturing, Boeing lost control of the development process. Second, Boeing had never before built an aircraft with composite materials. It had previously used aluminum -- whose behavior in the real world is much better understood. Boeing admitted: "We made too many changes at the same time -- new technology, new design tools and a change in the supply chain; we outran our ability to manage the project effectively.” 21 Risk management is hard. Experienced project manager (Gentry Lee) appointed as “Chief Systems Engineer” for all JPL missions “Risk mitigation is painful; not a natural event for humans to perform.” 22 Balancing Innovation and Risk: The Message from Janus “JPL engineers graduate from top schools at the top of their class. They are used to being right in their design and engineering decisions. I have to get them comfortable thinking about all the things that can go wrong. … Innovation, looking forward, is absolutely essential, but innovation needs to be balanced with reflecting backwards, learning from experience about what can go wrong.” 23 Individual and Organizational Biases Prevent Companies from Thinking and Planning for Risk Events • We are overconfident about the accuracy of our forecasts and assessments o Consistently under-estimate the variance of future events • We anchor our estimates to readily available evidence (e.g., housing prices in US, until 2006, had not decreased in 40 years) • We accept information that supports our initial position, the confirmation bias, and suppress information that contradicts it, cognitive dissonance: • When our actions do not seem to be working, we escalate our commitment to the original course of action; we throw good money after bad, and fail to recognize sunk costs. • Group Think: we go along with the flow, suppressing objections to actions that the leader and everyone else seems to endorse. • We incubate more risk through the normalization of deviance as we learn to accept minor failures and defects as normal; false alarms, rather than alerts of imminent danger. 24 To overcome individual and organizational biases, effective risk management requires: Active and intrusive processes that: • challenge existing assumptions about the world within and outside the organization • communicate risk information with the use of distinct tools (risk maps, value-at-risk models, stress tests etc.) • complement, but do not displace, existing management control practices 25 A Case Study in Risk Management: The Mars Explorer Project: EntryDescent-Landing (EDL) Stage 26 Companies need highly interactive and intrusive risk management processes to overcome these individual and organizational biases • Jet Propulsion Laboratory creates a 12 Person Risk Review Board for each project (G. Lee serves as chairman) o o Consists of experienced, respected technical experts who are independent of the project Conducts three full-scale 2 day reviews during the course of the project Creates a culture of “intellectual confrontation” Legitimizes rigorous questioning of the intended design What bad things can happen to even good designs? Creative paranoia – what can go wrong, what will you do if this component fails? Forces project team to view their work from a different perspective Canadian utility, Hydro One, holds dozens of Risk Review Workshops each year, facilitated by risk managers, at which employees identify and assess the risks they see in the organization. JP Morgan Chase embeds technically expert risk managers to help traders and investment managers understand the risk consequences from their decisions. o • • 27 The risk meetings quantify the likelihood and impact of risk events Risk Map Value-at-Risk Probability of Gain or Loss Liklihood 5 4 3 2 1 1 2 3 4 Consequence 5 95% line 99% line Magnitude of loss (measured in “standard deviation” units) 28 Risk review meetings also recommend actions to reduce the likelihood or mitigate the consequences of significant risk events • Establish cost and time reserves for product development projects • Identify cost-effective actions that reduce the likelihood or impact of the risk event • Assign an accountable manager to monitor each major risk 29 VW do Brasil uses its strategy map to identify risks to its strategy 91 risks in total 11 risks 4 risks 7 risks 11 risks 24 risks 13 risks 5 risks 2 risks 4 risks 4 risks 38 risks 9 risks 1 risk 4 risks 13 risks 4 risks 3 risks 7 risks 18 risks Identify Risk Events for each Strategic Objective on the Strategy Map Strategic Objective Achieve Market Share Growth Risk Event Outcomes Risk Indicators Industry • Loss of • Daily tracking sales below unit of industry expectations sales volume and due to market share political and • Loss of numbers economic revenues (from uncertainty registrations) triggered by changes in • Macrolaws, such as economic customs reports barriers and other sales • Market trend restrictions evaluations Likelihood/ Consequence 5 4 3 2 1 X 1 2 3 4 5 Management Controls Accountable Manager • Monthly meeting of Sales & Marketing, Finance, Governmental Affairs, Logistics, and Human Resources to consider alternative sales and production plans • Mr. A. Gonzalez Director of Governmental Affairs Identify Risk Events for each Strategic Objective on the Strategy Map Strategic Objective Guarantee Reliable and Competitive Supplier => Manufacturer Processes Risk Event Outcomes Risk Indicators Deliveries interruption • Overtime • Emergency freight • Quality problems • Production losses • Critical items report • Late deliveries • Incoming defects • Incorrect component shipments Likelihood/ Consequence 5 4 3 2 1 X 1 2 3 4 5 Management Accountable Controls Manager • Daily supply • Mr. O. Manuel chain meetings with Logistics, Director of Purchasing, and Manufacturing Quality Logistics Assurance • Monitor suppliers’ tooling to detect deterioration • Risk mitigation initiative: upgrade supplier’s tooling • Risk mitigation initiative: identify and select key supply chain executive at each critical supplier Summary of Critical Strategic Risks at Volkswagen do Brasil Numbers in table are fictitious, for illustrative purposes only. Scale Infra Talent Management Operational Excellence Client / Market Focus Financial Performance Values /Ethics Infosys uses its strategy map to identify strategy risks Nurture Infosys Values Conduct Business Legally & Ethically Be A Responsible Corporate Citizen Enhance Shareholder Value Improve Profits and Profitability Achieve Revenue Growth Grow Key / Large Accounts Optimize Onsite Offshore Mix Increase Revenue Productivity Acquire & Manage Large Deals Reduce Operational Cost Leverage Solutions & Alliances Improve Rate Realization Improve Return On Capital Investment Broaden Business Footprint Strengthen Brand Position Enhance Client Satisfaction Innovation Client Management Execution Excellence Risk Management Identify & Incubate New Business Ideas Strengthen Client Facing Processes Improve Quality & Productivity Reduce & Manage Operational Risk Leverage & Reuse Intellectual Property Strengthen Internal Collaboration Improve Resource Utilization Improve BEF and Unit Scalability Improve Quality Of Talent Recruited Develop & Retain Competencies Strengthen Performance Ethic Develop Diversity in Workforce Improve Workforce Motivation Develop Multiple Tiers Of Leadership Scale State-Of-The-Art Technology Infrastructure Scale State-Of-The-Art Physical Infrastructure 34 Identifying Strategic Risk Factors at Infosys (Illustrative only) Business Objectives Financial performance 1. Achieve revenue growth 2. Sustain profitability 3. Increase revenue productivity Client and market focus External Risk Factors Macro economic factors Exchange rate fluctuations Political environment 4. Grow client relationships 5. 6. Differentiate client offerings Broaden geographical footprint Execution excellence 7. Leverage Global Delivery Model 8. Control operational costs 9. Improve quality & productivity Organizational development 10. Develop and retain competencies 11. Develop global workforce 12. Develop 3 tiers of leadership Competitive environment Concentration of revenues Inflation and cost structure Internal Risk Factors Financial reporting risks Liquidity and leverage Contractual compliance Compliance with local laws Intellectual property management Engagement execution Integration of subsidiaries Immigration regulations Human resource management Security & business continuity Culture, values and leadership Technology obsolescence Partial Key Risk Indicator Scorecard at Infosys Risk Factor Risk Event Key Risk Indicator Concentration of Revenues Major Customer Default • Key Customer Credit Default Swap Rate Immigration Regulations Protectionism Leads to • % of employees with dual Denial of Work Permits citizenship and Work Visas • # of employees that can legally work in countries outside India Identifying, Mitigating and Managing Category II Risks What can cause us not to achieve the strategic objectives on our strategy map? For each objective, identify the key risk events and risk indicators for each strategy map objective Aggregate risk indicators into a Key Risk Indicator (KRI) scorecard Set priorities for initiatives to mitigate the major risk events 37 Category III: The risk from non-controllable external events What are the non-controllable external events that can cause the strategy or the entire enterprise to fail? Often these are risks that “we don’t know we don’t know” Need for “risk envisionment” o Scenario planning, War-gaming, Stress tests, and Tail risk meetings 38 What can a company learn from conducting a War Game? • Divide senior management into 3-4 teams, each representing a major competitive firm in the industry • Establish a base line scenario, including the strategy-of-record for own company o Teams attempt to answer the question, “How would you attack our company’s strategy if you were our competitor? • Designed to identify the holes in the company’s strategy? • Helps to overcome confirmation bias; tendency to find evidence that supports current beliefs and desires and to ignore evidence that could contradict them. 39 Scenario Planning: Why? • Provide a rational process for defining the plausible boundaries of future states of the world. • Strategy workshops help us choose which game should we play in the current environment? What should be the value proposition we offer to targeted customers to position ourselves for competitive advantage? • Scenario Analysis reveals that many possible future environments can exist. How will our current strategy perform in the various possible futures? 40 Risk Management and the CEO • When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing. Chuck Prince, CEO of Citigroup Financial Times (July 9, 2007) • “Jamie Dimon is the Chief Risk Officer of J P Morgan Chase. He sets the tone at the top.” Barry Zubrow, CRO of J P Morgan Chase • “Everyone does risk management in bad times. The strong test of risk management is whether it works in good times. Will top management stand behind the risk managers, avoiding temptation, and saying no to things that put the enterprise at risk?” M.D. Ranganath, Chief Risk Officer, Infosys 41